Crypto theft is more common than most traders think, and it rarely takes a sophisticated hack. A forgotten token approval, a poorl...

What Is the Best Crypto to Buy in 2026? – Top 10 Large Cap vs Early Stage Coins to Invest In

48 mins

48 mins According to our research, Bitcoin is the best established crypto to buy in 2026.

Bitcoin dropped after reaching its $125,500 all-time high in October, but historically these pullbacks signal strong buying windows for both BTC and altcoins before the next rally phase, especially with institutional demand outpacing mining supply.

Alternative established options like Solana and XRP bring stability through institutional adoption and proven infrastructure. Ondo Finance leads early-stage opportunities with partnerships including BlackRock and Goldman Sachs, while early-stage tokens like Arbitrum and Immutable offer higher-risk, higher-reward opportunities in derivatives trading and Web3 gaming.

When recommending the best crypto to buy, we use a methodology built on a multi-factor framework that evaluates growth potential, tokenomics strength and utility, go-to-market strategy, and price action and history. However, keep in mind that crypto and digital assets are highly volatile, and prices can fluctuate widely in a short period of time. Always do your own research and consult with a qualified financial professional before making any investment decisions.

Best Crypto to Buy Key Takeaways

- Bitcoin remains the top choice for established investors due to its first-mover advantage, deepest liquidity, and status as a strategic reserve asset.

- Solana and XRP are established large-caps benefiting from ETF speculation and institutional treasury allocations.

- Early-stage tokens like Ondo and Immutable target underutilized sectors with strong institutional catalysts and higher growth potential.

- For a balanced portfolio, allocate more to established large-caps and a lower amount to early-stage tokens based on your risk tolerance.

- The crypto market faced $638M in liquidations mid-October, and these pullbacks might present optimal entry points before the next leg up.

Top Crypto List to Invest in 2026

Let’s dive straight into the best crypto to buy now. We’ve categorized assets as Established (tested projects with $5B+ market caps, multi-year track records, and institutional backing) or Early Stage (emerging projects under $5B with higher growth potential but increased volatility and risk).

| Asset | Profile | Why Consider Now | Key Risk |

| Bitcoin | Established | Institutional flows / macro hedge | Drawdown risk on macro shock |

| Solana | Established | Staking ETFs / Institutional treasury adoptions | Meme decline could affect SOL price |

| XRP | Established | 95% ETF approval odds, 300+ banking partnerships | Policy reversals, large holder sell-offs |

| Chainlink | Established | Decentralized oracle network, 60+ blockchain integrations | Competition from alternative oracle solutions |

| Ondo Finance | Early Stage | RWA tokenization leader, SEC-compliant infrastructure | Regulatory risks in tokenized securities |

| TRON | Established | $78B USDT dominance, emerging ETF narrative | Heavy USDT reliance, recent price decline |

| Hyperliquid | Established | High-volume DEX with no gas fees | Transparency concerns, validator centralization |

| Immutable | Early Stage | Leading Web3 gaming infrastructure, AAA partnerships | Competition from other gaming L2s |

| NEAR Protocol | Early Stage | First L1 inflation halving completed, sharding tech | Governance controversy, reduced staking rewards |

| Arbitrum | Early Stage | Largest Ethereum L2 by TVL, proven reliability | Competition from BASE and other L2s |

| Zcash | Established | 560% rally, privacy tech revival | EU MiCA regulatory threats to privacy coins |

Editor’s Watchlist – Other Early-Stage Crypto Projects

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Quantum-resistant security infrastructure for wallets and enterprise use

- Uses deflationary tokenonomics, including burns, tied to quantum workload execution

- Staking and governance participation expand token utility

- Shared liquidity spanning Bitcoin, Ethereum, and Solana

- Improved trade execution through faster speeds and secure cross-chain capital movement

- Opens up greater cross-ecosystem connectivity for builders and developers

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

- High-performance broker for pros and newcomers alike

- Rebates and buybacks come from VFX's own market activity

- 10% bonus on sign up and early staking access

Best Crypto to Invest In Reviewed

Want to know more about what makes these tokens the best crypto to buy now? We’ll dive into the key features, pros, and cons of each coin so you can decide which ones to add to your portfolio.

1. Bitcoin (BTC) – Market Leader Poised for Growth in 2026 and Beyond

Bitcoin is the world’s first and largest cryptocurrency, serving as digital gold for institutional portfolios and retail investors. BTC maintains its dominant position, trading at $67,316.19 after October’s all-time high.

The cryptocurrency fell below $90,000 in late November for the first time in seven months, driven by broader risk-off sentiment, concerns about AI stock valuations, and uncertainty about Federal Reserve rate cuts.

Our View (Julia Sakovich): In my opinion, Bitcoin’s current price decline is an opportunity for long-term holders. The price has not been so low for a while now, creating price levels we haven’t seen since spring. This drop reflects broader market uncertainty, and this is a healthy correction within an ongoing bull cycle rather than a trend reversal.

Key Points on Bitcoin:

- Why It Stands Out: Proven resilience, strong institutional adoption, improving regulatory clarity.

- Ideal For: Long-term holders, institutional investors, macro-focused traders.

- Risks & Considerations: Extreme volatility with potential decline to $80K-$85K if current support levels break.

Community Sentiment: Users remain divided between “HODL” optimism and warnings against over-leverage, with r/CryptoCurrency showing mixed sentiment following recent liquidations. Most discussions warn that retail FOMO spikes often precede pullbacks.

| Project | Bitcoin |

| Price | BTC $67 204 24h volatility: 0.1% Market cap: $1.34 T Vol. 24h: $31.27 B |

| 24h Change | -0.14% |

| ATH | $126,173.18 |

| Market Cap | $1.35T |

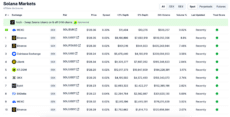

2. Solana (SOL) – High-Speed Blockchain Powering the Next Wave of Web3 Apps

Solana is a Layer 1 blockchain using Proof-of-History consensus to process 100,000+ transactions per second. The network trades at $82.37 SOL $82.30 24h volatility: 0.7% Market cap: $46.93 B Vol. 24h: $2.26 B after reaching highs of $295 in January 2025, driven by rapid growth in the DeFi ecosystem.

Solana achieved the milestone of becoming the first major blockchain to process 100,000 TPS on mainnet. Meme coin trading declined from over 60% to under 30% of DEX volume by September 2025, with stablecoins now accounting for 58% of trading activity.

Our View (Julia Sakovich): Although US Solana ETF approval has not spiked its price yet, I believe it could drive SOL toward analyst targets of $500, though sustainability concerns around past meme coin dependence warrant monitoring.

Key Points on Solana:

- Why It Stands Out: Treasuries’ adoption, $6.3B DeFi ecosystem (Snapshot from DefiLlama, February 11, 2026), spot ETFs launched in October 2025.

- Ideal For: Large-cap holders, traders, developers, and meme coin speculators.

- Risks & Considerations: Over-reliance on meme coin speculation, which could affect liquidity and usage.

