Naga is a fairly new cryptocurrency developed the Naga Group, a Hamburg-based company operating in financial services, financial technology and innovation incubation categories. Founded in 2015, the group develops and launches innovative fintech solutions, which aim to transform an outdated banking sector. One of such is NAGA debit card, a revolutionary new crypto-fiat debit card that aims to disrupt the whole crypto industry.

Indeed, Naga Token (NGC) is one of the newest and most promising cryptocurrencies out there. Looking on D1 chart, one can easily see this is a very attractive trading instrument with low entry level and moderate risk exposure.

With the highest high at $4.35 and the lowest low at 0.60, even a beginner investor would see the 7-fold upside potential here, while more seasoned professionals can compare NAGA potential with Bitcoin price dynamics.

Still, we can’t say Naga is at its lowest yet, as there is some room for further going down, as Chief Analyst at RoboForex Dmitriy Gurkovskiy said.

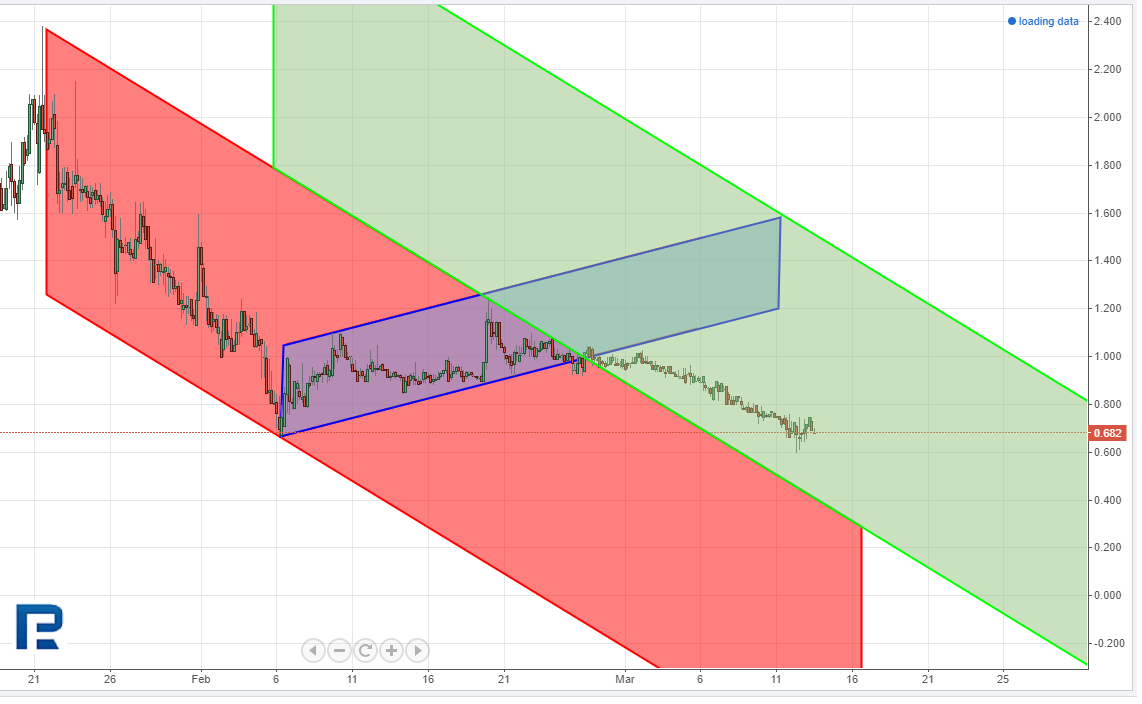

Photo: Roboforex

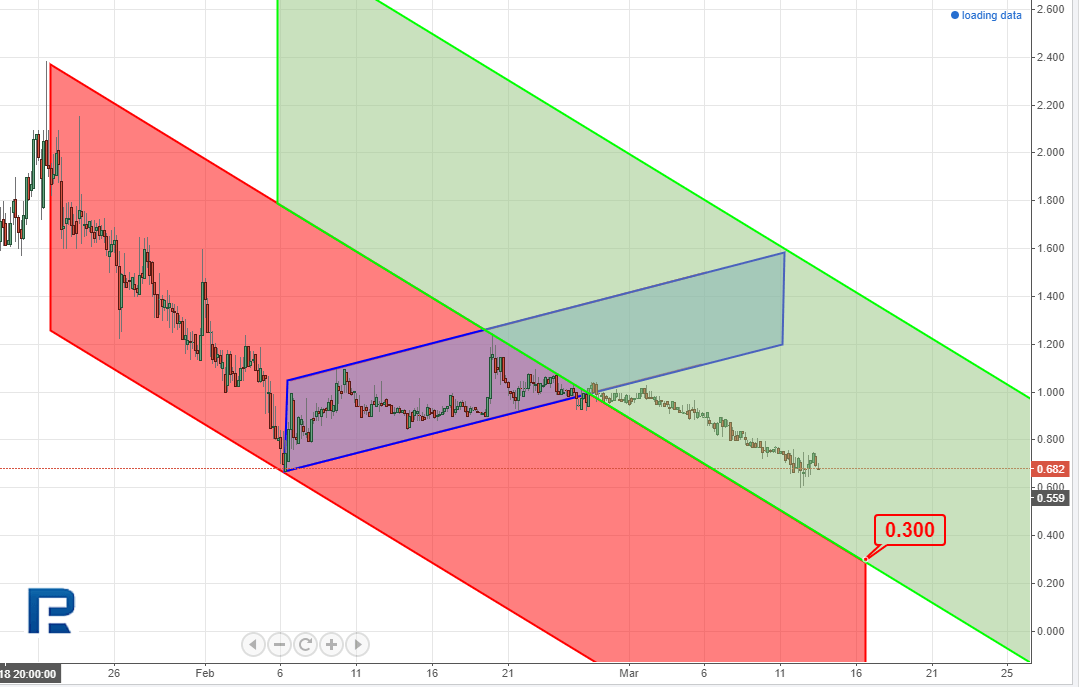

To understand how much room for downside movement we still have, we’ve got to scale down to some smaller time frames, such as H4. It’s showing there’s a downtrend, although it is forming inside a projection channel.

