Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!

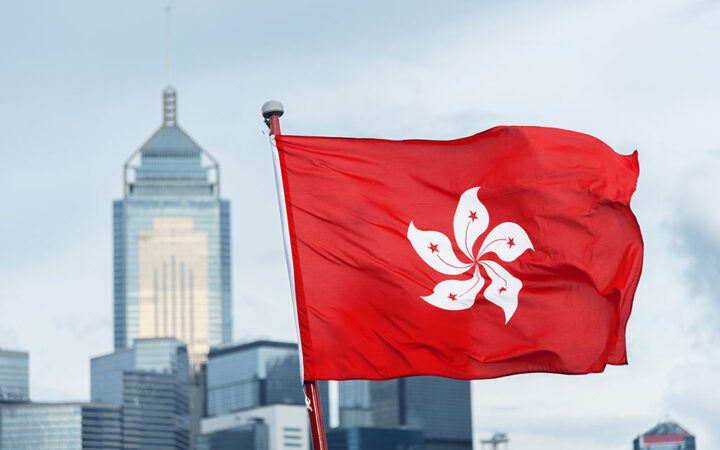

Following a successful Hong Kong initial public offering, Evergrande shares are expected to be listed on December 2.

Evergrande Property Services Group, part of China’s second-biggest property developer, has raised $1.8 billion in a Hong Kong initial public offering (IPO). According to news outlet Reuters, Evergrande Property has anticipated to raise up to $2.04 billion, but significantly affected by the heavy debt-laden.

Apparently, Evergrande Property borrowings totaled 835.5 billion yuan ($123.93 billion) at the end of June. With the slow market recovery process due to the coronavirus pandemic, the company had a tough time convincing investors to purchase its shares to offset its market debt.

“Evergrande has too much debt…the listing of the property services unit is to save the parent; Evergrande will continue to sell shares (in the unit) after the listing to cut debt,” said Francis Lun, chief executive of GEO Securities.

According to the IPO filings, the developer had set the share price between HK$8.5 to HK$9.75, however, it went down at HK$8.80 per share.

Apparently, the company has been in prior private funding all in a bid to counter its widening debt to revenue gap. Evergrande Property conducted private funding in August that raised $3 billion from private investors. The company sold shares at HK$8.375, approximately 5% lower from the recent IPO price.

With the IPO books closed, the company hopes to continue selling shares and raise more funds in the process. Notably, the firm now has a market valuation of approximately $12.3 billion, with the IPO funds priced in.

The company anticipates sharing the raised capital with its parent company. In addition, the firm has put an over-allotment option of approximately 15% to 17% stake.

Some of the notable listing joint sponsors included Huatai Financial Holdings (Hong Kong) Ltd, UBS, ABC International, CCB International, CLSA and Haitong International. Previously, the company had indicated that it signed cornerstone investment agreements with 23 investors.

With the debt crisis on an alarming level, Evergrande stated in a different filing on Sunday that it has entered into supplemental agreements with several of its investors including Hengda Real Estate not to demand investment repayment. This was primarily due to the termination of the Shenzhen backdoor listing.

Hereby calling for investors with approximately $19.17 billion stake in Hengda Real Estate to enter into supplemental agreements to hold their shares as ordinary shares. As a result, Evergrande was pushed to repurchase the remaining 4.3 billion stake.

Following a successful Hong Kong initial public offering, Evergrande shares are expected to be listed on December 2.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!