LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Best Cheap Cryptocurrencies to Buy with Most Long-Term Potential in 2026

36 mins

36 mins Bitcoin Hyper is our top pick for the best cheap crypto, for its potential as a high-speed Layer 2 for Bitcoin.

Using our methodology and research, we’ve also selected BMIC and JitoSOL for their use cases and long-term potential. They are built for, and tied to, the health of Bitcoin, Ethereum, and Solana.

According to Bitcoin Treasuries, companies held over $400 billion in BTC as of July 2025. In September 2025, Forward Industries announced a $1.65B Solana-focused crypto treasury.

HYPER and JitoSOL provide varying amounts of exposure to BTC and SOL, but are considered cheap as they have high growth potential.

Crypto investors should note that many are early-stage projects. All carry more risk than BTC, SOL, and ETH.

Best Cheap Crypto to Invest in February 2026 – Our Shortlist

Here’s our selection of some of the best cheap cryptocurrencies for investment in February 2026.

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Quantum-resistant security infrastructure for wallets and enterprise use

- Uses deflationary tokenonomics, including burns, tied to quantum workload execution

- Staking and governance participation expand token utility

- Shared liquidity spanning Bitcoin, Ethereum, and Solana

- Improved trade execution through faster speeds and secure cross-chain capital movement

- Opens up greater cross-ecosystem connectivity for builders and developers

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

- High-performance broker for pros and newcomers alike

- Rebates and buybacks come from VFX's own market activity

- 10% bonus on sign up and early staking access

What Cheap Crypto to Buy According to Our Research?

Our analysis has revealed 9 of the best cheap crypto to buy in 2026, for the highest potential percentage gains.

- Bitcoin Hyper (HYPER) – A Bitcoin scaling and DeFi solution built on Solana

- Maxi Doge (MAXI) – Humorous ERC-20 community-based memecoin

- JitoSol (JitoSOL) – Liquid staking and rewards token on Solana

- Curve Finance – DeFi borrowing and lending protocol focused on stablecoins

- Bonk (BONK) – Solana-native meme coin with broad ecosystem usage

- BMIC (BMIC) – Quantum secure wallet, staking, and security layer

- SUBBD (SUBBD) – Fan and creator platform with AI and blockchain

- SpacePay (SPY) – UK startup aiming to make it easy to accept POS payment in crypto

- IO.net (IO) – DePIN crypto to support a network of GPUs for AI development

- Akash (AKT) – Decentralized compute power marketplace for AI and Web3

We mainly chose coins with a market cap of under $250M, as these have a better potential to return bigger gains and outperform Bitcoin. We also included some higher cap coins that our research revealed as undervalued, due to the current state of the crypto market, political factors, trends, and growth potential.

Which Cheap Crypto Is Worth Buying? Our Full Analysis

We’ve created a shortlist of 9 cheap cryptocurrencies that could be worth buying, taking into account our research on potential, current trends, and institutional adoption. Another critical factor in our choice is focusing on blockchains that dominate the DeFi and dApp space, such as Solana SOL $81.84 24h volatility: 1.5% Market cap: $46.16 B Vol. 24h: $4.19 B and Ethereum ETH $2 023 24h volatility: 2.9% Market cap: $240.89 B Vol. 24h: $17.96 B .

1. Bitcoin Hyper (HYPER) – Combines Meme Power with BTC Functionality

Bitcoin Hyper is a meme and also a Layer 2 solution for Bitcoin. This means it adds smart contracts to Bitcoin and other functionalities that most blockchains have, including the ability to have dApps, DeFi, and games.

Bitcoin Hyper’s devnet announcement. Source. Bitcoin Hyper

Bitcoin Hyper uses Solana’s SVM to build a separate settlement layer, which sits on top of the Bitcoin blockchain. As a result, transactions are sent through Bitcoin but settled on the Bitcoin Hyper Layer 2, making them fast and cheap. The project’s devnet is now live, according to the website.

The HYPER token provides staking rewards for securing the network and ensuring its integrity.

Is HYPER the best cheap crypto?

- What makes it Unique: HYPER combines the power of memes with the practicality of a Layer 2 for the biggest crypto, BTC.

- Suitable For: Infrastructure Investors, Bitcoin and Solana bulls, Meme coin fans, Presale buyers.

- Community Growth: $31.44M raised, 14k+ followers on X.

- Key Risk Factors: Competitors in the BTC Layer 2 space.

- Access: Official Bitcoin Hyper website.

| Project | Bitcoin Hyper |

| Type | Layer 2 |

| Blockchain | Bitcoin / Solana / Hyper |

| Presale Price | $0.01367550 |

| Market Cap | $31.44M |

| Key Use Case | Bringing smart contracts and cheap payments to Bitcoin |

| Tokenomics Highlight | Staking rewards of 40% APY |

| What Makes It Cheap? | It’s in presale and targeting a potentially huge industry considering BTC’s $2T+ market cap |

2. Maxi Doge (MAXI) – Absurdist Meme Coin Focused on Degens and Community

Maxi Doge is an Ethereum-based memecoin in presale, targeting the dog-themed niche, mixing humor with some utility. The aesthetic is a parody of degen culture and gym bros, referencing some of the more risky trading behaviors, such as trading with 1000x leverage.

Maxi Doge Roadmap. Source: Maxi Doge

MAXI holders will have access to an alpha group, where members are encouraged and incentivized to share trading ideas.

The MAXI token can also be used for staking at 72% APY, live throughout the presale.

Is MAXI a good potential cheap crypto?

- What makes it Unique: The protocol plans to partner with a perps platform to offer high-leverage trading.

- Suitable For: Meme coin enthusiasts, high-risk traders, and those seeking early-stage presale opportunities.

- Community Growth: Early fundraising and a strong social media presence indicate a building community.

- Key Risk Factors: Maxi Doge relies heavily on its ability to maintain community interest and achieve viral attention.

- Access: Official Maxi Doge website or via Best Wallet.

| Project | Maxi Doge |

| Type | Meme Coin |

| Blockchain | Ethereum |

| Current Price | $0.00028030 |

| Market Cap | $4.6M |

| Key Use Case | Meme coin with a focus on community building, staking rewards, and an alpha group for trading ideas. |

| Tokenomics Highlight | The presale ends upon reaching a funding goal of $15,760,176. A substantial amount of tokens is reserved for marketing and development. |

| What Makes It Cheap? | Currently at a low presale price, with the potential for high growth if it successfully captures the meme coin market’s attention. |

3. Jito (JITOSOL) – Jito’s Liquid Staking Rewards Token on Solana

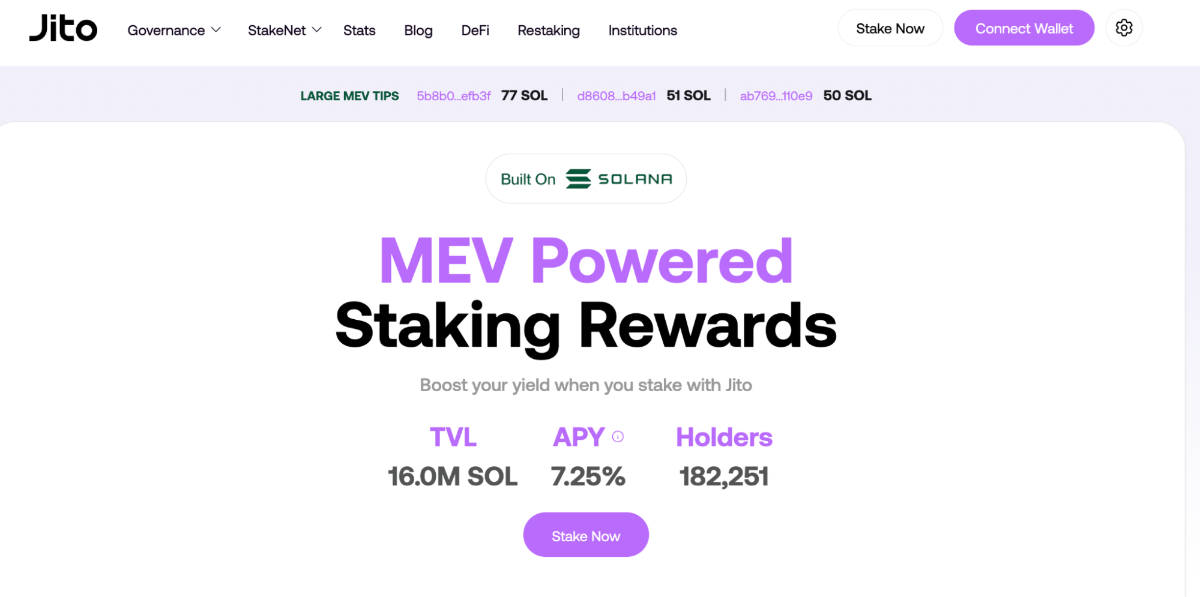

Jito is a liquid staking platform on Solana. Users stake SOL to receive JitoSOL, which represents their staked asset and accrued interest.