Community Sentiment: Reddit discussions praise Solana’s speed and low fees, with bullish sentiment around institutional adoption and ETF prospects. But users are concerned about the network’s heavy reliance on meme coins.

| Project | Solana |

| Price | SOL $82.30 24h volatility: 0.7% Market cap: $46.93 B Vol. 24h: $2.26 B |

| 24h Change | -0.74% |

| ATH | $294.16 |

| Market Cap | $48.49B |

3. XRP (XRP) – Cross-Border Payments Cryptocurrency with Banking-Grade Infrastructure

XRP is an institutional-grade cryptocurrency created for cross-border payments, processing transactions in 3-5 seconds, compared to traditional banking systems that take days.

Trading at $1.35, XRP has gained momentum following the launch of the first U.S. spot XRP ETF. Canary Capital’s XRPC began trading on November 13, 2025, pulling in $26 million in volume within the first 30 minutes.

Our View (Julia Sakovich): The ETF launch is real now, not speculation. With $3.8B in whale accumulation and 11 more applications pending, institutional flows could finally justify those $4-5 price targets if adoption picks up.

Key Points on XRP:

- Why It Stands Out: First approved spot XRP ETF now trading, 300+ banking partnerships processing $1.3T in payments, regulatory clarity following SEC settlement.

- Ideal For: Retail intersecting with TradFi, and crypto spot ETF investors.

- Risks & Considerations: Policy reversals could impact adoption. Vulnerability to large holder sell-offs.

Community Sentiment: Reddit’s XRP community shifted from speculation to utility-focused discussions around RippleNet partnerships. The “XRP Army” views the $1B Evernorth treasury and ETF filings as institutional validation, though frustration lingers over price stagnation.

| Project | XRP |

| Price | XRP $1.35 24h volatility: 0.0% Market cap: $82.87 B Vol. 24h: $1.55 B |

| 24h Change | -0.05% |

| ATH | $3.84 |

| Market Cap | $135.45B |

4. Chainlink (LINK) – Decentralized Oracle Network Powering Cross-Chain Interoperability

Chainlink is a decentralized oracle network that connects smart contracts with real-world data, APIs, and traditional financial systems, serving as critical infrastructure for DeFi and enterprise blockchain applications. Trading at $8.64, LINK has a circulating supply of 708 million tokens (Snapshot from CoinGecko, February 11, 2026).

Chainlink expanded its Cross-Chain Interoperability Protocol (CCIP) and Data Streams to TON, connecting TON to over 60 blockchains. CCIP has processed $7.77 billion in total transfers and collected $1.43 million in fees, with volume growing 1,972% over the past year, states The LinkMarine.

Our View (Julia Sakovich): The whale moves tell you everything, $188M pulled from Binance since October, and the Reserve keeps adding tokens. LINK’s becoming the infrastructure play for institutional DeFi, and if it breaks above $16, the $20-27 range might start to look realistic.

Key Points on Chainlink:

- Why It Stands Out: Oracle network connecting 60+ blockchains, and enabled $20+ trillion in transaction value across the blockchain economy.

- Ideal For: DeFi protocols, enterprise blockchain projects, institutional finance, and cross-chain application developers.

- Risks & Considerations: Price declined 8% in late October despite positive fundamentals, competition from other Oracle solutions, and integration timeline uncertainties.

Community Sentiment: Reddit’s “LINK Marines” shifted focus from price speculation to infrastructure discussions. They focus on partnerships with SWIFT, Mastercard, and UBS. Social sentiment hit a three-year high despite price weakness, with users celebrating CCIP adoption and real-world asset tokenization over short-term gains.

| Project | Chainlink |

| Price | LINK $8.63 24h volatility: 0.7% Market cap: $6.11 B Vol. 24h: $233.33 M |

| 24h Change | -0.71% |

| ATH | $53.01 |

| Market Cap | $8.64B |

5. Ondo Finance (ONDO) – Leading Real-World Asset Tokenization Platform Bridging TradFi and DeFi

Ondo Finance is a decentralized platform specializing in tokenizing real-world assets, particularly U.S. Treasuries and institutional-grade financial products. Trading at $0.24, ONDO manages over $1.8 billion in tokenized assets.

In October 2025, Ondo Finance completed its acquisition of Oasis Pro, gaining SEC-registered broker-dealer, Alternative Trading System, and Transfer Agent licenses. This move enables the platform to operate compliant tokenized securities markets within the United States.

Our View (Julia Sakovich): Oasis Pro’s SEC licenses are impressive, but the supply explosion from 1.5B to 3.4B tokens explains why the price can’t gain traction despite solid fundamentals. I think that at ONDO $0.25 24h volatility: 1.0% Market cap: $1.20 B Vol. 24h: $36.88 M , fundamentals say buy, but tokenomics say wait.

Key Points on Ondo Finance:

- Why It Stands Out: Partnerships with BlackRock, Goldman Sachs, and Franklin Templeton, SEC-compliant infrastructure, and $1.74 billion in Total Value Locked.

- Ideal For: Institutional investors, DeFi users seeking yield-bearing assets, and investors interested in tokenized real-world assets.

- Risks & Considerations: Token price has declined significantly from the all-time high of $2.14, regulatory risks in tokenized securities, and competition from emerging RWA platforms.

Community Sentiment: Reddit shows split sentiment, believers praise RWA leadership and institutional partnerships, but frustrated holders point to the brutal 63% ATH decline and relentless token unlocks diluting value.

| Project | Ondo Finance |

| Price | ONDO $0.25 24h volatility: 1.0% Market cap: $1.20 B Vol. 24h: $36.88 M |

| 24h Change | -0.59% |

| ATH | $2.14 |

| Market Cap | $2.47B |

6. TRON (TRX) – High-Throughput Blockchain Dominating Global Stablecoin Transfers

TRON is a decentralized blockchain platform created for high-speed transactions and decentralized applications, using a Delegated Proof-of-Stake consensus mechanism. Trading at $0.28, TRX has a market cap of approximately $26 billion and a circulating supply of 94.7 billion tokens (Snapshot from CoinGecko, February 11, 2026).

In October 2025, TRON achieved record metrics with DEX volume surging 174% to $3.04 billion, 87.72 million active addresses, and 304 million transactions.

Our View (Julia Sakovich): The $78B USDT infrastructure is undeniable, 51% of global USDT volume runs on TRON. But the death cross pattern and 20% decline from highs signal technical weakness, plus heavy USDT reliance means limited growth beyond stablecoin transfers at TRX $0.29 24h volatility: 1.5% Market cap: $27.50 B Vol. 24h: $438.79 M .

Key Points on TRON:

- Why It Stands Out: Dominates stablecoin infrastructure with $78.58 billion USDT supply, processes 2,000 transactions per second.

- Ideal For: Stablecoin users, international remittance senders, DeFi participants, and investors seeking low-cost blockchain infrastructure.

- Risks & Considerations: Recent 20% price decline from yearly highs, formation of a death cross pattern, and heavy reliance on USDT transactions.

