LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Crypto.com is one of the largest crypto exchanges offering a variety of services, from simple trading to derivatives. But is it the right platform for you? Our in-depth review will help you decide.

Crypto.com is one of the biggest cryptocurrency exchanges. Our review is an in-depth look into the platform in 2026 to see how it compares to its closest competitors like Binance and Coinbase, and find out what kind of user profile it fits best.

We opened and funded an account to test Crypto.com’s core features first-hand. We evaluated the supported assets, trading fees, wallet options, and security practices, while also exploring the CRO token ecosystem and the mobile app. Our goal is simple: to demonstrate how Crypto.com works in practice, so you can decide whether it fits your approach to managing your crypto.

| Category | Rating/Details |

| Overall Rating | ⭐ 8.5/10 |

| Privacy | KYC required, identity verification may include selfie |

| Transaction Speed | Matching fast, comparable to closest competitors |

| Fees | 0.25%/0.50% (maker/taker), but discounted by both volume and CRO staking down to 0%/0.1584% |

| Ease of Use | Polished and easy-to-navigate app and web platform |

| Supported Assets | 400+ coins, including all major alts |

Our Crypto.com Review Verdict Summarized

Crypto.com offers a wide ecosystem of trading and investment services, including spot markets, staking options, a crypto Visa card, and access to various DeFi tools. The exchange is accessible via web browsers and a dedicated app and lists over 400 tradable assets.

Crypto.com fees start at 0.25% for maker orders and at 0.50% for taker orders. This starting rate is more competitive compared to crypto exchanges like Coinbase, where the base fees start at 0.40% (maker) and 0.60% (taker). Users who stake the CRO token can qualify for discounted rates, with the scale of these discounts depending on region and account tier.

From a security perspective, Crypto.com holds ISO 27001 and SOC 2 Type II certificates, as well as an insurance policy for assets in cold storage. The platform also uses real-time monitoring to reduce operational risk.

Crypto.com Key Takeaways

- Crypto.com supports over 400 crypto assets on its exchange and offers multiple services, including a Visa card and a self-custodial wallet.

- Spot trading fees start at 0.25% (maker) and 0.50% (taker), between Binance’s and Coinbase’s, with CRO-based discounts available for eligible users.

- Crypto.com’s security stack includes ISO 27001 and SOC 2 Type II certificates, along with insurance coverage for cold storage.

- The Crypto.com app is available for iOS and Android, replicating the buying, selling, and monitoring capabilities of the web platform for mobile devices.

- Crypto.com is available in most global regions, including 49 U.S. states (exclusions are subject to local regulations).

Crypto.com Pros & Cons

Here are the platform’s biggest advantages and the trade-offs to consider:

Pros

- CRO Token Benefits: Users who hold or stake CRO can qualify for lower spot trading fees and higher Visa card tiers. Locking up at least 1,000 CRO for 180 days cuts maker-taker fees by 3%, while locking up 50,000 CRO eliminates maker fees entirely.

- Visa Card Integration: The Crypto.com Visa Card lets users spend their crypto balances and earn CRO cashback. It’s a practical way to link portfolio holdings to everyday payments.

- Competitive Fee Structure With Available Discounts: Base spot fees sit at 0.25% maker and 0.50% taker. CRO staking reduces taker fees up to 30% and unlocks maker rebates for high-volume traders.

- Broad Product Ecosystem: Crypto.com combines spot trading, derivatives, margin trading, a P2P marketplace, DeFi earning tools, an NFT market, and a token launch platform into a single account.

- Strong Security Framework: Crypto.com holds ISO 27001, SOC 2 Type II, and PCI DSS Level 1 certifications. It also maintains $120 million insurance coverage for assets held in custody (including $100 million for cold storage), FDIC insurance for USD fiat balances, and publishes 1:1 Proof of Reserves attestations.

