Ibukun is a crypto/finance writer interested in passing relevant information, using non-complex words to reach all kinds of audience. Apart from writing, she likes to see movies, cook, and explore restaurants in the city of Lagos, where she resides.

Sources revealed that Ant Group hopes that Jack Ma’s stake will be sold to existing shareholders or Alibaba Group Holdings.

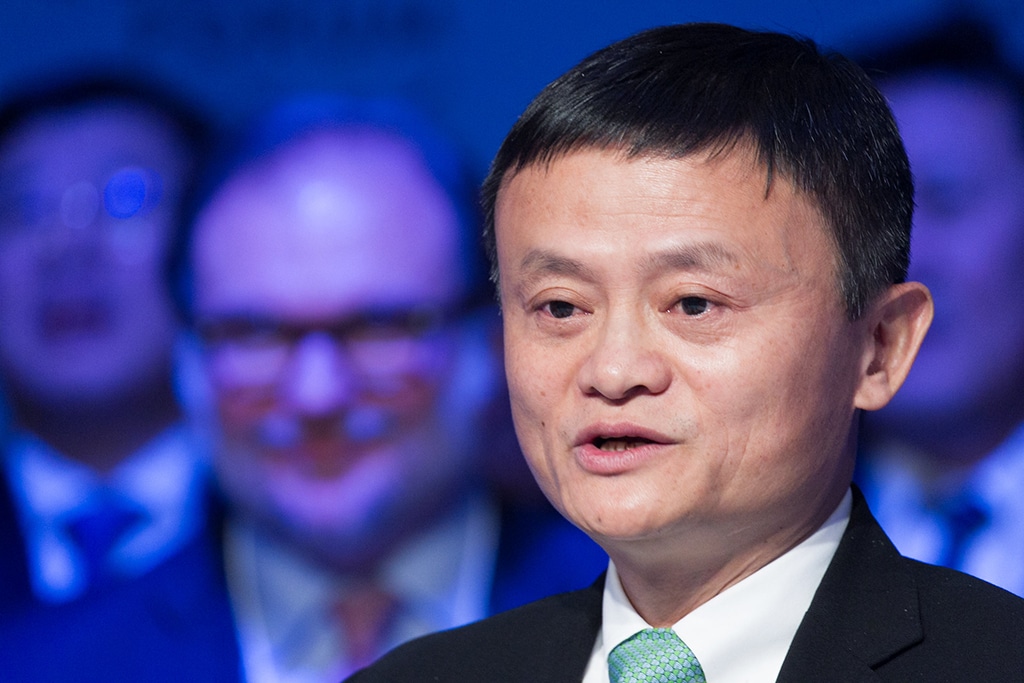

Ant Group is reportedly exploring ways for Jack Ma, the company’s founder, to sell his stake and give up control. The new development was revealed by Reuters in a report published on the 19th of April.

Citing reliable sources, Reuters noted that Ant Group’s move to make Ma divest his stake is to relieve the company of pressure from Chinese regulators. According to the sources, Ma’s exit from Ant Group could help the company with Beijing’s scrutiny of its business.

According to sources familiar with the regulators and Ant Group, discussions on Ma’s exit have been going on for months. The sources said that representatives from the People’s Bank of China (PBoC) and China Banking and Insurance Regulatory Commission (CBIRC) had held separate meetings with Ma and Ant Group. The meetings about Jack Ma leaving the company held between January and March.

One of the sources said that the company hopes that Ma’s stake will be sold to existing stakeholders in the fintech giant. The company is also hoping that Ant Group’s e-commerce affiliate, Alibaba Group Holdings (NYSE: BABA), will take over Ma’s stake, worth billions of dollars. The source added that Ant Group aims not to involve an external entity.

The global head of equities at Aberdeen Standard Investments, Devan Kaloo, commented on Ma’s exit from Ant Group. He said:

“Indeed Jack Ma stepping away may help the company’s share price re-rating by removing uncertainty and resolving the perception that the Chinese government’s issue with the company is with the individual.”

Reuters further noted a second source familiar with Ant Group, who mentioned the regulators’ instruction to Ma. The source stated that Ma will not be able to sell his stake to an entity or person close to him. Instead, the founder will have to leave Ant Group completely. The source added that regulators offered Ma another option to transfer stake to Chinese investors affiliated with the state. Whatever option Ma decides to choose, the sources said there would be a need for Beijing’s approval.

However, an Ant spokesman denied that the company is considering options of divesting Ma’s stake. “Divestment of Mr. Ma’s stake in Ant Group has never been the subject of discussions with anyone,” said he.

Furthermore, Ant Group’s public debut at about $37 billion valuation may have another chance at going public after Ma’s exit. The company’s initial public offering (IPO) was to be the world’s largest. However, the IPO plans failed after Ma met with regulators on the 2nd of November last year.

At the time, The Wall Street Journal said in a report that Ma offered to release parts of Ant Group to the Chinese government. Ma presented his offer in a meeting with regulators a few days to the company’s scheduled IPO.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibukun is a crypto/finance writer interested in passing relevant information, using non-complex words to reach all kinds of audience. Apart from writing, she likes to see movies, cook, and explore restaurants in the city of Lagos, where she resides.