ATH in January for Ethereum? Pectra Upgrade Sparks Hope for Bullish Ethereum Price Prediction While PlutoChain Gets Traction- Ethereum News Today

/PlutoChain/ – Ethereum, trading around $3,400, is getting attention as the highly anticipated Pectra upgrade approaches.

This upgrade will improve scalability and lower transaction costs, and it has sparked hope that ETH could soon hit new highs.

Aside from technology updates, there’s also growing excitement around increasing institutional interest and the rise of layer-2 solutions that are strengthening Ethereum’s ecosystem.

While it’s too early to call an all-time high, the combination of these factors has many wondering if January 2025 might mark a turning point for Ethereum.

PlutoChain ($PLUTO) is another emerging project that could tackle Bitcoin’s limitations head-on.

With its Layer-2 chain, it may be able to deliver near-instant transactions while enabling smart contracts — an upgrade that could expand Bitcoin’s use cases beyond payments.

How the Pectra Upgrade Could Transform Ethereum’s Scalability and Adoption – Price Prediction for 2025

Ethereum is currently trading at around $3,400 with a slight 2% increase over the past week and a 7% drop in the last 24 hours.

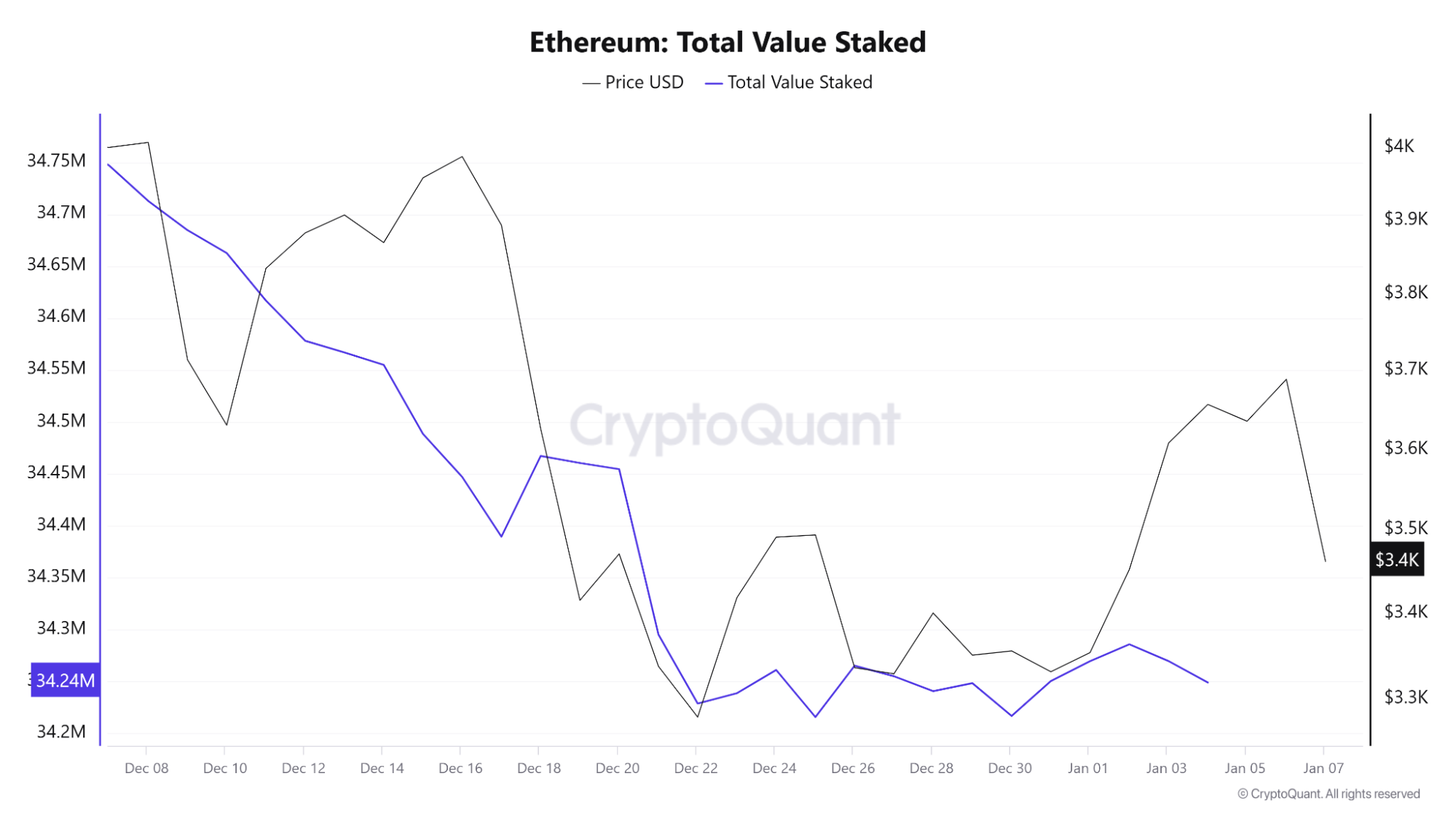

Ethereum has been at the center of intense market activity in recent weeks, with big shifts in investor behavior. Since early December, over 500,000 ETH has been withdrawn from staking protocols, according to CryptoQuant.