- Highly Rated Mobile App: The Crypto.com mobile app is rated 4.5 and 4.7 out of 5 on Google Play and App Store, respectively, from over 1 million combined reviews.

Cons

- Higher Base Fees Than Binance: Users who don’t lock up their CRO face higher spot trading fees compared with Binance’s entry tier.

- Geographic Restrictions: Some services (such as derivatives or specific Visa card tiers) vary by location and are unavailable in regions like New York.

- Costly ERC-20 Withdrawals: Ethereum network withdrawals can be expensive (10 USDT/USDC per transaction), making Layer 2 alternatives more cost-efficient where available.

- Extra Spread Costs in the App: Simple buy and sell orders in the Onchain App (not the exchange) may incur extra spread costs.

- Support Response Times Vary: The support team is available 24/7, but some users note that response times can take longer than desired.

What Is Crypto.com?

Crypto.com launched in 2016 as “Monaco”, before rebranding in 2018 after securing the Crypto.com domain. Kris Marszalek and Bobby Bao founded the company as a payments-focused project before transforming it into a digital-asset platform.

Currently, Crypto.com offers two main products. The Crypto.com app targets everyday users who want to buy, sell, earn, or spend digital assets on their smartphone or tablet. Meanwhile, the Crypto.com exchange suits traders who prefer order-book markets, deeper liquidity, and advanced trading tools. According to the platform’s 2024 report, these products serve over 140 million users in 90 countries. As of December 2025, Crypto.com reports more than 150 million users globally.

Crypto.com homepage. Source: Crypto.com

The exchange supports more than 400 of the best altcoins and regularly handles over $3 billion in daily spot trading volume (Snaphot from CoinMarketCap, December 18, 2025), allowing users to manage trading, staking, and spending tools without switching platforms.

Tying this ecosystem together is the Cronos (CRO) token. CRO holders receive fee discounts (by locking up their tokens) and access to various Visa card tiers. This gives them a way to connect with multiple services within the same account.

Regulation and licensing shape how Crypto.com operates. In the U.S., the Crypto.com app is supported in 49 states and territories but not in New York, where virtual currency firms must hold a specific BitLicense or equivalent charter. On top of that, features such as derivatives, Earn products, and card perks are enabled or disabled based on local regulations.

Crypto.com’s Products & Services

Crypto.com offers products that combine trading, various payment methods, Web3 access, and DeFi tools in a single platform. The Crypto.com exchange supports spot markets and, in eligible regions, derivatives such as margin trading and perpetual futures. This dual structure gives traders a way to move between basic order types and more advanced strategies.

The Crypto.com app acts as the central “hub” for most users. It supports direct crypto purchases, portfolio tracking, on-platform earning features, and management of the Visa card. Because you can link crypto balances to card spending, users can spend their digital assets (like BTC and ETH) at merchants that accept Visa.

Crypto.com exchange dashboard. Source: Crypto.com

Another focus of our review is the self-custody wallet Onchain. With this wallet, users hold their own private keys and can interact with dApps on multiple blockchains. This setup opens the door to activities like token swaps, staking, and crypto lending.

Crypto.com also runs token launch campaigns referred to as “Syndicate” events. These provide discounted access to new cryptocurrency projects for eligible users. While the format differs by region, the general idea mirrors a launchpad model.

Rounding out Crypto.com’s product suite are an NFT marketplace, institutional services, and merchant payment tools. This product mix lets Crypto.com serve both everyday users and businesses.

What Cryptocurrencies Can You Trade on Crypto.com?

Crypto.com supports more than 400 of what we consider the best cryptocurrencies to buy via its mobile app and browser-based exchange. This selection includes large-cap assets such as BTC, ETH, SOL, XRP, ADA, and DOT, as well as widely used stablecoins such as USDT, USDC, DAI, and TUSD.

The platform also lists a range of top meme coins, including DOGE, SHIB, PEPE, BONK, and FLOKI. Its native asset, CRO, sits across multiple trading pairs and supports various ecosystem features.

