January 30th, 2026

As a Democratic-affiliated SEC Commissioner, Gary Gensler has shifted his regulatory role to a politician seeking to be appointed as Treasury Secretary according to some Congressmen.

Coinbase CEO Brian Armstrong voiced frustration over the charges. He mentioned how his company has provided a lot of clarity to the SEC but the commission on the other hand is not making matters easier.

The Forbes Under 30 List, including all categories and individual profiles are available on the Ethereum blockchain for permanence.

Customers who have interacted with both Coinbase and Bybit reported receiving emails from Coinbase notifying them of the CFTC subpoena.

Ark Invest seems to be rearranging its investment portfolio and has continued to sell huge amounts of Coinbase, while acquiring Robinhood shares.

Brian Armstrong said that although there are bad actors in the market, it’s wrong to say that crypto is predominantly used for illicit activities such as fraud, money laundering, and terrorist financing.

COIN is presently trading at $119 after closing at $115 on November 27, which is the highest close since May 2022. The price now has minimal resistance ahead as it is moving toward $130, the May 2022 high.

In the new letter filed at the US Court of Appeals for the Third Circuit, Coinbase’s legal team believes that only the court can order the SEC to do its bidding to provide a clear regulatory framework for the crypto space instead of choosing to control the industry by enforcement.

Legal experts, including Ripple lawyer John E. Deaton, share Armstrong’s optimism, speculating that Coinbase will be a significant beneficiary of Binance’s regulatory challenges.

Bernstein analysts are not the only experts who believe Binance will remain the world’s leading crypto exchange despite the recent settlement with the US authorities.

As part of the settlement with Binance, FinCEN will impose a five-year monitorship program on the company’s order books despite the fact that the exchange agreed to completely exit the US market.

Armstrong touted Coinbase’s efforts at remaining in line with US compliance, while calling for regulatory clarity in the sector.

New Binance CEO Richard Teng has a rich track record in the financial regulatory environment, having worked in Dubai and Singapore for the past years.

The ranking provides a measure of the credibility and perceived influence of these personalities in the eyes of the crypto community.

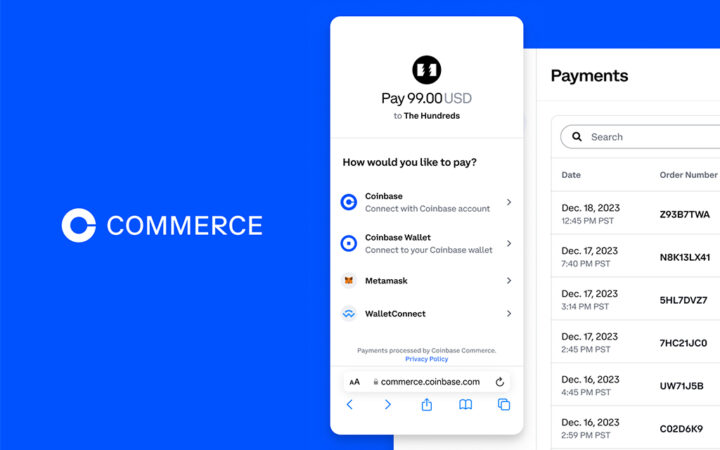

The platform includes a Coinbase Commerce button which allows merchants to easily accept payments for goods, services, and donations.