This decline in staked assets signals growing caution among investors, possibly due to profit-taking after a sharp price increase in recent months.

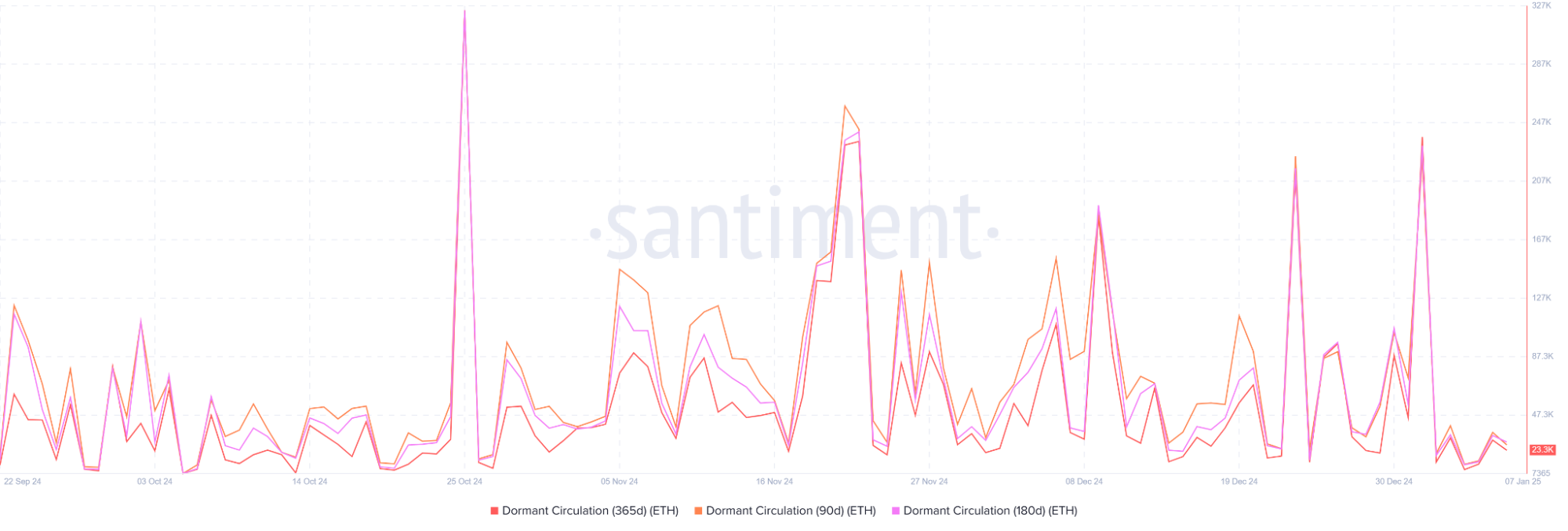

Data from Santiment highlights that much of the recent selling activity comes from short-term holders, with coins less than a year old seeing increased circulation.

Such patterns are typical during periods of price swings, as short-term holders often react swiftly to changing conditions. Meanwhile, WisdomTree, a major asset manager, recently deposited 11,733 ETH — valued at over $42 million — into Coinbase.

