An experienced writer with practical experience in the fintech industry. When not writing, he spends his time reading, researching or teaching.

SDF CEO believes that the Money Fund is ideally suited to run on the Stellar blockchain network.

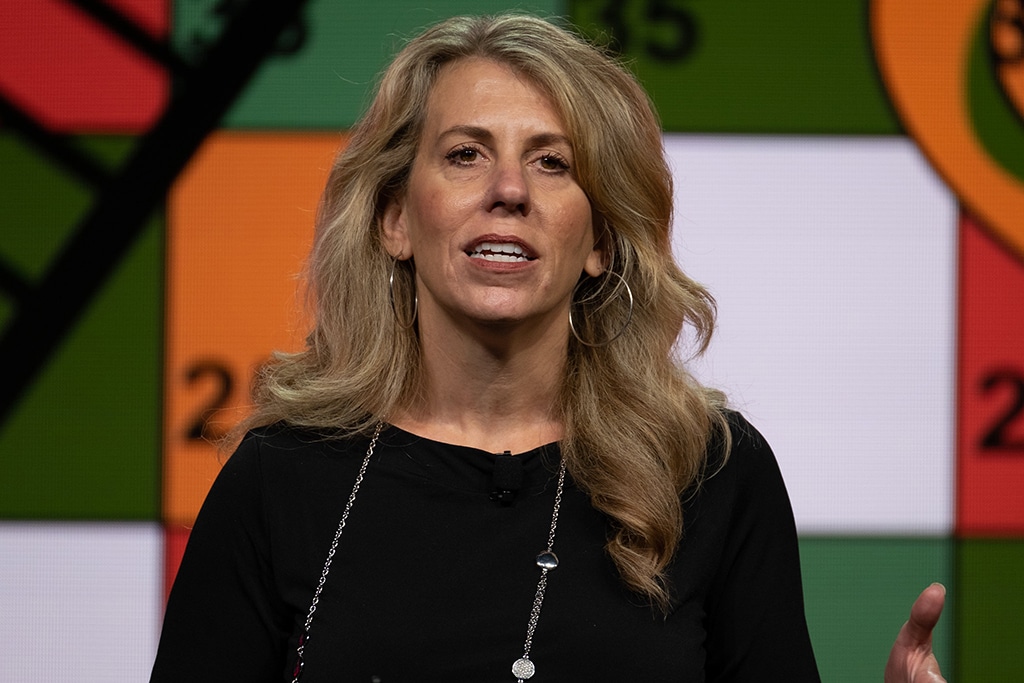

Edited by Julia Sakovich

Updated

2 mins read

Edited by Julia Sakovich

Updated

2 mins read

Stellar Development Foundation (SDF), a non-profit organization supporting the development of the Stellar chain, has announced a $20 million investment in the Franklin OnChain Money Fund.

With some of its funds still caught up in the failed Silvergate Valley Bank, SDF’s investment is an attempt to diversify its treasury. According to the CEO Denelle Dixon, their “money was just sitting in the bank accounts and that was not the best place for the value to sit.

Franklin OnChain US Government Money Fund is a US Government money fund that processes transactions and record share ownership on a public blockchain. The Fund’s transfer agent keeps shares ownership records on a private blockchain-integrated system based on the Stellar blockchain.

According to the press release, the Fund now has over $270 million in assets under management (AUM) as of March 31, 2023. 99.5% of these are invested in US government securities, cash, and repurchase agreements. These investments are fully backed up by treasury securities to safeguard shareholders’ capital and liquidity. The Fund also attempts to maintain its share price at $1.

According to Dixon, the Money Fund is ideally suited to run on the Stellar blockchain network. She added that the integration of blockchain with traditional finance demonstrates greater chances of interoperability in the financial sector.

Further, given Stellar’s prime focus on asset tokenization, SDF considers the potential use cases for the Funds’ native assets, the BENJI tokens, as important.

On his part, Roger Bayston, the Head of Digital Assets at Franklin Templeton, believes blockchain technologies can transmute traditional investing. Also, he cited the greater transparency and cheaper operational costs provided by such systems.

“Blockchains like Stellar’s are important to the investment process of the future,” he concluded. He also noted that the Fund will be operable with the rest of the digital asset ecosystem in the future.

Meanwhile, SDF and Moneygram also partnered with Techstars to drive technological innovation on the blockchain for cross-border payments. Likewise, the digital wallet platform Decaf recently announced an integration with an SDF-backed fiat ramp service for digital wallets.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

An experienced writer with practical experience in the fintech industry. When not writing, he spends his time reading, researching or teaching.