This allows JitoSOL to be used in other DeFi protocols, while still earning staking rewards. The Rex-Osprey Solana Staking ETF uses Jito to offer returns to its holders, similar to stock dividends in TradFi. The SSK had $183 million in assets under management in mid-August 2025, according to Intellectia.

Jito staking and MEV rewards. Source: JitoSOL

While JitoSOL is not cheap in terms of market capitalization, our analysis shows Solana Staking ETFs are important for Solana and Jito, making JitoSOL a means to capture value.

Is JItoSOL the best cheap crypto?

- What makes it Unique: The biggest protocol on Solana with high potential due to institutional adoption from Solana Staking ETFs.

- Suitable For: DeFi investors, web3 investors, people seeking yields on investment, and Solana bulls.

- Community Growth: According to Dune and The Block, Solana averages around 4 million active addresses daily. Jito has 95k X followers.

- Key Risk Factors: SOL and therefore JitoSOL could fall if meme coins lose steam; however, the success of pump.fun continues.

- Access: On crypto exchanges such as Coinbase, Binance, and Bybit. And dexes such as Raydium, Jupiter, and Orca.

| Project | Jito Staked Sol |

| Type | Liquid Staking Token / DeFi |

| Blockchain | Solana |

| Current Price | $305 |

| Market Cap | $3.7B |

| Key Use Case | Liquid staking for SOL, capturing MEV, generating yield for stakers, and enabling participation in DeFi while assets remain staked |

| Tokenomics Highlight | JitoSOL accrues staking rewards and MEV profits, with the exchange rate to SOL continuously increasing |

| What Makes It Cheap? | It’s utility in liquid staking and its ability to generate MEV-enhanced yields on Solana, rather than being a low-priced presale asset |

4. Curve Finance (CRV) – DEX, Borrowing and Lending, Focusing on Stablecoins

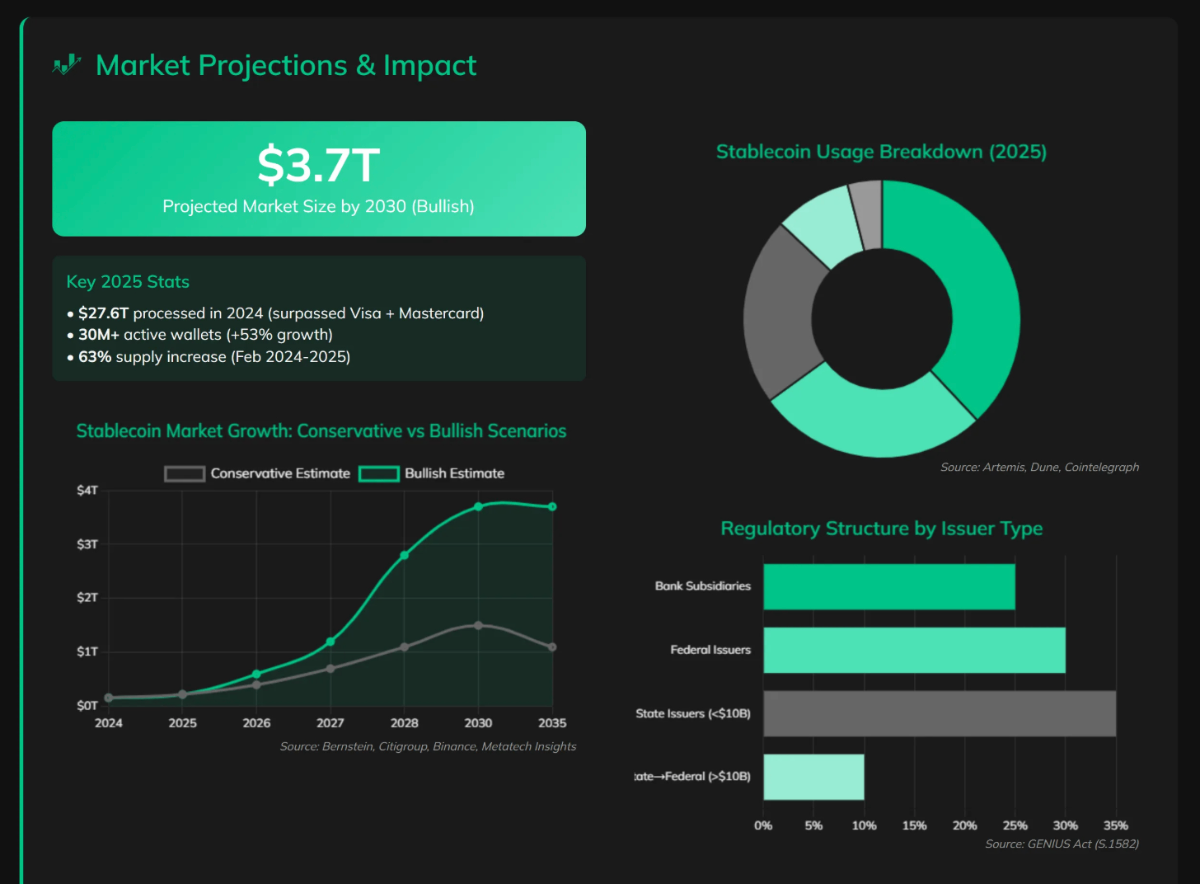

Curve Finance is a blue-chip DeFi platform that was established in 2019, specializing in stablecoin swaps. It now includes more coins and opportunities to earn yields, while continuing to focus many of its offerings on stablecoins. Bloomberg estimates that stablecoins could reach a market cap of $3.7 trillion by 2030.

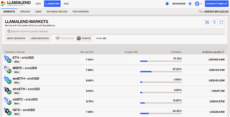

Llamalend enables crypto assets as collateral and borrowing crvUSD. Source: Curve.Finance

The protocol’s Llamalend service enables borrowing and lending for advanced yield-bearing strategies, made possible by its unique loan health algorithm.

Users can receive stablecoin yields of up to 10% and earn enhanced rewards for providing liquidity. The CRV token can also be used for staking and governance.

Is CRV the best cheap crypto?

- What makes it Unique: Curve offers high yields for stablecoins and has a TVL of over $300 billion.

- Suitable For: DeFi users, Narrative investors, Crypto Borrowers and Lenders, and Crypto blue-chip investors.

- Community Growth: Over 370,000 followers on X and approximately 15,000 members on Telegram.

- Key Risk Factors: Curve’s unique AMM model makes it more prone to slippage at times of intense market, as coins can trade below the peg.

