Trustly Acquires SlimPay for Over $75M in European Expansion Bid

Trustly acquired SlimPay shortly after launching its data engine – Trustly Azura.

Business news features trending events about all activities that relate to daily business engagements around the world.

Explore the latest business news today about high-profile deals, the world’s biggest investors, key initial public offerings (IPOs), ambitious startups, and more.

The primary goal of every business is to make a profit. Making profit involves various economic and commercial activities such as operations, investments, financing, etc.

For the most part, a business starts with a business idea (the thought) and a name. Subject to the idea of the business, broad statistical surveying might be important to decide if transforming the thought into a business is plausible, and if the business can convey an incentive to customers. The business name can be one of the most significant resources of a firm; cautious thought should, in this manner, be given while picking a business name. Organizations working under invented names are usually enlisted with the regulatory bodies. The ownership of a business can either be in a sole proprietorship or a form of partnership among shareholders, although most of the top firms in the world today are jointly owned.

Most organizations are usually based on the structure of a strategy for continuous growth and expansion, which is a conventional record itemizing a business’ objectives and targets, and its systems of how it will accomplish the objectives and destinations. Marketable strategies are practically fundamental when getting capital to start business activities.

It is equally essential to decide on the legal framework of a business. Based on the nature of a business, there might be need to obtain suitable grants, stick to staffing prerequisites, and get licenses to lawfully work. In numerous nations, business firms are viewed as a juridical entity, this implies that they can possess property, procure debt, and be charged in the court of law.

Coinspeaker offers you cutting edge business news and headlines on the world’s most important companies as it relates to their services, operations, and market involvements.

Trustly acquired SlimPay shortly after launching its data engine – Trustly Azura.

X’s legal team argues that the company did not mandate employees to go the arbitration route and as such cannot be expected to cover the larger share of the filing fees.

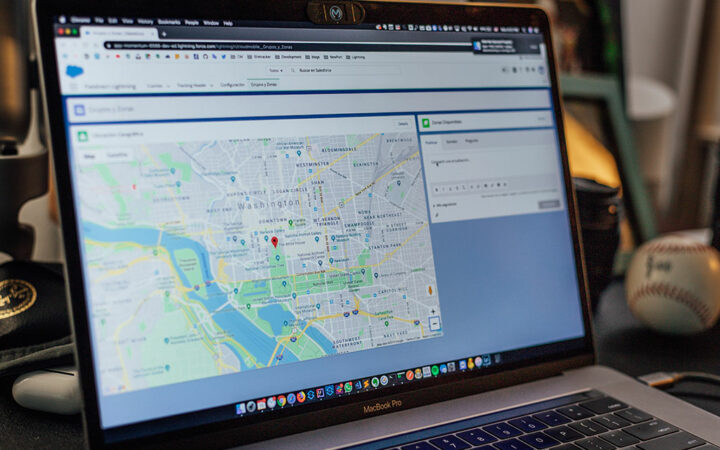

Google’s transition towards monetizing its mapping products is not only a strategic financial move but also a response to the evolving economic landscape.

Creative Planning is a registered investment advisor boasting a workforce exceeding 2,100 individuals. It overseas $245 billion in AUM.

A DoorDash spokesperson has revealed that the company will continue to seek ways to perfect the AI service.

Uber Eats is seeking to stay ahead of some of its direct competitors, such as DoorDash and Instacart, by using AI to improve food delivery.

Apple’s dominance in this arena is further underlined by its complete control over the top shipping models.

The Indian billionaire highlighted during Reliance’s annual general meeting that JFS intends to further widen its financial services with global partners including Blackrock.

The company said the acquisition is expected to enhance its market share and foster synergy with its existing products, ultimately boosting its overall competitiveness.

With the infusion of assets and insights from Didi, Xpeng is seizing the opportunity to develop an affordable electric car under a new mass market brand, codenamed “MONA”.

Huge stock selling for the China’s Evergrande Group trigged on Monday, as trading for the stock started a month after the real estate giant filed for the US bankruptcy.

Alibaba revealed its intention to provide the two AI models as open-source solutions to the global community.

Watches of Switzerland Group has undergone rapid expansion in recent times, establishing itself as a dominant force in the global market.

Gap Inc’s new CEO Richard Dickson took over after the company reported an 8 percent drop in sales in Q2 to $3.55 billion, compared with $3.86 billion a year earlier.

Hugging Face provides various tools with AI code for data science hosting and development. The startup plans to use fresh funds for further expansion.