Santander Partners with Taurus for Crypto Asset Management

The new partnership with Taurus suggests that Banco Santander anticipates a greater role for crypto in traditional finance.

Santander and Monitise make a joint venture agreement with the aim of launching a fintech venture builder later this year.

The new partnership with Taurus suggests that Banco Santander anticipates a greater role for crypto in traditional finance.

Shooting 27% BNB price has surged past $600 for the very first time. With the surge, Binance Coin has registered nearly 1300% gains year-to-date beating some of the biggest traditional banking institutions.

Ten banks have joined to build a self-managed digital identity system using blockchain technology thereby giving users higher control over their data.

Santander is rebranding its venture capital arm Santander InnoVentures as Mouro Capital, and doubling its allocated funds from $200m to $400m as fintech investment hots up. Mouro Capital will manage Santander InnoVentures’ existing investments as well as further deepen Santander’s fintech involvement.

Several major banks are part of the Fnality International project. Fnality is working to create digital versions of five major fiat currencies, including the dollar and yen. The project has been delayed until at least 2021 as it seeks regulatory approvals.

One Pay FX – Ripple and Banco Santander’s joint collaboration – is looking to get a share of the FinTech market by using innovative solutions that offer transparent, low-cost and faster banking services to its customers.

RAKBANK announced the expansion of RAKMoney Transfer (RMT) services using Ripple blockchain technology RippleNet. The new service will be used along the Bangladeshi corridor by partnering with Bank of Asia.

Bank of America (BoA) is the second-largest bank in the U.S. It reportedly will join RippleNet for fast and cheap cross-border payments and exclusive infrastructure. But there is still no official confirmation.

On February 5, the Reginald Fowler’s case got an important update regarding three bank accounts in Santander UK. The assets held in them have been restrained.

Some experts think that Ripple’s IPO will put an end to the inherently speculative nature of the XRP token that won’t be much appreciated by its investors.

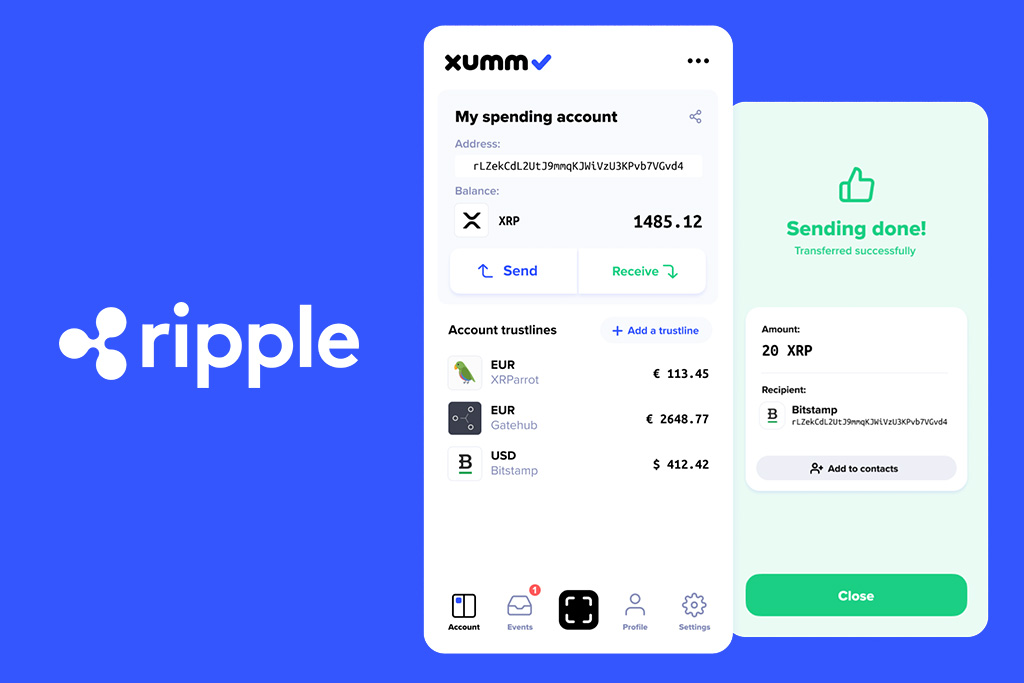

According to Wietse Wind, the lead developer of XRPL Labs, Ripple is considering launching not only a free version of the banking app but also a paid one that will be called ‘Xumm Pro’.

A new Market Integrity Working Group, tasked with the responsibility of ensuring fairness and accountability in the crypto space, will be co-chaired by senior executives of both Ripple and Coinbase.

Despite a growing interest by global organizations and government institutions for the blockchain technology, the industry saw a drop in new funds raised. Ripple managed to steal the show with over $200 million raised in Series C funding.

During the first day of WEF 2020 at Davos, the U.S. Treasury Secretary acknowledged the demand for faster cross-border payment solutions and said that the U.S. will support companies like Ripple offering such services.

Securitize announced it has managed to raise a whopping $14 million in latest investment from Nomura Holdings, MUFG, and Banco Santander.