Changpeng Zhao

Co-Founder of Binance.

Changpeng Zhao, widely known by his initials CZ, is one of the most influential and controversial architects of the modern cryptocurrency industry. Zhao is a co-founder and was a long-time CEO of Binance, the world’s largest cryptocurrency exchange by trading volume. He reshaped how digital assets are traded globally, spurred the development of related infrastructure, and became a central figure in debates about regulation, compliance, and the role of exchanges in the global financial system.

Early Life and Path to Crypto Leadership

Born in 1977 in Lianyungang, Jiangsu Province, China, Changpeng Zhao moved with his family to Vancouver, Canada, in 1989 following political turmoil in China. Growing up in Canada, Zhao worked early jobs: from flipping burgers to overnight shifts at a gas station.

Later, he entered McGill University, where he studied computer science. Before founding Binance, he co-founded or worked with several crypto and finance startups: he was an early team member at Blockchain.info, worked as CTO of OKCoin, and built high-frequency trading systems for traditional markets.

This blend of technical expertise and financial markets experience primed Zhao to capitalize on the explosive growth of crypto trading in the mid-2010s.

Founding Binance and Building a Global Powerhouse

In 2017, Zhao launched Binance via an initial coin offering (ICO) that raised roughly $15 million. Within months, Binance distinguished itself through a powerful combination:

- rapid listing of tokens,

- low trading fees,

- intuitive user experience,

- lightning-fast matching engines.

By early 2018, Binance had become the world’s largest cryptocurrency exchange by trading volume — a staggering achievement for a platform barely a year old.

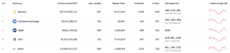

Top crypto exchanges by volume in 2025 | Source: CoinMarketCap

Binance Coin (BNB) and Binance Smart Chain

Alongside the exchange, Binance launched its own utility token, Binance Coin BNB $902.0 24h volatility: 2.0% Market cap: $123.04 B Vol. 24h: $1.36 B . Initially, it offered trading fee discounts and later became integral to the Binance ecosystem, including decentralized finance (DeFi) applications and the Binance Smart Chain. The latest is a smart contract chain aimed at competing with ETH $3 002 24h volatility: 2.4% Market cap: $362.37 B Vol. 24h: $28.28 B .

The Binance ecosystem grew into a sprawling global presence that influenced crypto liquidity, token listings, and even how decentralized applications were structured. It positioned Zhao not just as a platform operator but as a central node in the broader blockchain economy.

Expansion into the United States: Binance.US

Zhao recognized the importance of the American market, the largest by many measures for crypto trading. Binance established a U.S.-focused affiliate, Binance.US, in 2019. This separate legal entity was intended to comply with U.S. regulatory requirements and offer trading services to U.S. customers under more stringent oversight.

While Binance.US struggled with regulatory clarity and competition from established U.S. exchanges such as Coinbase and Kraken, its launch marked a significant step toward mainstream adoption. The effort underscored Zhao’s strategic recognition of the U.S. as a critical regulatory and economic arena for cryptocurrency infrastructure.

Legal Scrutiny and Guilty Plea

Despite its meteoric rise, Binance and Zhao came under escalating scrutiny from U.S. regulators. Authorities alleged that Binance had failed to implement an effective anti-money-laundering (AML) program, neglected Know-Your-Customer (KYC) requirements, and enabled transactions without adequate safeguards. This exposed Binance to potential misuse for illicit activity.

In 2023, Binance, under Zhao’s leadership, pleaded guilty to charges connected to violations of the Bank Secrecy Act and related U.S. anti-money-laundering laws. The company agreed to pay a substantial settlement of $4.3 billion, one of the most significant fines ever imposed on a crypto exchange. As part of the legal resolution, Zhao stepped down as CEO and personally paid a $50 million fine.

Prison Sentence

In April 2024, Zhao was sentenced to four months in U.S. federal prison after pleading guilty to failing to maintain an effective anti-money-laundering program at Binance. This milestone event marked the first time a primary crypto exchange founder received imprisonment under U.S. law for such violations. He completed his sentence later that year.

The sentencing underscored a turning point in global enforcement attitudes toward crypto platforms. It also signaled that rapid growth without compliance could carry personal consequences for executives.

Presidential Pardon and Implications

In a flashpoint moment for the industry, President Donald J. Trump pardoned Changpeng Zhao on October 23, 2025. The pardon came after Zhao had completed his sentence and amid political and industry pressure, including Zhao’s own appeal for clemency.

Trump framed the pardon as a correction of what his administration described as overly aggressive enforcement that stifled innovation.

The pardon immediately reignited debate over the appropriate scope of presidential clemency and its intersection with economic sectors, particularly one as politically charged as digital assets. Critics, including U.S. lawmakers such as Senator Elizabeth Warren, argued that the pardon undermined accountability and raised concerns about “regulatory backsliding” and the message it sent to global markets about the enforcement of financial laws.

Supporters in the crypto industry, however, welcomed the pardon as a sign of a pro-crypto policy environment in the U.S. They saw it as an opportunity for Binance to contemplate renewed engagement with American regulators and market participation. Reports soon emerged that Binance was exploring a return to the U.S. market, buoyed by the pardon’s elimination of legal barriers.

Binance’s Ongoing Regulatory and Legal Landscape

Despite the pardon, Binance’s journey remains far from smooth. The company has faced allegations of sanctions violations and AML failures that extend beyond the original plea. Civil lawsuits have alleged that Binance facilitated millions of dollars’ worth of transactions for sanctioned entities.

These claims, which extend into counterterrorism concerns, pose reputational and legal risks for Zhao and Binance alike, even as they push for broader market acceptance and compliance improvements.

CZ’s Broader Influence on Crypto Policy and Industry Norms

Zhao’s career encapsulates many of the tensions inherent in the crypto sector:

- innovation versus regulation,

- decentralization versus centralized platforms,

- rapid growth versus compliance with legacy financial laws.

Through Binance, CZ transformed crypto trading from a fragmented collection of small venues into a unified global marketplace with unprecedented liquidity and access.

His decisions reshaped not only technology, thanks to Binance Smart Chain and ecosystem tools. They also demonstrated how regulators conceptualize crypto exchanges: as central actors in financial integrity frameworks that must be held to similar standards as traditional banks and broker-dealers.

The legal and regulatory saga surrounding Binance and Zhao stands as a defining case study in how the crypto industry has matured from the “Wild West” of early trading to a space where public enforcement actions carry real weight and political implications.

Legacy and Continuing Impact

Today, Changpeng Zhao remains one of the most high-profile figures in cryptocurrency, defined by his creation of Binance, his navigation of legal challenges, and the extraordinary circumstance of a presidential pardon. He can be viewed as a visionary leader who built one of the foundational infrastructure pillars of crypto, or a cautionary example of the risks of unchecked growth. In both cases, CZ’s story reflects the complex interplay of innovation, law, and influence that defines digital assets in the 21st century.

For observers, analysts, and crypto participants alike, Zhao’s legacy will continue to shape discussions around exchange compliance, global market access, and the evolving relationship between emerging financial technologies and longstanding regulatory frameworks.

-

Known for:

Binance

-

Born:

Feb 5th, 1977

-

Nationality:

Canadian

-

Location:

Vancouver, British Columbia, Canada

-

Education:

Montreal McGill University, Computer Science

-

World wealth rank:

123

-

Net worth:

$15.0 B

-

Other Projects:

Binance - Co-Founder & former CEO

OKCoin - CTO

Blockchain.info

Fusion Systems - Founder