VW-backed QuantumScape to Go Public at $3.3B Valuation

QuantumScape said that it plans to go public. It is the latest transportation startup to integrate with a special purpose acquisition company or SPAC.

QuantumScape said that it plans to go public. It is the latest transportation startup to integrate with a special purpose acquisition company or SPAC.

After announcing more jobs in the U.S., Amazon has recently revealed plans to add more permanent roles in the UK. The company is also open to temporary employees.

French drugmaker Sanofi and Britain’s GlaxoSmithKline revealed that they had started a clinical trial of their protein-based COVID-19 vaccine candidate, aimed at reaching the final testing stage by December.

SoftBank decided to invest in the sector using its own assets through the replacement to the $100 billion Vision Fund as it is trying hard to draw the attention of potential investors.

Walmart (WMT) is introducing Walmart Wonder Lab, a virtual game testing hub created to replace the retailer’s annual physical toy testing.

Alphabet Inc. stock (NASDAQ: GOOGL) jumped 3.76% yesterday to close the day trading at $1717.39. This came after the company announced plans to develop a self-sufficient new town-like tech hub in the Mountain View area.

Despite the green ticks seen in key tech stocks, traders appear to have taken profit off the shares of Apple and Tesla as both stocks strive to stabilize after the implementation of their respective stock splits.

Through a filing to the SEC, Baillie Gifford & Co. disclosed that it has sold 19.23M of Tesla (TSLA) shares to meet the company’s internal guidelines. Tesla shares dropped by nearly 5% yesterday and lost another 2% after hours.

Li’s 8.5% stake in Zoom (ZM) added $3.2 billion to the billionaire’s wealth yesterday following Zoom’s cataclysmic growth amid the pandemic.

Macy’s jumped over 6% at the pre-market. The surge is attributed to the stronger than anticipated 2020 Q2 results across all its three brands: Macy’s, Bloomingdale’s and Bluemercury.

Major stock indexes including the Dow Jones Industrial Average gained 215.61 points, or 0.8%, to close at 28,645.66. The S&P 500 climbed 0.8% to 3,526.65 and the Nasdaq Composite advanced 1.4% to 11,939.67. Both the S&P 500 and Nasdaq hit all-time highs.

Zoom (ZM) stock surged 40.78% on Tuesday. The impressive performance is attributed to the 2020 Q2 results released earlier in the week.

Tesla plans to sell its stocks worth $5 billion through banks. Wedbush analyst Dan Ives called this idea a “smart move”.

Apple expects a massive demand for its upcoming flagship 5G iPhone 12 and is all geared up for the launch next month in October 2020. Apple has successfully dodged the coronavirus economic slowdown and despite the contracting economy, it expects to do it in the coming quarters as well.

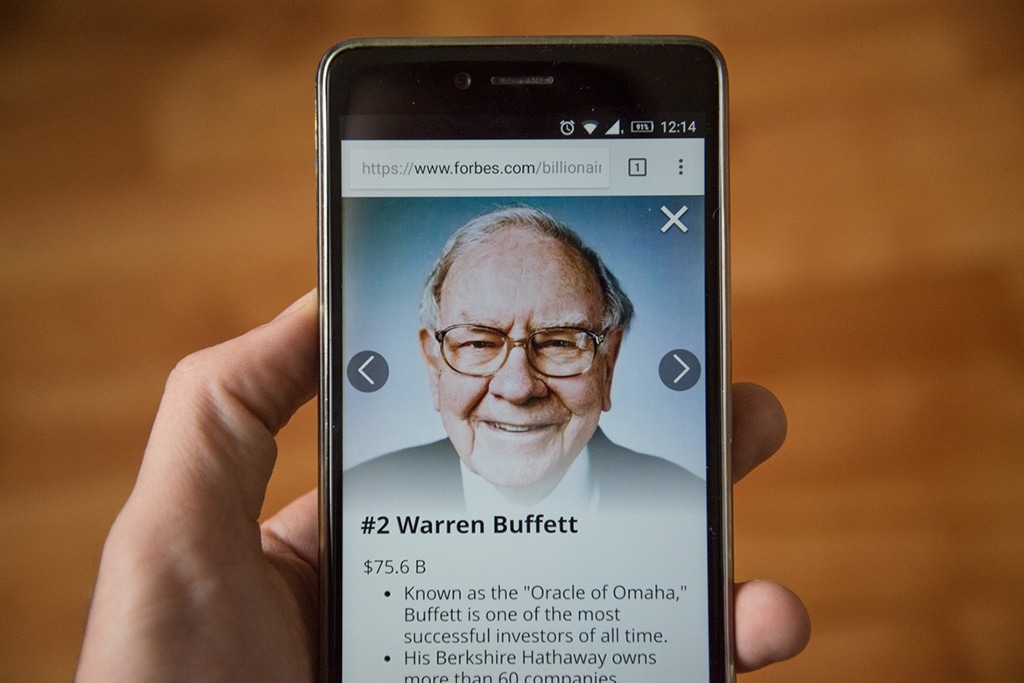

Warren Buffett has changed his mind about gold as an investment, prompting some people to think that he might do the same with BTC. Max Keiser has predicted that the Berkshire Hathaway CEO will panic-buy Bitcoin at $50,000.