LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Best Low-Cap Crypto in February 2026 (Ranked by Risk-Adjusted Criteria)

31 mins

31 mins Low-cap crypto are assets with small market capitalizations, high volatility, and low liquidity. Our analysis suggests that the best low-cap crypto in February 2026 are Fluid (FLUID), REI Network (REI), and ZetaChain (ZETA).

To build this list, we reviewed over 60 coins using our methodology, which evaluates liquidity, market access, community activity, tokenomics, and transparency. The selection will be most interesting to high-risk traders seeking undervalued projects with potential upside.

How We Define and Rank Low-Cap Crypto

Low-cap crypto are digital assets with small market capitalizations that often come with high volatility and low liquidity, and so are best suited for high-risk traders.

The ranking is based on our own methodology. In practice, we looked at liquidity, market access, community activity, real use cases, and how transparent the project is. Illiquid coins, inactive projects, and opaque launches are excluded from the list.

Presales Expected to Launch as Low-Cap Crypto (February 2026)

This is a list of early-stage presales expected to launch as low-cap crypto.

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Quantum-resistant security infrastructure for wallets and enterprise use

- Uses deflationary tokenonomics, including burns, tied to quantum workload execution

- Staking and governance participation expand token utility

- Shared liquidity spanning Bitcoin, Ethereum, and Solana

- Improved trade execution through faster speeds and secure cross-chain capital movement

- Opens up greater cross-ecosystem connectivity for builders and developers

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

- High-performance broker for pros and newcomers alike

- Rebates and buybacks come from VFX's own market activity

- 10% bonus on sign up and early staking access

Top Low Cap Crypto Gems in February 2026

This table highlights the best low-cap crypto in February 2026, ranked using Coinspeaker’s low-cap scoring model. Market data updated daily.

| Rank | Coin | Market Cap | 24h % Change | 7d % Change | 30d % Change | Audit | Buy |

|---|---|---|---|---|---|---|---|

| 1 | Fluid (FLUID) | Coin data not available | Coin data not available | Coin data not available | Coin data not available | PeckShield | OKX, Bybit, Coinbase |

| 2 | REI Network (REI) | $2.61M | +3.65% | -13.58% | -27.98% | CertiK | MEXC |

| 3 | ZetaChain (ZETA) | $113.12M | -1.66% | -13.49% | -30.49% | Hacken | OKX, Bybit |

| 4 | Hash AI (HASHAI) | $5.21M | +9.08% | -11.41% | -54.82% | SolidProof | MEXC, KCEX |

| 5 | Celestia (TIA) | $375.98M | -0.66% | -7.79% | -40.37% | CertiK | Binance, Coinbase, Kraken |

| 6 | ApeCoin (APE) | $132.06M | -0.37% | -11.46% | -39.63% | CertiK | Binance, BingX, OKX |

| 7 | Starknet (STRK) | $503.36M | -3.52% | -10.11% | -39.82% | CertiK | OKX, Binance, Bybit |

| 8 | LayerZero (ZRO) | $1.63B | -2.97% | -4.03% | +10.24% | Chain Security | Binance, Coinbase, OKX |

| 9 | Arweave (AR) | $132.93M | -6.45% | -22.21% | -47.65% | CertiK | OKX, Binance, MEXC |

| 10 | Axelar (AXL) | $69.24M | -2.58% | -12.74% | -25.17% | Code4rena | Binance, Bybit, Bitunix |

Key Takeaways

- Despite BTC’s drop below $84K, CryptoQuant data suggests a healthier base for the next move on the crypto market.

- Over the past year, the TVL of the DeFi protocol FLUID grew by 89% (DefiLlama, January 30, 2026), indicating rising interest.

- LayerZero and Axelar operate in the cross-chain interoperability sector, valued at $9.8B (CoinGecko, January 30, 2026).

- REI Network and Hash AI are low-cap AI plays, supported by global AI growth with a 35.9% CAGR, per Founders Forum.

- To assess low-cap crypto, focus on real use cases, audited contracts, and active communities.

Best Low-Cap Crypto Gems with Potential – Analysis and Reviews

Here are the best low-cap crypto that our analysis uncovered. These opportunities may be suitable for those seeking high-risk, high-reward, low-market-cap plays.

1. Fluid (FLUID) – Multi-chain DEX, Lending and Borrowing DeFi Protocol

Fluid is a multi-chain DeFi protocol that provides decentralized lending, borrowing, and a DEX. Users receive APYs for supplying assets. The FLUID token grants holders governance rights and rewards users who provide liquidity or stake assets. It is used for transaction fees, buy-backs, and burns to help stabilize the price.

