Crypto theft is more common than most traders think, and it rarely takes a sophisticated hack. A forgotten token approval, a poorl...

Bitcoin Hyper (HYPER) is a presale Layer 2 token powered by Solana VM, which aims to scale Bitcoin’s ecosystem. This guide explores its 2026–2030 price forecast and investor outlook.

Built to address Bitcoin’s transaction throughput and programmability limitations, the HYPER token wants to bridge the performance gap between Bitcoin and emerging DeFi protocols.

While this long-term Bitcoin Hyper price prediction is speculative by nature, it’s grounded in a data-driven analysis of the project’s tokenomics, roadmap milestones, and comparable meme coins and AI-infused tokens like PEPE and AI16Z.

With a current presale price of $0.01367670, Bitcoin Hyper enters the market with a low-cost entry point, and has already caught the attention of early investors.

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

Bitcoin Hyper Price Forecast (2026–2030)

| Year | Low | Average | High |

| 2026 | $0.03 | $0.12 | $0.35 |

| 2028 | $0.05 | $0.20 | $0.50 |

| 2030 | $0.08 | $0.30 | $0.75 |

Bitcoin Hyper Price Forecast – The Next Five Years

Bitcoin Hyper sits right on the edge between meme hype and actual utility. While it leans heavily on the Bitcoin name, it’s trying to justify that attention with things like staking and bridges.

This makes predicting HYPER’s price tricky. In the short term, it will behave like most crypto launches: driven by sentiment, listings, and of course, timing. Longer term, the question becomes simpler: will people actually use it?

Bitcoin Hyper Price Prediction 2026

The year 2026 marks the end of the honeymoon period for Bitcoin Hyper. At this point, people won’t be buying HYPER just because it is new. They’ll be buying it (or not) because it is being used. Are people staking? Is the bridge seeing real activity? Are there new exchange listings that bring in fresh liquidity?

This is also the point where the wider market really matters. When crypto sentiment turns risk-on, money flows into smaller, higher-beta tokens fast. When it turns cautious, those same tokens can bleed just as quickly.

If Bitcoin stays strong and HYPER shows even modest real usage, we should see it trading around $0.12 on average in 2026, with upside spikes toward $0.35 if the market gets overheated, again.

Bitcoin Hyper Price Prediction 2028

Looking out to 2028, things calm down, for better or worse. Projects that are still around by this point usually aren’t mooning every other week. Instead, they either fade into irrelevance or quietly build a stable user base.

For Bitcoin Hyper, this phase depends almost entirely on whether it has carved out a niche within the Bitcoin ecosystem or not. If it has, price moves become slower (and more deliberate). If not, interest gradually drifts elsewhere.

If we assume steady but unspectacular growth, we can see HYPER trading in a $0.05 to $0.50 range, with an average closer to $0.20.

Bitcoin Hyper Price Prediction 2030

By 2030, speculation alone won’t carry the token. At this point, value comes from usage. We are talking about active wallets, integrations, and reasons for people to actually hold the token beyond flipping it.

If Bitcoin Hyper manages to stay relevant through staking, DeFi, or other Bitcoin-adjacent use cases, the demand could still be there.

In a strong long-term scenario, where Bitcoin expands globally and Layer 2 solutions become standard, HYPER could push toward $0.75, with an average price around $0.30. Still, this is a big “if”, even though it is not impossible.

Bitcoin Hyper Price Overview Table

| Category | Value |

| Current Price | $0.01367670 |

| Forecasted High | $0.1 – $0.5 (based on comps and speculative upside) |

| Circulating Supply | TBD (to be finalized post-launch) |

| Total Supply | 1,000,000,000 HYPER |

| Blockchain | Bitcoin Layer 2 (custom scaling protocol for BTC interoperability) |

| Key Catalysts | Layer 2 narrative, DeFi integrations, meme virality, AI narrative |

| Risks | Early-stage volatility, an unproven dev team, and market saturation in meme coins |

| Key Outlook | High-risk, high-reward token with potential to mirror early PEPE/Ai16Z moves |

| Time to Next Price Increase | Loading...

|

What Is Bitcoin Hyper (HYPER)?

Bitcoin Hyper (HYPER) is a presale-stage cryptocurrency that aims to supercharge Bitcoin’s scalability and utility through a high-speed infrastructure powered by the Solana Virtual Machine (SVM).

As a Bitcoin Layer 2 solution, the project uses Solana’s high-speed architecture to solve Bitcoin’s limits on transaction speed and smart contracts, while staying true to the Bitcoin values of decentralization, financial sovereignty, and trustless systems.

