CREDO Could Be Competitive As Visa And MasterCard

“We carried out a transaction in Europe through Deutsche Bank and VTB Bank in Russia executed a cross-border transfer for purchase liabilities of one of our Spanish counterparties”, – says Konstantin Galibus, CEO & Founder of CREDO.

While Deutsche Bank, which acted as a correspondent bank, suspended the transfer of funds until the transaction structure was explained. When the processing model CREDO was presented to Deutsche Bank and the economic feasibility was proved, the funds were released and the transaction was concluded with success.

This example demonstrates not only the adaptability of our system to the strictest requirements of international banks, but also our willingness to ensure cross-border transactions using an absolutely independent financial instrument.”

It was not so long ago to be announced pre-ICO of nextgen payment system CREDO (powered by ico-marketplace.com) which provides settlement processing for profitable transactions acting as an agent between seller and customer. As it was said CREDO is a new generation multifunctional payment system based on an algorithm that involves the participation of an independent agent in the financial transactions.

“CREDO could be comparative and competitive as Visa and MasterCard using its model on B2B and C2C markets”, – says Oksana Evseeva, expert on international investments, certified IFRS by Institute of Financial Accountants, London. –

“It could work as on B2C as on B2B and C2C markets combining current financial and new crypto-currency markets.”

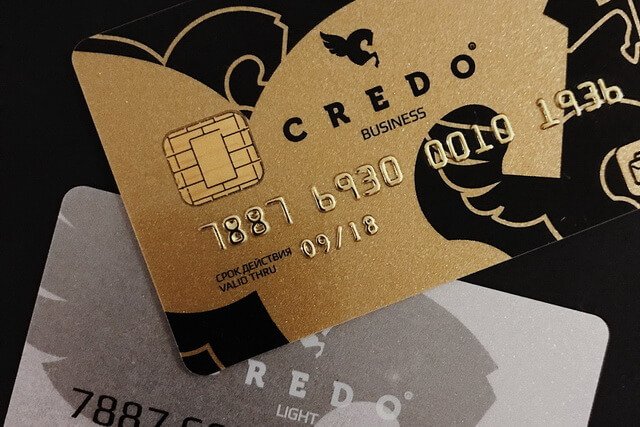

CREDO model is very efficient and applicable not only to goods and services but intangible and tangible assets’ deals, credit and payment operations not only via classic financial markets but also crypto-currency. The key competitive advantage of CREDO is its internationality of the system: CREDO-certificate could be derivative for any international sales transactions and provide payments in crypto-currency. The CREDO-card could be issued as virtually as physically attached to banking accounts and have all needed basic features of classic bank card.

The model B2C works similar to loyalty programs but gives more opportunities in market coverage: any customer can buy goods and/or services at any places with the discount all over the world. The basic mechanism of transactions in CREDO in B2C sector looks as follows: the Retailer issues emission of Electronic certificates (Derivatives) for future sales of its goods/services – the Operator works with the Retailer providing payments for Derivatives and also with Clients providing sales of Derivatives with a discount in case of rising clients’ base and loyalty – Clients buy Certificates for goods and services. And this means that we get win-win-win strategy for all the participants: Retailers get more customers (Clients) and working capital, Operators – Client’s base and margin, Clients – pay less.

As indicated in the project Whitepaper: “CREDO has a patent for the designed system. The functional of the business model of CREDO has already been provided with all the necessary software and hardware and confirmed by positive test results in Europe. CREDO is a real financial project with its own technical processing, POS terminals, and EMV Smart Cards.”

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.