Ripple’s XRP Underperformance in 2020 Is Highly Likely, Says Mike Novogratz

While some experts are rather bullish about the performance of Ripple’s XRP in 2020, Mike Novogratz believes that the coin will underperform again this year.

XRP news section is specifically tuned to XRP and the ecosystem around Ripple updates. Find out about cross‑border payment use‑cases, developments in Ripple vs. SEC history, partnership news. Learn how XRP fits into the broader token environment. Perfect if you follow XRP closely.

While some experts are rather bullish about the performance of Ripple’s XRP in 2020, Mike Novogratz believes that the coin will underperform again this year.

Just recently BitMEX has launched XRPUSD swaps. At the very beginning Ripple’s XRP price hasn’t reacted, staying stable. However, now XRP seems to be climbing up.

Ripple has entered in a new partnership. Together with International Money Express, Inc. (Intermex) it will ensure faster cross-border payments between the U.S. and Mexico.

Ripple’s XRP has surprised the market and the investors as its price jumped 10% due to a sudden surge in trading volumes. With today’s move, the XRP price has gained 35% year-to-date.

Despite markets are going down, XRP price remains stable. BitMEX has added USDXRP perpetual swaps to attract sophisticated users to its platform.

Market analysts believe that the XRP 750-day descent will end in 2020. As a result, there could be a possibility that the price would jump over $100 before the year ends.

The XRP token has registered gains of more than 2 percent at the start of the week following the release of half a billion tokens from Ripple’s escrow account.

The usage of XRP within RippleNet for cross-border payments is continuously growing. It is one of the factors that can ensure a more liquid and stable market.

A recent hearing in the U.S. Congress included the discussion of fiat currencies, payment methods and cryptocurrencies. In this context, XRP and the efforts made by Ripple in the sphere of payments were directly mentioned.

XRP is still in an odd spot: nobody knows for sure whether or not the asset is a commodity or security or even neither. Some people, like Ben Askren, believe that it is just a scam.

It is believed that XRP is ready to leave the bear market aside and move higher. XRP price could reach $14 with the next bull run.

Some experts think that Ripple’s IPO will put an end to the inherently speculative nature of the XRP token that won’t be much appreciated by its investors.

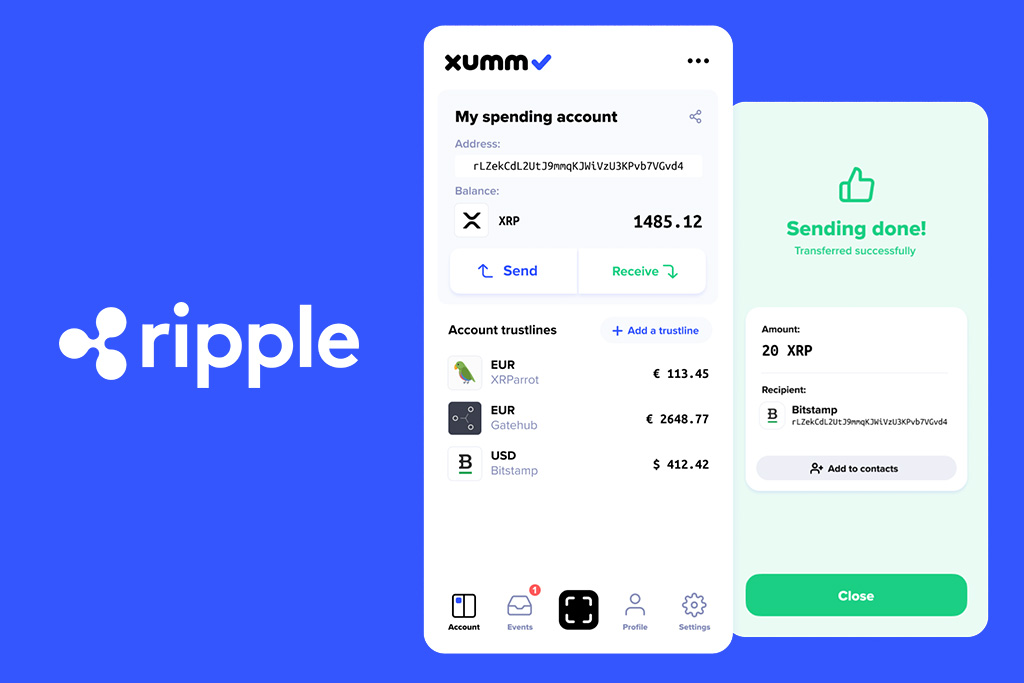

According to Wietse Wind, the lead developer of XRPL Labs, Ripple is considering launching not only a free version of the banking app but also a paid one that will be called ‘Xumm Pro’.

According to Jeffrey Tucker, the future for the XRP price is quite unclear right now. It can either reach one million dollars or fall to zero.

Ripple says that the future of payments will be commanded and shaped by emerging technologies. The company is said to be fully prepared for this future.