UK Financial Services and Markets Bill Includes Stablecoins Regulations

The UK Treasury Department had earlier called for regulations for only those stablecoins that are pegged to a fiat currency.

For the average millennial or at least anyone that pays attention to the business world, the term “cryptocurrency” would not seem like such a strange word. If that is, then the terms Bitcoin, Ethereum or at least Blockchain should ring a bell. One might wonder, why are these terms suddenly so prevalent, especially cryptocurrency news? Computing is getting rather pervasive and the society is leaning towards digital services. The finance world too isn’t spared as the disruption of technology into this sector has fostered the birth and development of Fintech organizations.

These Fintech organizations look to digitize payments and transactions, offering the same services that are currently in existence but in a better, efficient and more effective way.

Blockchain is the network upon which most of these cryptocurrencies operate on. The history of blockchain and bitcoin, in particular, does not have a definite story. In 2009, an individual or group of individuals known to be “Satoshi Nakomoto” developed and published the technology to allow people make digital payments between themselves anonymously without having an external party to verify or authorize the transfer of the currency being exchanged.

Although technologies like this might seem rather complex, understanding how Blockchain works is quite easy, given that one has a basic idea of how networks work. Blockchain is simply a database shared between several users, containing confirmed and secured entries. It is a network, where each entry has a connection to its previous entry.

This technology affords a very secure model whereby every record in the database cannot be tampered with. Apart from the stellar security that this network offers, the transparency and speed at which the network operates give it an edge over the conventional way of conducting transactions.

In simple terms, cryptocurrencies are just monies in digital form, transacted via digital means and over a digital network. The transfer of these currencies is utilized with cryptography and the aforementioned blockchain network. Up until the 2010s, cryptocurrencies were not really known until Bitcoin made its breakout and this gave rise to the birth of new cryptocurrencies.

Cryptocurrencies have had their fair share of bullish and bearish trends, going to show how unstable they can be. The latest cryptocurrency news reports lots of people predicting prices for various cryptocurrencies in the years to come but no-one can say for sure.

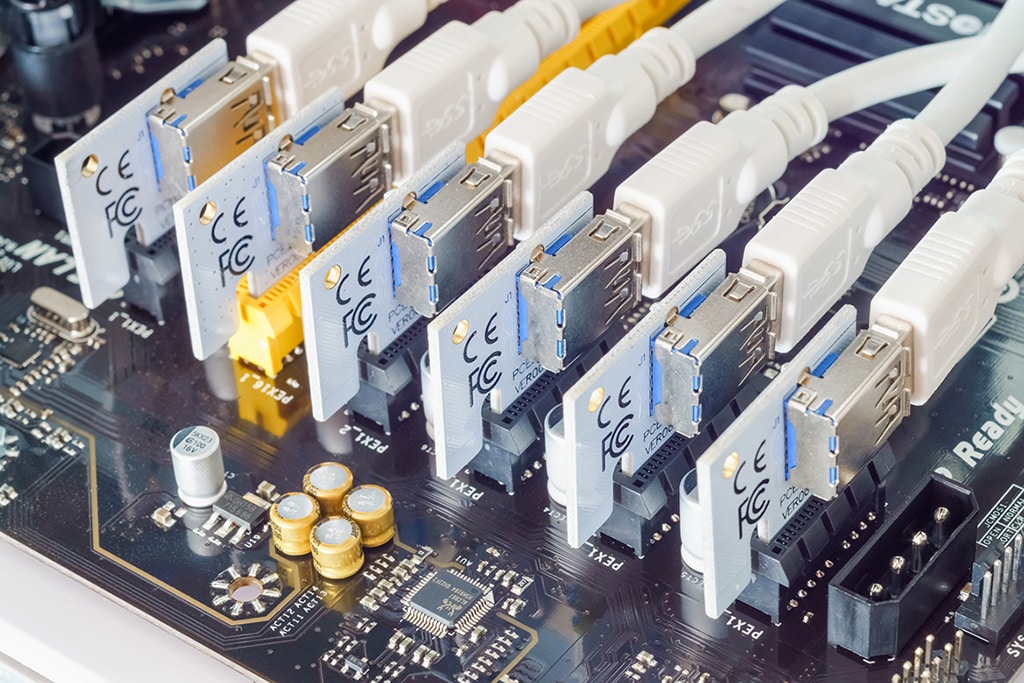

Blockchain, on the other hand, is making its way into pervasive computing, especially IoT, giving way for the development of new solutions that embrace data security and transparency.

