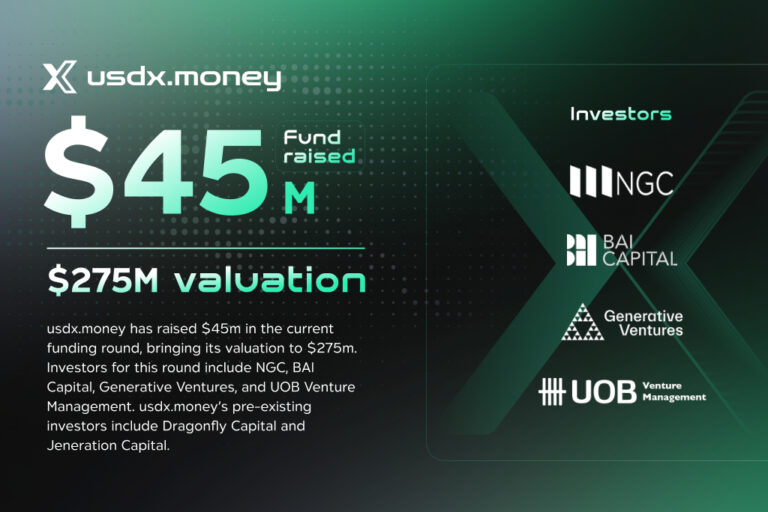

usdx.money Secures $45m New Financing at $275m Valuation

Hong Kong /usdx.money/ – usdx.money, a stablecoin infrastructure project, announced it has raised $45 million in the latest round of financing. The round puts the project’s valuation at $275 million. Investors for this round include NGC, BAI Capital, Generative Ventures, and UOB Venture Management, with a portion of the investments made in the form of warrants. Its pre-existing investors are Dragonfly Capital and Jeneration Capital.

usdx.money aims to build the next-generation stablecoin infrastructure, with USDX as its first stablecoin product. After concluding a successful funding round, usdx.money is accelerating its ecosystem efforts for increased adoption of USDX, with a focus on:

- USDX liquidity: bootstrapping USDX liquidity in leading DEXs, including Pancakeswap, Uniswap, Balancer, and Curve

- DeFi integration: integrating USDX as collateral in various DeFi money market and perpetual protocols

- Innovative payout model: providing non-correlated dollar payouts for USDX users

- Stablecoin infrastructure: enabling other stablecoin issuers to leverage usdx.money infrastructure

- Payment rails: providing alternative payment service for the underserved population

About usdx.money

usdx.money is a secure, decentralized, and bankless synthetic stablecoin issuer, dedicated to building the next generation of stablecoin infrastructure. By connecting decentralized finance (DeFi), centralized finance (CeFi), and traditional finance (TradFi), usdx.money provides efficient and stable financial solutions to meet the diverse needs of its users.

About the Support Team

usdx.money is powered by Stables Labs and is committed to driving rapid growth in the stablecoin space through innovative technologies and proven solutions.

For more information, users can visit the website.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.