Ethereum Price Prediction: SEC’s Approval of Bitwise’s Bitcoin-Ethereum ETF — Could This Push ETH to $8,000?

/PlutoChain/ – SEC has approved Bitwise’s Bitcoin-Ethereum ETF and this move could open the doors for more institutional investment.

At the same time, PlutoChain ($PLUTO) might position itself as a game-changing Layer-2 solution for Bitcoin.

By enabling instant transactions, lower fees, and Ethereum compatibility, it could finally solve Bitcoin’s biggest scalability challenges.

Here’s all you need to know.

Can Ethereum (ETH) Surge to $8,000 as ETF Adoption Gains Momentum?

As of February 1, 2025, Ethereum (ETH) is trading at approximately $3,248.71, down 2.1% over the past 24 hours. The 24-hour trading volume is around $20.11 billion.

The RSI is at 48 right now, which puts ETH in the neutral zone.

The SEC has just given the green light to Bitwise’s Bitcoin and Ethereum ETF.

This ETF offers investors exposure to both BTC and ETH in a regulated and accessible way, which makes it easier for institutions and retail traders to jump in.

While the fund has passed the 19b-4 approval process, it still needs final approval of its Form S-1 before trading can officially begin.

This move follows the SEC’s earlier approval of spot Ethereum ETFs in mid-2024, which was a game-changer for ETH’s mainstream adoption.

By allowing investors to gain exposure to Ethereum without directly holding the asset, these ETFs have attracted a lot of attention from big players in the financial world.

With Ethereum-focused ETFs now gaining traction, analysts expect more capital to flow into ETH.

Crypto analyst Merlijn The Trader predicts that Ethereum is set to surge to $8,000.

How PlutoChain ($PLUTO) Could Transform Bitcoin With Faster Transactions, Lower Fees, and Seamless Ethereum Compatibility

Bitcoin is the most dominant cryptocurrency, but it still faces challenges like slow transaction speeds, high fees, and network congestion.

Faster networks like Ethereum and Solana have adopted scalability solutions, but Bitcoin hasn’t fully embraced advancements that make it more efficient for everyday transactions.

PlutoChain ($PLUTO), a next-generation Layer-2 solution, might be able to change that by making Bitcoin faster, cheaper, and more versatile.

PlutoChain could operate alongside Bitcoin to help reduce congestion and speed up transaction processing without altering Bitcoin’s core infrastructure.

