With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

Morpho (MORPHO) soared over 40%, reaching an all-time high of $4.11 on January 17, 2025, following a groundbreaking partnership with Coinbase to offer Bitcoin-backed loans to US customers.

Edited by Julia Sakovich

Updated

2 mins read

Edited by Julia Sakovich

Updated

2 mins read

Morpho’s native token MORPHO soared over 40%, reaching an all-time high of $4.11 on January 17, 2025. The surge followed a groundbreaking partnership with Coinbase, introducing Bitcoin-backed loans to US customers. Trading volume spiked 183% to $222 million, reflecting heightened investor interest in the DeFi platform.

Source: CoinMarketCap

The collaboration revolutionizes borrowing by eliminating reliance on credit scores. Borrowers over-collateralize Bitcoin, receiving loans below their posted value. Coinbase’s wrapped Bitcoin (cbBTC) facilitates this process, allowing users to mint cbBTC while utilizing Morpho’s lending services.

The Morpho/USDT chart on the 4-hour timeframe indicates a strong bullish trend, with the price rising from $2.50 to $4.04. RSI has entered the overbought zone at 75.59, signaling potential momentum exhaustion. The MACD histogram confirms bullish momentum with rising green bars.

Source: TradingView

Further analysis shows a recent breakout above $3.50, indicating significant buying pressure. The RSI at 75.59 suggests overextension, while support near $3.50 could be critical during a pullback. MACD lines diverging upward reflect sustained positive sentiment and potential continuation.

The MACD line at 0.19 remains above the signal line at 0.15, confirming a bullish crossover. If resistance at $4.10 is broken, upward momentum could persist. However, a decline below $3.58 could reverse the recent uptrend, potentially pulling prices down to $2.26. Investor profit-taking remains an unpredictable factor that could hinder continued bullish momentum.

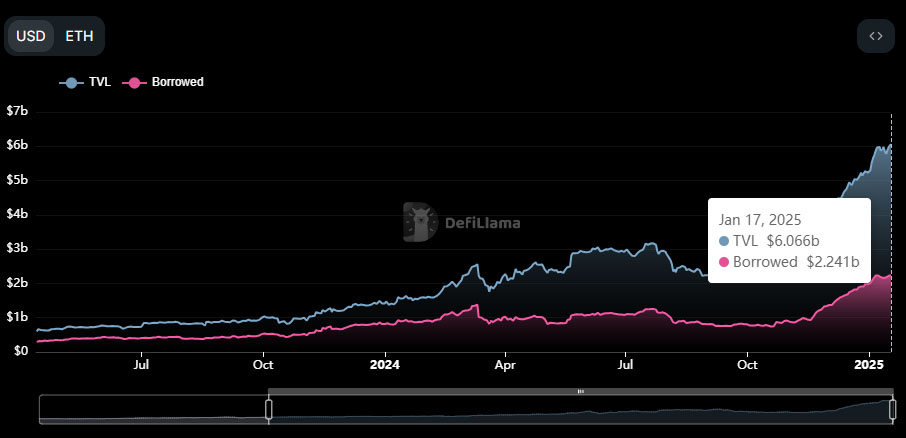

The Morpho Protocol has also witnessed explosive growth in its total value locked (TVL), now at an impressive $6.06 billion, according to DefiLlama. This reflects the project’s rapid expansion into Ethereum layer-2 networks, boosting its daily fees and user activity. Morpho’s infrastructure supports various use cases, including credit cards, savings, and permissioned markets, while integrating with platforms like Moonwell and Centrifuge.

Source: DefiLlama

A broader push into decentralized finance has strengthened its position, especially as the sector rebounds following last year’s market rally. Despite this progress, the industry faces scrutiny from new IRS broker reporting rules, which have ignited debates about regulatory challenges for DeFi supporters.

The buzz surrounding Morpho isn’t just about numbers. The platform recently secured $50 million in funding, with Ribbit Capital leading the round. Major players like a16z, Pantera Capital, and Coinbase Ventures also backed the initiative, signaling strong institutional faith in its potential.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.