Amid economic sanctions against Russia following the military conflict the country kicked off, new worries among financial regulators over the rising risks of the billion crypto industry also saw the light at the beginning of 2022.

In response to the incoming news from Ukraine, western countries began imposing sanctions on Russia and Russian oligarchs keeping in mind crypto as a potential back entrance for the sanctioned transacting. Regulators either raised their voices for urging swift regulation of crypto assets or issued work plans monitoring the risks emerging from increasing crypto-related activities.

The European Central Bank Executive Board Member, Fabio Panetta, has given a speech on the “wild west” of crypto assets, calling for a swifter and stricter response to the emerging challenges posed by crypto assets, including strengthening the requirements around public disclosure, regulatory compliance reporting, transparency and standards of conduct.

In April, US Secretary of the Treasury, Janet Yellen, announced principles underpinning the Treasury’s work on digital assets. Among everything, she encouraged responsible innovation, taking a risk-based, technology-neutral approach and maintaining the centrality of the US dollar.

That all brings into sharp focus a few concerns. Will the military conflict between Ukraine and Russia make governments put pressure on the crypto sector even more, and how will constant restrictions affect the crypto community’s views on global centralization and centralized crypto platforms, in particular?

How the Crisis Impacted Crypto Trading Volume

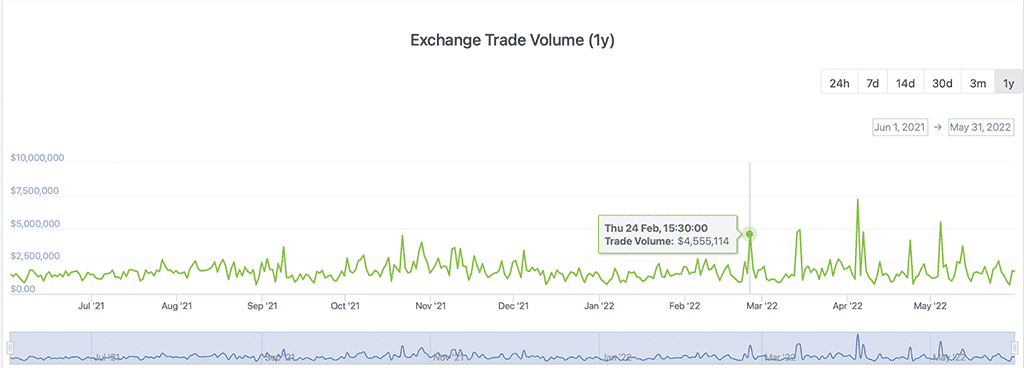

Right after the conflict broke out, in response to the complications in the movement of capital, crypto trading volume for Bitcoin and other cryptocurrencies on popular Ukrainian crypto exchange Kuna surged over 200%, according to CoinGecko.

Trading volumes on Kuna went from under $1 million on February 21, and reached highs of $4.8 million on February 24, the highest volume seen on the exchange since May 2021, before stabilizing around $2 million.

Ukrainian Hryvnia (UAH) trading volume on Feb 24, 2022. Photo: Coingecko

“In present-day Ukraine, where the uninterrupted movement of funds is a matter of life and death, the increased use of cryptocurrencies becomes a viable payment method in the event that others get disrupted or overloaded”, CEX.IO CEO, Alex Lutskevych, says, with one of the offices of his exchange operating in Kyiv. Lutskevych adds that USDT is popular among volunteers in Ukraine who provide help to civilians by delivering medications and maintaining kitchens

The crypto trading volume in Russia was also surging in the first days of the crisis, once again testing the digital currency for the role of a possible safe-haven asset. There were a number of reasons for such a response.

First, as a result of sanctions, Visa and Mastercard suspended operations with Russian sanctioned banks. That barred Russian users from paying with their cards for foreign services or goods. Second, the CBR (Russia’s Central Bank) imposed monetary restrictions on US dollar and Euro flow in a bid to mitigate the impact of sanctions and prop up the ruble. The CBR restricted Russian citizens from transferring money abroad, with transfers limited for individuals to $10,000 per month. As of June 2022, the limit is amped up and is $50,000 until September 2022. But that was not all at the time being. Even though in June 2022, Putin canceled this requirement, initially, the Government Commission on Monitoring Foreign Investment in the Russian Federation has established a requirement for shippers to sell 50% of the US dollar currency earnings.