Crypto.com supported cryptocurrencies. Source: Crypto.com

While the overall selection of cryptocurrencies is smaller than some other centralized exchanges (like Binance), Crypto.com covers most assets with established liquidity and consistent market demand. But it’s important to remember that availability for specific assets can vary by region.

Crypto.com Fees

Platform’s fee structure rewards active traders, balancing competitive base rates with CRO-based discounts. The platform charges both trading and non-trading fees, which are outlined below.

Trading Fees

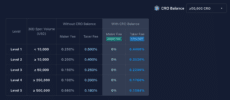

Crypto.com uses a volume-based maker-taker model, with CRO staking lowering trading costs. At the entry tier (under $10,000 in 30-day spot volume), the exchange charges 0.25% maker and 0.50% taker fees without CRO staking. With CRO staking, the maker fee can potentially drop to 0%, while the taker fee is reduced to 0.1584% at monthly volumes of over half a million USD.

To compare: Binance’s standard spot tier is 0.10% maker and 0.10% taker, while other Tier-1 exchanges offer comparable structures. The Coinbase exchange charges 0.40% maker and 0.60% taker for volumes up to $10,000, and Kraken Pro lists 0.25% maker and 0.40% taker at the same volume threshold.

So, on a $1,000 taker trade, that’s roughly $5 on Crypto.com (base rate), $1 on Binance, $6 on Coinbase, and $4 on Kraken. However, the same trade can be conducted at just over $0.16 if you stake CRO and reach the highest trading volume tier over 30 days.

Maker-taker fees for spot trading. Source: Crypto.com

Derivatives fees follow a similar tiered structure, and availability depends on jurisdiction. Crypto.com publishes separate VIP tiers for derivatives, with an additional 0.50% forced liquidation fee applied if the platform automatically closes a margin position.

Non-Trading Fees

For non-trading fees, the most important factor is the purchase method. Card-based purchases in the Crypto.com app carry a 2.99% processing fee, while eligible new users may receive a limited card-fee waiver for seven days after their first purchase.

Crypto.com also notes that app-based buy/sell pricing includes an admin fee that is influenced by the cryptocurrency market conditions and liquidity. This admin fee is why active traders often prefer the exchange’s limit order book.

Crypto deposits are free, but withdrawal fees vary by asset and network. For example, withdrawing USDT on Ethereum costs 10 USDT per transaction, while using Base drops the cost to 0.033 USDT.

| Fee Type | Crypto.com | Binance | Coinbase | Kraken Pro |

| Spot Trading (Base) | 0.25%/0.50% | 0.10%/0.10% | 0.40%/0.60% (up to $10,000) | 0.25%/0.40% (up to $10,000) |

| Token/Loyalty Discounts | CRO lockup + CRO Rewards can reduce fees | BNB discounts available | Volume tiers | Volume tiers |

| Derivatives | Tiered; forced liquidation fee of 0.50% | Tiered (varies by product) | Tiered; product availability varies | Tiered; product availability varies |

| Fiat Deposits | Free (ACH, wire, SEPA) | Free (ACH, SEPA) | Free (ACH, wire) | Free (ACH, wire) |

| Card Purchases | Card fees may apply; a new-user waiver can apply in limited cases | Varies by region/method | Varies by method | Varies by method |

| Crypto Withdrawals | Network-dependent (e.g., 10 USDT on ERC-20, 0.033 USDT on Base) | Network-dependent | Network-dependent | Network-dependent |

User Experience: Is Crypto.com User-Friendly?

While reviewing Crypto.com, we found the platform easy to navigate on both desktop and mobile. The interface arranges most features in a way that will feel familiar to anyone who has used a major exchange before.

The desktop exchange offers a straightforward layout built around TradingView charts, live order books, and market depth indicators. Order types are easy to locate, and switching between markets, funding options, and account settings feels intuitive.

