Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!

The S&P 500 gained about 3.17 percent in the past five days to trade at around 4,514.87 as of Wednesday’s close.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

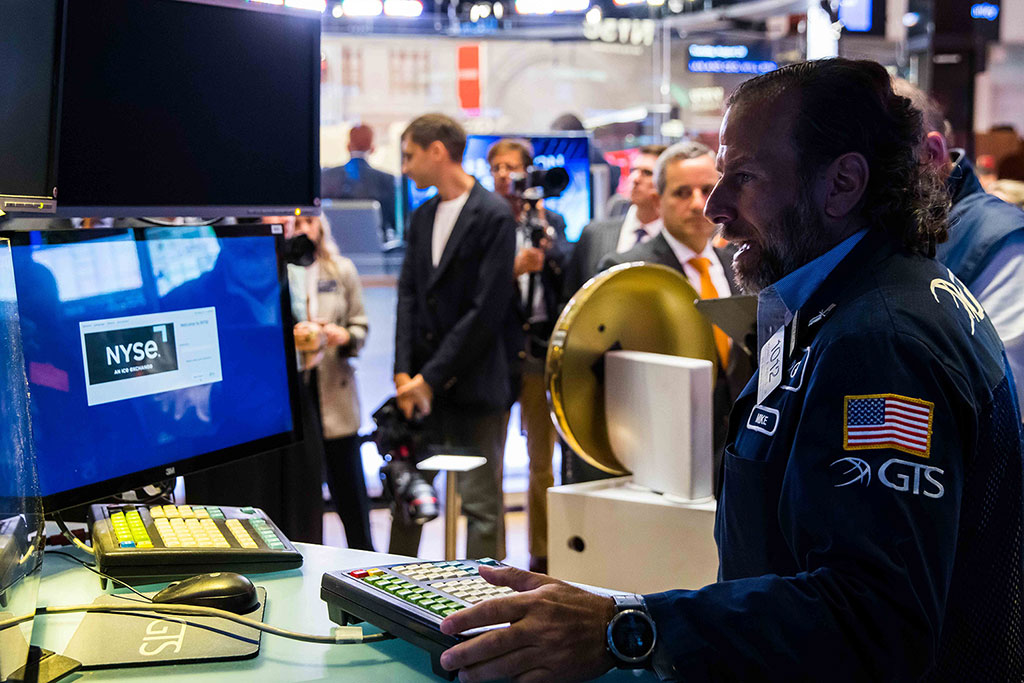

The S&P 500 (SPX) edged higher on Wednesday, closing above crucial support levels that could see the stock index revisit its ATH soon. The Standard and Poor’s 500 gained about 0.38 percent on Wednesday to close the day trading at around 4,514. Other major stock indexes led by the Dow Jones Industrial Average (DJIA) and the US 100 Index (NDQ) gained about 0.11 percent and 0.56 percent respectively.

The general bullish outlook coincided with most companies reporting impressive second-quarter earnings. As a result, investors had more data to assess the United States’ economic outlook amid shifting global status led by the BRICS movement. Notably, the BRICS movement led by Russia and China added several other members from different continents and was perceived to be major oil producers.

The S&P 500 is undeniably headed to revisit its ATH that was set during the 2021/2022 bull market. The artificial intelligence (AI) hype has seen most of the S&P 500 components thrive in the past few months. However, the general economic uncertainty has most investors betting on risky assets like digital assets, and precious metals.

The United States Bureau of Labor Statistics and the Bureau of Economic Analysis are expected to release high-impact news on Thursday and Friday, which will provide investors with a crucial economic outlook. Later today, investors will be watching the core Personal Consumption Expenditures (PCE) price index which released MoM, and the Unemployment Claims.

On Friday, investors will be on the lookout for the unemployment rate, also called the jobless rate, which is expected to be released with economists forecasting it to come at 3.5 percent, similar to the previous one. The Bureau of Labor Statistics will release the average hourly earnings MoM, which is expected to drop to 0.3 percent from 0.4 percent. Additionally, the agency will release data on non-farm employment change on Friday, which is estimated to come in at 169k down from 187k from the previous one.

Despite the investors highlighting weaker-than-expected economic data, the S&P 500 continued to gain and could continue for the rest of the year. Moreover, the Fed is expected to continue with its strict monetary policy to combat the high inflation to the desired 2 percent.

“Traders and investors alike want to see ‘follow through’ in today’s market action, helping to confirm that the uptick in market performance is a more viable move as the market heads into September,” said Quincy Krosby, chief global strategist at LPL Financial.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!