Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.

Payment gateways are pivotal for enabling secure and efficient financial transactions in today’s rapidly evolving digital world.

Edited by Julia Sakovich

Updated

5 mins read

Edited by Julia Sakovich

Updated

5 mins read

In today’s technologically driven era, the need for secure and seamless payment solutions is crucial for the success of businesses operating within the complex transactional environment. Here, the pivotal role of payment processors comes into play. These entities serve as the connecting thread between merchants, consumers, and financial institutions, ensuring the fluid transfer of money during transactions. This comprehensive piece aims to delve into the intricate world of payment processors, exploring their functionality, and highlighting their indispensable role in fostering secure and efficient payment transactions.

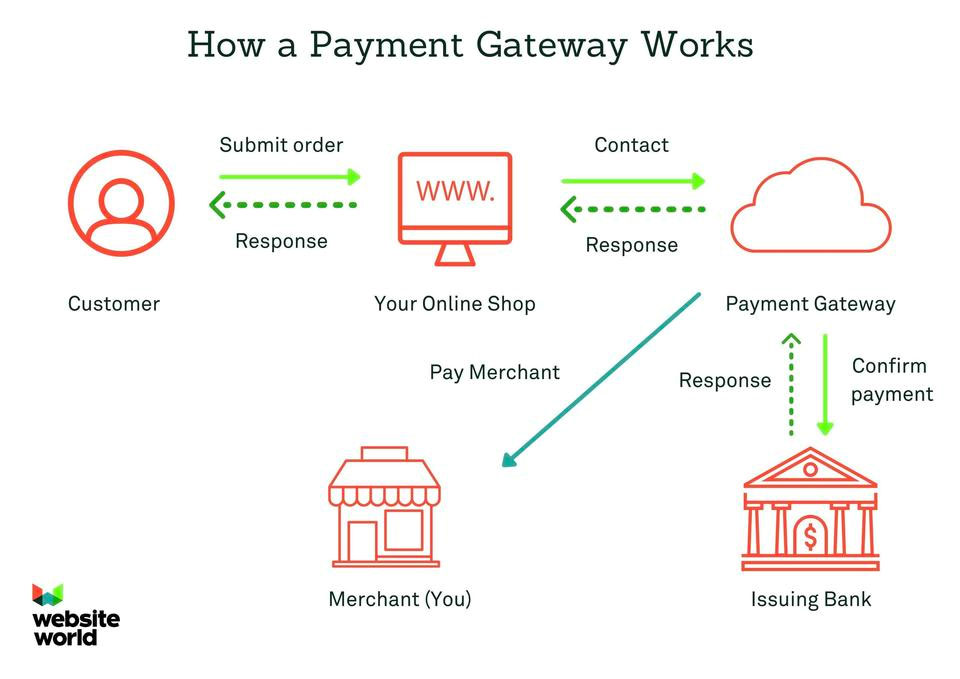

Payment gateways are foundational elements within the conventional banking system, acting as the bridge linking merchants, consumers, and financial entities. Their foremost role is to streamline and secure the execution of payment transactions. When a consumer engages in a purchase via a payment card or any digital payment means, the payment processor diligently forwards the transaction data to the associated financial institution for approval, validation, and finalization.

A principal task of payment gateways is the process of payment authorization. They examine and confirm the consumer’s payment specifics, like credit card information, to verify the presence of sufficient funds and the legitimacy of the transaction. This measure is crucial in averting fraudulent activities and shielding both merchants and consumers from unauthorized dealings. Upon the authorization of a payment, payment gateways activate the settlement mechanism. They oversee the movement of funds from the consumer’s account to the merchant’s account. This settlement procedure ensures that merchants are compensated punctually for their offerings, fostering stable financial flow and operations.

Moreover, payment gateways play a significant role in maintaining transaction security. They implement stringent security measures such as encryption and tokenization to protect sensitive payment data. Compliance with industry norms, especially Payment Card Industry Data Security Standards (PCI DSS), is crucial for maintaining customer trust and data security within the financial sector. Payment gateways also manage the reconciliation process, ensuring accurate accounting and reporting, vital for maintaining financial transparency.

In the prevailing banking infrastructure, payment gateways collaborate with various banks and card networks to ensure the uninterrupted flow of funds among all parties involved in a transaction. They aid in the settlement of funds and manage interactions with card networks to ensure continuous payment processing and network connectivity.

Several kinds of payment gateways are at the disposal of businesses in today’s market:

Typically consisting of banks and other financial entities, these have historically been the preferred choice for many businesses. They provide an extensive range of payment services and typically furnish businesses with merchant accounts, allowing them to accept multiple forms of payment.

The advent of e-commerce and the escalating popularity of online transactions have propelled the rise of specialized online payment providers. These providers specialize in secure online payment solutions, enabling businesses to receive payments via various digital platforms, including websites and mobile apps. Mobile payment processing, in particular, has experienced a surge in popularity.

Finally, solutions for processing crypto payments enable businesses to receive payments in cryptocurrencies like Bitcoin, Ethereum, or Litecoin. Crypto processing comes with its unique set of advantages, including access to a broader consumer base, swift and unrestricted transactions, heightened security, and reduced transaction costs. The decentralized nature of cryptocurrencies allows for quicker transaction processing and facilitates international transactions without the usual hassles and costs inherent to traditional banking systems. Adopting cryptocurrency payment methods signals a business’s readiness to embrace new technologies and trends, positioning them as innovators and attracting tech-savvy consumers, providing a competitive edge in the market.

When opting for a fiat payment intermediary, companies must reflect on several significant elements.

Firstly, there is a need to assess the security frameworks and data-safeguarding mechanisms of the processor to safeguard customers’ transactional details. Strict adherence to prevailing standards, like the Payment Card Industry Data Security Standard (PCI DSS), is indispensable.

Evaluating the stability, operational uptime, and the caliber of customer service offered by the processor is essential to maintaining uninterrupted and seamless payment processes. Detailed analysis of the pricing structure, encompassing transaction fees, initial setup costs, and any supplementary charges, is critical to confirm alignment with the company’s financial plans and revenue structures.

Additionally, exploring features like payment APIs and integrations and their compatibility with the company’s current systems is pivotal. Scalability and the capacity to manage increasing transaction volumes are crucial for companies experiencing growth in their customer bases.

Lastly, it’s imperative to scrutinize the processor’s standing and historical performance in the sector to establish confidence in their reliability and efficacy. By weighing these elements,

CoinsPaid stands as an illustrative example of an extensive payment gateway, offering diverse payment processing services, inclusive of cryptocurrency payments. With its robust gateway and integration features, it simplifies the acceptance of varied digital currencies for businesses. Prioritizing transactional data security and the implementation of anti-fraud mechanisms, CoinsPaid assures secure transactions for both merchants and consumers.

In conclusion, payment gateways are pivotal for enabling secure and efficient financial transactions in today’s rapidly evolving digital world. They simplify the complexities associated with payment processing, offering businesses a reliable mechanism to accept various payment forms. By leveraging the capabilities of both traditional and online payment processors and integrating cryptocurrency payment processing, businesses can stay competitive, ensuring regulatory compliance and offering unparalleled payment convenience to their customers. The meticulous selection of an appropriate payment provider and consideration of the multifaceted aspects involved enable businesses to facilitate smooth, seamless, and secure transactions in today’s dynamic business environment.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.