- Access: CRV is available on major CEXes such as Binance, Coinbase, and OKX, as well as DEXes including Uniswap and PancakeSwap.

| Project | Curve Finance |

| Type | Decentralized Exchange (DEX) / DeFi Protocol |

| Blockchain | Ethereum and 24 other chains |

| Current Price | CRV $0.24 24h volatility: 3.1% Market cap: $358.10 M Vol. 24h: $51.49 M |

| Market Cap | $1.4B |

| Key Use Case | Efficient stablecoin swaps with low slippage, yields from lending and borrowing, core liquidity provider in DeFi |

| Tokenomics Highlight | Holders can lock CRV for veCRV to participate in governance and earn boosted rewards |

| What Makes It Cheap? | On trend for yield-bearing stablecoin and leverage plays, which could see Curve grow substantially |

5. Bonk (BONK) – Solana’s Original Meme Coin That Actually Gets Used

Bonk is one of the first big meme coins on Solana. It launched in late 2022 and became popular after a large airdrop to Solana users, builders, and NFT traders. The idea was to bring fun and activity back to Solana after a rough year.

The Bonk team released a short video explaining how BONK started and introducing its mascot. Source: Bonk

Unlike many meme coins, Bonk didn’t stop at hype. BONK is now used across the Solana ecosystem for payments, NFT mints, games, and DeFi apps. It is integrated into wallets, marketplaces, and even some on-chain games, which gives it real usage beyond speculation. That is a reason why it stayed relevant while many meme coins faded.

Is BONK a good cheap crypto?

- What makes it Unique: BONK is a meme coin with real adoption inside the Solana ecosystem, not just social hype.

- Suitable For: Solana bulls, meme coin traders, and ecosystem users looking for a familiar, liquid token.

- Community Growth: BONK has one of the largest and most active meme communities on Solana, driven by frequent integrations and campaigns.

- Key Risk Factors: BONK still follows meme coin cycles and can drop when hype cools down.

- Access: Available on major Solana DEXs and CEXs, including Jupiter, Raydium, Binance, and Coinbase.

| Project | Bonk |

| Type | Meme Coin |

| Blockchain | Solana |

| Current Price | BONK $0.000006 24h volatility: 1.2% Market cap: $541.61 M Vol. 24h: $53.13 M |

| Market Cap | $989M |

| Key Use Case | Payments, tipping, NFTs, games, and DeFi across Solana |

| Tokenomics Highlight | Large community allocation and ongoing ecosystem usage |

| What Makes It Cheap? | Low unit price and strong Solana-native adoption compared to newer meme coins |

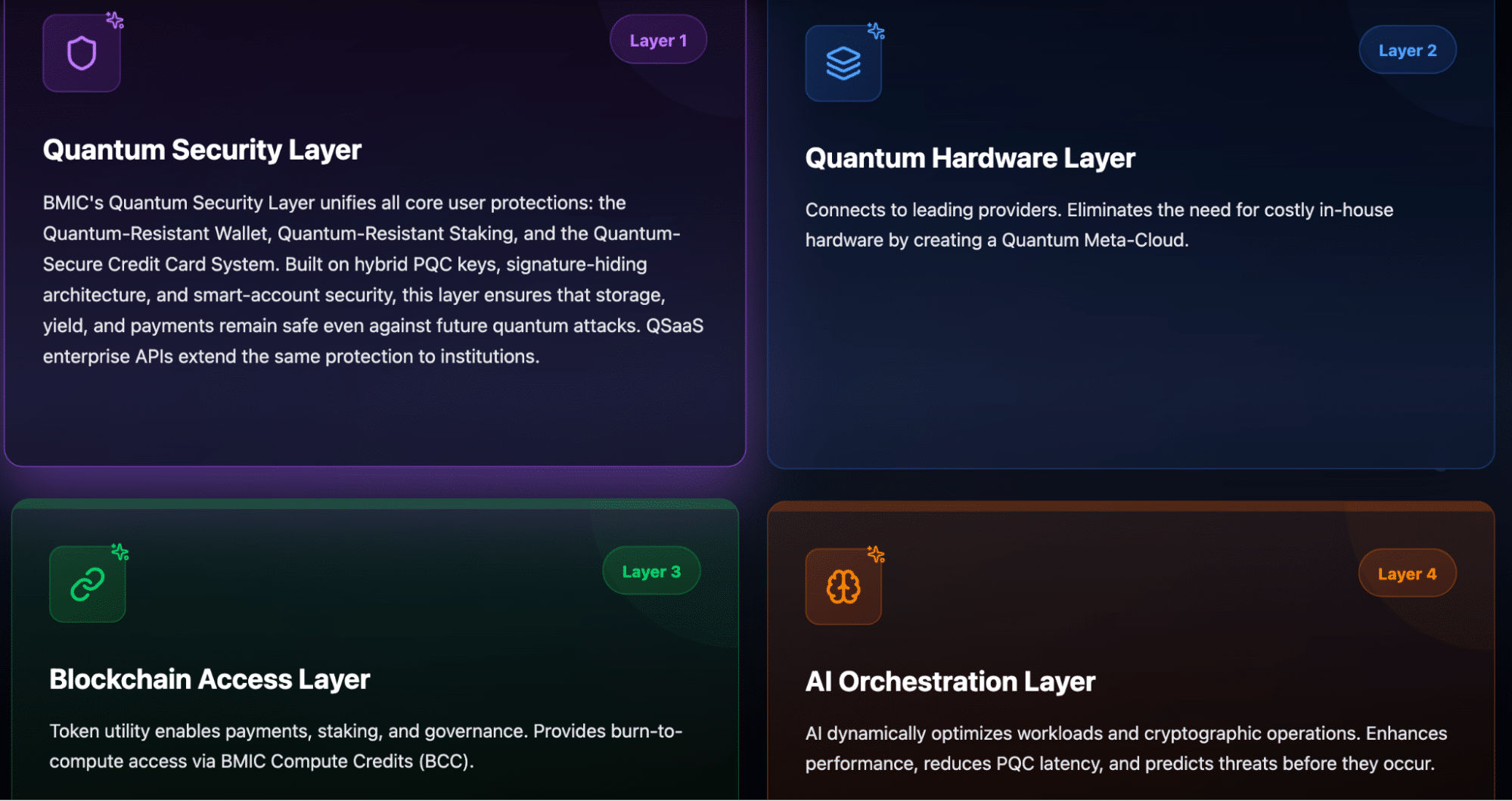

6. BMIC (BMIC) – Quantum Secure Wallet and Crypto Ecosystem

BMIC is aiming to address the safety issues surrounding quantum computing and blockchain. As quantum computing improves, a survey in 2025 showed that 73% of IT professionals believe quantum will become a material threat to cybersecurity within the next 5 years. To combat that, companies will need to implement post-quantum cryptography (PQC), however, only 9% of teams report having it on their roadmap.

BMIC’s four-layer structure, including security, hardware, blockchain access, and AI optimization.

BMIC is making a secure wallet and staking platform using PQC, expanding into a credit card and a QaaS (Quantum as a service) platform. This will allow businesses and enterprises to plug into their quantum security system. They will also build a quantum compute network and marketplace.

The BMIC token will be used throughout the ecosystem and has deflationary tokenomics.

Is BMIC one of the best cheap cryptocurrencies?

- What makes it Unique: BMIC is building a full ecosystem to secure against quantum threats

- Suitable For: Future-proof Web3 plays, those concerned about quantum attacks

- Community Growth: The BMIC X account has over 3700 followers since it was created in August

- Key Risk Factors: It could take several years before quantum attacks are possible

- Access: On the BMIC official presale page

| Project | BMIC |

| Type | Quantum secure wallet and ecosystem |

| Blockchain | Ethereum |

| Current price | $0.048881 |

| Market cap | $73.3M |

| Key use case | Keeping crypto safe and providing companies with access to protocols with PQC |

| Tokenomics highlight | A burn mechanism that removes a percentage of BMIC used in fees, and for accessing quantum compute power |

| What makes it cheap? | A relatively novel concept; tackling cybersecurity for blockchain and beyond, before quantum hardware becomes mainstream |

7. SUBBD (SUBBD) – AI-assisted Content Creator and Fan Platform on Web3

SUBBD is a social platform in development that seeks to challenge issues in the content creator space, such as high fees. It plans to offer AI tools to both creators and fans, simplifying content creation and enabling collaboration between creators and fans.

SUBBD token presale. Source: SUBBD

The platform also uses Web3 to address de-platforming by removing managers and gatekeepers. The SUBBD token’s use cases include VIP content and event access for holders, staking and governance, content purchases, and tipping creators.