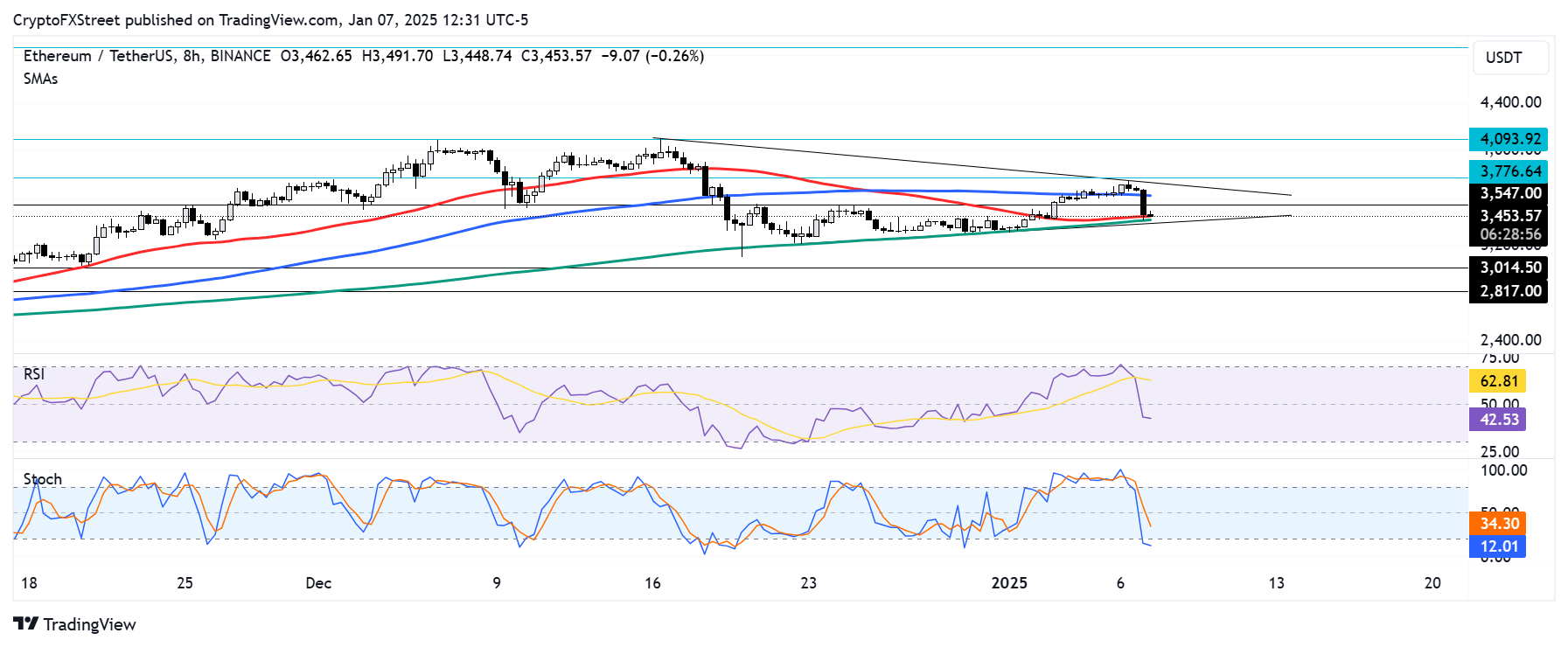

On the technical front, Ethereum’s price is consolidating within a symmetrical triangle pattern formed in mid-December.

After rejecting the upper boundary of the triangle, ETH has dropped below its 200-day Simple Moving Average (SMA), testing support at the lower boundary where the 100-day and 50-day SMAs converge.

A bounce from this level could trigger a breakout above $3,780, setting the stage for a rally toward key resistance at $4,093. If ETH manages to clear this hurdle with strong volume, it might even challenge its all-time high of $4,868.

Looking ahead, Ethereum’s upcoming Pectra upgrade in Q1 2025 has sparked optimism among retail and institutional investors. This transformative upgrade is designed to enhance the blockchain’s scalability, improve the staking experience, and optimize user interactions.

The new Ethereum Improvement Proposals (EIPs) included in the upgrade will address long-standing network challenges, making Ethereum a leading platform for enterprise-grade solutions and decentralized applications (dApps).

The combination of the Pectra upgrade, increasing adoption of layer-2 solutions, and Ethereum’s robust developer community could be key drivers for long-term growth.

Anonymous, a crypto analyst on X, says that major surges for ETH will probably come in Q2 2025 and that it might even outperform BTC in the next six months.

The Crypto Professor, another popular analyst, says that $4,500 is a realistic target for Ethereum in the upcoming weeks.

PlutoChain ($PLUTO) Could Bring Speed and Scalability to Bitcoin With a Layer-2 Foundation and Smart Contracts

Bitcoin’s widespread adoption has always been hindered by slow transactions, network congestion, and high fees.

PlutoChain ($PLUTO), a hybrid Layer-2 solution, may offer a potential fix for these challenges.

By establishing a parallel network, PlutoChain could reduce congestion on Bitcoin’s mainnet, potentially lowering transaction fees and enhancing scalability.

Historically, Bitcoin’s 10-minute block time has limited its efficiency, especially when compared to faster networks like Ethereum or Solana.

