Mercy Mutanya is a Tech enthusiast, Digital Marketer, Writer and IT Business Management Student. She enjoys reading, writing, doing crosswords and binge-watching her favourite TV series.

Swedish fintech firm Klarna is close to reaching its $1 billion target in a funding round, say sources familiar with the matter.

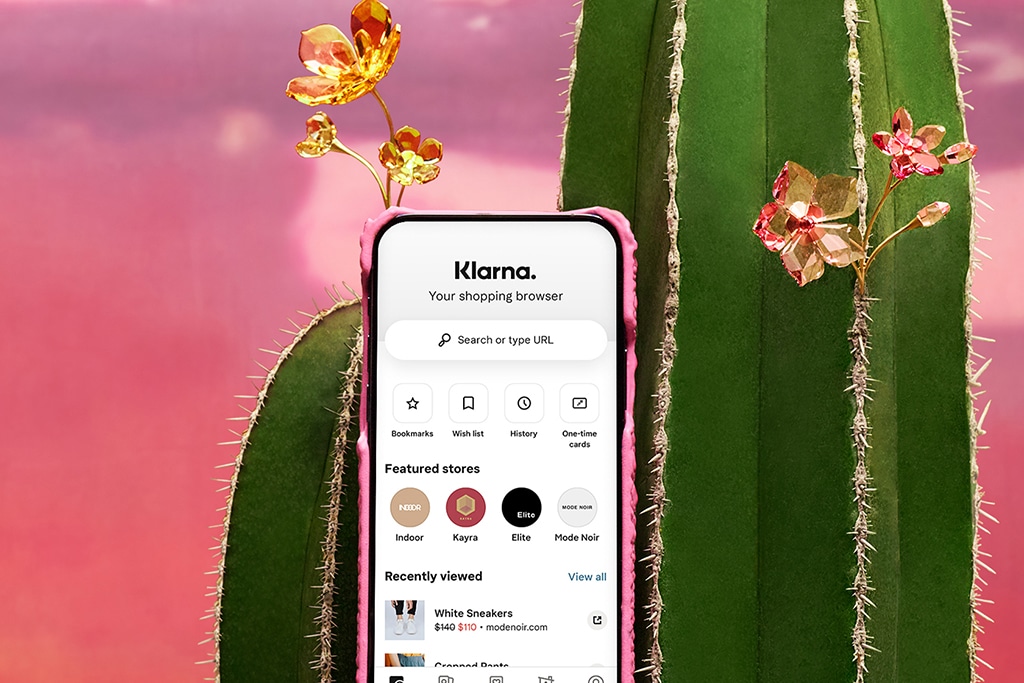

The $1 billion funding, which comes amidst IPO rumors, would bring the Stockholm-based Klarna valuation to $31B. Founded in 2005, Klarna is now one of the world’s most-used “buy now, pay later” (BNPL) service providers. The service allows customers to purchase items and “pay later” in installments. All interest-free.

Sources told CNBC that the deal “could close within days” citing an overwhelming response from investors. The rumored public listing would mean a huge payday for long-time investors like Atomico, Sequoia, Ant Group and entertainer/entrepreneur Snoop Dogg.

Klarna is among some major European tech-centric companies thought to be planning IPOs this year including, Deliveroo, TransferWise and Darktrace. Klarna CEO and co-founder Sebastian Siemiatkowski previously said the company could be listed this year, but will not make such decisions until their new CFO Niclas Neglen has settled in.

“Maybe it could happen this year, maybe it would be next year, but it’s obviously going to happen fairly soon,” Siemiatkowski said. “It’s definitely in the works but we haven’t officially started the process.

Klarna is yet to comment on speculations that this round of funding is for an IPO.

Klarna’s revenue saw a huge boost last year thanks to a lockdown-fueled rise in demand for BNPL plans. The company, whose retail partners include H&M, IKEA, Expedia Group, Samsung, ASOS, Peloton, Abercrombie & Fitch, Nike and AliExpress, has continued to expand into the U.S.

The growth of the BNPL industry has given rise to concern among regulators. The U.K government recently declared that the industry would come under the country’s Financial Conduct Authority (FCA) for stricter regulation.

Meanwhile, consumer advocacy groups are growing more vocal. One such organization, Which, claims that a survey they conducted revealed that 24% of BNPL users admitted to spending over-budget because of the service.

Klarna, however, is open to regulation.

“We’re on the right side of this. We are, with this product, challenging a massive industry that has overcharged consumers with overdraft fees, with interest-bearing terms of use. There’s a lot of misconceptions in the U.K. but when we get the chance to sit down with U.K. politicians … they get convinced and then they switch sides,” Siemiatkowski told CNBC

Read more business news on Coinspeaker.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Mercy Mutanya is a Tech enthusiast, Digital Marketer, Writer and IT Business Management Student. She enjoys reading, writing, doing crosswords and binge-watching her favourite TV series.