Bitcoin Hyper home page. Source: Bitcoin Hyper

The HYPER token is designed with a multifunctional utility model that supports staking, governance, and DeFi applications. Holders can stake their tokens to earn yield, participate in decentralized decision-making, and access emerging financial tools built on top of the Bitcoin Hyper ecosystem.

The project roadmap follows a phased approach:

- Phase 1: The presale phase is currently live with a token price of $0.01367670.

- Phase 2: The token launch and initial exchange listings are planned shortly after the presale concludes.

- Phase 3: Deployment of staking infrastructure will enable early holders to generate passive income.

- Phase 4: The final stage involves expansion into DeFi integrations, with tools for swaps, lending, and cross-chain functionality.

The combination of Solana’s speed with Bitcoin’s global trust layer might be interesting to investors seeking exposure to the next wave of high-performance, Bitcoin-linked crypto assets.

Why Are Investors Watching Bitcoin Hyper?

Bitcoin Hyper is gaining traction in the crypto community by combining three high-conviction narratives: meme coin virality, Layer 2 scalability, and early-stage access. This puts HYPER at the intersection of speculation and utility, a formula that has propelled tokens like AI16Z, Dogeverse, and MIND to early breakout success.

With these factors in mind, analysts and traders believe that HYPER could be one of the next meme coins to explode in 2026.