Staking rewards are paid in SUBBD, with a staking APY of 20%.

Is SUBBD one of the best cheap cryptocurrencies?

- What makes it Unique: This AI and fan content creator platform bridges Web2 influencers to the blockchain.

- Suitable For: AI creation plays, content/fan business models, and those interested in bridging Web2 businesses into Web3.

- Community Growth: 10,755 holders, and a network of influencers with a social reach of around 250 million.

- Key Risk Factors: Success depends on migrating a large Web2 audience to Web3 and competition in the social platform economy.

- Access: On the SUBBD official presale page.

| Project | SUBBD |

| Type | AI and Fan Content Creator Platform |

| Blockchain | Ethereum |

| Current Price | $0.05747500 |

| Market Cap | $1.48M |

| Key Use Case | Bridging Web2 influencers to the blockchain, enabling lower fees for creators and fans, and AI-powered content creation tools |

| Tokenomics Highlight | Designed to incentivize creators and fans, providing access to premium content and exclusive livestreams for token holders |

| What Makes It Cheap? | It is in presale with a low market cap and targets the $85B subscription creator economy |

8. SpacePay – Making Crypto Payments as Easy to Accept as Card Payments

SpacePay is a POS system that will allow merchants to accept crypto payments without needing specialized equipment. The platform converts transactions into fiat, so merchants are not required to hold crypto. The project says its fees will be zero for customers and that it will enable merchants to create loyalty programs.

SpacePay user experience details. Source: SpacePay

The SPY token will facilitate payments and may be used to distribute a share of revenue to its holders.

Our analysis suggests that PayPal’s decision to accept over 100 cryptocurrencies is promising for SpacePay as it familiarizes people with using crypto, while leaving space for other lower-fee providers.

Is SpacePay the best cheap crypto for 2026?

- What makes it Unique: It offers a terminal-agnostic POS solution, facilitating crypto spending and receiving in everyday life.

- Suitable For: Payment processor / tangible infrastructure plays, mass adoption bulls, TradFi to crypto enthusiasts.

- Community Growth: Over $1.3 million raised so far, with over 70,000 followers on X and over 5,300 members on Telegram.

- Key Risk Factors: Not yet audited. No whitepaper.

- Access: On the official SpacePay presale website.

| Project | SpacePay |

| Type | Crypto Payment Solution |

| Blockchain | The SPY token can be bought on Ethereum, Polygon, Avalanche, Base and BNB |

| Current Price | $0.003181 |

| Market Cap | $108M |

| Key Use Case | Simplifying crypto acceptance for retailers and customers at Point-of-Sale terminals, integrating with existing systems |

| Tokenomics Highlight | 36% of the tokens are reserved for marketing and making strategic partners – vital for the success of the project |

| What Makes It Cheap? | It is in presale, with a low market cap, offering an opportunity to invest in a solution for mass crypto adoption in everyday transactions |

9. Io.net (IO) – DePIN GPU Network with Rewards for AI Engineers and GPU Providers

Io.net is building a decentralized network of GPUs to provide AI engineers with unlimited GPU power. They claim to be up to 90% cheaper than traditional cloud-based platforms.

IO project homepage. Source: Io.net

Io.net seeks to assemble a network of over 1 million GPUs and collaborate with Render RENDER $1.35 24h volatility: 2.5% Market cap: $691.17 M Vol. 24h: $50.22 M , Injective INJ $3.06 24h volatility: 0.1% Market cap: $304.27 M Vol. 24h: $35.72 M , and Filecoin FIL $0.92 24h volatility: 1.6% Market cap: $689.76 M Vol. 24h: $73.51 M .

The IO token has utility; users with spare GPU capacity can contribute and earn rewards, while engineers who hold IO get discounted access. IO also supports staking rewards.

The project was recently listed on Coinbase due to high regulatory compliance.

Is IO the best cheap crypto for 2026?

- What makes it Unique: Offers VC investing for projects using machine learning.

- Suitable For: AI infrastructure investors, GPU DePIN investors.

- Community Growth: 12k+ followers on X.

- Key Risk Factors: How quickly IO can scale and onboard users to provide GPU power.

- Access: CEXs, including Binance, Coinbase, Gate, KuCoin, Bybit, LBank, MEXC, and CEX.IO. Solana DEXs, including Raydium.

| Project | IO |

| Type | Decentralized Physical Infrastructure Network (DePIN) / GPU Cloud |

| Blockchain | Solana |

| Current Price | IO $0.10 24h volatility: 0.4% Market cap: $29.04 M Vol. 24h: $9.74 M |

| Market Cap | $119M |

| Key Use Case | Providing a decentralized network of GPUs for AI using people’s idle computer power. |

| Tokenomics Highlight | Includes a buy-and-burn mechanism funded by network revenue to create deflationary pressure. |

| What Makes It Cheap? | Low market cap and high growth potential, in a high-growth industry (AI). |

10. Akash (AKT) – Decentralized Cloud Compute Network Marketplace

Akash, established in 2018, connects people with spare GPU power to those needing GPU resources. With the AI boom, Akash now primarily focuses on targeting developers needing power for AI applications.

Akash’s GPU provider calculator, showing how much people can earn from providing resources. Source: Akash

AKT is used for governance and securing the network, as well as providing incentives and a way to store and exchange the value of GPU power. Due to high token unlocks, AKT has struggled to maintain value, but with 72% of the supply now released, inflation is declining. However, tokens will continue to vest until 2030, with miners being the main recipients.

Akash is an alternative to bigger closed providers such as AWS, but according to the CEO, it doesn’t aim to replace them, but rather to offer a more sustainable energy solution targeted at startups.

Is AKT the best cheap crypto for 2026?

- What makes it Unique: Well-established project with enhanced use case due to the AI boom

- Suitable For: DePIN investors, decentralized compute power bulls, AI plays.

- Community Growth: 127k+ followers on X

- Key Risk Factors: Growing number of competitors, AI “bubble” fears

- Access: Coinbase, Kraken, Upbit, Crypto.com, Osmosis

| Project | Akash (AKT) |

| Type | DePIN / GPU cloud marketplace |

| Blockchain | Cosmos |

| Current price | AKT $0.32 24h volatility: 2.1% Market cap: $92.49 M Vol. 24h: $3.36 M |

| Market cap | $108M |

| Key use case | An energy-sustainable decentralized marketplace for GPUs |

| Tokenomics highlight | Uses a take fee system to reward stakers and pay for token burns, linking network usage to AKT’s value. |

| What makes it cheap? | Low market cap, established tech in a fast-growing sector. |

Top Cheap Cryptos Compared Side-by-Side

| Coin Name | Why it Stands Out | Current Value Metrics | Launch Status |

| Bitcoin Hyper | Layer 2 solution bringing smart contracts to BTC | Price $0.01367550, Raised $31.44M | Presale |

| Maxi Doge | Community-driven meme coin with staking and trader-focused perks | Price $0.00028030, Raised $4.6M | Presale |

| JitoSOL | Solana’s leading liquid staking token. | [NC] | Launched |

| Curve Finance | DeFi protocol specializing in stablecoins and high-yield opportunities. | CRV $0.24 24h volatility: 3.1% Market cap: $358.10 M Vol. 24h: $51.49 M | Launched |

| Bonk | Solana’s original meme coin with real ecosystem usage | BONK $0.000006 24h volatility: 1.2% Market cap: $541.61 M Vol. 24h: $53.13 M | Launched |

| BMIC | Building quantum secure crypto technology for retail and enterprise | Price $0.048881, Raised $298M | Presale |

| SUBBD | AI-enhanced content creator platform addressing high fees. | Price $0.05747500, Raised $1.48M | Presale |

| SpacePay | A point-of-sale system to enable crypto payments for merchants. | Price $0.003181, Market Cap $108M | Presale |

| Io.net | DePin GPU network providing low-cost computing power for AI. | IO $0.10 24h volatility: 0.4% Market cap: $29.04 M Vol. 24h: $9.74 M | Launched |

| Akash | DePin GPU network focusing on sustainability. | AKT $0.32 24h volatility: 2.1% Market cap: $92.49 M Vol. 24h: $3.36 M | Launched |

How We Chose These Cheap Cryptocurrencies (Our Methodology)

When assessing cheap cryptocurrencies, we use a rigorous methodology that comprises various criteria, including assessing tokenomics, market capitalizations, social attention, project utility, whitepapers, litepapers, idea and growth potential, market sector sizes, and due diligence where possible.

