Coinbase Profitability Would Have Been $2B if It Had Invested Its Seed Money into Bitcoin

Many analysts believe that if Coinbase had had more faith in Bitcoin, its profitability would have been remarkably boosted.

Stay ahead of the crypto curve with in‑depth coverage of the digital‑asset ecosystem. Here you’ll find the latest on new coin launches, regulatory shifts, wallet innovations and market movements across major chains. Whether you’re a seasoned trader or just exploring the space, our timely updates offer clarity on the crypto universe’s fast‑evolving landscape.

Many analysts believe that if Coinbase had had more faith in Bitcoin, its profitability would have been remarkably boosted.

The growing adoption of Bitcoin by large institutions is also a factor that affects the expansion of the crypto market.

Coinbase Pro continues to explore new digital assets to add to their platform. On Wednesday, April 7 it announced it is listing a number of tokens that have shown promise to investors and passed their standards.

The digital advertising agency Amris.media team will participate in the international conference Blockchain Wave in Antalya and will share the latest trends in the staking field.

With almost 3 times the revenue predicted by market analyst DA Davidson, Coinbase is likely heading for a bumper listing next week. Da Davidson pegs COIN stock price to $400+ per share.

CZ said he had sold his apartment to buy Bitcoin some years ago. Moreover, he also left his job back then.

QuickX has been working towards wider acceptance of cryptocurrencies through its various crypto-centric products.

Autograph will provide interactive offerings including live auctions, physical product drops, and also in-person experiences.

The Messari study showed that Coinbase listings bring much more returns to investors in comparison to other exchanges like Gemini, Binance, Kraken, FTX, and OKEx.

The $20 million venture capital firm makes its first allocation in FinTech payment platform COTI offering financial solutions to the crypto community.

A Twitter user, however, countered Allaire’s opinion on USDC and PayPal.

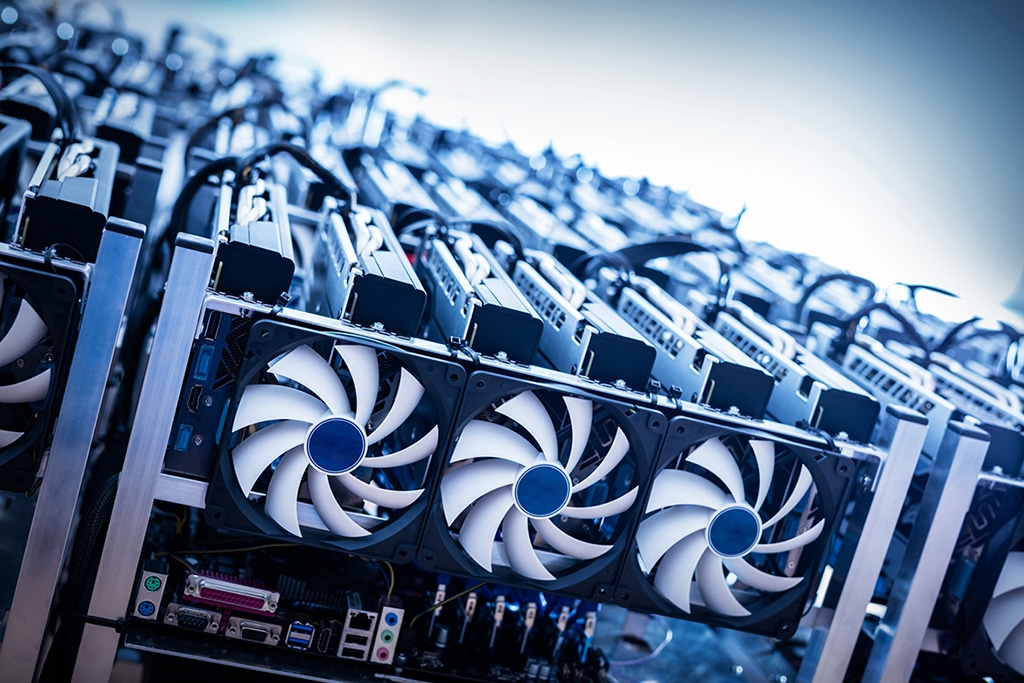

Hindenburg stated in their report that Ebang failed in their mining machine business and turned their attention to establishing a cryptocurrency exchange called Ebonex.

The potential launch of a CBDC following the developmental work being carried out by the Riksbank may not be feasible under current banking laws.

According to the prosecutor, Hayes was found to have based the BitMEX exchange in Seychelles in an attempt to evade regulatory scrutiny.

The SEC seeks to compel Ripple to register XRP as security or pay a fine for selling it as an unregistered security.