Darya is a crypto enthusiast who strongly believes in the future of blockchain. Being a hospitality professional, she is interested in finding the ways blockchain can change different industries and bring our life to a different level.

Once the new service launches, MoneyGram platform will be using USD Coin (USDC) that the fintech company Circle and crypto exchange Coinbase jointly launched on the Stellar blockchain in order to quickly move value around the globe.

The US largest money transfer company MoneyGram International Inc (NASDAQ: MGI) is planning to launch a service that would help carry out stablecoin remittances. For the initiative, MoneyGram partnered with Stellar Blockchain.

MoneyGram CEO Alex Holmes said:

“The cryptocurrency world and the fiat world are not really compatible today. We are trying to be a bridge between the cryptocurrency world and the fiat world.”

As a result of this partnership, users will be able to send stablecoins and easily convert them to hard currency in MoneyGram agent locations. Once the new service launches, MoneyGram platform will be using USD Coin (USDC) that the fintech company Circle and crypto exchange Coinbase Inc. (NASDAQ: COIN) jointly launched on the Stellar blockchain in order to quickly move value around the globe. Then, users can cash out the stablecoins for fiat currency through MoneyGram’s own network.

Cryptocurrencies are volatile, you can never be absolutely sure that there are no risks associated with these assets. For example, those who bet on Terra recently suffered because of its ecosystem’s collapse. The crash of Terra affected the entire industry, leading to a downturn in the crypto market. However, despite the volatility, MoneyGram CEO believes that the future is in cryptos.

Holmes said:

“Cryptocurrency is obviously here to stay and it’s going to be here for a long time despite recent selloffs and volatility. I think adopting it, bringing it into the mainstream is important.”

Holmes also hopes that USD Coin has a very different implementation, which means that it will not fall in the same way TerraUSD did.

Previously, MoneyGram had a partnership with Ripple. It was employing Ripple’s product for cross-border payment and foreign exchange settlement. However, after the SEC filed a complaint against Ripple, alleging that it had been engaged in illegal security offering through sales of XRP, MoneyGram also faced a lawsuit over its misleading statements regarding the legal status of the XRP token.

The relationship between remittances and digital currencies has also grown significantly. Last year, remittances to low- and middle-income countries grew to $589 billion. And this year, this number will further grow. According to World Bank, the remittances will increase by 4.2 percent this year to reach $630 billion.

The new stablecoin remittances service offered by MoneyGram will spread the use of cryptos.

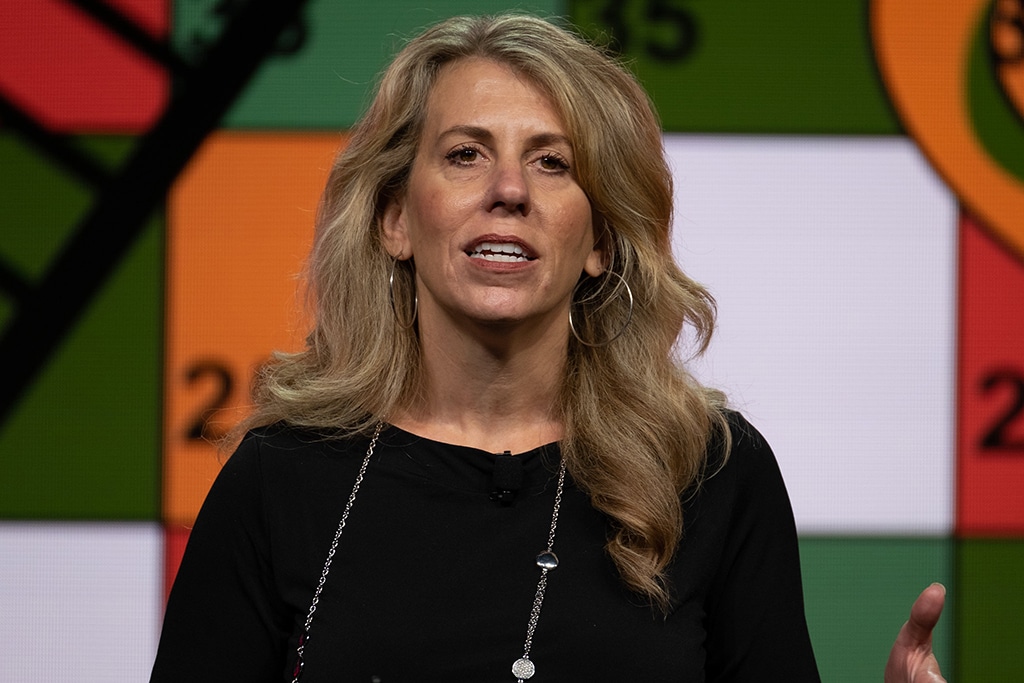

Denelle Dixon, CEO of the Stellar Development Foundation, said:

“There are billions of people who depend on cash around the world and could benefit from the utility that digital assets and blockchain offer. The answer is what we are building through this partnership: a service to help them move from cash to digital assets.”

The top five recipient countries for remittances in 2021 were India, Mexico, China, the Philippines, and Egypt. This year, it will change, as the Russian invasion of Ukraine has affected the international payment systems with implications for cross-border remittance flows.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Darya is a crypto enthusiast who strongly believes in the future of blockchain. Being a hospitality professional, she is interested in finding the ways blockchain can change different industries and bring our life to a different level.