That all being the case, in fact, turned crypto into one of the easiest means to transfer dollar capital out of Russia, at least, in the spring of 2022.

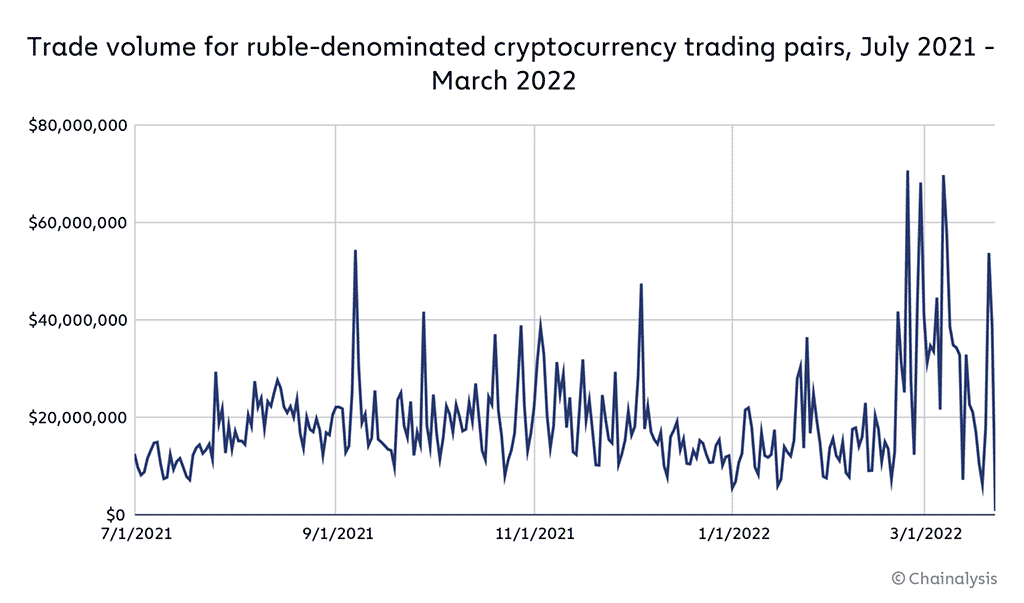

According to the blockchain-analytic firm Chainalysis, ruble-denominated crypto trading volume peaked at roughly $70 million, growing over 900% to over $70 million between February 19 and 24.

Will the Current Crisis Speed Up Crypto Regulation?

Whenever a geopolitical crisis is hitting the traditional monetary climate, it only paves the way for an alternative kind of money. However, with the ambiguous nature of crypto, not only it can be used by regular Russians and Ukrainians in an attempt to keep their life savings intact in the darkest hour. Now the Russian government might want to use crypto to evade sanctions since the country’s financial operations are canceled across the globe.

The geopolitical crisis the world is seeing, and breeding grounds for crypto can give a jump start to other countries in terms of speeding up crypto regulation. On the face of it, one might think that there’s no need for crypto traders from countries outside of Russia to worry about preserving their capital. But in truth, the fact that regulators across the globe are now placing special emphasis on crypto can speed up the regulation of the niche in the whole world.

“I’ve already seen a bill introduced by Senator Warren that would clamp down on crypto intermediaries that serve Russian customers,” Lee Reiners, CFA, Executive Director at Global Financial Markets Center at Duke University School of Law, says, “but the Treasury Department has also said they’ve seen little evidence that crypto is being used in any meaningful way to bypass US sanctions. I think the recent decline in crypto prices is a bigger motivation to strengthen crypto oversight.”

For users who tax their income and keep their savings and crypto accounts transparent, there’s seemingly nothing to be afraid of. However, “the US government will continue to go after non-compliant exchanges, darknet markets, darknet mixers and other entities that facilitate illicit activity and sanctions evasion,” Ari Redbord says, Head of Legal and Government Affairs at TRM Labs, a blockchain analytics firm.

