Interactive Webinar Platform ON24 to List on NYSE, Seeks $2.22B Valuation in IPO

ON24 noted that it has applied for listing on the New York Stock Exchange where it is set to trade under the ticker symbol ‘ONTF’.

ON24 noted that it has applied for listing on the New York Stock Exchange where it is set to trade under the ticker symbol ‘ONTF’.

The buyback program will see UBS Group purchasing up to $4.5 billion of shares with $1 billion to be used for this operation in the first quarter of the year.

According to the recent survey report, 59% of the respondents believe that Zoom stock will hit $500 again by 2022.

Wall Street investors are optimistic about the results that big tech companies will announce ahead this week. Since all indices are currently at their all-time highs, investors are maintaining caution.

Kimberly-Clark’s full-year 2020 net sales came up at $19.1 billion, showing a 4 percent increase, with organic sales up 6 percent. The organic sales for the fourth quarter grew by 5 percent.

Referring to the increasing demand for the iPhone, Dan Ives said Apple could have sold about 90 million iPhones by the December quarter.

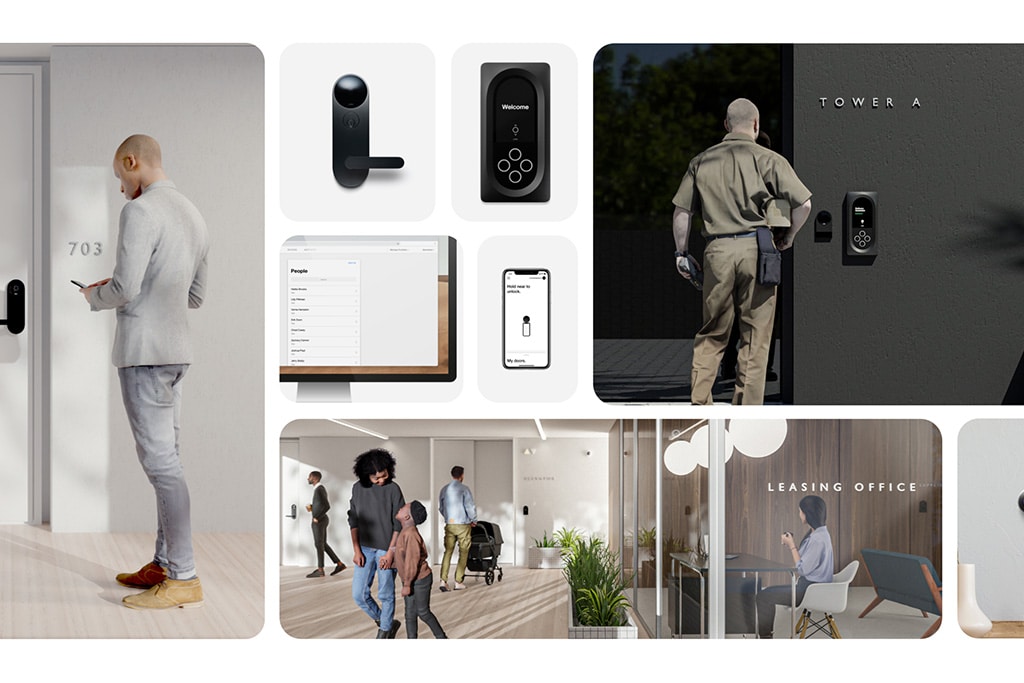

After the news about the deal with Latch, TSIA stock has skyrocketed in the pre-market.

Merck has a reported market valuation of approximately $204.88 billion with 2.53 billion outstanding shares. The company’s leadership has opted to commit its resources towards developing coronavirus therapy drugs.

The shares of Google were also boosted by the corresponding redesign of the search engine to feature COVID-19 related data.

Philips however in a statement revealed that, even though its net profit for 2020 rose, it saw “uncertainty” this year due to the COVID-19 pandemic.

This move by Coinbase will allow all its current and past employees as well other private stockholders to sell their stock before the IPO on the Nasdaq Private Market.

Besides being subjected to speculative traders, GameStop has experienced an increase in demand for its products since the onset of the coronavirus pandemic.

Last year, Evergrande showed off six new electric vehicles under a brand called Hengchi, with the hope of starting production this year.

According to Chuck Carlson, CEO at Horizon Investment Services, the upcoming reports could help determine whether the resurgence in growth stocks will continue.

Trustly’s parent company, Nordic Capital, is working with Goldman Sachs, JPMorgan Chase, and Carnegie on the IPO. Besides, it is reportedly in the process of hiring more banks to launch the IPO in late April or early May.