Lido Adopts stETH/USD Chainlink Price Feed to Expand stETH Adoption Across DeFi

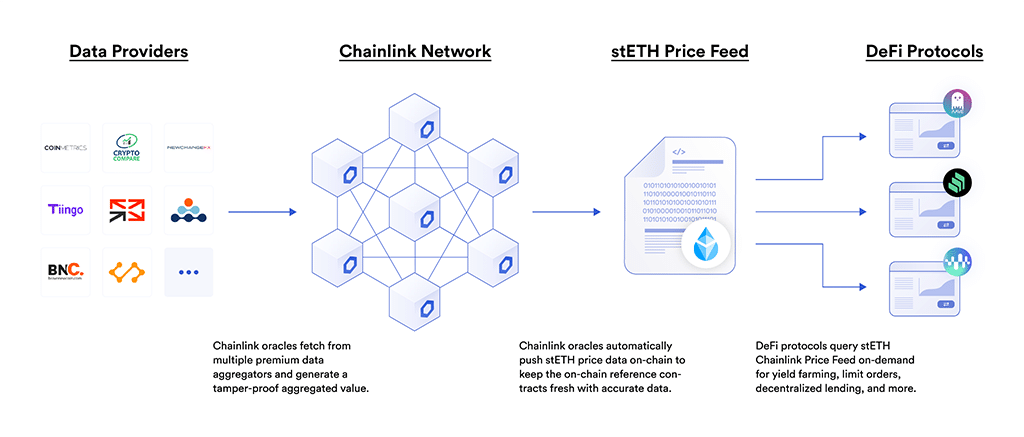

Lido is excited to announce that we are now sponsoring the first in a series of Chainlink Price Feeds to enable DeFi protocols across leading blockchains to quickly and securely support Lido staked assets. With the stETH/USD Price Feed live on Ethereum mainnet, DeFi projects can now reference this Chainlink oracle contract at any time to get the current price of stETH when executing key on-chain functions. In fact, the stETH/USD Chainlink Price Feed is already being collectively used and sponsored by a decentralized community of users, including Aave, Compound, and Enzyme.

The result of our ongoing work with Chainlink is an expansion in the utility of stETH, as users can earn the normal staking rewards from Lido while also deploying stETH as collateral in DeFi. It also makes it very easy for new DeFi protocols to add support for stETH, given they have immediate access to a secure and reliable oracle solution. We plan to expand our support of Chainlink Price Feeds in the future to aid in multiple platform initiatives, including decentralized price oracles for bLUNA, stSOL, and the assets of new blockchains that Lido plans to support such as Polkadot, Avalanche, and Matic.

We selected Chainlink as it’s the most time-tested decentralized oracle network in the industry, demonstrating verifiable reliability across multiple blockchains during the most extreme network congestion and market volatility. Not only do Chainlink Price Feeds supply real-time price data with wide market coverage, but it’s a blockchain agnostic oracle solution, which will be critical to aiding in our multi-chain expansion.

Lido is an industry-leading liquid staking protocol that allows users to stake various coins and receive staked liquidity tokens in return at a 1-to-1 ratio. Staked liquidity tokens allow holders to earn staking yield while also deploying their staked assets within a wide range of DeFi protocols such as money markets and yield farming programs. LIDO is fully DAO-operated and transparent, and currently supports staking for ETH, LUNA, and SOL – this includes over 7 million ETH locked on Lido at the time of writing.

stETH tokens represent a share of the total pool of staked ETH, which Lido automatically delegates to validators on the Ethereum network. When these delegations accrue rewards on their stake, the total ETH under management grows, increasing the value of stETH tokens for holders. Users can simply hold stETH for rewards, trade their stETH on the open market, or redeem it at any time for a proportional amount of ETH.

One of the main value propositions of Lido besides democratizing access to staking rewards is increasing the utility of staked assets without sacrificing the underlying cryptoeconomic security those staked assets bring to blockchains and various other protocols. While DEXs can easily support staked assets like stETH, there is a whole subset of DeFi applications like money markets that need access to real-time prices of the staked assets. Hence, why we have sponsored the stETH/USD Chainlink Price Feed and will follow with support for stSOL, bLUNA, and more.

We decided to sponsor Chainlink Price Feeds over other solutions because of their specific optimizations for:

-

- High-Quality Data – Chainlink Price Feeds source data from numerous premium data aggregators, leading to price data that’s aggregated from hundreds of exchanges, weighted by volume, and cleaned from outliers and suspicious volumes. Chainlink’s data aggregation model helps generate precise global market prices that are resistant to API downtime, flash crash outliers, and data manipulation attacks like flash loans.

- Secure Node Operators – Chainlink Price Feeds are secured by independent, security-reviewed, and Sybil-resistant oracle nodes run by leading blockchain DevOps teams, data providers, and traditional enterprises with a strong track record for reliability.

- Decentralized Network – Chainlink Price Feeds are decentralized at the data source, oracle node, and oracle network levels, generating strong protections against downtime and tampering by either the data provider or the oracle network.

- Transparency – Chainlink provides a robust reputation framework and set of on-chain monitoring tools that allow users to independently verify the historical performance of node operators and oracle networks, as well as check the real-time prices being offered.

In addition to Chainlink Price Feeds, we are actively exploring how to automate certain functions of our smart contracts using Chainlink Keepers, further decentralizing the Lido platform and improving the user experience. Stay tuned for future details!

Vasiliy Shapovalov, Co-founder of Lido, stated:

“Integrating Chainlink Price Feeds is an important step in supporting the next wave of integrations for Lido’s staked assets, such as within money markets and certain yield farming apps. Chainlink effectively serves as a great enabler for DeFi protocols looking to quickly and securely add support for assets like stETH, removing manual process and mitigating security risks around using unproven oracle solutions.”

About Chainlink

Chainlink is the industry standard for building, accessing, and selling oracle services needed to power hybrid smart contracts on any blockchain. Chainlink oracle networks provide smart contracts with a way to reliably connect to any external API and leverage secure off-chain computations for enabling feature-rich applications. Chainlink currently secures tens of billions of dollars across DeFi, insurance, gaming, and other major industries, and offers global enterprises and leading data providers a universal gateway to all blockchains.

Learn more about Chainlink by visiting chain.link or read the documentation. To discuss an integration, reach out to an expert.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.