Ibukun is a crypto/finance writer interested in passing relevant information, using non-complex words to reach all kinds of audience. Apart from writing, she likes to see movies, cook, and explore restaurants in the city of Lagos, where she resides.

According to the FSB, crypto assets need regulation to comply with as they are predominantly used for speculative purposes.

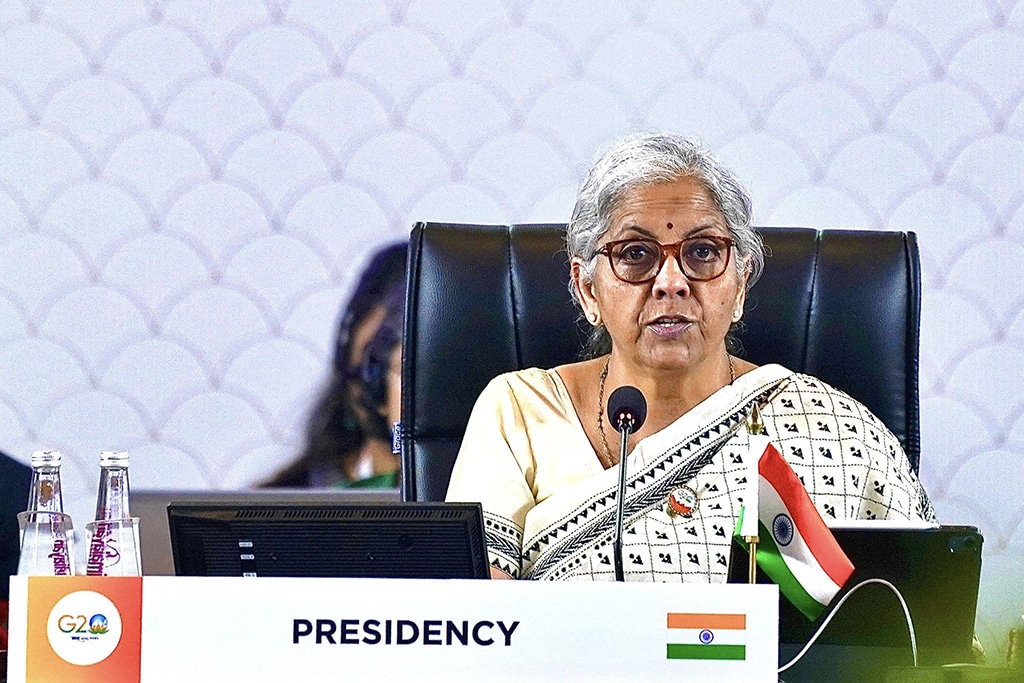

The Financial Stability Board (FSB), which consists of all G20 countries, is planning to propose crypto regulation by October. On 11th July, the regulatory body said the “robust” rules would govern crypto and stablecoins globally. The regulator said its members are committed to using their enforcement powers within the legal framework of their jurisdiction to promote regulatory compliance and act against violations. Same with other regulators across the world, the Board emphasized the need to regulate the “speculative” sector as the crypto markets struggle persists.

Referring to the market crash, the FSB said that the volatility poses significant losses and threatens market confidence. The group added that the risks could transfer to other crypto assets in the ecosystem. Bitcoin, for example, has dropped by about 70% since its ATH of $69,000 in November. Currently, the top crypto asset by market cap is trading at $19,621, a 4.42% loss over its previous close.

The organization will present regulatory approaches to stablecoins and crypto assets to the G20 finance ministers and central bank governors. Also, the global financial regulator said the robust regulation must capture stablecoins if owners use them for payment. The Terra ecosystem collapsed earlier this year, resulting in many losses and impacting investors. Due to the crash, major crypto firms like Voyager Digital and Celsius Network have halted withdrawals and transfers.

The recent turmoil in the crypto industry influenced a statement by the FSB. The statement refers to crypto and stablecoins as being intrinsically volatile and having structural vulnerabilities.

According to the FSB, crypto assets need regulation to comply with as they are predominantly used for speculative purposes. Therefore the group said crypto and markets may be subject to “effective regulation and oversight commensurate to the risks they pose, both at the domestic and international level.”

“Any persons and entities operating in crypto-asset markets must be aware that they should meet all applicable regulatory, supervisory and oversight requirements of a particular jurisdiction before commencing any operations. In case they have questions on such requirements, they should consult domestic regulators to ensure their activities comply.”

Reacting to the FSB update, CoinStats CEO Narek Gevorgyan said the Board has no power to make laws. However, it commits to infusing crypto into the existing legal frameworks of member countries.

“Existing legal frameworks can help regulate the speculative aspects of the market and centralized exchanges, but how does the FSB plan to integrate the hundreds of existing and newly emerging protocols that are radically resistant to regulation by design?” asked he.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibukun is a crypto/finance writer interested in passing relevant information, using non-complex words to reach all kinds of audience. Apart from writing, she likes to see movies, cook, and explore restaurants in the city of Lagos, where she resides.