Editor’s view (Julia Sakovich, Senior Editor): In my opinion, FLUID’s value mainly comes from two things: cross-chain lending and its DEX features. At the same time, the project faces real risks, including strong competition and upcoming token unlocks. There’s no guarantee it will grow much, but I personally see FLUID as a possible addition to a diversified portfolio.

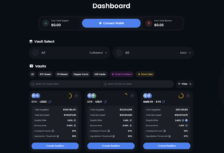

Fluid offers a 6.86% borrow rate for the ETH/USDC trading pair (Snapshot from January 30, 2026). Source: Fluid

Best for: DeFi users and traders who already use lending, borrowing, and DEX platforms

Why it ranked:

- Active DeFi usage with TVL of $1.8B (DefiLlama, January 27, 2026)

- Exposure to the lending and borrowing sector

- Multi-chain support across Ethereum and major L2 networks

Key risks:

- Strong competition from other DeFi lending and DEX protocols

- Token unlocks could increase supply and add selling pressure

- DeFi usage can drop quickly during broader market downturns

| Category | DeFi |

| Chain | Ethereum, Arbitrum, Polygon, Base, Solana via Jupiter Lend |

| Price | Coin data not available |

| Market Cap | Coin data not available |

| ATH | Coin data not available |

| Audits | Immunefi |

2. REI Network (REI) – Fast Gasless Blockchain Targeting AI and Apps

REI Network is a Layer 1 blockchain focused on fast, gasless transactions. The project targets use cases that need high throughput, such as AI-related apps, GameFi, and microtransactions. REI uses a Proof-of-Stake model, and token holders can stake REI to help secure the network.

Editor’s view (Julia Sakovich, Senior Editor): I was drawn to REI Network by its gasless transactions and AI integration. It seems the main risk lies in the development pace. However, if the testnet confirms the promised performance, it could turn out to be a good Layer 1 project.

REI Network’s roadmap plans to optimize block time on the testnet in 2026. Source: REI Network

Best for: AI investors, Blockchain Layer 1 fans

Why it ranked:

- Targets the AI crypto sector with a market cap of $25.7B (CoinGecko, January 27, 2026)

- Gasless transaction design, which lowers barriers for frequent on-chain activity

- Public audit disclosed, improving security transparency

Key risks:

- Long development history with delayed execution milestones

- Early-stage adoption and limited real-world usage so far

- Strong competition from other Layer 1 and AI-focused blockchains

| Category | L1 Blockchain / AI / GameFi |

| Chain | Proprietary (EVM compatible) |

| Price | $0.0026 |

| Market Cap | $2.65M |

| ATH | $0.35 |

| Audits | Cyberscope |

3. ZetaChain (ZETA) – Blockchain that Connects Other Blockchains

ZetaChain is a Layer 1 blockchain built to help different networks work together. It lets apps interact with assets across chains like Bitcoin, Ethereum, and Cosmos without using bridges or wrapped tokens. The goal is to make cross-chain apps simpler and reduce technical risk when moving value between chains. The ZETA token is used for network fees, staking, and helping secure the blockchain.

Editor’s view (Julia Sakovich, Senior Editor): Interoperability as a niche is in high demand within the crypto industry, and ZetaChain aims to natively integrate Bitcoin into cross-chain DeFi without custodial bridges. However, competition in this segment is intense, with alternatives like LayerZero, Axelar, and others. As for me, ZetaChain’s success will heavily depend on broader ecosystem adoption.

ZetaChain claims that its community includes more than 1.8 million participants. Source: ZetaChain

Best for: Developers building omnichain apps, infrastructure investors, cross-chain DeFi users

Why it ranked:

- Crosschain sector TVL potential recovery to $5.3B ATH, currently at $332M (DefiLlama, January 27, 2026)

- Direct support for major networks, including Bitcoin and Ethereum

- Public audits disclosed, improving security transparency

Key risks:

- Strong competition from other interoperability and omnichain protocols

- Adoption depends on real dApp usage, not just infrastructure design

- Cross-chain systems can face higher technical and security complexity

| Category | Interoperability / Layer 1 |

| Chain | ZetaChain (Cosmos-based) |

| Price | $0.053 |

| Market Cap | $112.74M |

| ATH | $2.78 |

| Audits | Hacken, CertiK |

4. Hash AI (HASHAI) – AI and Crypto Mining Infrastructure

Hash AI combines crypto mining with AI-based optimization tools. It focuses on improving mining efficiency by using AI to manage hardware, nodes, and mining decisions. The project also offers a rental-style model, where users can access GPU power and mining nodes without running their own infrastructure. The HASHAI token is linked to platform access and internal incentives.