Community Sentiment: Community is split between those celebrating $78B USDT dominance and critics pointing to centralization concerns and Justin Sun controversies affecting credibility.

| Project | TRON |

| Price | TRX $0.29 24h volatility: 1.5% Market cap: $27.50 B Vol. 24h: $438.79 M |

| 24h Change | +1.29% |

| ATH | $0.44 |

| Market Cap | $25.03B |

7. Hyperliquid (HYPE) – High-Performance Layer 1 DEX with Institutional-Grade Trading Infrastructure

Hyperliquid is a large-cap, custom Layer 1 blockchain and ecosystem designed for decentralized perpetual trading, featuring sub-second finality via HyperBFT consensus. Trading at Coin data not available with a $12.7 billion market cap, HYPE gained massive attention following its November 2024 airdrop, distributing $1.6 billion to 94,000 users without VC allocation.

The platform offers derivatives DEX trading with $5.4 billion monthly volume according to DefiLlama (Snapshot from February 11, 2026), while offering on-chain perpetual futures and spot markets with no gas fees and up to 40x leverage.

Our View (Julia Sakovich): I think the $10.9B monthly volume and no-gas-fee trading are impressive, but the $12B token unlock over 24 months (starting November) creates massive sell pressure that buybacks can only offset by 17%. At HYPE $30.83 24h volatility: 2.5% Market cap: $7.35 B Vol. 24h: $131.60 M , fundamentals look strong, but tokenomics makes me cautious until 2027.

Key Points on Hyperliquid:

- Why It Stands Out: $750M+ TVL, no gas fees, Layer 1 blockchain with high volume, strong public presence.

- Ideal For: Derivatives traders, DeFi users seeking institutional-grade infrastructure.

- Risks & Considerations: Critics argue the platform lacks transparency and public validators.

Community Sentiment: X shows 51% bullish sentiment with #HYPEto100 trending, but critics raise serious decentralization concerns, initially only 4 validators (now 27), closed-source code, and transparency issues sparked a 15% dump in January when validator fairness questions emerged.

| Project | Hyperliquid |

| Price | HYPE $30.83 24h volatility: 2.5% Market cap: $7.35 B Vol. 24h: $131.60 M |

| 24h Change | Coin data not available |

| ATH | Coin data not available |

| Market Cap | Coin data not available |

8. Immutable (IMX) – Layer 2 NFT and Web3 Gaming Platform on Ethereum

Immutable is a Layer 2 scaling solution for NFTs and blockchain gaming, built on Ethereum, that utilizes zero-knowledge rollup technology to enable gas-free transactions and instant trades. Trading at $0.15, it has a circulating supply of nearly 834 million tokens (Snapshot from CoinGecko, February 11, 2026).

Immutable partnered with major studios, like Ubisoft and Netmarble, becoming a key infrastructure provider for AAA game developers entering Web3. The platform has onboarded 660+ games and continues to expand its zkEVM capabilities.

Our View (Julia Sakovich): The Ubisoft and Netmarble partnerships look solid, but Web3 gaming hasn’t proven mass-market traction yet; most projects remain in development. IMX needs actual game launches to justify valuations against Layer 2 competitors.

Key Points on Immutable:

- Why It Stands Out: First major gaming token with full circulating supply, zero gas fees for NFT minting and trading, and partnerships with major AAA studios.

- Ideal For: Web3 game developers, NFT creators and traders, blockchain gaming investors.

- Risks & Considerations: Token price declined over 32% in late 2024, and is facing competition from other Layer 2 solutions.

Community Sentiment: Community is cautiously optimistic, whales accumulated heavily at $0.15 lows, and exchange supply hit record lows (7.33%), signaling accumulation. But concerns focus on a 32% price decline in late 2024 and whether 680+ onboarded games will actually launch successful titles.

| Project | Immutable |

| Price | IMX $0.15 24h volatility: 1.8% Market cap: $128.88 M Vol. 24h: $7.70 M |

| 24h Change | -1.47% |

| ATH | $3.76 |

| Market Cap | $303.34M |

9. NEAR Protocol (NEAR) – Scalable Layer 1 Blockchain with Sharding Technology and Cross-Chain Capabilities

NEAR Protocol is a Layer 1 blockchain that uses Nightshade sharding technology to enable high transaction throughput and low fees for decentralized applications. Trading at $1.23, it has a circulating supply of 1.28 billion tokens (Snapshot from CoinGecko, February 11, 2026).

On October 31, 2025, NEAR completed its first-ever mainnet halving, reducing annual token inflation from 5% to 2.5%. This upgrade reduces new token emissions by approximately 60 million tokens annually, improving tokenomics sustainability.

Our View (Julia Sakovich): The halving mechanics make sense, cutting 60M tokens annually from emission should reduce sell pressure. But forcing it through after governance rejection raises red flags about centralization. At NEAR $1.23 24h volatility: 1.4% Market cap: $1.59 B Vol. 24h: $146.06 M , staking rewards dropped from 9% to 4.5%, which could hurt validator retention despite better tokenomics on paper.

Key Points on NEAR Protocol:

- Why It Stands Out: First major Layer 1 to complete inflation halving, processes over 8 million daily transactions with 80 TPS average.

- Ideal For: dApp developers seeking scalability, DeFi users, cross-chain traders, and investors interested in AI and Web3 infrastructure.

- Risks & Considerations: Governance controversy over halving implementation, reduced staking rewards may affect validator participation, and price volatility.

Community Sentiment: Community is divided, the halving proceeded despite the original governance vote failing (only 45% approval vs 66.7% threshold needed). Key validators like Chorus One criticized it as a “dangerous precedent” that eroded trust in NEAR’s decentralized governance.

| Project | NEAR Protocol |

| Price | NEAR $1.23 24h volatility: 1.4% Market cap: $1.59 B Vol. 24h: $146.06 M |

| 24h Change | +1.23% |

| ATH | $20.40 |

| Market Cap | $1.52B |

10. Arbitrum (ARB) – Leading Ethereum Layer 2 Token with Growing Development

Arbitrum at $0.096 has established itself as a leading Ethereum Layer 2 solution with around $2.25 billion in total value locked (TVL) (Snapshot from DefiLlama, February 11, 2026). According to L2beat, it is the largest Ethereum rollup by total value secured.

The protocol has 3.5 million monthly active users (MAU), after BASE, which has 6.2 million MAU, and opBNB with 14.6 million MAU, according to Token Terminal (Snapshot from February 11, 2026). Its optimistic rollup technology has proven reliable for both users and developers across over 950 deployed applications.

Our View (Julia Sakovich): Staking utility helps, but ARB doesn’t have that gas token advantage its competitors do. November’s unlock adds selling pressure, though, I think, breaking $0.50 could open the path to $1.

Key Points on Arbitrum:

- Why It Stands Out: Low fees, fast speeds, proven reliability, high MAU.

- Ideal For: DeFi users seeking low fees and investors interested in staking utility.

- Risks & Considerations: Arbitrum could become obsolete if BASE and other blockchains continue to grow.

