Top 10 Major Crypto Headlines in 2023 by Coinspeaker: Year of Triumphs, Scandals, and Transformations

It was a controversial year for the crypto indutrsy. Let’s have a closer look at the major crypto-related events that too place in 2023.

Your essential daily read: our featured Story of the Day highlights the most impactful development across crypto, blockchain, or regulation—curated for urgency, significance, and insight. Don’t miss what moves the market today.

It was a controversial year for the crypto indutrsy. Let’s have a closer look at the major crypto-related events that too place in 2023.

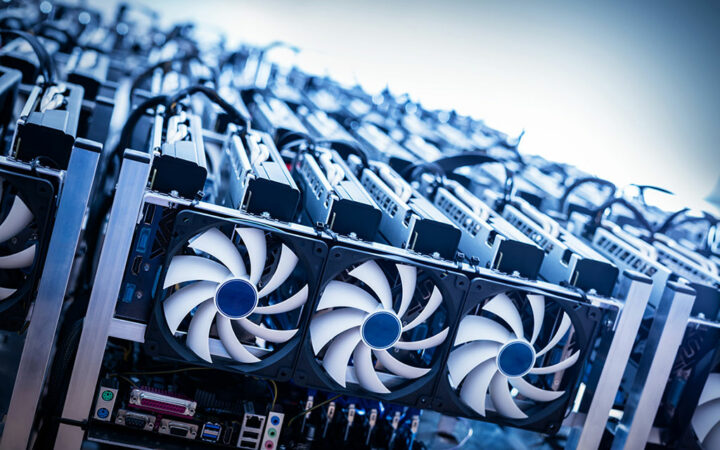

Marathon Digital and Riot Platforms, sensing the potential for increased demand, have made strategic moves to fortify their positions in the market.

2024 could be a slower year for the business landscape in the US economy, however, many economists are positive that the US recession could be thwarted with a soft landing.

Bitcoin holds the losses at $42,000 as investors await the approval of spot Bitcoin ETF which is around the corner. The level of interest in Bitcoin post the ETF approval remains uncertain.

In 2023, the Bitcoin hashrate has surged by a staggering 130% which shows growing competition and reduced profitability for miners.

The Bureau of Economic Analysis reported that GDP increased at a 4.9% annualized rate in Q3, slightly below the previously reported 5.2% pace.

The overall crypto market cap was close the $1.7 trillion mark on Wednesday, signaling that more money might be flowing into the crypto industry.

With November’s finalized Eurozone Consumer Price Index (CPI) settled at 2.4%, the Core CPI (excluding energy, food, alcohol, and tobacco) stood at 3.6%.

The Saga phone comes with extra benefits, including a complimentary month of access to Helium Mobile and a free toy. Moreover, apps on Saga’s dApp Store offer special benefits and rewards for Saga holders.

Bitcoin (BTC) is starting the new trading week on a slightly high note while there has been an increased amount of activity on many L1 chains.

FTX highlighted its intention to repay billions of dollars in cash to affected customers.

Ledger claims that the funds were drained in less than two hours, after which it came on top of the situation.

The Santa Claus rally in the crypto market is likely to continue with analysts expecting the Bitcoin price to touch $48,000 during pre-spot ETF approval.

Coinbase said the launch of the international digital asset trading platform is part of its move for global expansion driven by regulatory uncertainties in the United States.

With the US inflation having eased without significant unemployment, the Fed unanimously agreed to hold the borrowing rate between 5.25 and 5.5 percent for the third consecutive time.