We also gave specific focus to the following criteria, as they are very relevant to deciding whether a crypto is in fact ‘cheap’ and therefore good value. We reviewed over 80 coins and tokens as part of our research.

Price / Valuation – 30%

We considered the price of the crypto relative to the token supply, as measured by the market capitalization. Lower market caps with good ideas or products usually lend themselves to higher growth potential. We also factored in the circulating supply of tokens relative to locked tokens, as this can indicate potential selling pressure as the tokens unlock.

Growth Potential – 25%

We factored in the price, as well as the market’s appetite for the niche and type of project. Coins that fit highly sought-after narratives or novel ideas received attention, as did projects that have benefited from recent regulatory changes, such as the GENIUS Act. We also factored in the institutional interest in coins such as BTC, ETH, and SOL, and how that might affect demand for tokens on those networks.

Utility – 20%

A token with high utility, or high potential utility, is likely to rise in price as people buy the token to use the protocol it’s based on, or access perks or special features for holders only. Tokens with a clear use case were prioritized in most cases, although we also made exceptions for certain meme coins. We also considered the project’s utility as a whole, asking questions such as “Is the demand for this concept likely to increase or decrease as time goes on?”

Social Traction – 10%

Sometimes an idea or token takes people by storm, especially in the case of meme coins, but also with other types of projects. We examined social metrics, including X followers and Telegram users, as well as mentions on popular social platforms such as Discord and Reddit.

Exchange Listing Potential – 10%

We considered how likely a token is to get listed on Tier 1 exchanges, as these tokens typically experience a significant boost if they are listed on platforms like Binance or Coinbase. This is in part due to the ability of new entrants to a token, as they discover it for the first time, and speculation based on the clout that a tier 1 listing confers. Regulatory compliance and similarity to other previously listed tokens are significant factors in considering a new token’s exchange listing potential.

Security & Risk Screening – 5%

Projects that have experienced recent exploits, unresolved audit issues, or delistings are capped in score, until such time as the issue is resolved. We review and look out for audit histories and incident reports where available.

Visit our Methodology page for a comprehensive look at Coinspeaker’s scoring process.

Market Insights for Top Cheap Crypto Opportunities in February 2026

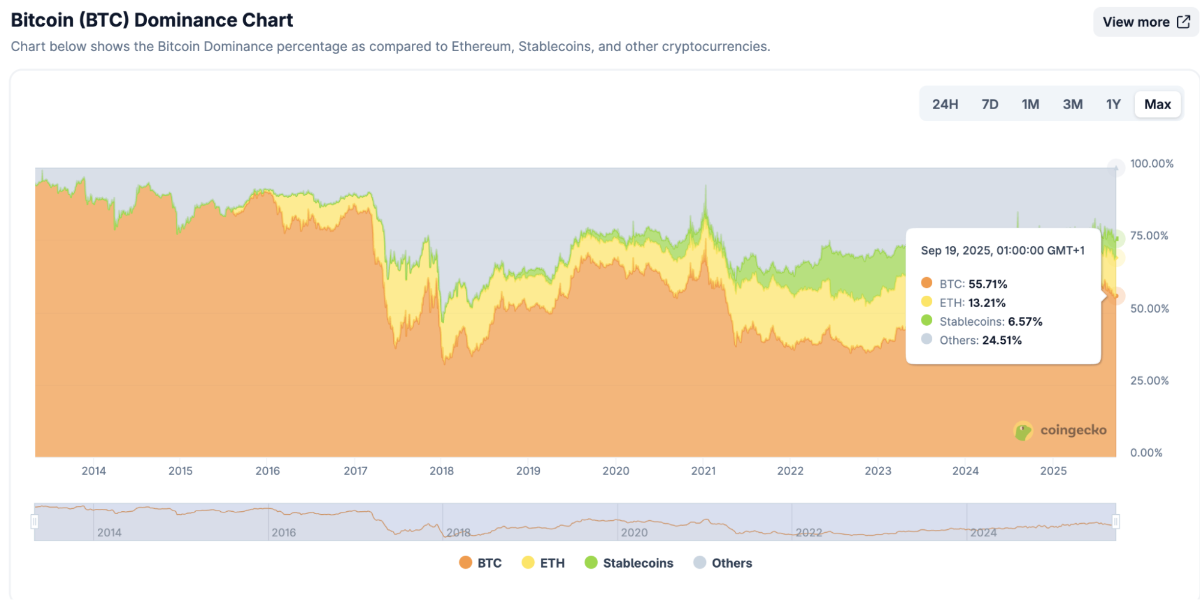

Bitcoin dominance has dropped from its 2025 high of 65% to 55.7% (as of September 19). As a result, many altcoins have seen strong growth over the past month, particularly in DeFi, such as APX Finance and presale projects like MYX Finance and Pump.fun, along with other memecoins like the Memecore blockchain token.

Bitcoin dominance chart. Source: CoinGecko

This is due, in part, to the US ‘crypto week’ and the passage of legislation surrounding the legitimisation of cryptocurrency in the United States – the CLARITY and GENIUS Acts.

These bills give clear guidance on whether a crypto is a security or not, providing a certain amount of security for investors, and allowing stablecoins to be legitimate trading vehicles in TradFi.

GENIUS Act stablecoin effects and projections. Source: Pragmatic Coders

These bills, continued investment from institutions, and retail re-entering the market, bring the overall market capitalization of crypto to over $4 trillion for the first time.

Coins on Ethereum are set to benefit from CLARITY, as Ethereum has approximately 50% stablecoin dominance, which in turn leads to greater liquidity for trading and DeFi.

Small-cap coins, cheap crypto tokens, and presales are also benefiting, since they are more reactive to broad movements in the crypto market and the effects of bullish conditions.

Macroeconomic conditions such as dovish policies from the FED, and political developments such as unrest in the Middle East, are also driving capital into stocks and crypto, as investors try to preserve the value of their money.

How to Evaluate the Best Cheap Crypto Projects

Here, we’ll cover the ways to identify promising cheap crypto projects, including the due diligence you can do, and what actually qualifies as a cheap crypto.

What is the meaning of a ‘Cheap crypto’?

To find and evaluate a cheap crypto project, it’s essential to first understand what defines ‘cheap’. Some investors look for a low-priced cryptocurrency, such as Dogecoin DOGE $0.0947 24h volatility: 1.1% Market cap: $15.88 B Vol. 24h: $864.73 M , as opposed to a cryptocurrency like Hyperliquid HYPE $31.26 24h volatility: 0.5% Market cap: $7.37 B Vol. 24h: $262.51 M , which, due to its token price, may seem expensive.

However, this is a phenomenon called unit bias, since DOGE is worth a lot more than HYPE.

We know this because the value of a crypto is calculated by the token supply multiplied by the price. This gives us the market capitalization, which is a better guide to the size and value of a cryptocurrency.