Editor’s view (Otar Topuria, Crypto Editor): In my opinion, AI is already deeply intertwined with cryptocurrencies. That’s why projects like HASHAI will play an increasingly important role in the crypto industry. Mining optimization is a valuable utility, but remember the risks tied to centralized control and physical infrastructure.

HashAI users can choose from multiple nodes to utilize GPU power for their projects. Source: HashAI

Best for: AI and mining investors, high-risk traders

Why it ranked:

- Potential to lead the AI crypto sector with $25.8B market cap (CoinGecko, January 27, 2026)

- Clear focus on mining optimization using AI tools

- Public audit disclosed

Key risks:

- Success depends on the physical infrastructure under construction

- Execution risk if hardware expansion or AI systems underperform

- CoinGecko token warning from GoPlus

| Category | AI / Mining |

| Chain | Ethereum (ERC-20), Multi-chain Layer 1 Blockchains |

| Price | $0.000057 |

| Market Cap | $5.49M |

| ATH | $0.0031 |

| Audits | CertiK |

5. Celestia (TIA) – Modular Blockchain for Data Availability and Rollups

Celestia is a blockchain that focuses only on data availability. Instead of doing everything on a single chain, it lets other blockchains handle execution while Celestia handles data. This makes it easier for developers to launch lightweight rollups. The TIA token is used to pay for space on the network and for staking to help secure it.

Editor’s view (Julia Sakovich, Senior Editor): Celestia was one of the first big projects to push the idea of modular blockchains, and, in my opinion, that has changed how a lot of people look at crypto. I think its future depends heavily on how fast rollups keep growing. Demand for TIA could go up over time, but it’s also worth keeping in mind that projects like EigenLayer are real competitors.

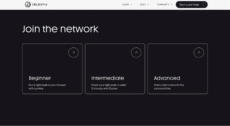

Celestia offers node-running options for beginners, intermediate, and advanced users. Source: Celestia

Best for: Infrastructure investors, rollup builders

Why it ranked:

- Remains a leading modular blockchain, trading 97% below its ATH with potential for recovery (CoinGecko, January 27, 2026)

- Active use by rollup-focused projects and infrastructure teams

Key risks:

- Strong competition from Ethereum and other modular data solutions

- Adoption depends on long-term rollup growth

- Infrastructure demand can fluctuate with market cycles

| Category | Modular Data Availability / Infrastructure |

| Chain | Celestia |

| Price | $0.33 |

| Market Cap | $371.76M |

| ATH | $20.93 |

| Audits | CertiK, Cyberscope |

6. ApeCoin (APE) – DAO-Governed Token Powering the Bored Ape Ecosystem

ApeCoin is the main token used in the Bored Ape Yacht Club ecosystem. People who hold APE can vote on DAO decisions and get access to certain events, games, and services. The token is also used in different Web3 apps built by other teams, which helps it stay relevant beyond just one NFT project.

Editor’s view (Otar Topuria, Crypto Editor): ApeCoin was designed as a logical extension of the Yuga Labs ecosystem and the popular Bored Ape Yacht Club NFT collection. Considering it’s 99.3% below its all-time high (Snapshot from CoinGecko, January 27, 2026), I see it as a potential opportunity for strong upside. However, it’s important to remember that the NFT sector has already gone through a crash, and its recovery pace remains uncertain.

Buying ApeCoin is a way to join the hyped BAYC ecosystem through a low-cap crypto. Source: BAYC

Best for: People interested in NFTs, virtual worlds, and DAO governance

Why it ranked:

- BAYC remains a strong Web3 brand with $3.3B in all-time sales volume (CryptoSlam)

- Active DAO structure with on-chain governance

- Ongoing use in games and third-party Web3 applications

Key risks:

- Slower demand growth if NFT market activity remains weak

- Heavy dependence on the BAYC brand and related projects

| Category | DAO / NFT / Metaverse |

| Chain | Ethereum |

| Price | $0.12 |

| Market Cap | $129.06M |

| ATH | $26.84 |

| Audits | CertiK |

7. Starknet (STRK) – ZK Rollup for Ethereum Scaling

Starknet is a zero-knowledge Layer 2 built to scale Ethereum using STARK proofs. It allows developers to deploy smart contracts with lower fees while keeping Ethereum-level security. The STRK token is used for transaction fees, staking, and future governance within the network.

