The markets are bleeding red in sans serif headlines, and half a year old ‘crypto writers’ are asking, “Is Bitcoin dead?” Venture Capitalists are choosing and picking amongst the ICOs, while Wall Street seems to be on the brink of pouring its corporate dollars into cryptocurrency. Yet the bear is untamed. What should a retail investor or a trader that does not have the might of Goldman Sachs or experience of Warren Buffet do? The first step is to stop panicking and try to understand what the hell is going on.

Market cycles are not a new concept; every market from oil to gold and foreign currency goes through bear runs and bull runs. Though Newton was talking about gravity when he said, “What goes up must come down”, his statement rings true for any market, including that of digital currencies. Now there is no one who can precisely predict the turns a market will take, but there are patterns to be found upon looking at historical charts of trading volumes and prices. Bitcoin goes through cycles of bear and bull like any other asset, it’s just so that these changes happen in the blink of an eye when compared to traditional markets, where trends reverse every few years or so.

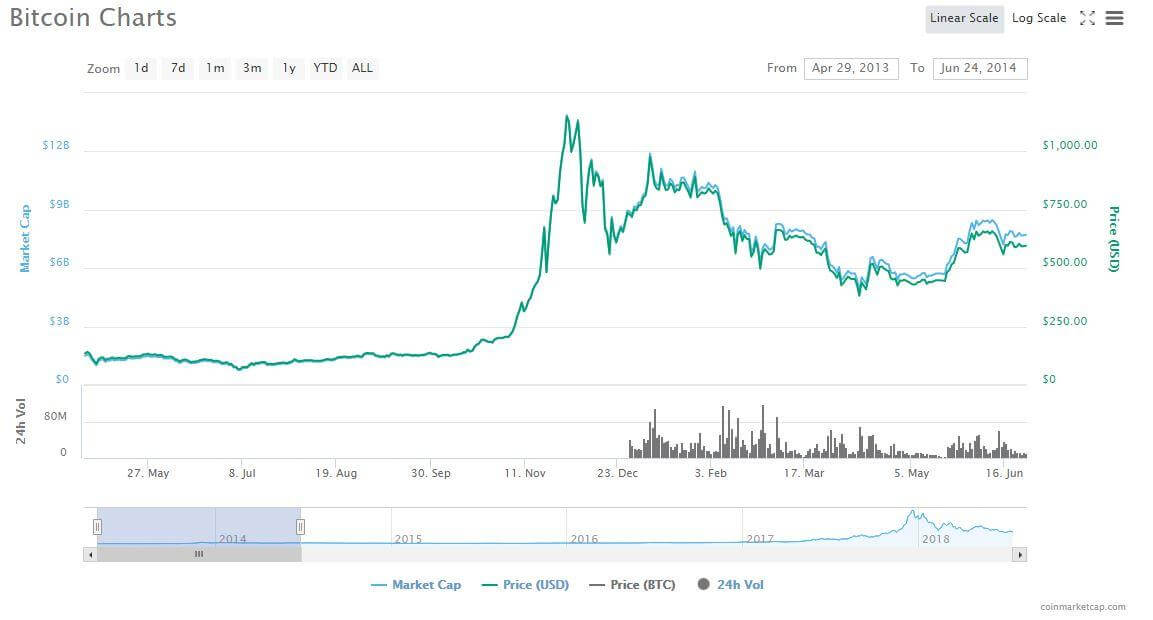

Bitcoin’s first meteoric rise in 2013-2014 was followed by a price dip. It had many ups and downs along the way till mid-2017 that another bull run, a historic one at that, would come to pass.