The price moved from the previous channel to this one after upside correction, which may signal that current downward momentum is fading out, with the downtrend getting weaker.

One of the major downtrend targets may be around $0.30, i.e. at the current channel support. This is not a final target, though, as the price may well head lower to $0.20 or even $0.10. You’ll have to constantly monitor the situation in order to make informed decisions while adjusting support and resistance levels of the current trend.

Photo: Roboforex

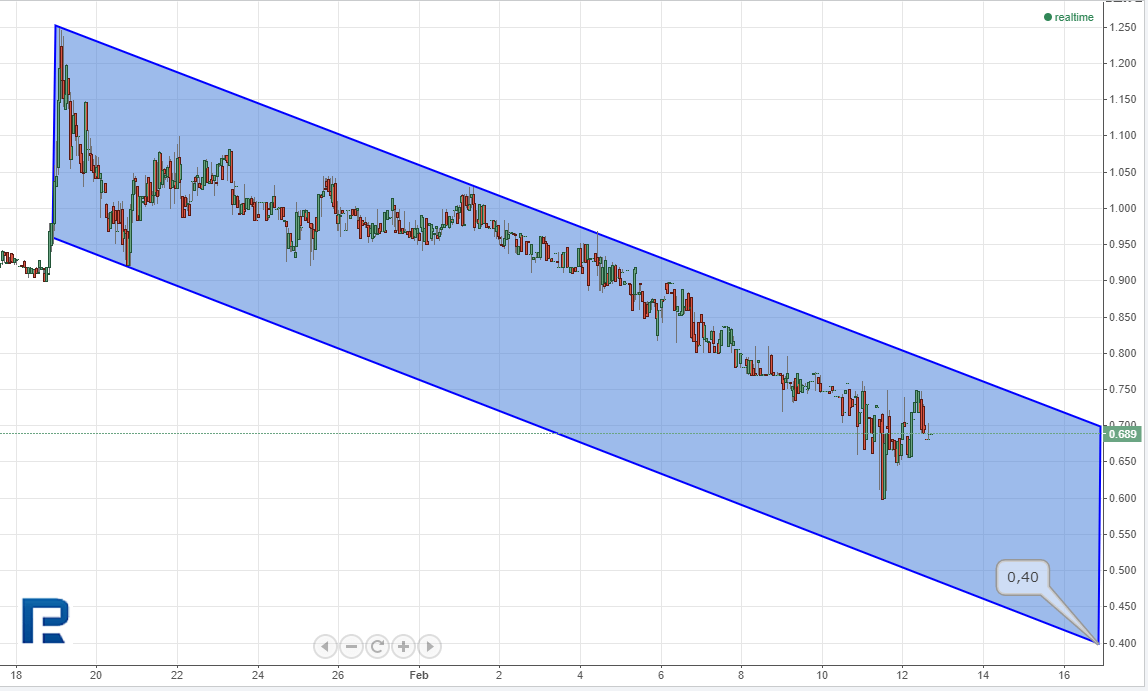

Most attention is however driven to the H1 time frame, which shows some range trading between $0.40 and $0.70. Statistically, one may assume that after the price goes down to $0.40, it may pull back, but to $0.55, not to $0.70.

Further testing of $0.40 may result in breaking out and falling by the same number of pips as the current 1-hour channel range.

This makes us think the absolute low will be at $0.10. With this being quite possible, the price is not quite likely to be around $0.10 for long, and few investors may have time to exploit it.

Photo: Roboforex

Still, Naga is going to be an attractive instrument before it reaches its current high again. As for the further rising potential, one may only throw wild guesses at the moment; meanwhile, taking informed decisions requires in-depth analysis and being always familiar with current events.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.