Christopher Haruna Hamman is a Freelance content developer, Crypto-Enthusiast and tech-savvy individual. He is also a Superstar Content Developer, Strategy Demigod, and Standup Guy.

Brazil is the first country where WhatsApp digital payments are starting to be introduced.

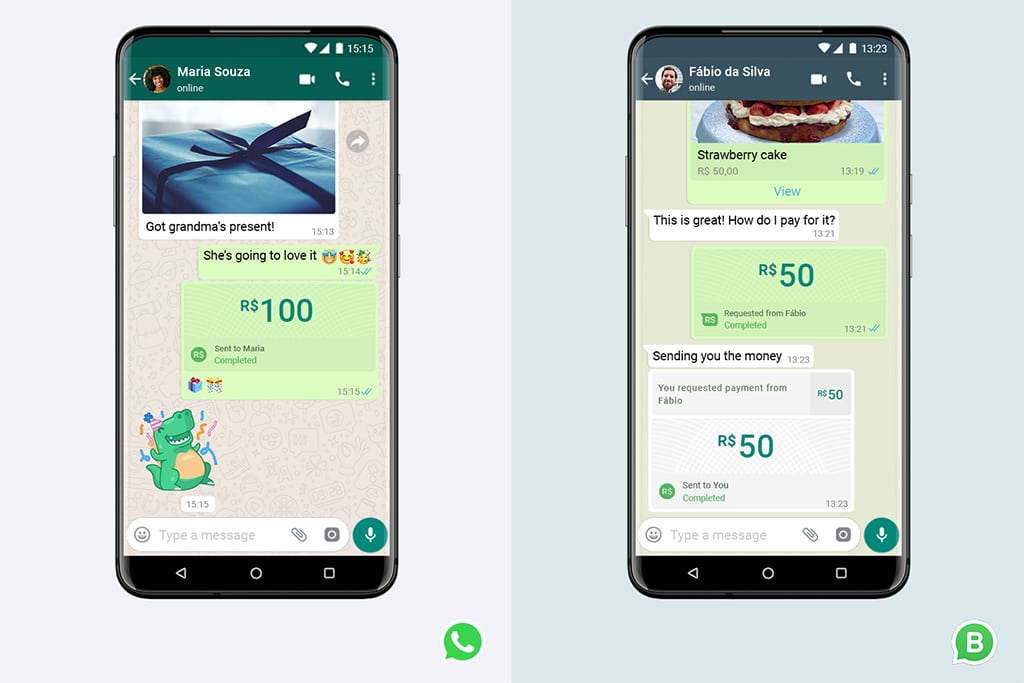

WhatsApp digital payments are set to start in Brazil. The messaging service indicated this on its website. The introduction of this feature will enable people to make purchases within their chats. Whatsapp went further to state that ” over 10 million small and micro-businesses are the heartbeat of Brazil’s communities”.

This comes as Facebook Inc‘s (NASDAQ: FB) Libra project is facing scrutiny and distrust from governments.

WhatsApp also said that its digital payments feature is powered by Facebook Pay. Facebook Pay is the social networking giant’s highly successful attempt at making payments between users. The payment service has also been seen by many as a route for increased cash flow for the social networking giant.

Mark Zuckerberg also introduced WhatsApp Digital Payments. He said in a post:

“We’re working with local banks, including Banco do Brasil, Nubank, Sicredi as well as Cielo, the leading payments processor for merchants in Brazil”.

Zuckerberg also indicated that Brazil is the first country that will have this feature.

Brazil has been one of the countries that have been at the forefront of the digital payments revolution. With about 26.5% of its population living in poverty, digital payments are one of the ways to create financial inclusion. It also changes the way banking activities occur.

Though digital payments come with their issues, they are still seen as the future of banking.

Whatsapp digital payments have two security features. A six-digit PIN or a fingerprint scan is required for transaction confirmation. Credit cards will start from Banco De Brasil, Nubank, and Sicredi. Both Mastercard Inc (NYSE: MA) and Visa Inc (NYSE: V) options will be available. Payment processing will occur through Cielo. Cielo is the top payment processor in Brazil.

WhatsApp has also indicated that its technical framework has an allowance for the addition of partners in the future.

In a reversal of the regular business model, payments sent by users free. Businesses have to pay a small fee for the receipt of funds. This is a significant step that enables the increase in inclusion and adoption.

The cost of transfer (COT) on a normal day is borne by the sender of funds. This burden shows that the sender has what it takes to make remittances. By reversing this, Whatsapp has been able to create a strategic advantage that most mobile payments providers don’t have.

Services are expected to start today. This will be a watershed for many people who have wondered how Mark Zuckerberg and his team of innovators will monetize WhatsApp.

Since the 2014 acquisition, WhatsApp’s two billion-plus user database can be monetized. The revenue generated hasn’t made any hits so far on Facebook’s (FB) bottom line. This may change however with the introduction of this feature, money flows will enable just about anybody to do business on the go.

It is also another welcome addition to the fintech space. As technology evolves, so will payments. Personalization of payments is the key as the world seemingly becomes smaller. The wizard of Menlo park seems to have his hands on another new formula. Let’s see how this goes.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Christopher Haruna Hamman is a Freelance content developer, Crypto-Enthusiast and tech-savvy individual. He is also a Superstar Content Developer, Strategy Demigod, and Standup Guy.