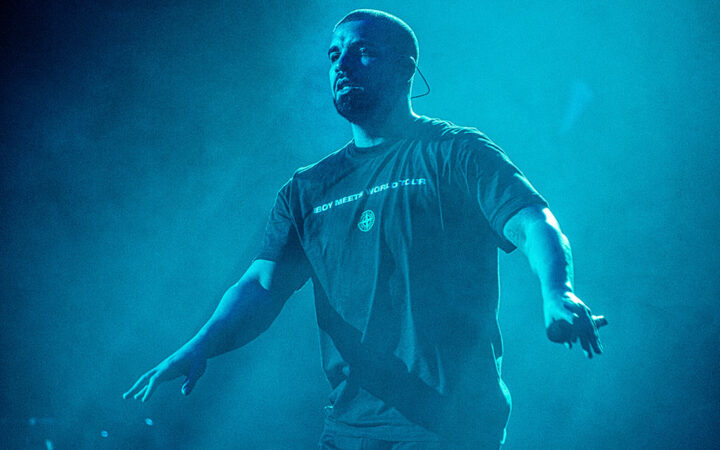

Popular Canadian Rapper Drake Advertises Bitcoin on His Instagram Page with Over 146M Followers

Bitcoin price has rallied to a new all-time high above $73K, with about five weeks to the fourth halving, thus indicating heightened demand from institutional investors.