He further adds that at the start of the invasion, TRM Labs identified about 340 Russian-connected high-risk cryptocurrency exchanges. ”We may see sanctioned Russians look to those types of exchanges to move funds, but we will also continue to see regulators target those exchanges. And sanctions are effective. According to TRM Labs, within two weeks of Treasury’s designation of Russia-based high-risk exchange Garantex, transaction volume was down 80%.”

Will the Current Crisis Push More Users to Move from CeFi to DeFi?

In April 2022, Binance, the cryptocurrency exchange with the largest trading volume in the niche, announced that it would follow the EU’s fifth package of restrictive measures against Russia and limit services for Russian nationals or natural persons residing in Russia, or legal entities established in Russia, that have crypto assets exceeding the value of 10,000 EUR. In other words, new deposits or trading for those users would be unavailable.

“While these measures are potentially restrictive to normal Russian citizens,” the post states, “Binance must continue to lead the industry in implementing these sanctions. We believe all other major exchanges must follow the same rules soon.”

Complying with new rules imposed because of Russia’s invasion of Ukraine, Coinbase, a US licensed cryptocurrency exchange with assets of US$21.3 billion worth, has blocked 25,000 wallet addresses related to Russia. “We shared them with the government to further support sanctions enforcement,” Coinbase’s chief legal officer, Paul Grewal, said in the company’s blog.

Coinbase CEO tweeted that they were not preemptively banning all Russians from using Coinbase. According to their blog post, they are maintaining a sophisticated blockchain analytics program to identify high-risk behavior, study emerging threats, and develop new mitigations.

However, “the concern is that while Russian oligarchs have been sanctioned, there have not been any crypto addresses added to the SDN list (The Specially Designated Nationals and Blocked Persons List), Ari Redbord says, “Therefore, exchanges typically don’t know if they are transacting with a sanctioned Russian.”

Will this behavior of centralized crypto entities imposing restrictions whenever they feel like it, lead the crypto community to consider avoiding centralized crypto players and turn even more towards DeFi?

“The main purpose of DeFi (Decentralized Finance) is to give people access to a complete, decentralized and transparent financial system which can be seen as an alternative to the traditional one,” Maria Magenes says, the marketing consultant at Balancer, a decentralized exchange with an automated market maker.

However, it shouldn’t be forgotten that as a niche DeFi was booming in the summer of 2020, long before the geopolitical crisis. Lee Reiners thinks that people go and lock their money in dApps not because they worry about being censored or restricted. “People are attracted to DeFi because of the attractive yields,” he said, commenting on the situation.

Indeed, the total value locked in DeFi projects as of May 2022 is tapping the $54.79 billion mark, and none of the decentralized entities have been heard yet to ban their users from their services.

“The fact that large centralized crypto companies cooperate with the government to comply with the sanctions could be an extra push for driving crypto adopters’ interest towards DeFi, however not the key driver,” Pauline Demchuk says, entrepreneur and founder of the automated trading bot TradeSanta, “in the long run, the key for DeFi adoption by the retail masses, so to say, are the benefits you get compared to CeFi. And I am not talking only about yields here. The other benefit is how easy it is to get in and navigate DeFi products, but we are far from being user-friendly yet.”

With all that said, does that mean that the current geopolitical crisis will push larger audiences to greater crypto adoption? The traditional-finance legislation is getting stricter, with swift measures to clamp down on crypto intermediaries serving Russian customers; Binance and Coinbase are shutting down crypto accounts of their Russian users to comply with the laws, and amidst this storm, Russians and Ukrainians are trying to preserve their savings in the collapsing economies. So, is it maybe a good time for a crypto community to turn to DeFi?

For sure, such a crisis has the potential to turn into an eye-opening experience for those skeptics out there who did not see the value in crypto before. Because the set of regulations and sanctions imposed as a result of the Russia-Ukraine military conflict is simply one more proof of how easily you could be cut off from moving your funds around. And it really doesn’t matter what is that entity that is restricting you: a centralized government or a centralized crypto player.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Julia is a crypto trading bots enthusiast and a content writer at TradeSanta. Her final goal is to help readers find what they need, understand what they find, and use what they understand appropriately.