Community Sentiment: Community shows cautiously optimistic, with developers praising Arbitrum’s reliability and $2.9B TVL, but frustration persists over weak price action despite strong fundamentals. Critics point to competition from BASE and zkSync, plus concerns about November’s token unlock adding sell pressure.

| Project | Arbitrum |

| Price | ARB $0.0956 24h volatility: 1.0% Market cap: $567.28 M Vol. 24h: $47.92 M |

| 24h Change | -0.42% |

| ATH | $2.40 |

| Market Cap | $963.63M |

11. Zcash (ZEC) – Privacy-Focused Cryptocurrency Experiencing Massive Institutional-Driven Rally

Zcash is a privacy-focused cryptocurrency that uses zero-knowledge proof technology (zk-SNARKs) to enable fully shielded transactions. ZEC has become one of October 2025’s top performers, trading at $207.31 after surging 560% from September lows and reaching a four-year high of $374.

Zcash broke its multi-year downtrend in October 2025, driven by Grayscale’s launch of the Zcash Trust for institutional investors and the successful deployment of the Zashi CrossPay platform. With over 4.91 million ZEC tokens now shielded (30% of supply), the network shows genuine privacy adoption.

Our View (Julia Sakovich): The halving and Grayscale Trust look solid, but RSI at 84 screams overbought. At ZEC $201.4 24h volatility: 1.1% Market cap: $3.34 B Vol. 24h: $215.18 M , with EU’s 2027 privacy coin crackdown looming, this, for me, feels like a momentum trade you flip, not a long-term hold.

Key Points on Zcash:

- Why It Stands Out: 560% monthly rally, institutional backing via Grayscale Trust, and upcoming November 2025 halving event.

- Ideal For: Privacy-conscious investors, institutional buyers seeking regulated exposure, and long-term holders betting on privacy tech.

- Risks & Considerations: EU MiCA regulations threaten to ban anonymous transactions by 2027, potentially reducing liquidity by 40%.

Community Sentiment: Community is split in half between privacy advocates celebrating Arthur Hayes’ endorsement and 30% shielded adoption versus skeptics warning of a speculative bubble driven by Satoshi rumors and retail FOMO.

| Project | Zcash |

| Price | ZEC $201.4 24h volatility: 1.1% Market cap: $3.34 B Vol. 24h: $215.18 M |

| 24h Change | -1.38% |

| ATH | $8,876.48 |

| Market Cap | $0.00 |

Tested by Editors: How These Projects Compare

Alfter we reviewed all projects side by side, a few patterns became obvious. Bitcoin, Solana, and XRP stand out as what we call “the macro picks”. They are driven less by niche use cases and more by regulation, ETF flows, and of course, institutional adoption.

Bitcoin remains the most stable option, but Solana clearly outperforms it in terms of speed and ecosystem growth. XRP sits somewhere in the middle. It has strong enterprise integration than SOL, but when we compare it to BTC, it has less price momentum.

Next we have Chainlink, Ondo Finance, and Hyperliquid, which cover a different category: infrastructure. Chainlink currently offers the most mature integrations and connects 60+ blockchains. This allows it to enable trillions in transaction value.

Ondo, on the other hand, beats everyone on regulatory readiness. It owes this to the Oasis Pro acquisition, but its token unlock schedule is quite a drawback.

Hyperliquid delivers unmatched trading speed, though there are some transparency concerns there.

Meanwhile, Immutable and NEAR focus on very specific verticals – gaming and Layer 1 design. Immutable has the strongest partnerships, but it lacks more real game launches at this point.

| Project | Primary Strength | Key Weakness | Ideal For |

| Bitcoin | Market stability; institutional demand | High volatility | Long-term holders |

| Solana | High TRS and strong DeFi growth | Meme coin reliance | Developers and traders |

| XRP | Banking integrations and ETF | Whale-driven risks | TradFi-leaning users |

| Chainlink | Cross-chain data and CCIP | Competition and price lags | DeFi infrastructure |

| Ondo Finance | Tokenized RWAs and SEC licenses | Heavy unlock dilution | RWA investors |

| TRON | Global USDT dominance | Centralization concerns | Stablecoin users |

| Hyperliquid | High-performance DEX | Validator transparency | Derivatives traders |

| Immutable | AAA gaming partnerships | Slow market adoption | Web3 game developers |

| NEAR | Sharding | Governance red flags | L1 builders |

| Arbitrum | Largest Ethereum L2 by TVL | Competition from BASE and other Layer 2s | Fast, competitive players |

| Zcash | 560% rally, privacy tech revival | EU MiCA regulatory threats to privacy coins in general | Stealthy, low-key players |

Overall, each project is successful in a different category. Still, the trade-offs become much clearer when placed next to each other.

Strong Contenders That Missed the List

Ethereum ETH $1 960 24h volatility: 0.2% Market cap: $236.20 B Vol. 24h: $15.62 B

The foundational smart contract blockchain that powers much of DeFi, stablecoins, and Web3 somehow missed our list. ETH remains the largest programmable network with massive developer activity. It has a huge network of dApps, ongoing upgrades, and deep developer activity.

We skipped this one because of some major drawbacks: persistent scalability limits, high gas fees and network congestion.

Polkadot DOT $1.47 24h volatility: 2.0% Market cap: $2.45 B Vol. 24h: $115.93 M

Polkadot is an ambitious multichain protocol that focuses on interoperability via parachains and cross-chain messaging. Its design promises a future of many specialized chains that would communicate seamlessly.

Still, it lands off our list because of its weaker real-world adoption so far. It has fewer active users and inflationary tokenomics that can dilute the value if there is a lag in the ecosystem growth.

Avalanche AVAX $8.94 24h volatility: 0.3% Market cap: $3.86 B Vol. 24h: $169.35 M

Avalanche is a Layer 1 alternative with low fees, EVM-compatibility, and fast throughput. It’s also a solid candidate in infrastructure if you expect growth in DeFi and blockchain-based apps.

We left this one off the main list because of network complexity and some concerns about governance transparency.

Best Crypto to Buy by Market Segment

Not every crypto investor has the same goals. Some prioritize long-term stability, while others chase outsized returns from early-stage projects.

One strategy is to allocate a portion of capital towards early-stage projects and a portion to larger-cap projects. Other investment strategies may focus entirely on larger projects (a lower risk/reward strategy, but still comes with inherent considerations) or solely on early-stage opportunities (a very high risk/reward strategy).

Below is a comparison of the differences and implications of buying established cryptocurrencies vs early-stage projects, depending on your investment strategy and risk appetite.

| Metric | Established | Early-Stage |

| Liquidity | Deep, stable, tight spreads | Low / medium, higher slippage, large sells affect the price |

| Volatility | Low – Medium, prices may spike or drop, but are more likely to recover over time. | High, prices can rise or drop dramatically and may not recover |

| Catalysts | Institutional adoption, macroeconomic trends, regulatory clarity | Product launches, exchange listings, viral marketing |

| Risk Profile | Relatively lower risk, higher stability | High risk, potential for total loss |

| Development Pace | Slow, methodical, with extensive testing and governance | Rapid, experimental, focused on quick iterations |

| Best For | Long-term holders, investors seeking portfolio anchors | Risk-tolerant speculators, those seeking outsized gains |

Regardless of your investment style, it’s essential to consider all the risks. Always avoid investing more than you can afford to lose, and keep in mind these important principles.

