February 13th, 2026

South Korea will begin a pilot test project of its CBDC to determine usability and functionality for programmed transactions.

In the report, the Israeli Finance Ministry explained that during the just-concluded pilot, the country tokenized digital bonds into security tokens compatible with ERC1155 smart contracts. This move allowed for seamless atomic transfers upon payment receipt.

Patex has launched its PATEX token on CEXs and DEXs for interested users and traders to enjoy several perks and advantages in the ecosystem.

The proposed digital shekel is different from other CBDCs in at least two ways. These are its interest-bearing nature and the separation of the role of banks from the provision of wallets and payment services.

Hungary’s move to embrace cryptocurrencies comes at a time when the global crypto market is making a comeback after a year-long market crisis.

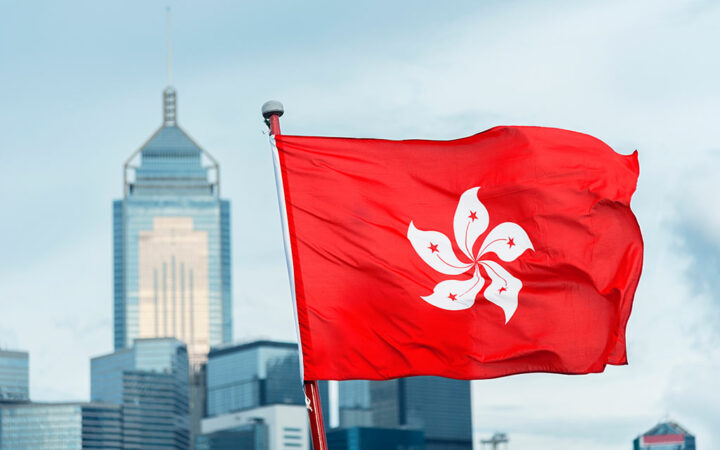

Hong Kong is currently pursuing an expansion of the digital yuan’s application. It is also approaching the second phase of its own CBDC pilot program and completing consultations for stablecoin issuance.

The bill aims to prevent the Federal Reserve from using CBDC as a tool to implement monetary policy or control the economy.

The Philippines might be setting out on its CBDC journey a bit differently from many others.

According to the crypto exec, Trump’s campaign and court cases will pump the tokens regardless of the election outcome.

The meeting with the SEC is now another step in South Korea’s journey of developing its local crypto economy.

Kennedy expressed his concerns about the potential infringement on civil liberties that comes with the ability to monitor every transaction.

Cryptocurrency has been a major point of discussion in politics lately, with experts stating that the crypto community stands to play a significant role in elections.

While Trump and his cohorts believe the introduction of CBDCs to the financial economy is a dangerous threat to freedom, many nations around the world are exploring such assets.

A known supporter of Bitcoin, DeSantis has openly opposed the idea of a government-issued central bank digital currency, calling it a threat to financial freedom.

The promotional approach seems effective in driving sales for Trump’s latest NFT collection, limiting “one of one” ordinals to a maximum of 200 in this exclusive offer.