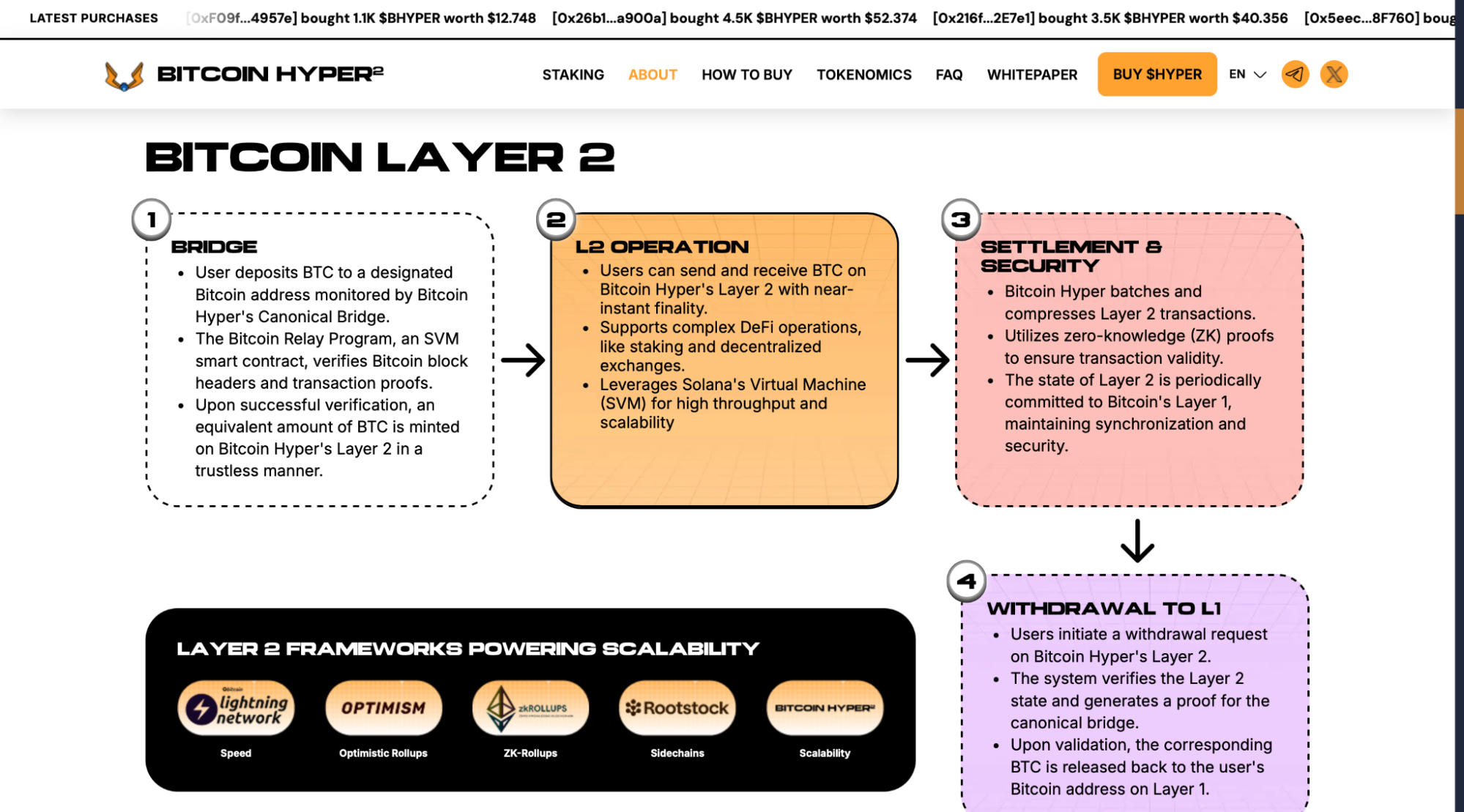

Bitcoin Hyper functionalities, inclduing bridging, L2 operation, settlement and security, and withdrawal to L1. Source: Bitcoin Hyper

What sets Bitcoin Hyper apart is its use of the Solana Virtual Machine (SVM) to enhance Bitcoin’s speed and smart contract capabilities, something most meme coins lack. At the same time, the project doesn’t shy away from the meme appeal, embracing bold branding and community-first engagement strategies that mirror the viral success of the Dogeverse and early PEPE.

From a traction standpoint, Bitcoin Hyper is already showing momentum. Its Telegram group has surpassed 18,000 members, and X (formerly Twitter) engagement is steadily climbing, with thousands of interactions on presale and roadmap-related posts.

Bitcoin Hyper offers multiple hooks for investor interest, like AI16Z, which capitalized on AI + meme narratives, or MIND, which leveraged themes of AI self-evolution and staking utility. But HYPER also backs its brand with technical ambition and a Layer 2 roadmap, giving it the potential to stand out in an increasingly crowded space.

Price Increases in

What Could Drive Bitcoin Hyper Higher?

Several key catalysts could propel Bitcoin Hyper (HYPER) above its current presale valuation, especially as the project transitions from concept to live ecosystem.

Among the most impactful are centralized exchange (CEX) listings, which often serve as a price discovery event and expand retail access. A successful debut on platforms like Gate.io, MEXC, or even mid-tier exchanges could inject fresh liquidity and broaden investor exposure.