Crypto.com exchange order form. Source: Crypto.com

Users who prefer browser-based trading can handle spot orders, monitor their portfolio, and manage funding without relying on the mobile app. However, some functions (such as certain fiat on-ramps and full card controls) are better supported on mobile.

Mobile App

Our Crypto.com app review found that the interface prioritizes quick actions: buying and selling coins/tokens, setting price alerts, checking rewards, and managing the Visa card. Navigation uses a simple tab structure, and the flows guide users through each step of placing a trade.

Because the app combines trading, card management, and on-platform earning features in one place, it can feel slightly “fuller” than more minimalist app designs. Still, the layout remains logical once users understand where each section is located.

Crypto.com app homepage. Source: Crypto.com

Features & Tools

Crypto.com offers a range of features designed to support trading, earning, payments, and on-chain activity from a single account. Below are some of the main ones:

Derivatives & Leverage Trading

Crypto.com provides access to derivatives through its exchange and designated derivatives portals, with availability subject to local regulations. Traders can use order-book interfaces powered by TradingView charts, apply standard order types, and take on leverage within the limits set for each market and jurisdiction.

The exchange also supports margin trading on selected spot pairs, with collateral, interest, and liquidation details displayed in the interface. This integration means Crypto.com consolidates spot and margin trading in one place, which is similar to how Binance and Kraken structure their margin products.

Syndicate & Token Launch Programs

Instead of a single launchpad product, Crypto.com periodically hosts “Syndicate” events that offer discounted access to new token listings. Participation typically depends on holding or staking CRO and may also involve meeting certain trading thresholds. These periodic campaigns build up user excitement in a similar way to new Binance listings.

Crypto.com Visa Card

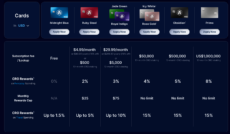

The Visa card is one of Crypto.com’s most-used tools. Users can convert cryptocurrencies to spendable balances and use them anywhere Visa cards are accepted, while receiving rewards in CRO.

Crypto.com Visa card tier breakdown. Source: Crypto.com

Card rewards are tied to Crypto.com’s Level Up program rather than just raw CRO balances. Users can access trading fee benefits and card perks by either locking up a qualifying amount of CRO or by paying for a Level Up subscription. Specific rewards depending on tier and jurisdiction.

DeFi & Staking Services

Crypto.com supports earning through two separate channels. The app’s custodial Earn feature allows users to allocate supported coins and stablecoins into flexible or fixed-term products with transparent rates.

For users who prefer self-custody, the DeFi Wallet enables direct interaction with on-chain protocols, including staking and lending across supported networks. These two approaches mean users can choose between convenience and control.

Crypto.com Wallet

Crypto.com offers two wallet options that serve different approaches to managing crypto: a custodial wallet built into the app and exchange, and a separate non-custodial DeFi Wallet where users hold their own private keys. The choice depends on convenience versus direct control.

The custodial wallet is managed by Crypto.com, meaning the platform holds the private keys and handles security on the user’s behalf. It integrates with trading, Earn products, the Visa card, fiat deposits, and instant swaps, which we find makes day-to-day activity straightforward.

Crypto.com Onchain Wallet homepage. Source: Crypto.com

According to the company, an insurance policy covers assets held in cold storage. However, because the wallet is custodial, users rely on Crypto.com’s infrastructure and must comply with KYC requirements.

The non-custodial DeFi Wallet is different. Users generate and store their own recovery phrase, giving them complete control of their crypto assets and direct access to on-chain activity. The crypto wallet supports staking, lending, swaps, NFTs, and interaction with dApps on multiple blockchains.

In practice, the custodial wallet appeals to users who prefer integrated services, while the DeFi Wallet caters to those seeking self-custody and full Web3 access. In our experience, both options are comparable to competitor options and mostly cover a similar set of features.