How to Pick the Best Crypto to Buy Right Now – Our Methodology

Our editorial team invested 300+ hours in Q4 2025 researching and analyzing cryptocurrencies in every market cap tier, from $50M micro-caps to Bitcoin’s $2T+ dominance. We evaluated over 150 tokens to identify which ones actually deserve your attention right now.

What We Look For

We built a multi-factor evaluation system that weighs what actually moves prices and what protects your downside. Here’s what matters:

Market Fundamentals

We check how easy it is to buy and sell without moving the price. That means looking at order book depth, trading volume across multiple exchanges (not just one), and whether the market cap makes sense compared to similar projects.

Healthy volume distribution across reputable exchanges. Solana shows trading spread across Binance (8.9%), Coinbase (3.58%), and 8+ other major platforms, not concentrated on one exchange. Source: CoinGecko

Data comes from CoinGecko, Token Terminal, and DefiLlama. We cross-reference everything. If a token shows $10M daily volume but it’s all on one sketchy exchange, that’s a red flag.

Catalysts & Momentum

This is where the money gets made. We identify what could push prices higher in the next 3-6 months: upcoming network upgrades, ETF approval odds, institutional money flows (like treasury allocations), regulatory wins, and major partnerships.

We track analyst predictions from Bloomberg and well-known crypto researchers, but we don’t just repeat them, we verify the underlying catalysts ourselves.

Utility & Tokenomics

A token needs to do something real. We look at actual usage: daily active addresses, transaction counts, Total Value Locked (for DeFi), and whether people are actually using the network or just speculating.

Then we dig into the tokenomics. How many tokens unlock next quarter? What’s the inflation rate? Are staking rewards sustainable, or are they just paying early buyers with new buyer money? Token unlock schedules can crush prices overnight, we track them obsessively.

Technology & Security

We check if the tech actually works. That means network performance (transactions per second, uptime, how fast transactions finalize), audit history, whether the code is being actively developed (GitHub commit activity), and how decentralized it really is. For the early-stage projects, we evaluate whether the team can actually execute, looking at testnet performance, previous project history, and whether they’re hitting milestones or making excuses.

Decentralization metrics matter: How many validators control the network? Is there client diversity, or does everyone run the same software? One bug shouldn’t take down the whole chain.

Risk Assessment

Every investment can go to zero. We flag the specific risks: Is the project too centralized? Does the team hold 40% of tokens? Are regulators circling? Has the roadmap been delayed three times already?

We also track red-flag events in real-time. If there’s an exploit, a major exchange delisting, or a governance meltdown, we update our analysis immediately, not next month.

How We Weight Different Crypto Types

Not all cryptocurrencies should be judged the same way. A $100B Layer 1 like Solana faces different questions than a $500M gaming token.

Established Assets (>$5B market cap)

For the big names, Bitcoin, Ethereum, Solana, XRP, we weight institutional adoption more heavily. Can pension funds buy it? Is there an ETF? How deep is the liquidity?

We also emphasize network maturity: uptime track record, how well past upgrades went, and whether the validator set is truly decentralized. These projects have less room for explosive growth, but they shouldn’t blow up overnight either.

Early-Stage Assets (<$5B market cap)

For smaller projects, we focus on growth catalysts and execution. Is the roadmap realistic? Are they hitting milestones? What’s the total addressable market if everything goes right?

We also look at community momentum: Are developers building on it? Is social media buzz translating into actual usage? Token unlocks and insider holdings matter more here because early investors can dump on retail.

Tokenomics matter most for early-stage projects. In this case, there’s often little valuable past price data to analyze, so we dig deep into token distribution and unlock schedules. A project might look promising, but if 40% of supply unlocks next quarter while the team holds another 30%, that’s massive sell pressure waiting to happen.

We’ve seen tokens drop 60-80% on major unlocks even with strong fundamentals. That’s why we track vesting schedules, insider concentration, and emission rates as closely as we track roadmap execution. Unbalanced tokenomics can erase gains overnight.

Our Data Sources

We don’t rely on any single provider. Here’s what we use:

- Price & Market Data: CoinGecko, CoinMarketCap

- On-Chain Metrics: DefiLlama, Token Terminal, Etherscan, Solscan

- Development Activity: GitHub repositories, release notes

- Analyst Research: Bloomberg crypto analysts, institutional reports

- Project Documentation: Whitepapers, roadmaps, governance forums, SEC filings (when applicable)

Best Crypto to Buy in March 2026 – Market Snapshot

As of March 2026, the crypto market is experiencing a crypto winter, with the total market cap hovering $2.5–$2.6 trillion. Bitcoin is trading around $75,000-78,000, down roughly 40% from its October 2025 all-time high. Ethereum has dropped over 50% from its peak, currently around $2,200–$2,300.

Institutional Flows into Bitcoin, Ethereum, and Solana

The market hit a critical inflection point. After record ETF outflows totaling $4.57 billion in November-December 2025 and continued weakness in January, Bitcoin ETFs saw a reversal on February 2 with $562 million in inflows led by Fidelity ($153M) and BlackRock ($142M). However, Ethereum ETFs continue bleeding capital with $2.86 million in outflows.

Solana ETFs attracted modest inflows of $5.58 million, while XRP ETFs saw small outflows. This divergence shows institutional investors are getting selective, favoring established assets with clear utility over speculative plays.

What Analysts Are Saying About This Downturn

Bitwise CIO Matt Hougan argues the market has been in a “full-bore crypto winter” since January 2025, masked by ETF inflows. He compares it to the 2018 and 2022 bear markets. But here’s the good news: crypto winters historically last about 13 months, which means a potential March–April reversal.

Bernstein analysts see Bitcoin bottoming in the $60,000 range before establishing a higher base for what they call the “most consequential cycle” for Bitcoin. They point to institutional resilience, Strategy continues buying despite losses, miners have diversified into AI data centers, and corporate treasuries keep accumulating.

Is This a Buying Opportunity?

The $75,000 level represents critical support for Bitcoin. If it holds, we’re likely in a re-accumulation phase where institutions buy from weak hands. A break below $60,000 would signal a confirmed bear market with potential downside to $48,000.

Early February showed signs of stabilization, institutional flows turned positive, sentiment hit “extreme fear” (index at 18), and major analysts see this as capitulation, not collapse.

If you believe in crypto long-term and have capital you won’t need for 12–24 months, prices in the $70,000-80,000 range for Bitcoin look better than $125,000. But calling it “the” buying opportunity implies we know the bottom, and the truth is, we don’t. It could easily drop to $60,000 or lower before recovering.

Portfolio Strategies and Entry Points

Now, let’s jump into the real talk. If you are a long-term investor:

- BTC: 40–50%. This is still the center of the crypto universe.

- ETH: 15–25%. The strongest alternative with real utility, but it is facing heavier selling pressure than Bitcoin right now.

- Quality large-caps: 20–30%. Examples are SOL, XRP, LINK, and HYPE, assets with institutional backing or clear use cases.