Editor’s view (Otar Topuria, Crypto Editor): Starknet stands out compared to other ZK L2 projects because it has a live mainnet, real utility, and an active user base. It is not a presale or an early-stage project and can be used right now, which is very important for me as an investor. On the plus side, it is closely tied to Ethereum, while on the risk side, competition in this space keeps growing.

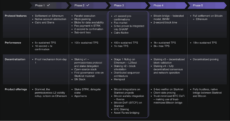

According to the roadmap, Starknet is currently in phase 3 and aims to reach 400+ sustained TPS. Source: Starknet

Best for: Developers, Ethereum users

Why it ranked:

- Active ZK rollup ecosystem

- Live mainnet with real applications and users

- Strong alignment with the Ethereum scaling roadmap

Key risks:

- Complex developer tooling compared to EVM-native L2s

- Strong competition from other ZK and optimistic rollups

- Tokenonomics still evolving post-launch

| Category | Ethereum L2 / ZK Rollup |

| Chain | Ethereum |

| Price | $0.050 |

| Market Cap | $501.99M |

| ATH | $3.59 |

| Audits | CertiK |

8. LayerZero (ZRO) – Omnichain Messaging Infrastructure

LayerZero is an interoperability protocol that enables applications to communicate across different blockchains. Instead of moving assets through bridges, it focuses on message passing between chains, which reduces some common cross-chain risks. The ZRO token supports protocol incentives and future governance.

Editor’s view (Julia Sakovich, Senior Editor): LayerZero plays an important behind-the-scenes role in crypto infrastructure. Its success mainly depends on whether developers continue building solutions on top of its messaging layer. For me, it is an interesting product, but strong competition and dependence on partners raise doubts.

In 2026, the ZRO supply will double, from 500,000 to 1 million. Source: LayerZero

Best for: Infrastructure investors and omnichain apps builders

Why it ranked:

- Widely used by cross-chain DeFi and NFT applications

- Strong ecosystem adoption across major blockchains

Key risks:

- High reliance on ecosystem partners and app adoption

- Competition from other interoperability protocols

| Category | Interoperability / Infrastructure |

| Chain | Multi-chain |

| Price | $1.71 |

| Market Cap | $1.71B |

| ATH | $7.51 |

| Audits | Chain Security |

9. Arweave (AR) – Permanent Decentralized Data Storage

Arweave is a decentralized storage network designed for permanent data storage. Instead of recurring fees, users pay once to store data indefinitely. The AR token is used to pay for storage and to reward miners who maintain the network.

Editor’s view (Julia Sakovich, Senior Editor): It seems to me that permanent data storage is a strong service in the crypto market, but questions about reliability still exist. Obviously, it is not a place to store private keys. Arweave has taken a very specific niche in crypto infrastructure, but in an era of subscriptions and rentals, a one-time payment looks like an unusual way to monetize.

Users can calculate storage cost using the Storage Fee Calculator. Source: Arweave

Best for: Infrastructure investors focused on data, AI, and long-term storage

Why it ranked:

- Real-world usage across Web3, AI, and archival data

- Unique economic model focused on permanent storage

- Long operating history

Key risks:

- Storage demand fluctuates with market cycles

- Competition from other decentralized storage networks

- Token demand tied closely to network usage

| Category | Decentralized Storage / Infrastructure |

| Chain | Arweave |

| Price | $1.99 |

| Market Cap | $130.49M |

| ATH | $97.32 |

| Audits | CertiK |

10. Axelar (AXL) – Cross-Chain Communication Network

Axelar is a cross-chain network that enables secure communication and asset transfers between blockchains. It acts as a middleware layer for developers building multi-chain applications. The AXL token is used for network security, staking, and fees.

Editor’s view (Julia Sakovich, Senior Editor): Axelar sits in a competitive but necessary part of crypto infrastructure. For me, its long-term relevance depends on whether it can keep trust and reliability as cross-chain activity grows. Maybe in the future it will compete with LayerZero, or maybe in a year no one will remember it.

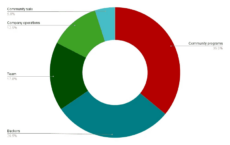

Axelar allocates a significant share of its tokenomics to community programs and backers. Source: Axelar

Best for: Developers and cross-chain infrastructure investors

Why it ranked:

- Live cross-chain usage with multiple supported networks

- Public team and active development

Key risks:

- Cross-chain protocols carry higher technical risk

- Competition from LayerZero and similar solutions

- Adoption depends on developer preference

| Category | Interoperability / Infrastructure |

| Chain | Multi-chain |

| Price | $0.059 |

| Market Cap | $70.56M |

| ATH | $2.68 |

| Audits | Code4rena |

How We Picked These Low-Cap Crypto Projects – Our Methodology

We looked through over 60 low-cap crypto before we made this list. Most of our picks are under about a $50M market cap, but we kept a few bigger names too. Then we scored every project using the same checklist. The total score is 100%. For a deeper dive into our scoring rules and update cadence, see the Coinspeaker methodology.