Deposits & Withdrawals

Crypto.com supports a mix of fiat and crypto funding methods, with availability varying by region. Bank transfers, such as ACH, SEPA, and SWIFT, are typically free on Crypto.com’s side, though users may encounter fees from their bank.

Card-based deposits are much faster but often incur processing charges, making them less cost-effective than bank transfers. Fiat withdrawals return funds to verified, same-name bank accounts and are subject to regional limits.

Key Points:

- Bank Transfers: Usually free from Crypto.com; speed and fees depend on your bank.

- Card Purchases: Convenience trade-off due to processing fees.

- Fiat Withdrawals: Region and bank-dependent limits; KYC must match account names.

Crypto deposits are free except for network confirmations. However, crypto withdrawals incur network fees that vary by asset and blockchain conditions. For example, transfers on Ethereum can be more expensive during congested periods, while using supported Layer 2 networks often results in lower fees.

| Method | Deposit? | Withdrawal? | Typical Limits | Typical Processing Time | Notes |

| ACH/SEPA/Bank Transfer | Yes | Yes | Varies by region and verification level | 1–3 business days | Usually free from Crypto.com; bank fees may apply |

| Credit/Debit Card | Yes | No | Card issuer limits | Near-instant | Processing fees apply |

| Crypto Transfer (All Supported Assets) | Yes | Yes | Network-based | Deposit: after confirmations

Withdrawal: network speed |

Fees vary by blockchain; alternatives shown at checkout |

| SWIFT (International Wire) | Yes | Yes | Higher limits for verified users | 1–5 business days | Bank charges may apply |

| Visa Card Top-Up | Yes | No | Card-dependent | Instant | Treated as a card purchase with applicable fees |

How Secure Is Crypto.com?

Our Crypto.com security review examines how the platform protects user assets through cold-wallet storage practices, audited controls, and on-device safeguards.

Crypto.com keeps most customer funds in multi-sig cold wallets and protects them with hardware security modules. Keeping keys offline means a breach of the hot systems doesn’t automatically mean lost funds. Even if an attacker compromises an online system, they can’t reach the user’s offline keys.

Crypto.com also maintains a long list of independent certifications. These include ISO/IEC 27001 and 27701 for information and privacy management, PCI DSS Level 1 for card data handling, SOC 2 Type II for operational controls, ISO 22301 for business continuity, and Singapore’s Data Protection Trustmark.

Crypto.com Proof of Reserves (PoR) information. Source: Crypto.com

The platform also publishes regular Proof of Reserves (PoR) attestations. These attestations are intended to prove that customer deposits are fully backed by on-chain assets. After the bankruptcy of FTX, PoR has become essential, since it addresses concerns regarding exchange solvency.

On the user side, security tools include two-factor authentication (2FA), biometric logins on mobile, anti-phishing codes, and address whitelisting for withdrawals. These controls are present on most Tier-1 exchanges, as they help reduce the risk of account takeovers, which are one of the most common attack vectors in crypto.

As with any centralized exchange, users remain subject to compliance reviews and jurisdiction-specific restrictions. Users might want to pair the platform with self-custody options, such as Crypto.com’s own DeFi Wallet, when managing long-term holdings.

Customer Support

Crypto.com offers 24/7 customer support through in-app live chat, web chat, email tickets, and a searchable Help Center. The platform does not provide phone-based assistance, so all queries run through digital channels. When requesting assistance through chat, we received a response within minutes, while the email reply took a couple of hours.

User feedback varies by channel and issue type. Some users report efficient resolutions for routine matters such as card activation, transaction checks, or fee questions. Others describe a slower turnaround for things like account verification reviews. But overall, the support infrastructure covers what you would expect from an exchange of this scale.

Account Types

The most typical account type on Crypto.com is the retail account. This comprises the Crypto.com app account, the Crypto.com exchange account, and the self-custody Onchain account.

Crypto.com user reviews note that its retail account structure is straightforward. Users create a single verified account that unlocks access to the Crypto.com app and, if enabled, the Crypto.com exchange.

