With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

WazirX is banking on creditor approval to avoid liquidation and push forward with the DEX model.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

Crypto exchange WazirX has announced that affected users will recover 85.25% of their lost funds, with the first round of distributions scheduled for April 2025. The compensation is based on users’ portfolio values recorded on July 18, 2024, the day when the exchange suffered a $230 million security breach.

📢 Rebalancing Complete!

— WazirX: India Ka Bitcoin Exchange (@WazirXIndia) February 10, 2025

The rebalancing of platform assets is now done!

✅ Initial Fund distribution will return ~85.25% of USD value to creditors, based on rebalancing prices.

✅ Creditors can check their allocated share on the WazirX app & website.

Zettai remains committed… pic.twitter.com/9OwXzs7vEm

Users can now track the US dollar and Indian rupee values of their lost assets directly on WazirX’s platform. The exchange has credited additional funds from unstolen tokens, boosting recovery amounts. The strategic move aims to mitigate losses for thousands of affected users and rebuild trust in the exchange.

In order to push forward with the recovery plan, WazirX has set a February 19 deadline for creditors to approve the asset rebalancing scheme. At least 75% of creditors must vote in favor of the process to proceed. A failed vote would shift the process towards liquidation under section 301 of the Singapore Companies Act, potentially slashing compensation.

The July 2024 attack left the exchange struggling to maintain its liquidity, as the stolen funds made up over 45% of its total reserves, according to a June 2024 report. Intelligence sources suggest the Lazarus Group, a notorious North Korean hacking unit, was behind the cyber heist. This group has been linked to multiple high-profile crypto thefts in recent years.

WazirX has added three new tracking features to increase transparency on its website and mobile app. Users can now see their rebalanced portfolio, past balance as of July 18, 2024, and their creditor status. WazirX co-founder Nischal Shetty shared a screenshot of these updates on X (formerly Twitter) to keep the community informed.

Photo: Nischal Shetty, CEO of WazirX

WazirX, undergoing restructuring, plans to introduce a decentralized exchange (DEX) and recovery tokens (RTs). RTs will function as tradable assets, with WazirX repurchasing them periodically using platform profits and new revenue streams over three years.

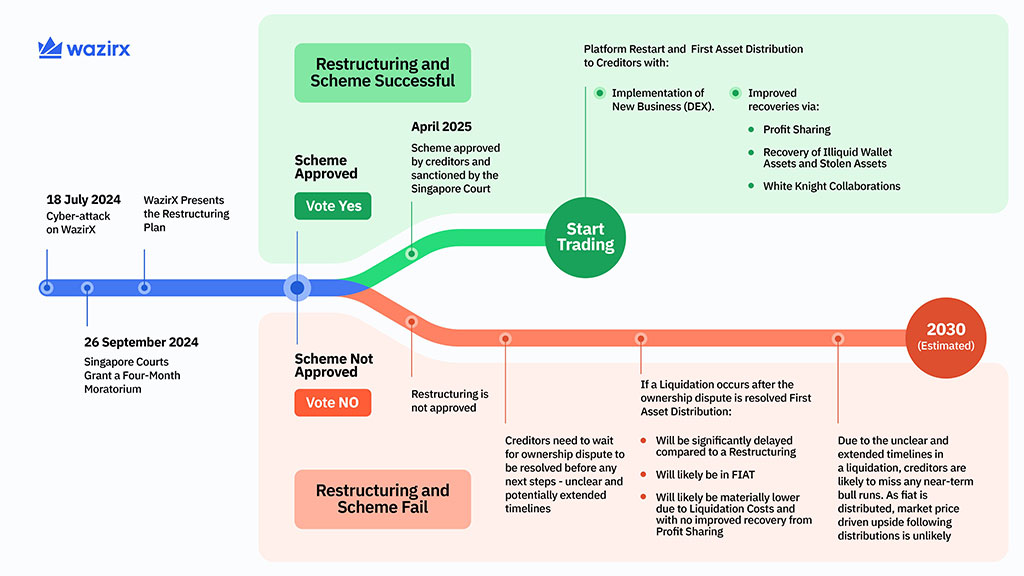

Despite the efforts to restructure, WazirX faces a critical risk. If creditors reject the compensation plan, the process would shift to liquidation. That could lead to a fire sale of assets, reducing the payout value significantly. As Coinspeaker previously reported, the recovery process could stretch until the end of 2030 if liquidation occurs.

WazirX roadmap shows that the recovery process could stretch until the end of 2030. Photo: WazirX

WazirX is banking on creditor approval to avoid liquidation and push forward with the DEX model. However, the final decision rests with the users, making the February 19 vote a crucial turning point in the exchange’s future.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.