Many readers use lists like this to find the next 1000x crypto. In reality, 1000x outcomes are rare and highly timing-dependent, so our framework prioritizes measurable indicators such as liquidity depth, tokenomics, and unlock schedules, product traction, and security over hype-driven signals.

Low Cap and Liquidity (25%)

A low market cap is not enough by itself. We also need the coin to be tradable. We checked the real circulating supply, how big the liquidity pools are, and how bad slippage gets on normal-sized buys. We also looked at whether liquidity is locked, and whether one wallet or one pool controls too much of it.

Community and Real Attention (20%)

We don’t just count followers. We look for signs that people actually talk about the project. We check growth on X, Telegram, and Discord, plus basic engagement like replies, reposts, and unique accounts joining in. If it looks like bot traffic or paid hype, the score goes down.

Tokenomics and Unlocks (15%)

We read the token supply, allocations, vesting schedules, and unlock dates. We also check how big the team and treasury wallets are, and how fast new coins will hit the market. If a project has big unlocks coming soon, we treat it as a real risk and score it lower.

Narrative and Timing (15%)

Low caps often move because of trends. So we asked a simple question: Does this project fit what people are buying right now? We gave more points to coins tied to strong themes like Bitcoin L2, AI, DeFi, Base/Solana ecosystems, and other narratives that already have momentum.

Product and Progress (10%)

We prefer things that work today, not just coming soon. A live app, a working dashboard, a real staking page, an active bot, or a usable protocol helps a lot. We also look for steady updates over time, not one big announcement and then silence.

Safety Checks: Audits and Basic Security (7%)

If a project has audits, we note who did them and whether key issues were fixed. We also look for basics like multisig wallets, bug bounties, and clear contract info. No audit does not always mean “bad”, but it does raise the risk.

Where Can You Buy It (5%)

We checked how easy it is to get exposure. That includes DEX liquidity, whether aggregators route trades well, and whether the token is listed on any CEXs. If it’s hard to buy or hard to sell, it loses points.

Transparency and Docs (3%)

We reward teams that explain things clearly. Good docs, clear risk notes, real on-chain addresses, and basic team info all help. If everything is vague or the site is mostly marketing, the score goes down.

After scoring, we compared the results and picked the projects with the best overall mix of upside and credibility. We also re-check the list regularly, because low-cap crypto can change fast.

Tested by Editors

The Coinspeaker editorial team compared the best low-cap crypto in 2026 across three factors: brand recognition, utility, and team credibility.

Among utility-driven projects, Fluid stands out for its active DeFi use cases, including lending, borrowing, and on-chain swaps on Ethereum. Unlike narrative-led tokens, its value is tied to a functioning protocol with real usage rather than branding alone.

From an infrastructure perspective, ZetaChain draws attention due to its focus on native cross-chain interactions. It also scores higher on transparency, with a public development team, open GitHub activity, and detailed technical documentation, which sets it apart from many low-cap peers.

ApeCoin remains one of the most recognizable names in the low-cap segment thanks to its connection to the BAYC ecosystem. While its utility centers on DAO governance and ecosystem participation, brand strength continues to play a major role in its visibility compared with less-established projects.

These examples show how low-cap projects can differ widely in where their perceived value comes from.

| Project | Brand recognition | Utility | Team credibility |

| Fluid | Low | Lending, borrowing, on-chain swaps | Partially public DeFi team |

| REI Network | Low | Gasless, high-speed blockchain | Public team (ex-GXChain) |

| ZetaChain | Medium | Native omnichain messaging and DeFi | Public team (Google, Coinbase, ConsenSys) |

| Hash AI | Low | AI-optimized crypto mining | Limited team disclosure |

| Celestia | Medium | Data availability layer for rollups | Public team led by Mustafa Al-Bassam |

| ApeCoin | High | DAO governance in BAYC ecosystem | Community-run DAO structure |

| Starknet | High | ZK rollup for Ethereum scaling | Public team (StarkWare) |

| LayerZero | High | Omnichain messaging infrastructure | Public team, VC-backed |

| Arweave | Low | Permanent decentralized data storage | Public long-standing team |

| Axelar | Low | Cross-chain communication middleware | Public team (Axelar Foundation) |

Why 2026 Is Big for Low Cap Crypto

Bitcoin started 2026 below $88,000, but by January 5, it reached a local high around $94,000, followed by a correction. On January 14, the Bitcoin price jumped to $97,500, but then fell below $90,000. Some analysts suggested Bitcoin could drop below $80,000 before a reversal in February. According to BitMEX co-founder Arthur Hayes, stress in Japan’s government bond market and the yen could push the Fed to restart money printing, which would support Bitcoin prices.

