Bitcoin Market Cap Overtakes Silver, Eyes Gold’s Crown

The recent surge in Bitcoin price, which saw a 2.6% increase in the past 24 hours, can be attributed to the success of spot Bitcoin ETFs.

The recent surge in Bitcoin price, which saw a 2.6% increase in the past 24 hours, can be attributed to the success of spot Bitcoin ETFs.

A UBS strategist says that both gold and Bitcoin will benefit from the Fed when the agency decides to cut interest rates.

The total assets under management of all Bitcoins ETFs combined is more than double of the Silver ETFs available in the market.

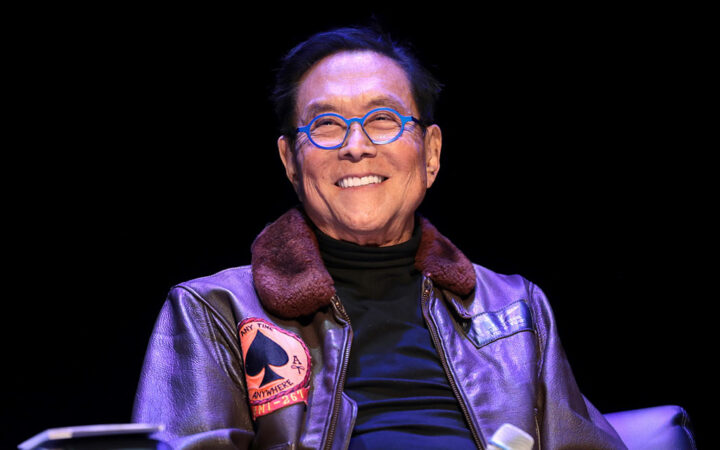

The author of Rich Dad Poor Dad expects the prices of Bitcoin (BTC), Gold, and Silver to rally in the near future as every government around the world prints more money pushing inflation to a multi-year high.

Galaxy Digital’s Mike Novogratz recommends strong exposure to Bitcoin, Ether, gold, silver, etc. for investors with high risk tolerance.

According to data from Silverprice.org, Silver has recorded an average growth of 7.4% over a 16-year period spanning 2007 to 2022.

The Reddit community of investors who fueled the GameStop rally has shifted its focus to precious metal silver taking its price 7% higher to $29 per ounce.

Before silver’s buying stampede, the Reddit frenzy also fueled the rise in GameStop, Dogecoin, and others.

Cryptocurrency market is showing recovery after a divergence last week, commodities follow the lead, hence Bitcoin was able to gain 1.1%, Ethereum 3.56% and Ripple recovered 2.0% in price.

Few charts to consider if you are ready to invest.

Gold price has so far reached its all-time high after crossing $2,000 level easily. Despite the fast rally, analysts anticipate silver price to outperform it.