With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

Bitcoin stands at the forefront of crypto adoption among 300 millions users, leading the pack as the world’s most widely adopted cryptoasset.

Edited by Marco T. Lanz

Updated

3 mins read

Edited by Marco T. Lanz

Updated

3 mins read

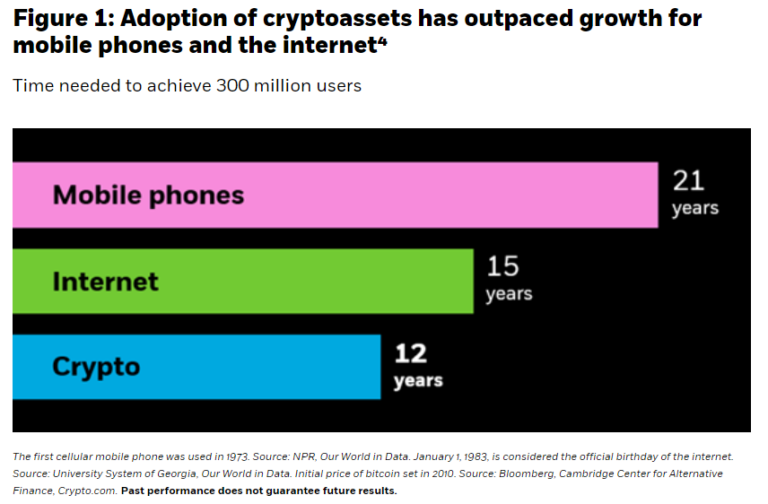

In a record-breaking trend, crypto adoption has outpaced the growth trajectory of both mobile phones and the internet, according to BlackRock’s recent report on Jan. 13. Mobile phones took 21 years and the internet 15 years to reach 300 million users. Cryptocurrencies, however, achieved that milestone in just 12 years. That remarkable growth highlights the global interest in decentralized finance and blockchain innovation.

Source: BlackRock

The growth of cryptocurrencies can be credited to their borderless accessibility and expanding use cases. BlackRock’s report emphasizes how this rapid adoption is reshaping traditional financial systems. Apart from the BlackRock, Bernstein also predicts massive crypto adoption in 2025, as CoinSpeaker reported.

Bitcoin stands at the forefront of this movement, leading the pack as the world’s most widely adopted cryptoasset. With a market cap nearing USD $2 trillion, bitcoin is now viewed as a potential global monetary alternative. As concerns over inflation, political instability, and declining trust in government-issued currencies grow, investors—both institutional and individual—are turning their attention to the digital giant.

The report highlights that Bitcoin’s adoption rate has eclipsed that of groundbreaking technologies, with the mix of factors contributing to this meteoric rise. Younger, digitally savvy generations have shown a stronger affinity for bitcoin compared to older demographics. Global uncertainties—ranging from inflation to fiscal instability—have further fueled bitcoin’s appeal as a decentralized asset.

“Younger generations are more likely to be considered “digital natives,” resulting in greater predisposition towards bitcoin adoption than GenX and Baby Boomers,” Jay Jacobs, U.S. Head of Thematics and Alternative ETFs, at BlackRock said in the report.

The ongoing digital transformation of the economy also plays a pivotal role. As the infrastructure for digital assets matures, barriers to access are being dismantled. This ease of entry is encouraging broader Bitcoin adoption, paving the way for its integration into mainstream financial systems.

Yet, despite the enthusiasm, challenges remain. Historically, gaining exposure to Bitcoin involved hurdles such as opening specialized accounts, facing high trading fees, and tackling security issues. The lack of seamless access has deterred many potential investors, leaving room for innovation to bridge the gap.

BlackRock’s iShares Bitcoin ETF (IBIT) serves as an innovative investment tool, streamlining access to bitcoin. By integrating digital assets into traditional brokerage accounts, IBIT simplifies investment by functioning like a stock. It offers an accessible entry point for investors across taxable and tax-advantaged accounts.

“As an ETF, IBIT provides exposure to bitcoin, but trades like a stock. Therefore, it can be traded through traditional brokerage platforms alongside other investments such as stocks, bonds, and other ETFs — across both taxable and tax-advantaged accounts like TFSA,” the report said.

The ETF removes the need for complex processes, such as setting up accounts on crypto exchanges or handling private digital wallets. That approach reduces risks and costs associated with direct Bitcoin investments. Supported by BlackRock, the largest asset manager globally, and developed with Coinbase Prime technology, IBIT delivers a secure and institutional-grade solution.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.