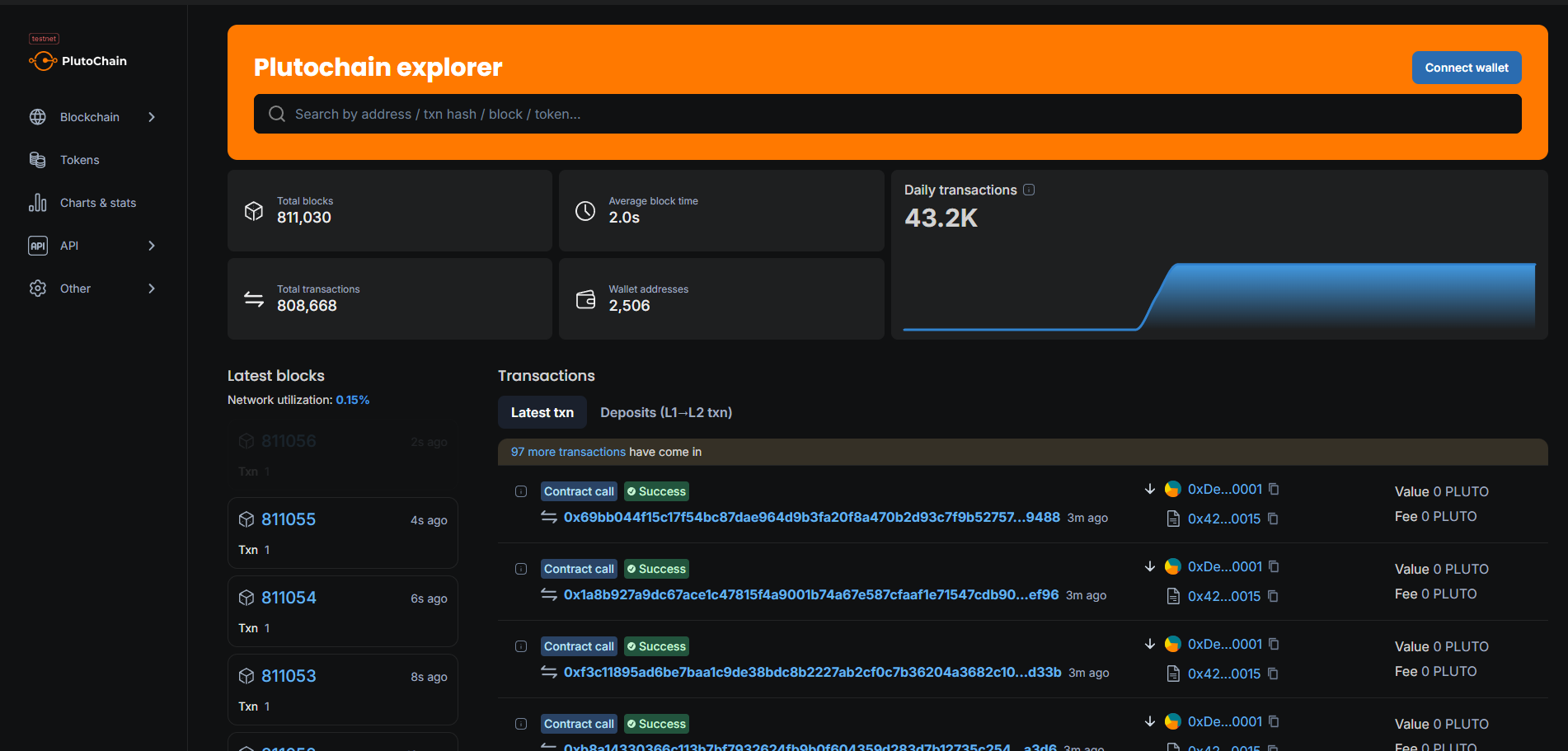

PlutoChain’s Layer-2 technology might reduce this block time to as little as 2 seconds on its own chain, potentially enabling quicker transactions and more efficient smart contracts, all while maintaining Bitcoin’s trusted core infrastructure.

This could position Bitcoin as more than just a store of value, opening the door to decentralized finance (DeFi), NFTs, and AI applications.

PlutoChain’s compatibility with the Ethereum Virtual Machine (EVM) may simplify the process for developers to transition Ethereum-based projects to Bitcoin.

On its testnet, PlutoChain has reportedly handled up to 43,200 transactions per day without significant delays or congestion, demonstrating its potential real-world efficiency.

Security is a top focus for PlutoChain. The network has undergone audits by SolidProof, QuillAudits, and Assure DeFi and regularly performs stress tests and code reviews to ensure compliance with international regulatory standards and to maintain user trust.

Governance may also be a key strength of PlutoChain. The platform’s development could be shaped by community input, with users able to vote on upgrades, partnerships, and new features through a transparent system. Proposals are submitted via the official Discord channel.

Final Words

The Pectra upgrade is coming to Ethereum soon and it could play a major role in pushing the world’s most popular altcoin to $5,000 or beyond.

PlutoChain is another project that could gain traction during this period due to its robust fundamentals and advanced technology.

With its emphasis on scalability, security, and community-driven innovation, PlutoChain might transform Bitcoin’s ecosystem, potentially expanding its use cases and addressing its long-standing limitations.

This article does not offer financial advice. Cryptocurrencies can be unpredictable and carry risks. It is important to conduct thorough research before acquiring any crypto asset. Forward-looking statements carry risks and are not guaranteed to be updated.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.