Early Signs of Low Cap Crypto with High Potential

There are several recurring signals that a low-cap crypto may have breakout potential.

- Trending narratives. When a narrative begins appearing across multiple channels, it usually signals rising interest, and users typically start looking for new crypto projects or crypto under $1.

- A bigger cap coin with a similar idea is mooning. When a larger token within the same theme starts rallying, traders often search for the best cheap crypto to buy and the next crypto to explode.

- Big partnerships. A low-cap project gaining institutional or mainstream partnerships can radically increase legitimacy and visibility.

- Regulatory changes. Rules and laws can hurt some crypto projects, but they can also help them. A good example is XRP. Long court cases in the US slowed it down for years.

- High community engagement. Sometimes, a project takes off at the right moment. Suppose a project experiences strong community growth on social media or is consistently mentioned in crypto groups.

- Platform and token use case. A token that has real utility and sound tokenomics is more likely to sustain rallies.

Low Market Cap Crypto That Exploded in the Past

Looking at past low-cap crypto that later saw sharp price increases, a few common patterns appear. The strongest performers were either meme tokens with viral community momentum or projects built around a clear technical idea. In many cases, broader visibility through major exchange listings and sustained community activity played a key role, while the timing and scale of gains remained highly unpredictable.

| Token | Launch Price (approx.) | Peak Price (approx.) | ROI (Launch to Peak) | Key Catalysts |

| Pepe (PEPE) | $0.000000001 (Apr 2023) | $0.00002803 (Dec 2024) | 62,070% | Tier-1 exchange listings, strong community, deflationary supply |

| Bonk (BONK) | $0.000000001 (Dec 2022) | $0.00005825 (Nov 2024) | 54,080% | Solana integration, large airdrops, major exchange listings |

| Kaspa (KAS) | $0.0001699 (Nov 2021) | $0.2076 (Aug 2024) | 110,000% | GHOSTDAG protocol, high throughput, decentralization focus |

| SPX6900 (SPX) | $0.001318 (Aug 2023) | $2.05 (Jul 2025) | 115,449% | Satirical branding, strong community engagement, deflationary tokenomics |

| Dogwifhat (WIF) | $0.001 (Nov 2023) | $4.83 (Mar 2024) | 488,900% | Solana ecosystem growth, rapid CEX adoption |

What Is a Low Market Cap Crypto?

A low market cap crypto is a cryptocurrency with a total market value below $1 billion. These projects are usually considered early-stage and often come with higher volatility and execution risk compared with large-cap crypto. While they may offer more room for growth, outcomes depend on adoption, liquidity, and whether the team can deliver on its plans.

Low Cap vs Traditional Finance Comparison

Low market cap crypto projects are similar to small or niche companies in traditional finance. They usually have fewer users, lower liquidity, and less public awareness, but may offer higher growth potential if execution is strong. At the same time, these assets tend to be more volatile, react quickly to news or narratives, and often fail to recover after early peaks, with no guarantees of long-term success.

What to Know Before Buying Low Cap Crypto

Retail traders often see low cap crypto as high-risk bets. They are usually cheap to buy and can rise fast, but they can also fall just as quickly because of low liquidity and fast changes in market mood. In this segment, it is more important to watch possible triggers, ease of entry and exit, token unlocks, and community activity than deep fundamentals.

Some users look at community opinions to understand short-term sentiment, but these views change fast and often contradict each other. That is why critical thinking is important, even if opinions in a Reddit thread match your own view. Holders of low cap crypto often become loyal and actively promote projects on social media, so treat these discussions as background context, not as reliable buy or sell signals.

Because of high volatility, traders often treat low cap crypto as short-term, high-risk opportunities rather than long-term investments. Large projects usually have proven demand and more stable price behavior, while low cap coins have fewer holders and thin liquidity. Even medium-sized sales can push prices down sharply.

Many new and early-stage projects offer high staking rewards to increase token holding. The real value of these rewards depends on future price movement. Token burns are also used to reduce supply and can support price, and this practice is common in both small and large projects.

Exchange access also matters. Listing announcements or actual listings on major platforms like Binance or Coinbase often lead to short-term price and volume spikes due to higher visibility and liquidity. These moves can reverse quickly, so this risk should be considered.

