World’s First Ethereum ETF Goes Live on TSX

The Ethereum ETF is the first of its kind to be listed on a major stock exchange. It is backed by 3iQ with Gemini Custody Services managing the ETF.

Focus on the ecosystem surrounding Ethereum, the second‑largest network by market cap. Get insights into network upgrades, smart‑contract innovations, DeFi and NFT trends, staking developments and other Ethereum news today.

The Ethereum ETF is the first of its kind to be listed on a major stock exchange. It is backed by 3iQ with Gemini Custody Services managing the ETF.

MEW has become the first Ethereum wallet to announced staking with the PoS Ethereum 2.0. The service launch comes in partnership with Staked who will be running validator nodes on behalf of MEW.

Grayscale revealed that there had been a significant increase in Ethereum investors in 2020.

With the full implementation of the scaling solutions, the Ethereum network will now be able to process up to 10,000 transactions per second.

Speaking at the Asia Pacific Conference 2020, Lubin hinted that the next phase of the Eth2 may be rolled out in 9-12 months from now.

After growing actively at the beginning of the week, the leading altcoin stabilized near 590.00 USD.

Vitalik Buterin presented a detailed roadmap ahead for the transitions to the PoS Ethereum 2.0. He talked about sharding implementations and the use of scalability solutions like rollups.

The latest decision of splitting the ETHE shares comes on the heels of improving its market liquidity and promote higher investor participation. The Grayscale Ethereum Trust (ETHE) holds more than $1.6 billion worth of assets under management.

The launch of Ethereum 2.0 today will be followed by other significant events including the ushering in of the Shard Chains and subsequently the merger of the current PoW Ethereum and the PoS Ethereum.

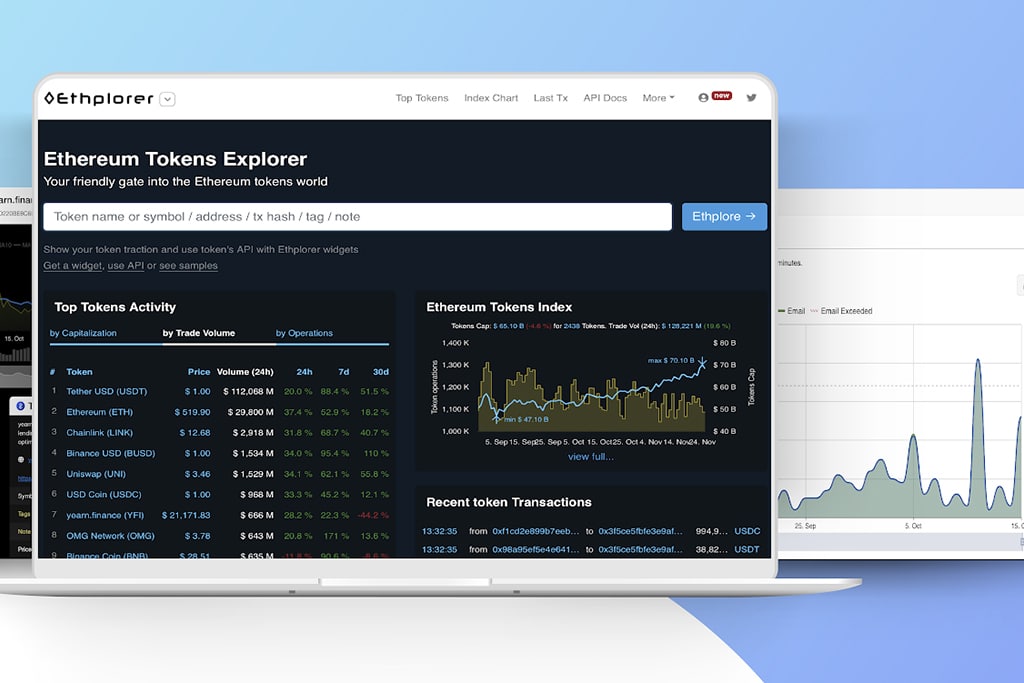

Ethplorer isn’t the only Ethereum tracking service out there. What makes it unique is its ability to track any number of addresses and transactions – millions if needed.

Coinbase said that it will support ETH 2.0 staking rewards in eligible jurisdictions starting from early 2021. Other crypto exchanges like Huobi, Kucoin, and Binance has also made similar announcements.

The rally in the crypto-market undergoes as Bitcoin is only a few hundred dollars away from hitting its all time high. Bitcoin dominance is dropping drastically since November 18 providing enough space and volumes for the boost of altcoins. This week only Bitcoin dominance is down to 3.35%.

Approximately 16,384 validators got involved in ETH 2.0 deposit contract that saw the threshold achieved hours before the deadline.

Bitcoin crossed $18,000 as it points towards an all-time high of $20,000. The last time Bitcoin traded a $20,000 was in December 2017. Altcoins have started following BTC on its way to new record levels.

Despite the significant yields available in DeFi, many institutional and mainstream retail investors are hesitant to enter, due to the risks factors associated with DeFi. Ether.Insure is here to change the situation.