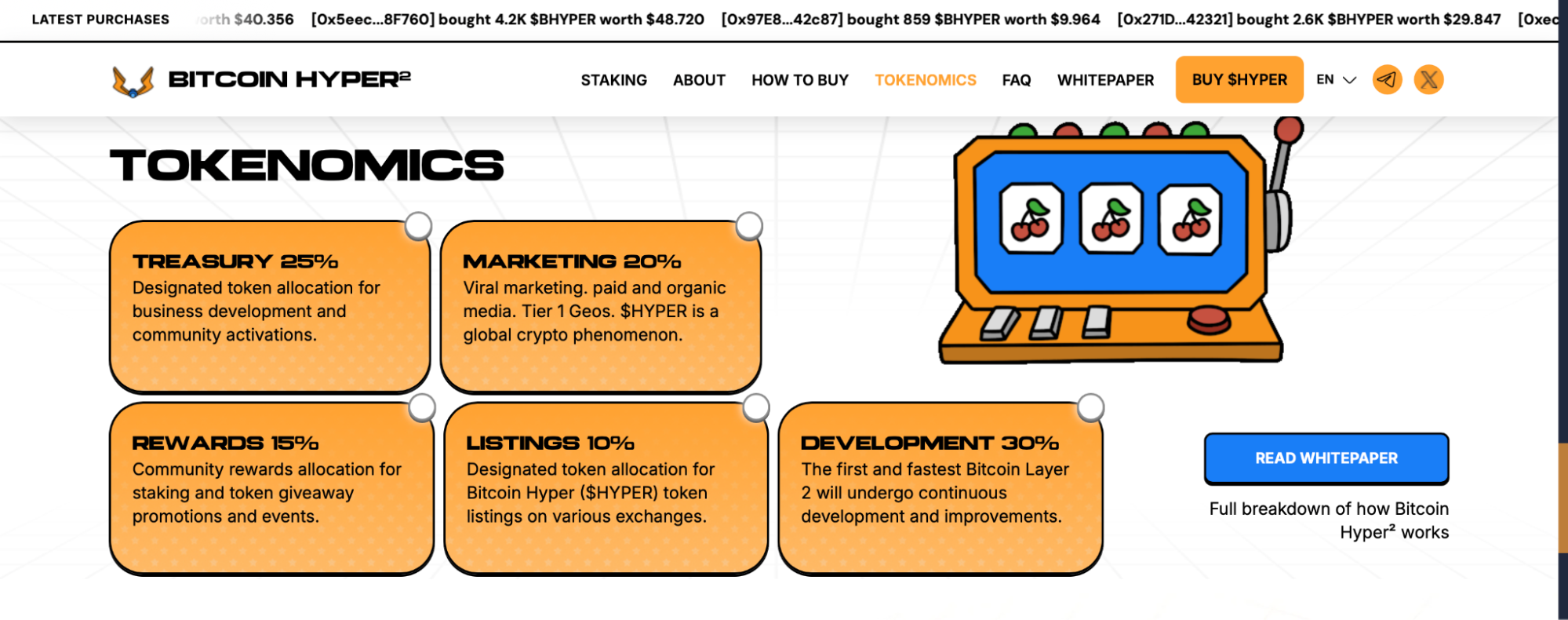

Bitcoin Hyper tokenomics, including allocations for treasury, marketing, rewards, listings, and development. Source: Bitcoin Hyper

On the utility front, staking is already live with 40% APY, offering long-term HYPER holders a powerful way to earn passive income. This utility layer adds real value beyond the speculative buzz, potentially helping to stabilize and support HYPER’s price as the ecosystem matures.

Finally, Bitcoin Hyper’s success is closely tied to the broader adoption of Layer 2 solutions, especially those that aim to extend Bitcoin’s utility. If Layer 2 narratives continue gaining momentum — as seen with growing interest in protocols like Stacks and Rootstock — Bitcoin Hyper’s positioning on Solana VM could become a competitive advantage, attracting both developers and users looking for high throughput and BTC alignment.

These factors suggest a high-upside scenario for Bitcoin Hyper if execution aligns with investor expectations and market sentiment remains favorable.

Risks to Consider Before Investing

As with any early-stage crypto project, execution risk looms large. Promises of fast Layer 2 scaling, staking integration, and meme-level virality mean little if the team cannot deliver on its roadmap milestones.

Another concern is post-launch token dumping, a common scenario where early buyers or insiders offload large amounts of tokens after exchange listings, leading to sharp price corrections. Without strong vesting schedules or liquidity controls, HYPER could face similar volatility.

Additionally, the development team’s anonymity or lack of publicly verifiable experience can be a red flag. If the team remains pseudonymous and the project leans heavily on meme branding without building meaningful utility, long-term viability becomes questionable.

Finally, Bitcoin Hyper’s roadmap is still evolving, and like many presale projects, there’s a risk that features such as staking, DeFi tools, or CEX listings may face delays or fail to materialize altogether. Without consistent delivery, even the strongest narratives lose steam, and so do price expectations.

Investors should treat HYPER as a high-risk, high-reward play, balancing its upside with careful due diligence and realistic expectations.

How to Buy Bitcoin Hyper (HYPER)