As mentioned earlier, the app account covers everyday actions such as buying and selling crypto, using Earn features, and managing the Visa card. Traders who prefer order-book markets can activate the exchange under the same identity, which connects the two accounts under one set of credentials.

Aside from retail accounts, Crypto.com also offers institutional exchange accounts for corporate users with adjusted features and a custom KYC procedure, while businesses that would like to accept crypto payments can sign up for a Crypto.com Pay Merchant account.

How to Use Crypto.com

Whether you want to buy Bitcoin on Crypto.com or invest in low-cap altcoins, the process follows the same basic flow as most major exchanges: create an account, complete identity checks, fund your wallet, then place a trade. Here are the key steps in more detail:

Step 1: Open a Crypto.com Account

Visit Crypto.com or download the Crypto.com app from the Apple App Store or Google Play, then tap Sign Up. You’ll be asked to enter an email address, phone number, and country of residence.

Create a new account on the Crypto.com app. Source: Crypto.com

Some regions support faster registration through Apple or Google login. Confirm your email address and phone number using the verification codes sent to each.

Step 2: Complete Crypto.com’s KYC Verification

Before you can access full account features, Crypto.com requires identity verification. This process involves uploading a government-issued ID (like a passport or driver’s license) and completing a live selfie check. Approval times vary by region and workload.

Step 3: Deposit Funds

To deposit fiat, open Transfer, select Deposit, then choose your currency and deposit method. Bank transfers (ACH, SEPA, SWIFT) are often the most cost-efficient option. Card purchases settle much quicker but usually include a processing fee, which is shown before you confirm.

Deposit crypto on the Crypto.com app. Source: Crypto.com

To deposit crypto from an external wallet, also go to Transfer, Deposit, select the asset and network, then copy the address or scan the QR code. Wait for required blockchain confirmations before the balance updates.

Step 4: Execute a Trade

In the app, tap Buy, choose an asset (such as BTC), pick a funding source, enter the purchase amount, and review the final quote before confirming.

Buy Bitcoin using the Crypto.com app. Source: Crypto.com

For even more control, you can use the Crypto.com exchange (web or exchange app). Select a trading pair, choose market or limit, enter your position size, and submit. Trading fees depend on your tier.

Step 5: How to Sell Coins & Withdraw Funds on Crypto.com

To sell coins, open your portfolio, select the asset, tap Sell, choose whether to convert to fiat currency or another coin, and confirm. Funds will appear in your chosen destination wallet.

For fiat withdrawals, navigate to Transfer, then Withdraw, and Fiat, choose your linked bank account, enter the amount, and confirm. Processing time depends on local banking infrastructure.

Withdraw crypto using the Crypto.com app. Source: Crypto.com

Crypto withdrawals can be found in the same Withdraw menu under Transfers, where you need to select the asset and network, enter the destination address, review the on-screen fee, and confirm. Network choice matters here, and mismatches can cause permanent losses, so always double-check the chain before sending.

What Is Cronos Crypto? – The CRO Token of Crypto.com

Cronos (CRO) is Crypto.com’s EVM-compatible blockchain, where CRO is the native token. CRO plays two roles: powering on-chain activity and supporting benefits within Crypto.com’s products.

On-Chain Utility (Cronos Network)

- Gas Fees: Traders use CRO to pay transaction fees on the Cronos chain, which runs on the Cosmos SDK.

- Staking & Network Security: Validators and delegators can stake CRO to help secure the network and receive rewards.

- Governance: CRO holders participate in proposals that influence protocol upgrades.

- Fee Distribution: The network burns a portion of fees or allocates them to validators and ecosystem incentives.

Utility Within Crypto.com Products

- Trading Discounts: CRO staking can unlock reduced trading fees on the exchange, with larger stakes qualifying for deeper discounts.

