US Court Dismisses Investor Lawsuit against Bancor over Investment Protection Feature

The case highlights one of the many lawsuits filed by investors against service providers for financial losses in the volatile cryptocurrency market.

The Bancor token project raised about $150 million on Monday in an initial coin offering (ICO), making it the second-largest fundraising campaign in the blockchain industry.

The case highlights one of the many lawsuits filed by investors against service providers for financial losses in the volatile cryptocurrency market.

Bancor has said it is currently testing and auditing the Dual Rewards and Auto-Compounding Rewards features and plans to activate them in the weeks ahead.

Founded back in 2013, Grayscale has seen its assets under management rise to approximately $43.6 billion as of December 31, 2021.

One of the original creators of DeFi is aiming to fix one of the industry’s most pressing problems.

Coinspeaker is highlighting a distinguished group of women who have and continue to play key roles in the male-dominated crypto sector.

Modern crypto companies require legal registration to work and provide services worldwide. To clarify this, Victor Kochetov, Kyrrex CEO, provides his vision about it.

The number of prospective assets to be added by Grayscale has now been increased to 31.

Since the announcement, there has been a mixed price reaction. While some like Filecoin, Bancor, and Yearn Finance have gained by as much as 10%. Others like Cardano have barely moved, recording a marginal move of less than 1%.

Gemini said that this decision comes amid its efforts to support projects that redefine the boundaries of finance, gaming, and art, and offer more financial independence.

Through this new partnership, 1inch users will get the best rates for TRON assets. Moreover, liquidity providers on the TRON blockchain will benefit from Mooniswap’s virtual balances.

Oasis Network’s privacy-preserving components will have the ability to collect data from multiple sources via Chainlink and use it as input for privacy-preserving computation models that only release the outputs while the data and the models are kept private.

The data from Messari shows that all the platforms built on Ethereum have a combined market cap of $63.7 billion. This is nearly 20% of the total market capitalization of the coin.

Coinbase may soon add support for a number of digital assets, including Aave, Synthetix, VeChain, SKALE Network, KEEP Network, NuCypher, DigiByte, Aragon, Bancor.

The movement around decentralized finance (DeFi) is gaining swift traction, and many believe that it’s DeFi that will dominate blockchain space. Let’s find out what it is and why DeFi is such a big deal for the crypto community.

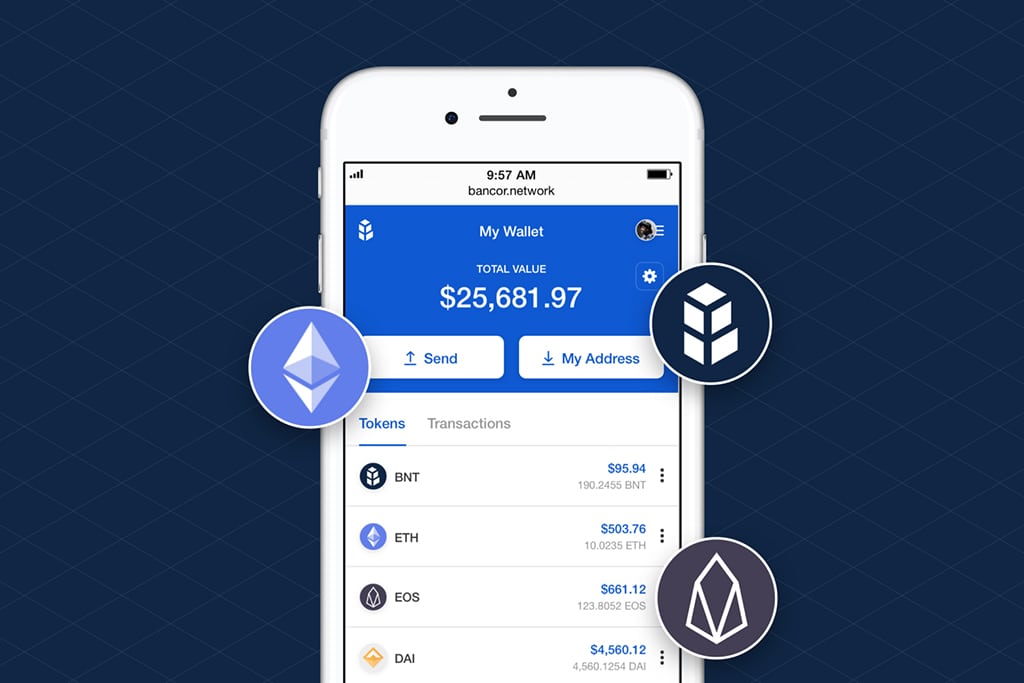

Decentralized liquidity network Bancor announces new non-custodial wallet for users to instantly convert between Ethereum and EOS-based tokens without order books or counterparties.