ETH Still Correcting after Ethereum Price Reached ATH

On Thursday, January 14th, the Ethereum altcoin keeps correcting, trading at $1,122.

Focus on the ecosystem surrounding Ethereum, the second‑largest network by market cap. Get insights into network upgrades, smart‑contract innovations, DeFi and NFT trends, staking developments and other Ethereum news today.

On Thursday, January 14th, the Ethereum altcoin keeps correcting, trading at $1,122.

As the asset retested its all-time high, Ethereum traders and investors are eagerly awaiting the launch of CME’s Eth futures scheduled in four weeks.

Ethereum (ETH) is expected to approach its new all-time high of over $1400. With this Ethereum’s 2021 returns so far stand at nearly 80%.

Having hit a new all-time high of $38,280, Bitcoin is now trading at around $37,950 showing a growth of more than 8% in the past 24 hours.

ETHE shares started to plummet on December 24, when it lost over 18% within 24 hours while Ether had seen a drop of just 3% within the same period.

Ethereum starts the year with a bang skyrocketing over 40% on Sunday, January 3 while making a strong move towards its all-time high. Institutional buying in ETH has also picked up considerably in a few years.

As BTC continues to hit new all-time highs, Ethereum (ETH) has also joined the rally surging past $725 levels in a strong bull run. Analysts say that the Ethereum journey is just getting started and 2021 could be an even bigger year for the crypto asset.

The end of the year is approaching, and the crypto price surge is still going strong. Bitcoin and Ethereum have managed to hold on rather well after reaching their yearly highs recently, not allowing the resistances standing above to push them down too hard.

On Thursday, December 24th, ETH is declining, trading at 580.00 USD.

Within three weeks of the launch of Ethereum 2.0 Beacon Chain, the Ethereum deposit contracts have seen over 2 million ETH inflows which is 380% more than the threshold value.

Konstantin Anissimov, Executive Director at CEX.IO, shares his insights about the Bitcoin (BTC) and Ethereum (ETH) daily price movements. 23 Dec, 2020.

The latest halt comes as the six-month lock-up period for selling the recently purchased shares of the Grayscale Bitcoin fund comes to an end. Also, it comes as Grayscle’s total assets under management (AUM) crossed $15.7 billion.

As for the Ethereum ecosystem, a lot has been taking place underground with the launching of phase 0 of ETH 2.0 that encompasses the Beacon Chain launch with notable investors on board.

The CME Group’s Ether Futures is one of the many crypto products set to go live in 2021.

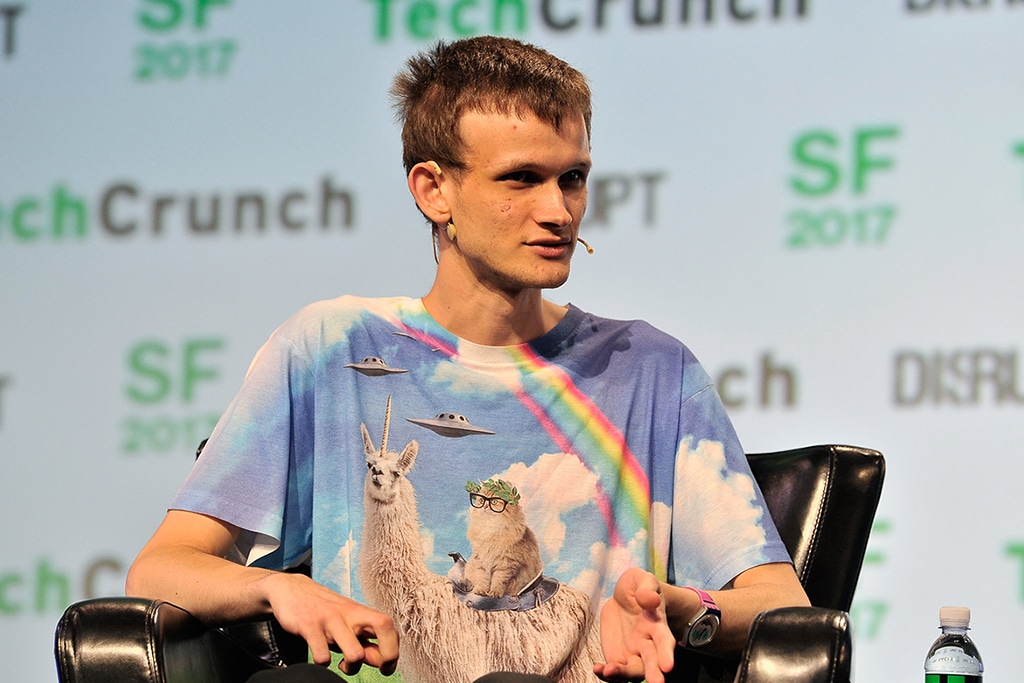

Buterin has asked users to maintain caution with the volatile asset class and revealed that he had sold half of his Bitcoin holdings in 2013 to avoid going broke.