Whale Accumulation Surges as Bitcoin Hyper Rockets Past $22M

From topping $21 million just over the weekend, Bitcoin Hyper (HYPER), the fastest Bitcoin Layer-2 chain, has already crossed the $22 million funding milestone as of Monday.

The main driver behind this milestone appears to be ongoing whale accumulation. Their appetite for HYPER tokens has become a defining trend over the past week, showing growing conviction among deep-pocketed investors.

This steady buying indicates that whales see something potentially massive in Bitcoin Hyper and these successive purchases and visible FOMO suggest expectations of a much larger move ahead – especially once the project moves past the presale stage.

For retail investors, on-chain whale accumulation offers a clear signal that current prices may represent one of the most favorable entry points.

At the moment, HYPER is up for grabs at $0.013075 per token, with the current presale round set to close in less than 29 hours or once the $22.4 million target is reached, whichever happens first.

The price was $0.013065 just yesterday, which means another price increase could arrive within hours.

Whales Pour Millions into HYPER as Bitcoin Hyper Smashes Four Funding Milestones in a Week

Over the past seven days, Bitcoin Hyper has continued to break milestones in rapid succession. From $18.8 million on September 29, the project has crossed $19 million, $20 million, $21 million, and finally $22 million by Monday. That means $3.3 million in fresh funding within a single week.

Each of these jumps has been fueled by large-scale investors joining the trend. Last week, one whale purchased 24.6 million HYPER worth $327,000. Soon after, two more whales collectively acquired 25.65 million HYPER valued at $333,000.

Over the weekend, another massive buy came in – 42.2 million HYPER worth $560,000 – followed by Monday’s headline purchase when Bitcoin Hyper stood at $21.6 million in funding. The same whale, linked to address 0xDd00D150C7a38aA26b590De42e31C7086F494669, added another 20 million HYPER to their stack worth $273,000.

Source: Etherscan

All of this points to a clear pattern. Those who typically move with deeper insight and data are positioning early for what could become one of the most influential projects shaping Bitcoin’s next phase, particularly in the development of hybrid Layer-2 applications that combine Solana’s speed with Bitcoin’s security.

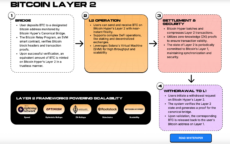

How Bitcoin Hyper Balances Speed, Security, and True Decentralization

The biggest challenge in blockchain design comes from the trade-offs between security, decentralization, and speed. When a network prioritizes security and decentralization, it often sacrifices scalability. On the other hand, when it chases speed and high throughput, it tends to give up some decentralization or security.

Ethereum has made major progress toward solving this through Layer-2 solutions like Optimism, Arbitrum, and zkSync, which improve scalability while maintaining Ethereum’s base-layer security. However, most of these networks still rely on the EVM (Ethereum Virtual Machine), which is built for broad compatibility but limited by how it processes transactions one at a time, in sequence, rather than in parallel.

For applications to truly perform at scale, they need speed, efficiency, and high throughput – exactly the kind of environment that can be built once Bitcoin Hyper is fully deployed.

Running on the Solana Virtual Machine (SVM), which processes multiple transactions simultaneously, Bitcoin Hyper is capable of handling thousands of transactions per second, far beyond the EVM’s sequential limits.

Throughput, however, means little without security. That’s where Bitcoin Hyper’s architecture stands out – its execution layer is fast, but it remains anchored to the Bitcoin base chain, the most decentralized and secure network in existence.

This combination is why Bitcoin Hyper is often described as bringing together the best of both worlds, and it’s a major reason investors are paying such close attention to its growth.

Bitcoin Hyper Set to Drive New Utility Demand for BTC

The new generation of applications that could emerge from Bitcoin Hyper may arrive quickly, especially since its development tools are already familiar to most blockchain engineers. Developers can build using Rust-based SDKs and APIs, similar to those used on Solana, which shortens the learning curve and speeds up deployment.

If adoption does gain traction, it could lead to a meaningful portion of Bitcoin’s supply being locked within the Canonical Bridge, effectively reducing circulation and potentially increasing the value of BTC held outside it.

What makes this setup unique is that the Bitcoin locked in the bridge isn’t idle. A wrapped version of BTC circulates across the new Bitcoin Hyper applications, serving as the medium of exchange within its DeFi, gaming, and real-world asset (RWA) environments.

As that wrapped BTC moves through these platforms, it creates utility-based demand for Bitcoin, turning it from a passive store of value into an actively used asset within a connected on-chain economy.

Even a small share of Bitcoin’s supply entering Bitcoin Hyper would represent substantial value – just 1% could amount to tens of billions of dollars as BTC advances toward $130,000.

In this setup, investors are accumulating HYPER, often referring to it as “Bitcoin 2.0”, since the token is directly connected to the network’s growth. HYPER powers gas fees, staking, and governance, ensuring the ecosystem functions seamlessly as activity expands.

That connection between Bitcoin’s liquidity and Bitcoin Hyper’s design explains why outlets such as 99Bitcoins, Cryptonews, and influencers like CryptoTV and Cilinix Crypto are covering Bitcoin Hyper and discussing its potential to replicate the kind of early-stage gains Bitcoin once delivered.

Could We See $23M This Week?

With everything Bitcoin Hyper is building, it’s no wonder the presale continues to gain strong traction. The question now is whether it can reach $23 million before the week ends.

That scenario looks increasingly likely given how much has been raised in just seven days. But as funding accelerates, it’s worth remembering that this early phase won’t last forever – once the target is hit, the presale will close.

While there’s still time to secure HYPER at presale prices, investors can purchase directly through the official Bitcoin Hyper website using SOL, ETH, USDT, USDC, BNB, or even a credit card.

New holders can also stake immediately through Bitcoin Hyper’s native protocol, currently offering a 53% APY with already nearly 1 billion HYPER staked.

For the smoothest experience, Best Wallet – one of the best crypto wallets in the market – lists HYPER under its Upcoming Tokens section, making it simple to buy, track, and claim once live.

Stay connected with the Bitcoin Hyper community on Telegram and X for the latest updates.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.