- Speculative/smaller caps: 5–10%. You should invest only if you can stomach 60–80% drawdowns, which many early-stage tokens are currently experiencing.

How to Build a Balanced Crypto Portfolio

A key question many new investors in the crypto world have is, “Why should I buy established cryptocurrencies when they have less growth potential than other coins?” Or, what is the advantage of a portfolio balanced between early-stage opportunities? The answer lies in managing risk and stability and optimising for overall wealth growth, regardless of market conditions or specific project occurrences.

The Foundation – Established Anchors

Established assets are the stable core of a diversified portfolio. They tend to have less volatile and have a proven track record.

Stability and Proven Performance

Bitcoin, for example, is the only cryptocurrency that has always reached new all-time highs in every bull run. Large caps have deep liquidity, which adds to price stability, and often have large teams of developers, ecosystem grants, and foundations to ensure continued technical success and marketing partnerships.

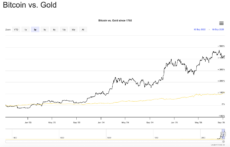

Many analysts, such as @Innerdevcrypto on X, Marion Laboure, from Deutsche Bank Research, and Kraken’s Dan Held, believe that within the next 10 years, BTC will reach at least a 10x from here, giving it a market cap roughly equal to or even significantly above physical gold.

Gold and Bitcoin price correlation over a 3-year period. Source: LongtermTrends

Institutional Adoption

Bitcoin, Ethereum, and Solana all have ETFs, which enable mainstream adoption and investment from TradFi institutions like hedge fund managers, banks, and company treasuries. These ETFs have been a dominating force in the growth of large caps like BTC, ETH, and SOL.

More ETFs are (likely) on the way for well-established large caps such as XRP, Dogecoin, Cardano, Litecoin, and Hedera. Although not guaranteed, Bloomberg analysts predict an SEC approval rating of over 90% in 2025 for these coins and more.

Bloomberg analyst James Seyffart is tweeting odds for large-cap ETF approvals. Source: X

Positioning in a Portfolio

Ultimately, the percentage of large caps to early-stage cryptos is dependent on every investor’s strategy and risk appetite. However, a balanced approach could include 60%–80% of an investment portfolio allocated to large caps.

The Opportunity – Early-Stage Plays

Early-stage plays include new or relatively undiscovered cryptocurrencies and presales / ICOs.

Huge Growth Potential

New currencies tend to have a low market capitalization, from micro caps to small caps. This means that a relatively small amount of capital can move the price significantly, leading to potential gains of 10x – 1000x and more.

For example, from 2017 to 2026, Bitcoin (which at that time was worth $998) has grown by 114,000%. This is an exceptional case, as the first-ever crypto. But a recent example of an early-stage coin that launched from Binance Alpha as an ICO is MYX Finance. The token is up by 36,685% since May 2025, with most of the growth occurring in September 2025.

There are very few stocks that have delivered such gains over such a short period.

Community and Innovation

Cryptocurrencies are the gateway to web3, the decentralized internet. They provide investment returns as well as access to new ways of interacting with people and technology around the world.

For example, decentralized utilities provided by a token can spur new ways of thinking or financial and social relationships that were previously impossible. These interactions can create value for individual investors but can also be worthwhile regardless of their profit-making potential.

Investors may enter the cryptocurrency market in search of gains, but many remain invested even during downturns because of the utilities their tokens provide.

Balanced Portfolio Allocation for Growth

How to allocate early-stage and presale cryptos into a portfolio depends on risk appetite. Investors must take into account that early-stage coins are best suited as speculative positions.

For most investors who want to know the best crypto to buy for a balanced portfolio, early-stage coins should amount to a smaller percentage of the overall holdings. This allows investors to seek asymmetric returns without exposing their entire portfolio to significant risk.

While famous investor Warren Buffett was not a fan of cryptocurrencies, his approach to risk and growth involved buying undervalued businesses with long-term potential, investing in an S&P 500 index fund for the long term, and allocating 10% to short-term bonds to reduce portfolio volatility.

| Risk Category | Established Assets | Early-Stage Assets |

| Primary Threats | Macroeconomic shifts, regulatory changes, network failures | Scams, flawed tokenomics, execution failures |

| Market Volatility | High, but with relative stability compared to early-stage plays | Very high, with extreme price swings |

| Security Risk | Primarily external (e.g., exchange hacks, wallet security) | Includes external threats plus internal project-level vulnerabilities |

| Potential for Total Loss | Lower, though still possible in extreme conditions | High due to unproven technology and business model |

Where to Find the Top Crypto to Buy

Another important part of investing in both established and early-stage cryptocurrencies is developing new ideas for the best crypto to invest in now. This guide serves as an important starting point, but investors can expand their portfolios to include more than just the cryptocurrencies we have covered.

So, where can investors find ideas? We’ll cover four broad categories of sources to explore.

Social Media

Social media channels like X and Reddit are frequented by crypto investors, traders, and analysts. These platforms can be excellent for monitoring crypto news, gaining insights into market movements, or discovering the latest new and early-stage cryptocurrencies.

Investors can directly communicate with one another on social media about cryptos to buy. In addition, almost all major crypto projects – and most new projects – have a presence on social media. So, checking social media can be a good way to evaluate established and new tokens, find out what they’re all about, and assess how much community support they have.

Crypto Analysts and Influencers

Crypto analysts and influencers can be very good sources of information about the best crypto coins to buy in any market condition. They spend their days searching for exciting new tokens and analyzing factors that could be bullish or bearish surrounding existing coins.

In many cases, analysts and influencers are public with their analysis. They share price predictions and technical analysis on social media, on YouTube, or through their channels. Finding analysts who have an investment style that matches your own and following their latest insights can be a great way to generate ideas for cryptocurrencies to invest in.

However, discernment is needed to identify genuine experts from less experienced or less authoritative sources.

Crypto News Platforms

Following crypto market news is another key way investors can stay informed about the market and identify tokens to buy. Market news may highlight tokens that are pulling back or new crypto projects, for example, creating buying opportunities. Or outlets might cover new developments that make an existing large cap project more valuable.

Investors should check multiple news platforms to ensure they never miss a big story. It’s also possible to set up news alerts for specific tokens, which can be great for investors looking for an entry point into one of the best cryptocurrencies to invest in.

Exchange and Presale Aggregators

Investors can also monitor token prices, news, new launches, and more on crypto exchanges and presale aggregators like DEXTools. These exchanges and aggregators serve as hubs for the crypto market, and they typically display information about trending tokens to help investors see what’s hot.

DEXtools interface. Source: DEXtools

Investors can also use these sites to conduct basic analysis, such as comparing tokens to other cryptos in the same market sector or performing basic technical analysis. While exchanges and aggregators don’t replace dedicated research tools, they can be a starting point for finding the best cryptocurrencies to buy.

Potential Risks of Investing in Crypto

Although investing in crypto has the potential to yield strong returns, this market also involves risks that investors need to be aware of.

Risks of Investing in Established Cryptocurrencies

Large market capitalization cryptocurrencies have a different set of risks than early-stage investments.