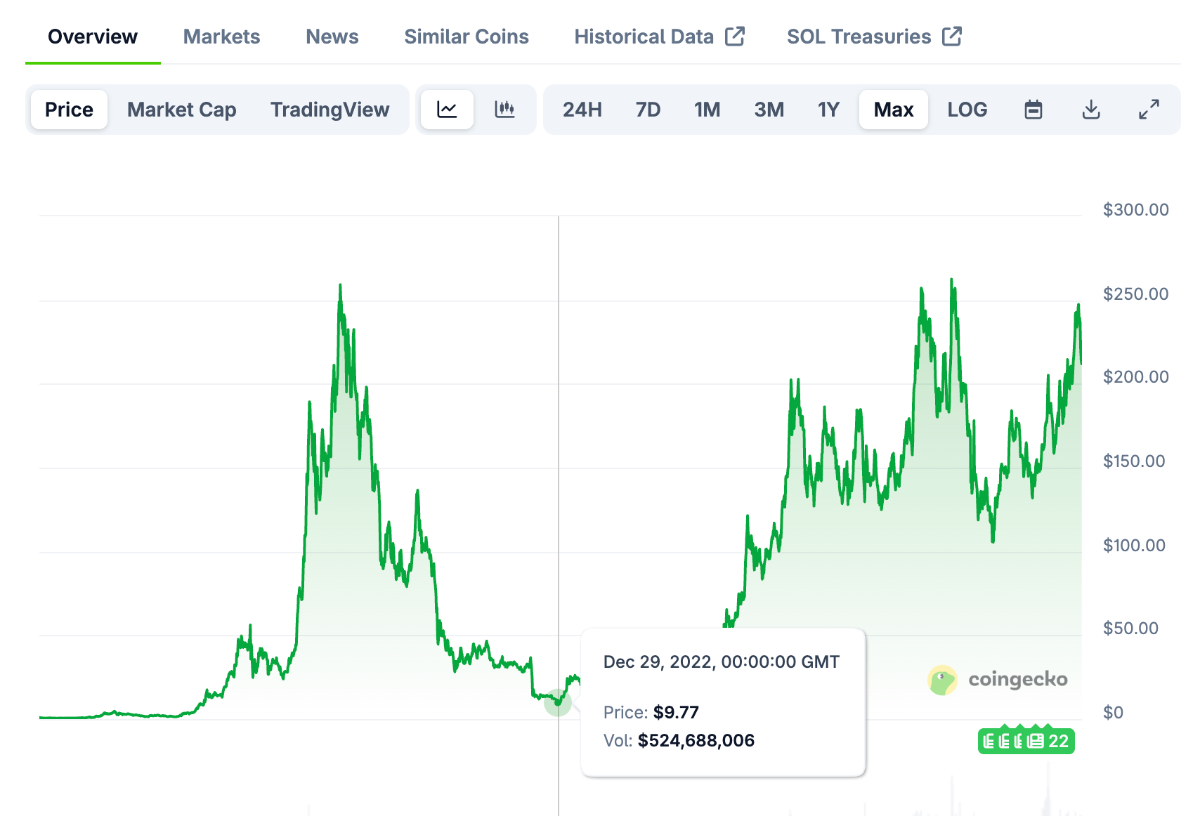

A crypto can be considered cheap and good value if it has a low to medium market cap with high growth potential. Large-cap cryptocurrencies can also be thought of as cheap, if people strategically invest when the price is low. For example, after the fall of the exchange FTX, Solana crashed to $9.77. Investors who felt SOL was undervalued are now realizing gains of over 1800%.

Solana price chart. Source: CoinGecko

Therefore, projects that are experiencing temporary FUD or issues, but have good potential, may be considered cheap. Similarly, if the market experiences a correction, many large-cap cryptocurrencies with strong fundamentals could be regarded as undervalued.

High-cap coins may also have a lot of potential not yet priced in by the market, making them potentially good value. Low cap coins with good ideas are most likely to make especially big gains, and may even be the next 1000x crypto.

It’s good to have some capital on the sidelines and a list of cryptos for buying when the market dips.

Use this checklist to find out what to look for in a promising cheap crypto before you invest.

Project’s use case

- What does the project actually do?

- What unique advantages does it have over competitors?

If the project is in an existing market, look at how other, more established companies are performing. For dapps, you can check estimated user counts with DappRadar, and use DefiLlama for TVL. The Curve DEX, for example, has over $3bn in TVL according to DefiLlama.

Token use case

- What is the token’s utility?

- Are there mechanisms to increase demand, such as burning?

If the token has high or convincing utility, for example, it’s needed to enable people to use the protocol, or it can be staked or held for other rewards, then this can enhance the price as the project grows.

Team Details

- Is the team doxxed?

- Were their previous projects successful?

- Do they have special knowledge that will help them bring the project to success?

If possible, try to identify team members and assess their knowledge, experience, and whether they have been part of any web3 or similarly relevant projects in the past. Were the projects successful? Was there a rug pull? A doxxed team is a great sign of trust, but many small projects and presales don’t dox their teams due to privacy concerns and the difficulty of launching a new project.

Roadmap and Whitepaper

- Does the project have a convincing roadmap and whitepaper?

- If so, how far is the team in achieving its goals?

- Is development active or paused?

With open-source projects like Litecoin, you can check the project’s GitHub to see when the last code commit was, and what kind of change it was (something substantial or merely a tweak)

Liquidity

- Is the liquidity pool locked?

- Is there sufficient liquidity to enable easy trading and cashing out?

- Which dexes and cexes can you trade the token on?

A liquidity pool should always be locked to ensure that the project doesn’t halt trading. Although there are many more things to consider when avoiding rug pulls, this is one metric that websites like Tokensniffer can help you analyse.

In the case of smaller or new coins, check how much liquidity is in the dexs. At any given point in time, the size of the liquidity pools is the size of the maximum position that can be cashed out. Even if you make huge gains on paper, it doesn’t count until you can cash out.

Coins on tier 1 CEXs tend to have excellent liquidity.

Exchange listings

- Is the coin listed on any CEXs?

- Are they Tier 1 and 2?

- Are any exchange listings planned?

Tier 1 CEX listings show that a certain amount of due diligence has been completed by the CEXes, particularly ones like Coinbase, Binance, and Kraken.

If the coin is not listed on CEXs or any exchanges because it is in presale, are there any listings in the works? When coins are listed, they often pump, so insider knowledge about this can mean you can buy the coin beforehand, getting it at a cheaper price.

Tokenomics

- Are the tokenomics well distributed?

- Is there a burn mechanism?

- Are tokens reserved for future development?

- What are the token unlocks and vesting schedules like?

Sometimes a project may seem cheap or undervalued, but be underpinned with subpar tokenomics. There is no one perfect tokenomics structure, but look out for a reasonable amount assigned to the team and founders (too much could crash the token price, too little leaves little incentive for them to continue working)

Good tokenomics usually include a budget for marketing, future development, and may include staking rewards, protocol rewards, and liquidity providing rewards as incentives.