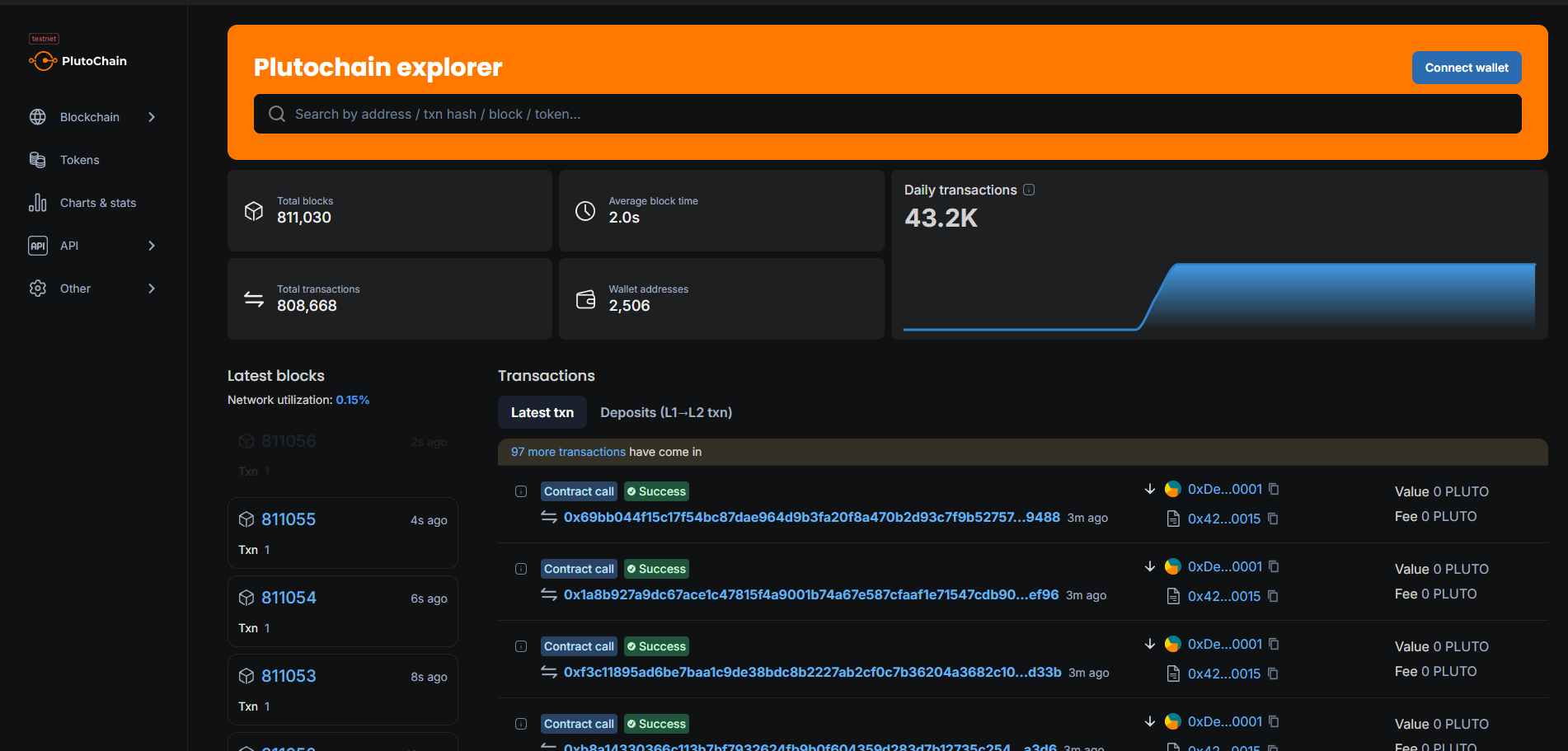

Instead of waiting 10 minutes for confirmation, PlutoChain offers block times of only 2 seconds with the help of its Layer-2 technology.

This improvement could make Bitcoin far more practical for daily payments, remittances, and microtransactions — areas where it has struggled due to long wait times and high costs.

Beyond speed, PlutoChain could significantly cut transaction fees, which could make Bitcoin more accessible for both individuals and businesses.

By lowering costs, it could remove a major barrier that has prevented Bitcoin from being widely used for small, everyday transactions.

Another standout feature of PlutoChain is its cross-chain compatibility.

Since it’s fully Ethereum Virtual Machine (EVM)-compatible, PlutoChain could allow Ethereum-based applications — including DeFi protocols, NFT marketplaces, and AI-driven projects — to seamlessly integrate with Bitcoin.

This means Bitcoin could expand beyond being just a store of value and unlock entirely new use cases in decentralized finance (DeFi) and Web3 development.

PlutoChain has already demonstrated its potential by successfully processing 43,200 transactions in a single day without disruptions during the testnet phase.

Security measures include comprehensive audits conducted by SolidProof, QuillAudits, and Assure DeFi, as well as routine code reviews and stress testing.

A key aspect that sets PlutoChain apart is its community-driven governance model. Rather than relying on a central authority, PlutoChain gives users a say in network upgrades, partnerships, and protocol changes through a voting system.

This decentralized approach makes sure that the platform continues to evolve based on the needs of its growing user base.

With instant transactions, lower fees, cross-chain interoperability, and decentralized governance, PlutoChain could be the missing link that finally makes Bitcoin scalable, efficient, and ready for mass adoption.

Closing Thoughts

Ethereum’s SEC-approved ETF will make it easier for traditional investors to gain exposure to ETH. As capital inflows increase, Ethereum’s position in the market could strengthen.

Meanwhile, PlutoChain ($PLUTO) is stepping up as a potentially game-changing Layer-2 for Bitcoin.

By enabling near-instant transactions, drastically reducing fees, and integrating seamlessly with Ethereum-based applications, PlutoChain could transform Bitcoin from a store of value into a highly efficient, scalable network.

This article is not financial advice. Cryptocurrencies and meme coins are volatile and risky. Do your own research before buying any cryptocurrencies and meme coins. All forward-looking statements include uncertainties and may not be revisited.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.