Macro Risks

All of crypto, particularly large caps, are affected by macroeconomic conditions, such as black swan events (the 2008 financial crisis) or stronger-than-expected economic data from the Fed, which leads to interest rate hikes. Even large-cap crypto like Bitcoin are considered risky assets, so institutional investors may reduce their positions in times of uncertainty.

Regulatory Concerns

Positive US regulations have played a significant role in the current bull run and price appreciation of established cryptocurrencies like Bitcoin and Solana. This is because of the ease of investment from TradFi and clarity from the SEC around what is legal.

However, if the US government were to dramatically change its stance on crypto regulations, this could result in a sharp drawdown of large caps as traditional finance investors liquidate their positions.

Network Outages

As crypto becomes more mainstream, it will be held to a higher standard of scrutiny. Network outages. like those experienced by Solana in its early stages, could be catastrophic for the price of the underlying asset, as investors lose trust in the technology.

Risks of Investing in Early-Stage Cryptocurrencies

Small caps and early-stage cryptocurrencies are also affected by macro and regulatory changes, but can still perform exceptionally well in times of broader financial uncertainty. However, they face a unique set of challenges.

Scams and Security Threats

While there are thousands of legitimate tokens and web3 services in the crypto market, this environment is also rife with scams seeking to take advantage of unsuspecting investors.

It’s very important to do your own research about new projects, make sure you only click on trusted links, and always do your research before making a transaction. Even well-intentioned new projects may encounter hacks and rug pulls, often without the resources or will to refund investors.

Without a proven track record or battle-tested smart contracts, the risks of scams and security threats are higher for early-stage projects.

High Volatility

Early-stage cryptocurrencies are notoriously volatile, meaning they can undergo large price swings in very short periods. This volatility can be great for investors when the net direction of a price movement is up. However, high volatility can also work against investors, as token prices can fall rapidly.

Low liquidity and a small number of holders mean that in the worst-case scenario, investors may not be able to cash out of their positions at all, or do so at an enormous loss.

Execution Risk

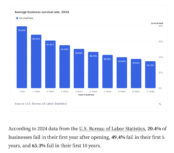

Many early-stage projects and presales involve the execution of a good idea. Just as 20% of regular US businesses fail within the first year of business, new blockchain projects also have a high rate of failure due to poor execution or unexpected hurdles and challenges.

Business survival rates in the US. Source: Commerce Institute

Presales and early-stage businesses may promise more than they can realistically deliver, or may fail to receive adequate funding to continue past the early stages.

Risk Management for Both Established and New Projects

There is no way to eliminate the potential risk of losses. However, investors can use a balanced portfolio, due diligence, careful monitoring of volatile investments, and stop-loss orders to limit the amount of money they lose on any single position.

It’s also important for investors to be mindful of the risk and only invest with money they are willing to lose.

Things to Consider Before Buying Crypto

Before buying crypto, investors should ensure they’re fully prepared and set up for success. Here are a few things to consider.

Set a Budget

Setting a budget for how much you plan to invest is a good way to manage your risk. Only invest money you can afford to lose – never invest money you need to pay for essential expenses.

A good rule of thumb is to start out investing a small percentage of your portfolio in crypto. Once you’re comfortable investing 1% or 5% of your total portfolio, you can consider whether a larger investment makes sense for your goals.

Identify Your Risk Tolerance – Established vs Early Stage Projects

Cryptocurrency is a high-risk investment compared to stocks, bonds, and other traditional investments. Token prices are highly volatile, and there are risks related to wallet security that don’t exist for other investments.

That said, there’s also a wide range of risk profiles for different cryptocurrency tokens. It’s up to you to decide whether you want to invest in high-risk, high-reward tokens like presale coins or whether a more conservative mega-cap crypto makes more sense for your portfolio. To make this decision, think about how much you plan to invest and how you would feel if your entire investment were lost.

Define Your Crypto Investing Goals

Your cryptocurrency investing goals should align with your risk tolerance and broader investment objectives. For example, is your aim to generate long-term profits from holding large-cap tokens or short-term profits from investing in early-stage projects? Are you trying to generate passive income from staking?

Defining your goals can help you identify what types of cryptos to invest in and how to diversify your portfolio across different coins.

Crypto Trends Driving the Top Coins to Invest in 2026

The crypto landscape is constantly shifting, and 2026 is already shaping up to be a big year. Here are the key trends influencing prices and investor decisions.

Regulatory Clarity Is Strenghtening

The Trump administration has launched “Project Crypto”, a commission-wide initiative to modernize securities rules and regulations to enable America’s financial markets to move on-chain. SEC Chair Paul Atkins has made developing a “rational regulatory framework” for crypto asset markets his key priority, establishing clear rules for issuance, custody, and trading.

One of the biggest stories entering 2026 is that regulators are moving toward clearer rules. The idea is to make it easier for institutional investors to participate. In the United States, the SEC has taken a more structured approach to crypto oversight. This is a massive shift from the previous administration’s enforcement-heavy approach, with the SEC rescinding restrictive rules like Staff Accounting Bulletin 121 and issuing guidance that most meme coins aren’t securities. In addition, Trump himself is involved in several crypto projects, which could mean a greater role for the White House in advertising crypto as an emerging industry.

Official White House fact sheet on President Donald J. Trump signing the GENIUS Act into law. Source: The White House

Stablecoins are also better defined now. The GENIUS Act has influenced banks and regulated entities to back stablecoins fully with U.S dollars or Treasuries.

Institutional Bitcoin and Ethereum Adoption

Bitcoin and Ethereum remain the backbone of the market, and institutional demand is a game changer. ETFs and regulated crypto funds are bringing long-term holders with deep pockets into the ecosystem.

For instance, BTC ETF flows reached record levels in late 2025. This level of institutional accumulation is reducing traditional boom-bust cycles, creating a more stable pattern in the top coins.

Altcoin Rotation and Early-Stage Infrastructure

Bitcoin’s dominance is hovering around 55-58% and money is rotating into promising altcoins. Large-cap Layer 1 blockchains like Solana and Arbitrum are capturing more and more attention from developers, not to mention institutions.

Early-stage presales and infrastructure projects, particularly those that enable real-world asset tokenization or AI/DeFi integration, are drawing a lot of attention. Still, while these tokens offer high potential for growth, they remain extremely volatile.

Meme Coins and Community-Driven Assets

Meme coins continue to be a niche trend. They often move independently of traditional market fundamentals. Recent spikes in XRP and Shiba Inu trading volume suggest that strong community support can temporarily drive price momentum.

These coins are highly speculative. Their long-term value doesn’t depend on fundamentals, but on community engagement and broad market sentiment. If you decide to invest in them, treat them as high-risk, small-allocation plays.

Decentralized AI and Web3 Integration

AI-powered crypto projects have seen rapid adoption. The AI crypto sector has surpassed $30 billion in market capitalization. Platforms like Fetch.ai and Ocean Protocol are creating decentralized AI applications already.