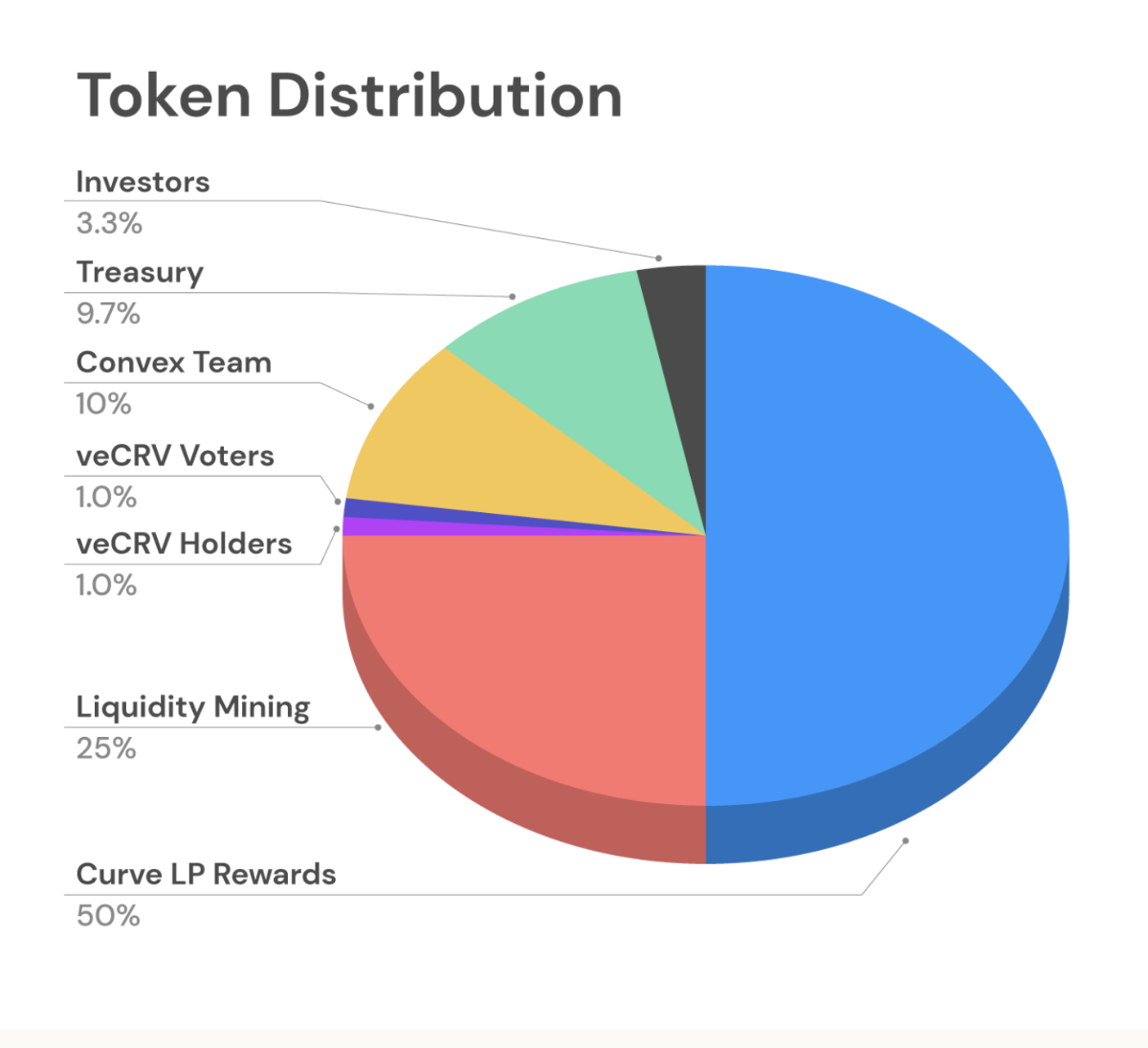

Tokenomics for Curve Finance. Source: Curve Whitepaper

As we can see from the image, Curve decided to keep 50% of its tokens to provide LP rewards, which is a sensible move for a DeFi protocol. 25% is for liquidity, 10% is for the treasury, which means that there are emergency or future funds to be used as token holders decide. Just 3.3% was reserved for investors and 10% for the team, indicating that there will not be much sell pressure from token unlocks.

For coins that are sold by presale or ICO, it’s usually good to see that a large amount of tokens are reserved for the public sale, as this helps with decentralization.

Where to Buy Cheap Cryptocurrencies

There are three main places to buy cheap cryptocurrencies:

- Centralized exchanges (CEXs) – including Coinbase, Kraken, Gate.io, Robinhood.

- Decentralized exchanges (DEXs) – including 1inch, Uniswap, Raydium, PancakeSwap, QuickSwap.

- Presale websites.

CEXs are often easier for new users, but require Know Your Customer procedures, which some may find invasive.

For the newest and cheapest currencies, you may need to use a DEX, because CEXs do not always have newer coins and tokens.

Presales are usually only available via the specific presale website, though some presales may be available through the decentralized Best Wallet app on mobile.

Getting your cash, aka fiat currencies, onto the blockchain

- In certain countries, such as the UK, CEXs are the only way to on-ramp cash.

- Some decentralized wallets like Best Wallet and MetaMask also allow users to on-ramp fiat. Best Wallet does not require KYC for on-ramping, and is the recommended choice for people who want to buy presales.

Safety Concerns and Other Things to Consider

- CEXs manage your account for you. This can mean less hassle – there is tech support if you need it. On the downside, you do not truly own your crypto on a CEX, and your account can even be frozen in certain cases. Not your keys, not your crypto!

- If you use a DEX, you will need to create a decentralized wallet. You have full control over your crypto, which means that it’s your responsibility to save your private key/secret passphrase safely. If you lose it, there is no recovery! If hackers find it, they can steal your crypto. Don’t share your details with anyone and only connect your wallet to sites you trust.

- Copycat websites sometimes exist for presale websites. These sites can’t sell you the token you want and may drain your wallet of all your crypto. Always double-check you are on the real site.

How to Buy Cheap Crypto

Here is a step-by-step guide to show you how to buy cheap cryptocurrencies:

- Download a wallet provider and create a non-custodial account.

Download a non-custodial wallet such as Best Wallet, MetaMask, Phantom, or Trust Wallet.

Best Wallet QR code: Source Best Wallet Website

Create or import a wallet. This will allow you to participate in presales and buy cryptocurrencies only available from decentralized exchanges. Many smaller-cap cryptos are not yet listed on Tier 1 and 2 CEXs.

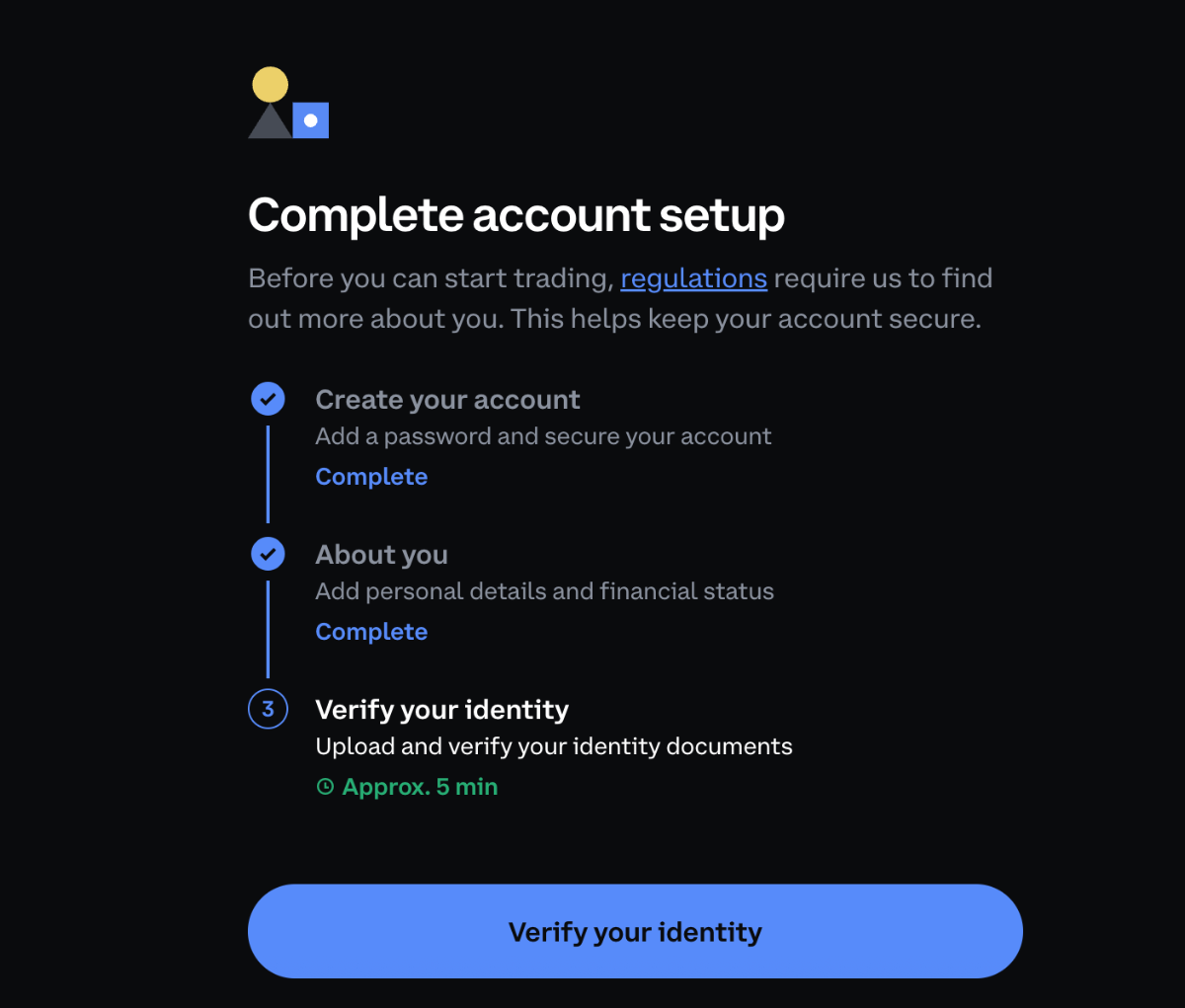

- Create an account with a centralized exchange.