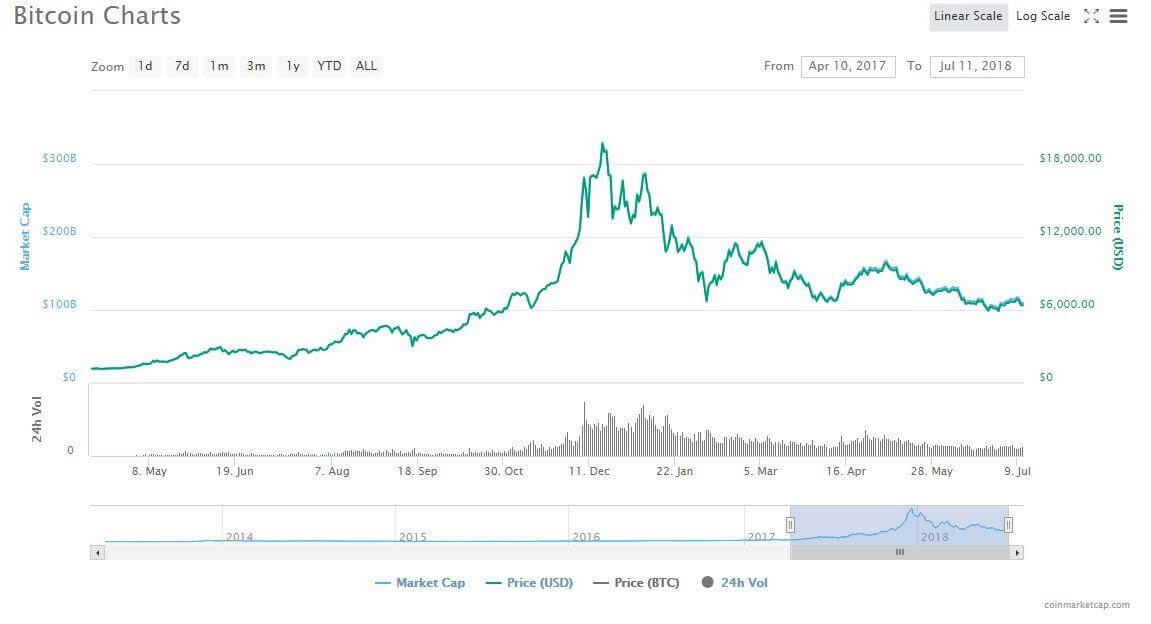

After clocking an all-time high of around $20000, prices began a descent around mid-January and thus began the time of the bear, leaving many in despair. You may now assume, well that means it will rise again, and you would be right. Although, difficult to tell when it will happen, we need not surrender to despondency.

Now we have established two things: the bulls will rise again and that a bear run is not the end of the world. But the question is, what to do in the meantime? Well, Bitcoin and other cryptocurrencies have given power back into the hands of the people and the people ought to keep using this power. Though many may scoff at the corporate suited ‘professionals’ who trade and invest, they are pretty good at it and retail investors can learn a thing or two from their book to brave the markets and reap profits while it is still red. Thus, here are three things you can do right now, that many traders, investors and VCs probably do daily for a living.

Change Your Trading Strategy

‘Buy low and sell high’ and ‘HODL’ may seem like the only two strategies floating around the crypto verse, but truth be told, there are many other ways to approach trading. As they say, there is more than one way to skin a cat. You could try margin trading, where you borrow at X times leverage to sell high (depends on your credit limit), then buy back the dip to acquire more coins/ tokens. You could also short cryptocurrencies by engaging in Futures Trading, where you buy and sell contracts based on crypto as opposed to crypto directly. Currently, not a wide variety of derivatives instruments are available for trading; you could, however, learn to navigate the opposite direction in the market while diverse crypto derivatives trading products like spreads and butterfly are in the works to be introduced (upcoming crypto derivatives exchange idap.io is introducing these new instruments soon). Thus, hedge and speculate instead of just buy low and sell high.

Research: Learn and Practice

While the bulls are asleep, it is a good time for self-improvement in terms of your knowledge about crypto and trading, along with learning how to pick out good projects amongst the hype of ICOs. You can read about technical and fundamental analysis, utilizing different order types while executing a trade and even practice crypto trading with a Trading Simulator. You can soon train using a novel Simulated Trading Environment, also being introduced by idap.io; it uses real market data, but you can trade without staking any real cryptocurrency. Get a grasp of how to assess good projects, how to break down the white paper and how to identify the long-term potential of any coin/startup doing an ICO. You don’t necessarily have to invest, but the preparation done today will benefit tomorrow.

Back Good Projects

To take an optimistic view, the fallen prices have forced the truth about many fake ICOs to come to the forefront. The scams and bad projects will perish under winds of crypto winter, while genuine ICOs, with actual real products, will carry on, keep building and under clearer skies, profit as the markets leap upwards. Thus, if you have the appetite for the risk, know how to do your homework when it comes to ICOs and can patiently sit tight till the markets turn green, go ahead and place your bet on a good project. There are many startups that stand to revolutionize the world of blockchain and crypto and if you can put in the time and effort to identify them, you could reap huge gains in the future upon investing today.

For instance, there is QuarkChain (a high-capacity P2P transactional system), coti (digital currency alternative to traditional payment systems like Visa), 0xcert (open protocol built to support the future of digital assets, powered by non-fungible tokens) and idap.io (first complete crypto derivatives exchange offering diverse crypto derivative products, Desktop Trading Interface with ladder based ‘point-and-click’ trading and customizable workspace & multiscreen support and Simulated Trading Environment). An exchange ICO like idap.io is especially lucrative as seen by the success of previous exchange ICOs like Binance, Kucoin and Cobinhood. Moreover, even in a market that is down, exchange coins fare better than other cryptos as their inherent value is tied to the success of the exchange and trading may dwindle but doesn’t stop in a bear run.

So here you have it, three things to do while the market is down. Now kick away the crypto market blues, pray for a bull run and get to work!