Alibaba Receives Approval for Primary Listing on Hong Kong Stock Exchange

The documents revealed that the Primary Conversion would become effective before 2022 ends.

Your essential daily read: our featured Story of the Day highlights the most impactful development across crypto, blockchain, or regulation—curated for urgency, significance, and insight. Don’t miss what moves the market today.

The documents revealed that the Primary Conversion would become effective before 2022 ends.

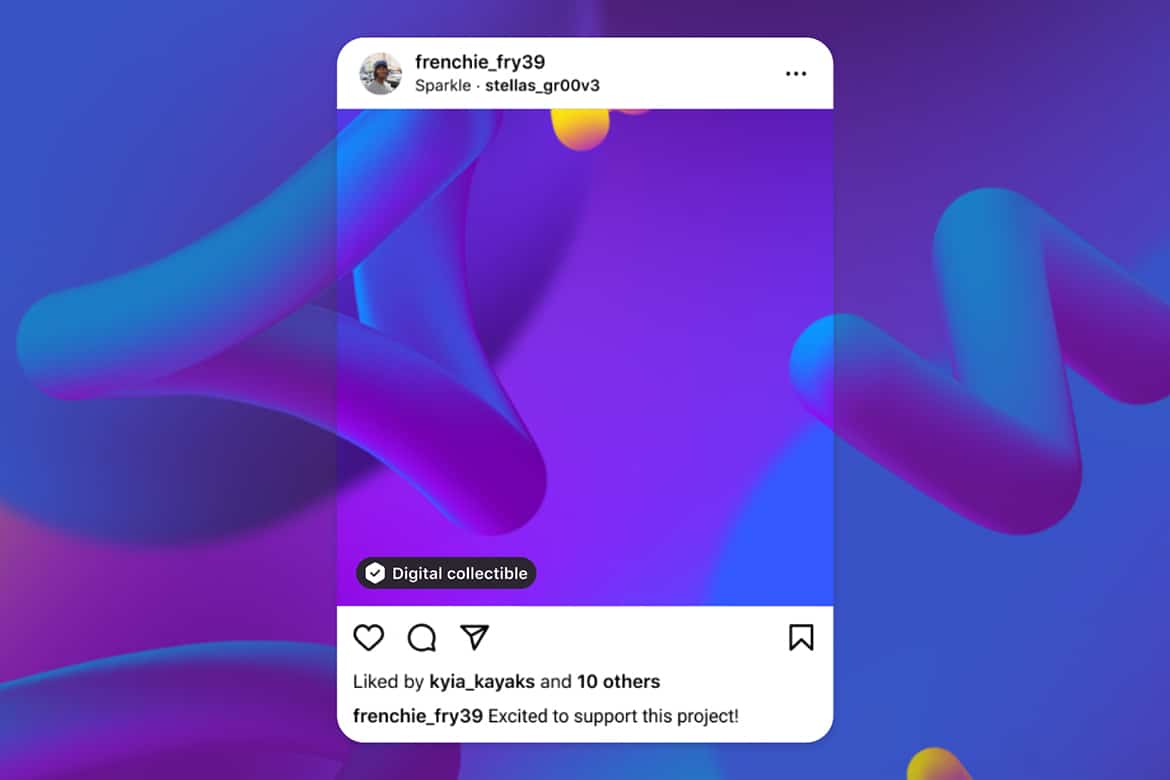

Tech giant Meta has announced its Instagram NFT initiative on supported blockchains such as Flow, Ethereum, and Polygon.

Amid the 2021 mania, SPAC deals were 59% of the total new listings in 2021.

Semiconductor heavyweight TSMC saw a slipup in share price as political tensions mount over intended Pelosi visit to Taiwan.

US Treasury yields for 2, 10, and 30 years were all trading higher on August 1 as investors brace for more earnings reports and economic data.

With the US GDP shrinking and interest rates rising, the crypto market so far hasn’t given up to the macro uncertainty. August could be a month of volatility.

Ethereum is currently trading above $1,700 after rising 15% on Thursday as network prepares for The Merge.

The Fed has acted on its decision to hike interest rates by 75 basis points and now sees its benchmark rate in the 2.25%-2.5% range.

The Fed decision to hike interest rates by 0.75% caused the price of Bitcoin to above $22K following a losing week.

While the US Fed has almost decided on the interest rate hike for this month following the two months of running inflation.

The IMF believes that several unsavory macroeconomic parameters, not including Bitcoin price slump, might soon trigger a recession.

Twitter is planning a shareholder vote soon to approve the compensation payable to execs in connection with Musk’s buyout.

Following the ECB’s rates hike last week, European markets might move depending on reports from corporate earnings and a new US Fed policy.

Despite facing production headwinds during the second quarter, Tesla delivered better-than-expected output driving the stock market higher on Thursday.

In the company’s letter to investors, Tesla executives stated that the company sold 75% of its Bitcoin holdings, adding $936 million in cash to its balance sheet.