With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

While prices might drop to $60,000, some analysts are optimistic. They believe large traders’ “spot absorption” and swift sell order removals at $72,000 indicate strategic market manipulation by whales, preventing further decline.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

Bitcoin (BTC) price is facing renewed downward pressure, dipping below $68,000 during the June 11th Asia trading session. Analysts are warning of further losses, with some fearing a potential drop to $60,000.

Photo: TradingView

This bearish sentiment stems from a 3.88% decline that pushed Bitcoin to lows around $66,800 in the last 24 hours, according to TradingView. The key support level of $69,000 failed to hold, and thin order book liquidity exacerbated the downward move.

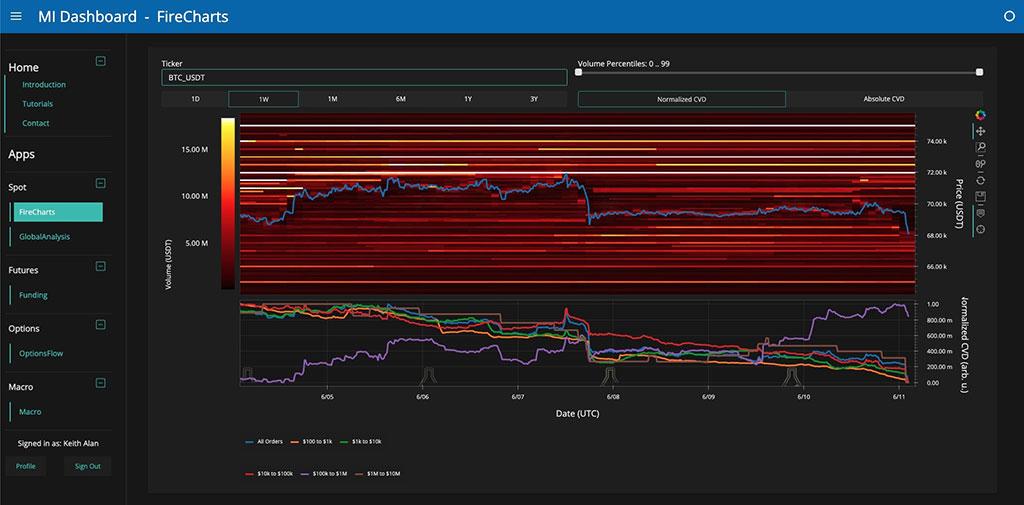

Market analysts are particularly concerned by the lack of strong buying pressure, often referred to as “bid liquidity.” Keith Alan, co-founder of Material Indicators, highlighted the weak buying pressure in a recent YouTube update:

“Sure we have some laddered bid support in here, but not a heavy, heavy concentration of it – and really, it’s not even heavy down to $60,000 if I can be completely honest.”

Further technical analysis by Material Indicators suggests a bearish outlook. With the latest price drop, Bitcoin has decisively rejected both the $69,000 support level and the 21-day moving average, a crucial indicator of short-term trends.

Photo: Material Indicators

“Support at the 21-Day Moving Average and the R/S Flip at $69k have both been invalidated,” the analysis stated. “This move isn’t over. In fact I expect these killer whale games to continue up to and through JPow’s comments on Wednesday and economic reports on Thursday.”

This week, Bitcoin and the broader crypto market may experience volatility due to upcoming US economic data releases. Key events to watch include the Consumer Price Index (CPI), the Producer Price Index (PPI), the Federal Reserve’s interest rate decision, and Jerome Powell’s press conference.

Popular trader Skew shared his view on the correlation between these events. He noted that CPI and PPI have been at the higher end of their range, while the FOMC has led to local lows. Skew mentioned that the coming days would be interesting.

While the possibility of a drop to $60,000 exists, some analysts remain cautiously optimistic. Credible Crypto, another prominent trader, suggests that large-volume traders’ actions may prevent a steeper decline. He points to the presence of “spot absorption” on dips, indicating buying interest even at lower price points.

He also noted the swift removal of sell orders (resistance) at $72,000 once the price started to reverse. This suggests that some whales might be strategically manipulating the market.

Credible Crypto believes there’s a decent chance we might hit range lows of $62K-65K and then reverse. While there’s no guarantee, we should know soon based on price action in the next 24 hours.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.