If you can on-ramp your fiat through your decentralized wallet, you may skip this step, as long as you are happy to trade with a non-custodial solution.

However, you may wish to create an account with Coinbase, Binance, or another provider, for larger onramping and offramping and extra tech support.

Coinbase asking for KYC details. Source: Coinbase.com

- Fund your Account or Wallet

Deposit or transfer money to your CEX account using fiat (bank transfer, card, etc.).

Send the correct gas token to your decentralized wallet on the blockchain, often ETH, SOL, or BNB, for DEX trades or presales.

OR onramp fiat via your decentralized wallet.

- Research & Choose Your Crypto

Identify promising cheap cryptocurrencies using your checklist: project fundamentals, team, tokenomics, liquidity, and exchange listings.

Verify contract addresses when using DEXs to avoid scam tokens. Verify presale websites to make sure they are real and not copycats.

- Check liquidity and exchange options

Is the token available on a major CEX, DEX, or only through presale? Is there enough liquidity to cash out of large positions?

- Make the Purchase

On a CEX:

-

- Search for the token and choose your trading pair (e.g., USDT/FLUID).

- Place a buy order.

On a DEX:

-

- Connect your wallet to the DEX (e.g., Uniswap, PancakeSwap).

- Import the token contract address (CA) to ensure you have the right asset.

- Swap the required amount.

- Approve the transaction in your wallet.

From a Presale:

-

- Go to the presale website.

- Connect your wallet.

- Buy tokens (typically using ETH, USDT, or BNB, although payment by card is usually possible).

- Provide the wallet address that you wish to claim the tokens with upon TGE (Token Generation Event).

- Claim tokens after the sale according to project guidelines – be aware of launch dates and vesting schedules.

Benefits and Risks of Investing in Cheap Crypto

Investing in cheap, high-potential cryptocurrencies can be a way to acquire assets that could grow substantially in value. However, this strategy is accompanied by a unique set of challenges that require a clear understanding.

Pros of Investing in Cheap Crypto

Early Entry and Higher Growth Potential: Investing in projects during their presale or early stages provides a lower entry price. If the project’s concept is validated by the market, these assets can provide larger returns compared to established, high-market-cap cryptocurrencies.

Access to New Technologies: Early-stage projects often introduce novel ideas or innovative technology. By investing in these crypto coins, you gain exposure to the future of the crypto sector and can benefit from the adoption of new protocols.

Sense of Community and Engagement: Many low-cost projects build their foundations on a strong, engaged community. Participating in these ecosystems can provide access to exclusive insights and a sense of ownership over a project’s direction.

Cons of Investing in Cheap Crypto

High Volatility and Unpredictability: Cheap cryptocurrencies are often illiquid and susceptible to dramatic price swings. Small trading volumes can lead to significant fluctuations, making these assets highly unpredictable.

Vulnerability to Scams and Rug Pulls: The presale and low-cap sectors are populated by projects with unproven teams, sometimes with malicious intent. Without a track record, a project may turn out to be a scam with no clear way to recover lost funds.

Low Liquidity: Smaller market cap crypto coins may have insufficient liquidity in their trading pools. This means that even if a coin’s price increases on paper, it may be impossible to sell a large position without causing a sharp drop in price (high slippage), which makes it hard to realize gains.

Regulatory Uncertainty: As a developing sector, cheap cryptocurrency investments operate with less regulatory oversight than traditional investments, which offers less protection for investors.

Should You Invest in Cheap Cryptocurrencies?

Investing in cryptocurrencies is always a speculative bet. Cheap cryptos provide a higher growth potential, with the aim of outperforming Bitcoin. BTC is considered the safest of all cryptocurrencies; new and cheaper ones carry more risk, but also higher return potentials. Consider these investor profiles and which one you fit into, based on your investment goals and risk tolerance.

Conservative investors may want to keep all their investments in cryptocurrencies that rank in the top 25–50 by market capitalization.

Moderate investors may wish to allocate a small part of their portfolio to some cheap cryptocurrencies with high potential.

Aggressive / experienced investors with a high tolerance for risk and a desire for outsize rewards should consider adding a substantial amount of low-cost cryptos to their portfolio.

While we do our best to investigate each crypto we feature, investors should always do their own research and due diligence, and accept that the outcome of a currency could go either way.

Cheap cryptocurrencies carry risk and are often cheap due to unproven teams or new and untested ideas. Like a large percentage of new businesses, many will fail, go to zero, or reach a lower price than was initially invested. Regulations are still developing, meaning that there are higher risks and less protection than investing in companies on the stock market or other TradFi products.

Conclusion: What Is the Future of Cheap Cryptocurrencies?

The future of cheap cryptocurrencies will remain closely tied to broader market trends and the progression of regulatory frameworks. As institutional and retail participation expands, the potential for high-growth projects with solid fundamentals should grow with it. The opportunity lies in discovering these assets before their full market value is established. Successful projects can end up worth significantly more than their original investment value.

However, the pursuit of these opportunities requires acknowledging the inherent risks. For every project that realizes substantial growth, a far greater number will not. The sector’s volatility and the potential for project failure necessitate a cautious and well-informed approach.

The final responsibility for every investment rests with the individual. Therefore, maintaining a high standard of personal research and due diligence is extremely important. Practicing a robust risk management strategy is also a core principle for investing in low-cost, high-potential cryptocurrencies.

FAQ

What is the best cheap crypto to buy now?

How do I find cheap cryptos with potential?

Is it better to buy low-priced or low-cap coins?

Are presale tokens considered cheap?

Is cheap crypto a good investment in 2026?

References

- What is Curve Finance (CRV)? (Bitstamp)

- DeFi Lending Sector Surges (Ainvest)

- Crypto Venture Capital Q1 2025 Report (Galaxy Research)

- US Crypto Policy Tracker: Regulatory Developments (Latham & Watkins LLP)

- The Institutionalization of Digital Assets (Grayscale)

- Cryptocurrency Market Report 2025 (Research and Markets)

- 10 Web3 Statistics to Know in 2025 (Bankless Times)

- Blockchain Technology Market Size Projected to Reach USD (GlobeNewswire)

- How AI and Machine Learning Transform Crypto Trading in 2025 (The AI Journal)

- Forward Industries: The SOL treasury company with a $1.65 billion warchest (Arkham)

- Top Bitcoin Treasury Companies (BitcoinTreasuries.NET)

- Telegram Users Statistics 2025 [Latest Worldwide Data] (DemandSage)

- Top Quantum Breakthroughs of 2025 – (Network World)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked By:

Fact-Checked By:

Ibrahim Ajibade

, 373 postsI’m a research analyst with experience supporting Web3 startups and financial organizations through data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in Economics, I bring a solid understanding of market dynamics, financial systems, and the broader economic forces shaping the crypto industry. I’m currently pursuing a Master’s degree in Blockchain and Distributed Ledger Technologies at the University of Malta, where I’m expanding my expertise in decentralized systems, smart contracts, and real-world blockchain applications.

I’m especially interested in project evaluation, tokenomics, and ecosystem growth strategies, as these are areas where innovation can drive lasting impact. By combining my academic foundation with hands-on experience, I aim to provide meaningful insights that add value to both the financial and blockchain sectors.