A significant event took place in the crypto ecosystem with Starknet’s STRK token commencing trading, immediately capturing the market’s attention. This event, highlighted by substantial airdrop, market makers’ investments, and growing user discontent, offers a multifaceted view of the token’s debut.

A Bold Market Entry of Starknet’s STRK Token

The STRK token launched with a notable airdrop, setting the stage for a vibrant market presence. Trading began at a price level of $0.50. It went up to $5.00 on KuCoin, which reflects both anticipation and the perceived value within the Starknet ecosystem. Primary market-making players, including Amber Group, Wintermute, and Flow Traders, have made substantial investments, reinforcing the token’s credibility and market potential. This has also injected both liquidity and momentum into the STRK token market.

Community Sentiments and Challenges

Despite the initial success and market enthusiasm, the Starknet community has voiced frustrations, particularly regarding the airdrop’s execution details. The anticipation surrounding the airdrop fostered high expectations among its users, which, when met with perceived shortcomings in distribution and transparency, led to a palpable sense of dissatisfaction.

Several users of the network on X and the project’s Discord channel said that, despite transacting thousands of dollars and bringing liquidity to the network, they were not able to get token distributions because they did not have the required amount in their wallet.

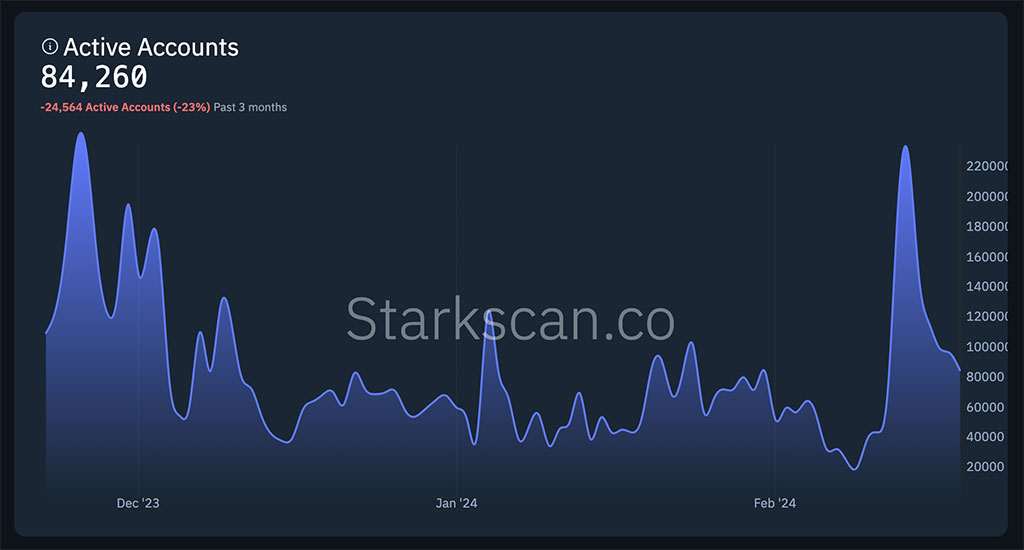

In terms of numbers, the Layer 2 had over 220,500 active users on February 14, which is almost a 1000% increase from the total number of active users (20,000) on February 9. This was primarily because the users and airdrop farmers flocked to the network in anticipation of getting an allocation from the airdrop. Soon after the details of the airdrop went live, the number of active users plummeted to near pre-announcement levels.

Current Dynamics of STRK

At the time of writing, Starknet (STRK) was trading around the price level of $3.00. The market cap was trading at around $1.93 billion, with $600 million in volume traded in just a couple of hours. The token also got listed on Binance, through which it has acquired the majority of its volume, amounting to 43% of the total volume. The initial release witnessed 7.28% of the total token supply, i.e., 728 million STRK tokens went into circulation. If we consider the total value of the total supply, it is firmly placed at approximately $30 billion.

One problematic issue with STRK is the token unlock schedule, which rewards Starknet investors and early contributors with 1.3 billion STRK, around 13% of the total supply, on April 15, just two months after the project’s start. This might result in pump and dump if the category to which the tokens will be unlocked is looking to book profits.

Overall, STRK is poised to face some severe market dynamics considering the falling active users on the network and the upcoming token unlock in April. However, with a collective TVL of $200 million and a strong positioning in the L2 landscape, this might be the beginning of the overall growth of the Starknet ecosystem.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.