Overall, low cap crypto sit at the core of early adoption, speculation, and market psychology. Final outcomes depend less on hype and more on how a trading strategy is executed.

How to Find Low Cap Crypto

Low cap crypto can be found by tracking new listings on platforms like CoinGecko, CoinMarketCap, DEXTools, or Jupiter Alpha. Decentralized tools often surface newer pairs earlier but also carry a higher scam risk, so caution is required.

The new cryptocurrencies page on CoinGecko. Source: CoinGecko

Other common methods include using listing bots, monitoring Telegram channels, or following crypto presales that are likely to launch with small market capitalizations.

How to Buy Low Cap Crypto

Before buying a low-cap crypto, make sure your wallet has funds and use a wallet you trust, such as Best Wallet, MetaMask, or another established option. Only connect your wallet to verified sites, especially when using decentralized exchanges, and consider using a separate wallet with a small balance for new or untested tokens.

Always double-check the token’s contract address using reliable sources like CoinGecko or CoinMarketCap, and review basic safety signals with tools such as TokenSniffer or GoPlus. It is also important to check liquidity levels through on-chain tools like DEXTools, as thin liquidity can make trades difficult or costly. Even after these checks, low-cap assets remain high risk due to volatility, limited liquidity, and possible smart contract issues.

Where to Buy the Best Low-Cap Crypto

Most low-cap crypto is first traded on decentralized exchanges (DEXs) before it reaches big centralized platforms. On DEXs, you trade straight from your wallet, without a middleman, and you need a wallet like MetaMask or Phantom plus some network coins to pay fees.

Different chains use different DEXs. Ethereum users often trade on Uniswap or SushiSwap, Solana users use Raydium or Jupiter, BNB Chain trades mostly happen on PancakeSwap, and Polygon and Avalanche have their own local DEXs.

Small projects sometimes move to centralized exchanges later. Mid-tier exchanges like MEXC, Bybit, Margex, BloFin, and OKX often list them first, while top platforms like Binance or Coinbase usually list only after a project gains traction.

What Are the Risks of Investing in Low Cap Crypto?

Low cap crypto can bring big gains, but the risks are high. Prices can swing fast, liquidity can dry up, and some projects simply fail. There are also scams, broken smart contracts, and problems with exchanges. Below are the main risks and some simple ways to think about them.

Volatility

Small tokens move fast. Even a normal buy or sell can push the price up or down a lot. If a large holder sells, the price can crash in minutes.

How to avoid: Don’t go all in. Use small amounts, enter and exit slowly, and set limits to protect yourself.

Liquidity problems

Many low cap coins are hard to trade in size. There may not be enough buyers when you want to sell, or the price can drop sharply while you try.

How to avoid: Check how much liquidity the token has and see how the price reacts to normal trades. Make sure liquidity is locked or spread out.

Rug pulls

Some teams remove liquidity and disappear, leaving the token worthless. This still happens a lot in small projects.

How to avoid: Always check the real contract address, see if liquidity is locked, and be careful with projects that have no known team or no audit.

Project failure

Even projects that look strong at the start can fail. Teams may run out of money, build too slowly, or lose key people. This is not rare. Startup data shows that about 70% of new businesses fail between years two and five, and around two-thirds do not survive 10 years. Crypto projects are not an exception.

How to avoid: Look for steady progress, clear plans, and real updates over time. It’s usually safer to wait until a project proves it can keep building.

Smart contract bugs

Smart contracts can break. A single bug or exploit can wipe out funds very fast. In the first quarter of last year alone, crypto security incidents caused losses of more than $2 billion, according to Web3 security firm Hacken. One clear example happened on June 6, 2025, when the Stacks-based ALEX Protocol was hacked for about $8.3 million.

How to avoid: Stick to projects with known audits and test things with small amounts first.

Exchange risks

Centralized exchanges are not risk-free. They can get hacked or suddenly remove a token from trading. On February 21, 2025, Bybit was hacked for around $1.5 billion, which US authorities linked to North Korea. It was one of the biggest crypto thefts ever.

How to avoid: Don’t keep everything on one exchange. Move funds to your own wallet when possible and spread risk across platforms.

Risks of Low-Cap Crypto in Trading

Low-cap crypto trading is associated with elevated risk due to the early and often unproven nature of many projects. These assets typically have smaller communities, limited market share, and thinner liquidity, which makes them more sensitive to market sentiment and sudden price moves.

