By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- BTC/USD tech analysis, Bitcoin price is moving down now.

- Large crypto forums canceled due to coronavirus.

- Demand for the BTC options is growing, beating records.

- The complexity of BTC mining has reached its extreme.

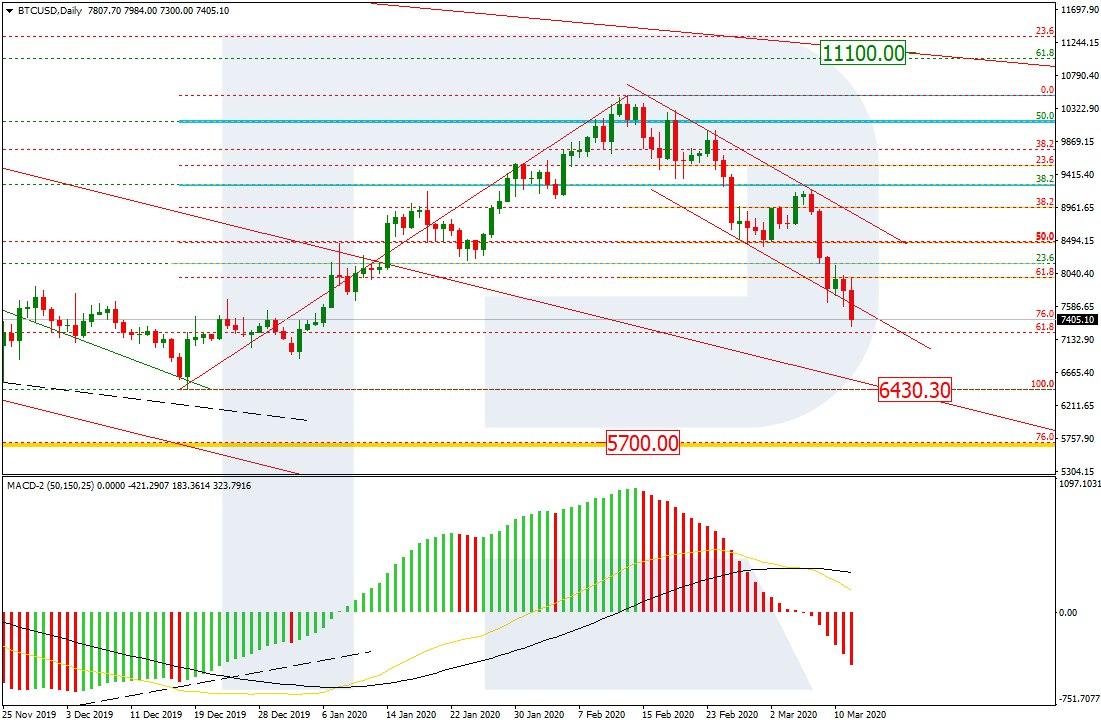

On W1, the BTC not just finished testing the support level of 50.0% Fibo in relation to the previous uptrend but also secured under it. The current technical picture indicates descending to 76.0% (5700.00 USD) and the low of 3121.90 USD. On the MACD and Stochastic, the lines are also going down, confirming the bearish market mood.

Photo: Roboforex / TradingView

On D1, after a correction to the resistance line, the trend is developing yet another declining impulse. Moreover, the quotations of the new impulse are breaking through the lower border of the channel, which means the decline is speeding up. The nearest goal of the decline is the fractal low of 6430.30 USD. Its breakout will allow a decline to the long-term goals.

Photo: Roboforex / TradingView

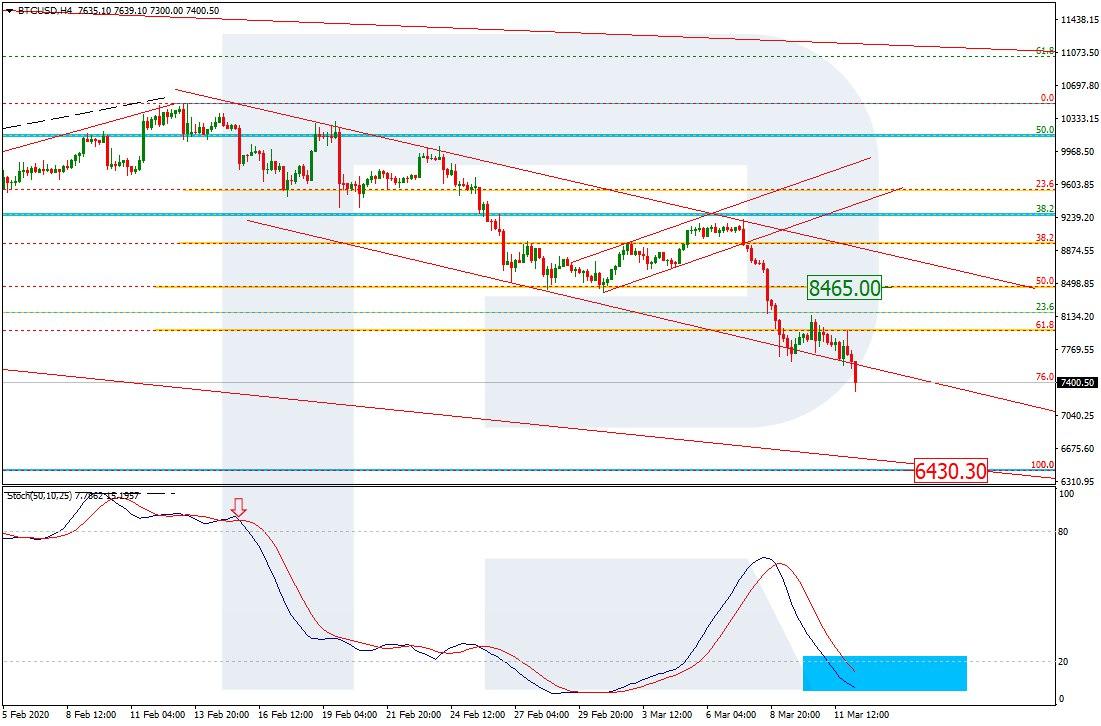

On H4, the technical picture of the decline is represented in more detail. Here, the quotations are confidently securing under 8465.00 USD. The Stochastic, having gone to the oversold area, is forming a convergence, signaling an approaching pullback.

Photo: Roboforex / TradingView

The coronavirus pandemic announced by the World Healthcare Organization (WHO) cancels large forums in the crypto world. On one of the latest events, a risk zone formed: the co-founder of the TorusLabs platform Zhen Yu Yong had COVID-19 diagnosed, and he had had contacts with lots of people.

The “blockchain week” in Paris is postponed till December 9th in a hope that by then the virus will have become less active. Some forums can be carried out online, but the majority are simply canceled. While Token2049 and Blockchain Week 2020 are postponed, EDCON and Nitron are simply canceled.

This week, the volume of trading BTC options has reached its high, amounting to 198.0 million USD. This is higher than the level of February 11th, which was 171.3 million USD. The majority of trades were made on the Deribit platform – some 86% of all operations. The second popular platform is the OKEx exchange, where options have brought 23 million USD. Curiously, the CME exchange in Chicago turned out to be one of the least popular platforms for trading BTC options. It may be due to its commission fees.

Since the beginning of the year, the BTC options sales have grown by 240%.

This week, the complexity of BTC mining has renewed its highs, reaching 16.55 trillion hashes. This month, the figure has grown by 7.5%. Partly, it may be explained by single restorations of mining equipment, which led to an increase in the number of users and processing power.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.