The UK Treasury Department had earlier called for regulations for only those stablecoins that are pegged to a fiat currency.

Despite seeing its highest vehicle production month in history, Tesla also saw its automotive gross margin fall for the first time in a long while.

As revealed by the platform, the equity offering will be opened to all investors across a wide range of jurisdictions.

Amid the crypto market downturn, Swiss crypto ETP issuer 21Shares is now offering investors low-risk exposure via its BTC & ETH ETPs.

Despite a bleak outlook, Novogratz believes that the Bitcoin “store-of-value” appeal will see it rise to $500K in five years.

Bitcoin has moved past its crucial resistance of 200-week EMA. But BTC needs to form a daily and weekly candle above it to confirm the uptrend.

The news of the stoppage of withdrawals is often a distress call that may imply a more menacing underlying liquidity crisis amidst the broader uncertainty in the global financial ecosystem.

BitGo will provide custody services for the NEAR Foundation, the first time NEAR is plunging into institutional investing.

Celsius has stated at a bankruptcy hearing that its mining outfit should be able to repay some creditors ahead of total reorganization.

Modular Capital is leveraging the crypto winter to invest in DeFi, NFTs, and other Web3 projects, and Multicoin wants to have a share in it.

Recent court documents of embattled crypto hedge fund 3AC show that the company owes $2.3 billion to Genesis Asia Pacific, one of the largest lenders.

Fintonia Group has been in business since 2014 and has been governed by the Monetary Authority of Singapore since 2016.

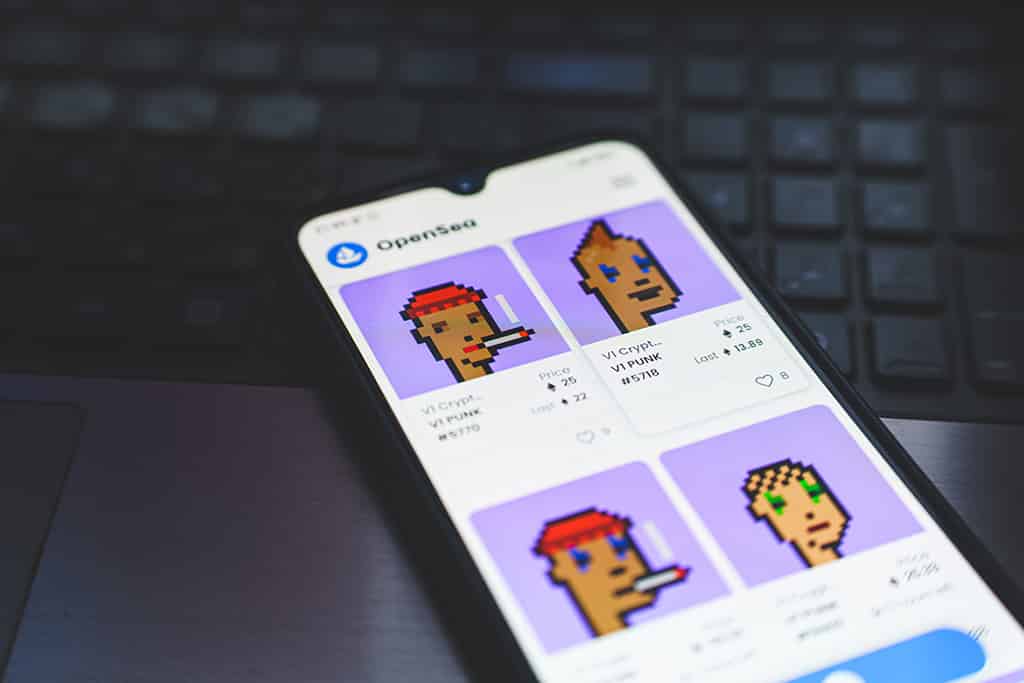

The NFT world is currently dominated by a few iconic collections, with CryptoPunks and the Bored Ape Yacht Club (BAYC) NFTs topping the charts.

According to Ben Gore, Christie’s COO, the launch of the fund will open more opportunities for exploring Web3 as well as provide another advantage over competitors.

The sell-off of Bitcoin is a way for companies to maintain their balance sheet.