Bitcoin Hyper Rockets Past $3M – The Only Real Layer-2 Built for Speed

Bitcoin Hyper (HYPER) crossed $3 million in presale funding just over a month after launch – a pace that mirrors the speed its network promises to deliver.

Powered by the Solana Virtual Machine (SVM), Bitcoin Hyper combines the speed of Solana with the security of Bitcoin – made possible through a non-custodial zero-knowledge bridge that locks BTC on-chain and mints a wrapped version on Layer-2.

This unlocks real BTC liquidity for use in high-speed applications, allowing users to stake, trade, launch tokens, or build dApps with near-zero fees and instant execution.

Attempts to scale Bitcoin have been made before, but none have delivered the speed, utility, and usability needed to drive true adoption.

Once the network is live, developers will be able to deploy the kind of high-throughput apps the Bitcoin ecosystem has never seen – all while preserving the trustless base-layer integrity that makes BTC so powerful.

The presale is moving fast. HYPER is currently priced at $0.012275, with a price increase kicking in less than seven hours from now.

Is the Lightning Network Already Falling Behind?

There have been several attempts to scale Bitcoin, but most have struggled to break through. The Lightning Network is one of the more well-known solutions, created to make Bitcoin usable for everyday payments.

It works by creating off-chain payment channels between users, allowing BTC to be sent quickly and cheaply without waiting for block confirmations.

In practice, though, the system has limitations. Every transaction requires a pre-funded channel. Payments can fail if liquidity isn’t available along the route. And for most users, managing channels is still too complex.

The bigger issue is scope – Lightning was built for payments, and that’s where it stops.

Without smart contract support, it can’t run decentralized apps – which means it’s not the solution that brings Bitcoin into Web3.

The Lightning Network’s Broken Promises: A Reality Check

The Lightning Network, once hailed as Bitcoin’s scaling solution, has failed to deliver on its core promises. As detailed in “Hijacking Bitcoin,” this second-layer technology falls short in speed, cost, scalability,… pic.twitter.com/xx0oahdeDZ

— Aaron Day (@AaronRDay) July 25, 2024

Bitcoin Hyper moves beyond the limitations of Lightning by opening the door to broader, more versatile use cases.

Instead of focusing solely on payments, it brings Bitcoin into an ecosystem where developers can launch real products, not just process transactions. From on-chain utility to high-speed execution, it’s the kind of leap Bitcoin has needed for years.

Has Stacks Flopped – Along with Other Programmable Bitcoin Projects?

But of course building another Layer-2 has also been done in the past to make Bitcoin more programmable. One of which is Stacks.

Stacks introduced smart contract functionality to Bitcoin through its own Layer-2 model, secured by a system called Proof of Transfer. It brought new capabilities to the network but also introduced new limitations.

The biggest challenge is usability. BTC isn’t directly usable within the Stacks ecosystem, and activity is mostly centered around STX, its native token. While the network is secured through Bitcoin, there’s no direct flow of BTC into apps, and smart contract interactions rely entirely on STX rather than Bitcoin.

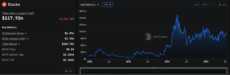

Despite being live for years, Stacks has struggled to attract meaningful on-chain activity. Its total value locked (TVL) sits at around $117 million, which pales in comparison to newer Layer-2s like Base, which has already surpassed $3.9 billion. The gap reflects a deeper issue – while Stacks aimed to bring smart contracts to Bitcoin, it hasn’t gained the developer or liquidity traction needed to sustain a thriving ecosystem.

Source: DefiLlama

Stacks also relies on a custom contract language called Clarity, which creates a learning curve for developers and limits cross-chain compatibility.

Bitcoin Hyper takes a different route – one that brings Bitcoin into high-speed, application-ready environments without detaching from its value base.

As mentioned, BTC is locked and bridged using zero-knowledge proofs, then deployed as a wrapped asset on a Solana-grade execution layer. Developers can build directly using Rust through SDKs and APIs, giving them scalable tools and a familiar workflow.

Where Stacks introduced smart contracts in theory, Bitcoin Hyper will make BTC usable in practice.

Other solutions like Rootstock and BitVM have also aimed to expand Bitcoin’s functionality. Rootstock introduced smart contracts via a sidechain, but adoption has been limited. BitVM brings a new approach to programmability, though it’s still early and not yet production-ready.

These efforts show there’s appetite for expanding Bitcoin’s capabilities – but none have unlocked the kind of usable, developer-ready environment that builders are looking for.

HYPER’s True Purpose Isn’t to Compete with BTC Like STX Does

But of course, this leads to another question: what happens with the HYPER token? Isn’t that just like STX – used for transactions and crowding out BTC?

Not quite. As mentioned earlier, the Bitcoin Hyper ecosystem uses a wrapped version of BTC for most activities. This includes the trading, staking, token launches, and dApp interaction functionalities of the token.

HYPER plays a different role. It’s used for paying transaction fees, unlocking staking access, and enabling premium features across the network.

It also acts as the reward currency for developer grants and ecosystem incentives – designed to bring new builders into the fold.

So unlike STX, HYPER doesn’t compete with Bitcoin for attention. It supports the ecosystem without taking away from BTC’s role at the center of it all.

Ready to Enter HYPER Mode?

The real solution to Bitcoin scaling and programmability is here and early access to discounted token prices is limited to those who join the presale.

If you’ve tested all the broken promises of past Bitcoin scaling projects, Bitcoin Hyper could be the answer you’ve been waiting for.

The only way to support the development and secure your allocation is by heading to the official Bitcoin Hyper website. You can buy HYPER using SOL, ETH, USDT, BNB, or even a credit card.

Newly purchased HYPER tokens can also earn a dynamic yield of 297% APY through the project’s native staking protocol on Ethereum, with over 176 million tokens already locked.

Bitcoin Hyper recommends using Best Wallet. This is because HYPER is already listed under the ‘Upcoming Tokens’ section, which makes it easy to track, manage, and claim – while also signaling its high-potential status as a vetted project on the platform.

The project’s smart contract has been audited by SpyWolf and Coinsult, two respected blockchain security firms, giving early investors confidence that the presale funds and staking mechanisms are protected from common exploits.

Stay connected with the Bitcoin Hyper community on Telegram and X.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.