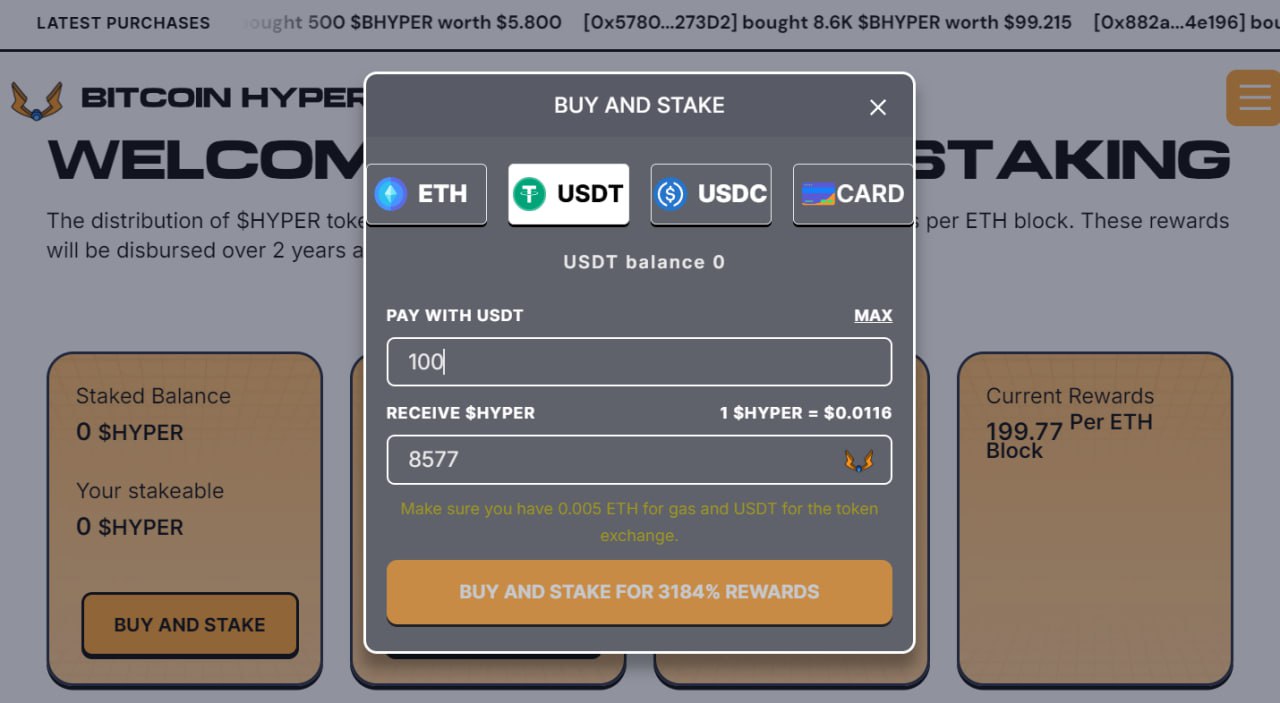

Getting started with Bitcoin Hyper is simple, especially for users already familiar with crypto wallets like MetaMask or Best Wallet. The HYPER token is currently available through the official presale portal, and buyers can participate using ETH, USDT, or even a bank card.

Here’s a step-by-step walkthrough of how to buy Bitcoin Hyper:

- Connect Your Wallet. Visit the Bitcoin Hyper presale website and click “Connect Wallet.” Choose MetaMask (browser extension) or Best Wallet (mobile app). Approve the connection when prompted.

- Choose Your Payment Method. Select the asset you want to use: Ethereum (ETH), Tether (USDT), or fiat via card. Ensure your wallet has enough balance and gas fees to cover the transaction.

- Enter the Purchase Amount. Input the amount of HYPER you’d like to buy. The platform will calculate how many tokens you’ll receive based on the current presale price of $0.01367670 per token.

- Confirm the Transaction. Review the purchase details and confirm the transaction in your wallet. Once complete, your HYPER allocation will be recorded and available for claim after the presale ends.

- Optional: Stake Your Tokens. If Bitcoin Hyper offers staking during or after the presale, users can immediately lock their tokens for passive rewards. Look for a “Stake Now” button on the dashboard to start earning yield.

You can buy HYPER tokens using crypto or a bank card. Source: Bitcoin Hyper

Buying Bitcoin Hyper early gives investors access at ground-floor pricing, with the potential for bonus allocations or staking rewards depending on how much and when they invest.

Conclusion

With a presale price of $0.01367670, Bitcoin Hyper (HYPER) offers a low-barrier entry point for those seeking early exposure to a token that blends utility, virality, and scalability, supported by the Solana VM and a roadmap targeting staking and DeFi adoption.

That said, HYPER remains a speculative investment. Like all presale projects, it faces execution risks, uncertain roadmap delivery, and the potential for post-launch volatility. Investors should temper excitement cautiously, especially given the anonymous nature of many early-stage crypto teams.

As with any emerging crypto project, doing your own research (DYOR) is essential. Monitor official updates, track progress against the roadmap, and assess community traction before making long-term decisions. Bitcoin Hyper has the narrative, but only time will tell if it can deliver its promise.

Price Increases in

Bitcoin Hyper Price Prediction FAQ

What factors influence the price of Bitcoin Hyper?

What data sources are used for this Bitcoin Hyper price prediction

Can the price of Bitcoin Hyper exceed the predicted range?

What is the difference between Bitcoin Hyper’s short-term and long-term predictions?

How should investors use these price predictions?

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

The team behind IPO Genie has not yet announced an end date for the presale.

Fact-Checked By:

Fact-Checked By:

11 mins

11 mins

Filip Stojanovic

, 45 postsI’m a crypto content strategist and writer who helps Web3 projects tell their story, build trust, and grow engaged communities in an increasingly competitive space. I’ve worked with presale tokens, exchanges, blockchain startups, and crypto marketing agencies, shaping content strategies that not only explain complex concepts but also inspire confidence, attract investors, and drive adoption.

My experience spans a wide variety of formats, from whitepapers, token launch campaigns, and pitch decks to thought leadership articles, technical documentation, and in-depth guides. Before diving into Web3, I built my expertise in B2B SaaS writing. This structured, analytical approach now underpins my work in crypto, allowing me to bring clarity and credibility to projects in a space often criticized for hype and jargon.

I’m especially interested in how blockchain innovation translates into real-world utility. My recent work explores the evolving role of DeFi protocols, NFT ecosystems, and next-generation infrastructure in reshaping industries and creating new opportunities for both businesses and individuals.