How to Buy Crypto

Ready to start building your crypto portfolio? We’ll walk you through the steps to buy the most promising crypto on the market today.

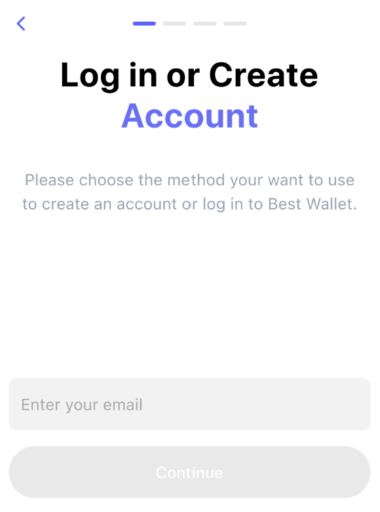

Step 1: Create a Wallet or Exchange Account

To get started, you’ll need either a crypto wallet like Best Wallet or an account at a crypto exchange like Binance or Coinbase. We recommend using Best Wallet because it gives you full control over your crypto tokens and offers access to a wider range of coins than many exchanges. You can also sign up for Best Wallet with just an email address, whereas exchanges require you to go through Know Your Customer checks.

Best Wallet App. Source: Best Wallet

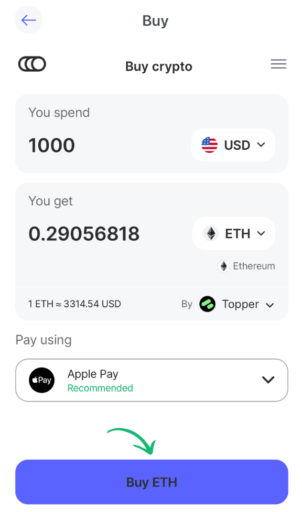

Step 2: Choose Your Payment Method

On Best Wallet, you’ll choose your payment method and make a payment instantly as part of the crypto buying process. You can pay with a credit or debit card, PayPal, bank transfer, Neteller, or Skrill.

Best Wallet App. Source: Best Wallet

At an exchange, you’ll need to deposit funds before purchasing. Payment methods vary, but most exchanges accept bank transfers, and some accept e-wallets.

Step 3: Choose Your Cryptocurrency

Select the cryptocurrency you wish to buy and enter the amount to purchase. With Best Wallet, you can convert directly from dollars to thousands of cryptocurrencies. On many exchanges, you have to first buy Tether (USDT) and then swap that for the cryptocurrency you want.

Best Wallet App. Source: Best Wallet

Step 4: Confirm Your Order

Once your order is ready, click or tap Buy to complete the transaction. Your purchased tokens will appear in your crypto wallet or exchange account immediately.

Best Wallet App. Source: Best Wallet

When to Sell Crypto

Once you buy one of the top cryptocurrencies, you can hold it for any amount of time and then sell it whenever you want. You can sell your crypto through the same wallet app or exchange you used to buy crypto in the previous steps.

It’s important to think about your investment time frame when selling. Some investors look to hold tokens for years and don’t worry about day-to-day pullbacks. Others take a more active approach, buying and selling the same token repeatedly to try to maximize profits.

To turn a profit, you need to sell tokens at a higher price than you bought them for – and the price difference needs to be enough to offset any transaction fees you paid along the way. If you sell tokens at a price lower than you bought them for, you’ll lose money on your investment.

That said, it doesn’t always make sense to hold tokens until they turn a profit. Some never will. It’s better to sell cryptocurrencies that aren’t living up to your expectations and put the money into a different token than to ride a coin down and lose your entire investment.

Is Cryptocurrency Investment Legal?

Before investing, understand your local laws and regulations, as legal status affects your ability to buy, hold, trade, and use crypto assets.

United States

Cryptocurrency investment is legal in the U.S. Bitcoin is regulated by the CFTC as a commodity, while other cryptocurrencies may be regulated by the SEC as securities. In 2025, President Trump signed the GENIUS Act, establishing federal standards for stablecoins.

United Kingdom

Cryptocurrency investment is legal under a new 2025 regulatory framework. Firms must be FCA-authorized, and retail access to crypto exchange-traded notes was expanded in August 2025.

Europe

The MiCA regulation is fully in effect, making cryptocurrency investment legal but highly regulated. CASPs must obtain licenses to operate across EU member states.

Asia

Asia has mixed regulations, with dramatic differences between countries.

- China has imposed a complete ban on cryptocurrency trading, mining, and all crypto-related activities since 2021.

- Japan recognizes cryptocurrency as a type of money and legal property. Transactions are managed by the Financial Services Agency.

- Taiwan announced dedicated VASP legislation in March 2025, focusing on minimum capital thresholds and enhanced consumer protection.

Cryptocurrency Tax Regulations

Tax laws vary across regions and jurisdictions. Below, we discuss the tax regulations in major markets worldwide.

United States

The IRS treats cryptocurrency as property. Short-term gains (held ≤1 year) are taxed as ordinary income at 10-37%, while long-term gains (held >1 year) qualify for capital gains rates of 0-20%. Starting January 2025, brokers must report digital asset sales via Form 1099-DA.

Europe

Most EU countries impose capital gains tax on crypto sales through the DAC8 directive:

- France imposes 30% on gains

- Germany has tax-free if held for more than 1 year

- Malta has long-term gains exempt from capital gains tax

Asia

Asia has big differences in crypto tax policies across various countries:

- Japan has progressive rates up to 55% on gains

- Singapore has no capital gains tax for individuals

- China has a complete ban on cryptocurrency use

- India applies a flat 30% tax rate with 1% TDS on all transactions

Conclusion

Cryptocurrencies remain one of the most potentially rewarding investment classes today. They can outperform traditional assets like stocks and bonds, but this growth potential comes with risks. Starting from market volatility and going to regulatory shifts, crypto is generally risky. This is why it’s important to build a well-balanced portfolio, preferably one that combines core, established coins like Bitcoin and Ethereum, with promising altcoins like Solana and Arbitrum, and selectively include early-stage opportunities like Ondo Finance.

While success in crypto may seem like it’s all about chasing the next big token, it’s much more crucial to understand trends, monitor market conditions, and make informed decisions based on it all.

FAQ

What is the best crypto to buy right now?

How do I find the best cryptocurrency to buy?

Can you get rich from crypto?

Is it safe to buy crypto?

Which coin will be the next Bitcoin?

References

- Price Charts – CoinGecko

- Top Cryptocurrencies – Forbes

- Trending Crypto – CoinMarketCap

- US’s Stand on Crypto – Guardian

- Forward Industries Stock Doubles as Firm Pivots to Being Solana Treasury – Investopedia

- Blockchains (L2) – Token Terminal

- Gold and Bitcoin Optimal Portfolio Research and Analysis Based on Machine-Learning Methods – MDPI

- What Was the Subprime Mortgage Crisis? – Investopedia

- Bitcoin Price: BTC Live Price Chart, Market Cap & News Today – CoinGecko

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

The team behind IPO Genie has not yet announced an end date for the presale.

Fact-Checked by:

Fact-Checked by:

Otar Topuria

Crypto Editor, 40 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.