Such projects also face strong competition from more established cryptocurrencies and similar early-stage alternatives. Many fail to gain traction or lose relevance over time, which can lead to prolonged declines or a complete loss of market interest. As a result, outcomes in the low-cap segment are highly uncertain and depend heavily on execution, adoption, and broader market conditions.

Pros & Cons of Best Low Cap Crypto Coins Explained

If you decide to invest in low cap crypto, it is important to consider the pros and cons of this decision.

Pros

- Big growth potential – even small inflows of money can push the price up quickly

- Early access – the chance to enter before a project becomes popular

- Strong community – you can become part of an active community and influence development

- Fast development – small teams often try to launch products faster than large companies

Cons

- Volatility – the price can jump or crash very quickly

- Low liquidity – trading can be difficult, as even small buys or sells can move the price

- Scam risk – new projects always carry risks like insider trading, pump and dumps, or rug pulls

- Uncertain future – even a clear and strong roadmap is not always delivered

Is It Legal to Invest in Low Cap Crypto in 2026?

In most places, buying low cap crypto is allowed. Still, the rules depend on where you live and which platform you use, so it’s always smart to check local laws.

- US: Owning and trading crypto is legal; some tokens are treated as securities by the SEC, while others fall under commodity rules from the CFTC

- UK: Buying and holding crypto is allowed, but promotions are tightly regulated under FCA rules

- EU: Crypto services operate under MiCA, with only approved providers allowed across EU countries

- Asia: China bans crypto trading; India allows investing with compliance requirements; Singapore permits crypto access through licensed providers

Do You Pay Taxes on Low Cap Crypto in 2026?

Yes. In most countries, crypto activity is taxed in some form. Selling, swapping, or spending crypto can create a taxable gain or loss. Staking rewards, mining income, and airdrops are often taxed as income when you receive them. Some countries offer tax breaks for long-term holding.

- In the US, crypto is treated as property, and both trades and income are taxable

- In the UK, Capital Gains Tax applies, and some rewards count as income

- In Germany, long-term holdings can be tax-free under certain conditions

- In Australia, crypto falls under capital gains tax rules

- In the UAE, there is no personal income tax, though business taxes or VAT may apply

Keep clear records of all transactions, separate income from trading gains, and track activity across wallets and exchanges. If you’re unsure, it’s best to speak with a tax professional.

This information is for general guidance only and is not legal or tax advice.

Final Verdict – Is Low Cap Crypto Worth It in February 2026?

Low cap crypto are worth considering for investment in February 2026. These are small and not very popular tokens that can jump at any time, but they also come with high risks: prices can drop fast, and liquidity can disappear quickly.

Investors in low cap crypto should choose coins carefully. The crypto industry is known for scam projects, so it is important to study a token before investing. Key risks include volatility, liquidity problems, rug pulls, smart contract bugs, and exchange risks.

Low cap crypto attract investors with high growth potential, but the risk of losing everything is real. Do not put all your funds into one project, diversify your portfolio, and do not expect fast or guaranteed profits.

FAQ

What is considered a low cap crypto?

Are low cap crypto assets riskier than large-cap cryptocurrencies?

What is the difference between low cap and micro cap crypto?

Does the price of a coin matter when defining market cap?

Why are low cap crypto coins more volatile?

Can low cap crypto really deliver 1000x returns?

How do you avoid low cap crypto scams?

Where can you buy low market cap crypto?

Are presales considered low cap crypto?

Is it legal to invest in low cap crypto in 2026?

Do you have to pay taxes on low cap crypto gains?

References

- Fluid Project Profile (Messari)

- Trending Cryptocurrencies (CoinGecko)

- Total Value Locked (TVL) Protocols (RWA) (DeFiLlama)

- Crypto Venture Capital Q1 2025 Report (Galaxy Research)

- US Crypto Policy Tracker: Regulatory Developments (Latham & Watkins LLP)

- Crypto Week: Market Insights (Betashares)

- What Is Bitcoin (BTC) Dominance? Chart Explained (Gemini Cryptopedia)

- H.R.3633 – 119th Congress (2025–2026): Digital Asset Market Clarity Act of 2025 (Congress.gov)

- AI Statistics 2024–2025: Global Trends, Market Growth & Adoption Data (Founders Forum Group)

- Top Meme Coins by Market Cap (CoinGecko)

- Volume 255: Digital Asset Fund Flows Weekly Report (CoinShares)

- Top Meme Sectors Market Cap Chart (CoinGecko)

- Bitcoin Breaches $86,000 While Volatility Rises (Yahoo Finance / Bloomberg )

- Binance Bitcoin/Stablecoin ratio signals rising buying power (CryptoQuant)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

Otar Topuria

Crypto Editor, 39 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.