- Visa Card Tiers: CRO determines card levels, which offer varying reward rates and perks depending on region and program rules.

- Ecosystem Rewards: CRO is used for card cashback, Earn-product enhancements, and liquidity incentives within the Cronos DeFi ecosystem.

CRO sits between Crypto.com’s centralized services and the decentralized Cronos network. When browsing through crypto news, we found that most updates tend to relate to Cronos ecosystem development and how CRO is used in Crypto.com’s products.

Who Is Crypto.com Not For?

While the Crypto.com exchange is suitable for a variety of users, there are some trader profiles that may find the experience not optimized to their needs.

An important factor to consider is the availability of services. There are plenty of features available on Crypto.com, but many are restricted to certain jurisdictions, while the exchange as a whole is not available in some key areas, such as New York. Before making an account, we recommend you check for the availability of the features you are looking for.

Additionally, the exchange may not be attractive to all fee-sensitive high-frequency traders who operate with low volumes. The fee structure depends on CRO token holdings, but a large portion of fee discounts still comes from substantial trading volumes. Traders who don’t reach these may find rapid trading to be on the expensive side.

Finally, users who rely on fast and consistent support may find the response times slower than desired. In our testing, the responses were sufficiently fast, but our research suggests that some traders experience slower response times, which negatively impacts their user experience, particularly during critical periods in crypto markets.

Crypto.com Review Methodology

Our review is based on direct testing and comparison with other exchanges. We created an account, completed KYC verification, and funded it with both fiat and crypto to assess how the platform works in practice. Our testing included using the exchange for spot trading, exploring the mobile app, and activating the Visa card.

We evaluated the user experience, fee transparency, execution flow, and the impact of CRO staking on trading costs. We also reviewed Crypto.com’s fee schedules, withdrawal structures across different networks, and the platform’s security certifications.

To add context, we compared Crypto.com’s features with those from our selection of top crypto exchanges, including Binance, Coinbase, Kraken, and OKX, focusing on fees, asset coverage, mobile usability, and support channels. Our goal was to provide a clear, balanced view of how the platform operates.

Our overall rating reflects both our hands-on experience with Crypto.com as well as the findings of other analysts and, most importantly, users. For example, while our experience with Crypto.com support was generally positive, some users found the responses too slow. We have taken that into account when grading the exchange.

Crypto.com Review: Final Verdict

How good is Crypto.com? The platform offers an ecosystem that brings trading, spending tools, and on-chain access into one place. While the exchange’s base fees are higher than those of the lowest-cost competitors, Crypto.com’s tiered structure and CRO-based discounts can even that imbalance out.

In our experience, the standout aspect of the platform is the range of features available from a single account. Users can move between spot markets, derivatives, the NFT marketplace, and the non-custodial DeFi Wallet without having to use separate platforms. The caveat is that some of these features are not available in all regions (derivatives, for instance), so it is essential to do your own research.

When it comes to asset support, security certifications, and 24/7 support channels, we find that Crypto.com is on par with competitor platforms, satisfying the contemporary standards for Tier-1 exchanges. Ultimately, Crypto.com is a well-rounded option for retail users who value convenience and a staking-based fee structure.

FAQ

Is Crypto.com safe?

How do you withdraw money from Crypto.com?

What is Crypto.com?

Is Crypto.com legit?

Is Crypto.com a popular crypto trading platform?

Can I buy crypto on Crypto.com?

Does Crypto.com accept credit or debit cards?

Is Crypto.com’s customer service available 24 hours?

Who owns Crypto.com?

Does Crypto.com charge fees?

References

- Crypto.com Official Website (Crypto.com)

- Monaco Rebrands as Crypto.com to Accelerate the World’s Transition to Cryptocurrency (PR Newswire)

- What Is a Multisig Wallet? (Ledger)

- Cosmos SDK Whitepaper (Cosmos)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

25 mins

25 mins

Otar Topuria

Crypto Editor, 39 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.