Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.

The team of Narbonne has analyzed the most successful cryptobanks from Polybius and Bankera to Cryptopay and Crypterium.

This review was performed by the team of Narbonne, a platform enabling its users to create any kind of financial services. New projects arise monthly, calling themselves cryptobanks and launching ICOs. This trend was started in 2017 by the Polybius team, raising $32 millions. So far this figure remains unmatched by the competition, however their number grows constantly.

The biggest successes so far:

Three cryptobank ICOs are going in full swing right now:

Four more projects have announced their upcoming ICOs:

We have analyzed all of the above companies and identified the key common denominators of such services.

All successful projects who have completed their ICO have similar financial goals. They mostly raise money for the following features:

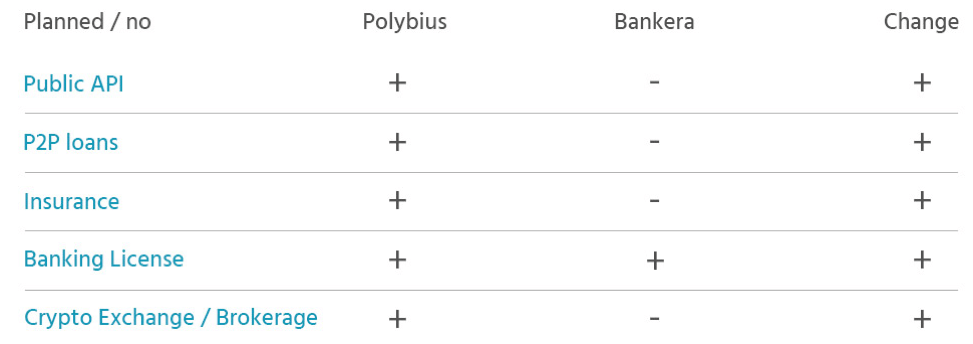

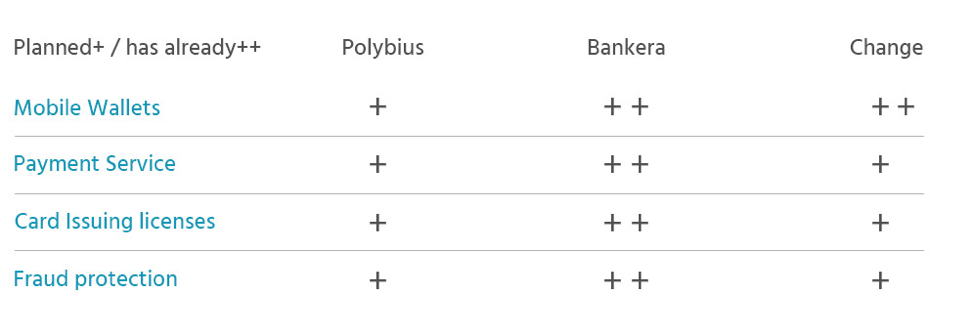

Bankera stands out to a certain extent, as it already has many products in place that are only planned or being developed by others (“-“ stands for “planned” or “in development”):

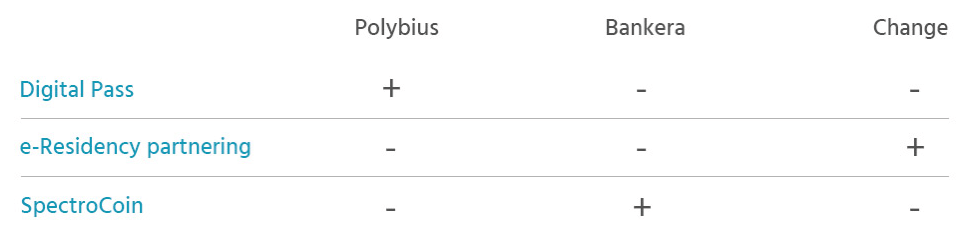

Each of the 3 projects that completed the ICO has its own unique, distinguishing advantages, related either to the technologies or to the business processes. We expect these advantages to help the banks in question to become reliable financial services:

Polybius has developed Digital Pass, a unique technology and service that provides a common interface for interaction across systems, and ensures trust through integrity and transparency of records. Digital Pass facilitates storage of encrypted data, private and corporate, in a decentralized data warehouse for both companies and individuals.

Bankera has valuable experience and a whole technological complex of banking services. The required IT infrastructure to facilitate payment processing and issue personal IBANs or payment cards have already been developed and are available as a minimal viable product (MVP) in the form of SpectroCoin.

Change offers a partnership with its unique e-Residency program:

“As a strong validation to our vision and plans, Change has partnered with the most advanced digital society in the world, the e-Residency initiative by the government of Estonia. This highly ambitious project is revered among global nomads and supporters of decentralization, including Tim Draper and Edward Lucas.”

The teams of the projects mentioned above still have a long way to go to a solid cryptobank, but their expertise and distinct advantages leave no room to doubt their future success. Experienced teams create products that the cryptomarket required. And it’s great.

Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.