Crypto Wallet Ledger Loses $484K in Fresh Hack, Users May Still Be at Risk

Ledger claims that the funds were drained in less than two hours, after which it came on top of the situation.

Ledger claims that the funds were drained in less than two hours, after which it came on top of the situation.

There was a general rise in the Dow, S&P 500 and Nasdaq Composite indexes following hints that the Fed policy would favor the general market.

With yesterday’s historic high, the Dow Jones extends its Q4 rally to more than 10%. On the other hand, the technology sector also makes a fresh all-time high.

The Santa Claus rally in the crypto market is likely to continue with analysts expecting the Bitcoin price to touch $48,000 during pre-spot ETF approval.

Coinbase said the launch of the international digital asset trading platform is part of its move for global expansion driven by regulatory uncertainties in the United States.

With the US inflation having eased without significant unemployment, the Fed unanimously agreed to hold the borrowing rate between 5.25 and 5.5 percent for the third consecutive time.

JPMorgan chosen Amazon and Alphabet stocks as the most probable front-runners for 2024.

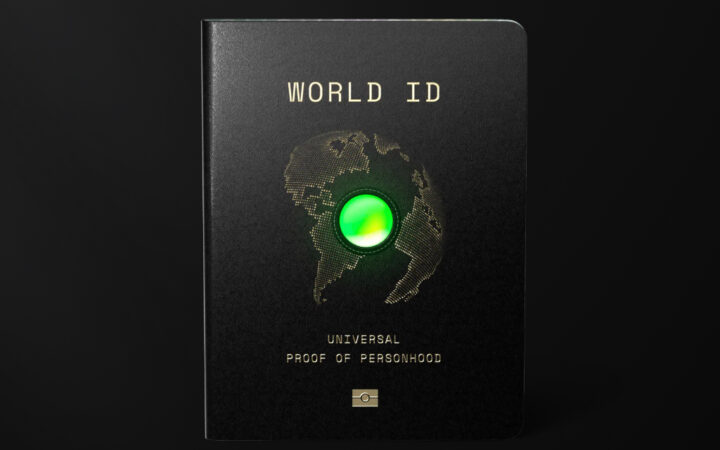

Riding in its current wave of success, Worldcoin has decided to spread its tentacles. Presently, the company is looking at expanding to Mexico and Singapore.

As the crypto market braces for the Federal Reserve’s decision, traders are showing caution, evidenced by a 40% drop in trading volume over the last 24 hours.

The gains have come while traders await the conclusion of the final Fed meeting of 2023.

Headline inflation in November remained unchanged which extended the trend that began in the previous month.

Unlike its competitors, Mistral AI chose to make its model available as a free download instead of providing access through APIs. This approach empowers developers to run the model on their own devices and servers.

Traders are on edge, eagerly watching the Federal Reserve meeting for clues about prospective interest rate changes.

The inflation growth rate in the United States has significantly declined in the past two years thus the anticipated interest rate cuts in the second half of 2024.

The 6.5% plunge represents the largest single-day decline for Bitcoin in over a month, despite the asset’s overall growth of more than 12% in the past 30 days and an impressive 150% rally since January 1.