Y00ts NFT Collection to Return $3M Grant to Polygon as It Opts to Migrate to Ethereum

The announcement has raised concerns about the weakening state of Polygon’s NFT ecosystem.

This news section spotlights emerging altcoins, project updates, tokenomics changes and ecosystem developments driving innovation in DeFi, Web3 and digital assets. Keep track of the next wave of digital currencies before they make headlines—and gain insights that matter in the altcoin sector.

The announcement has raised concerns about the weakening state of Polygon’s NFT ecosystem.

The unveiling of Wallet’s TON Space is a significant step towards realizing the potential of blockchain technology in everyday life.

US House leadership is calling for robust regulatory framework for the new PayPal stablecoin despite being on opposing ends of the discuss.

Following the announcement by Judge Analisa, Jeremy Hogan, a partner at Hogan & Hogan, highlighted that the final judgment in the case will not be issued until at least late 2024.

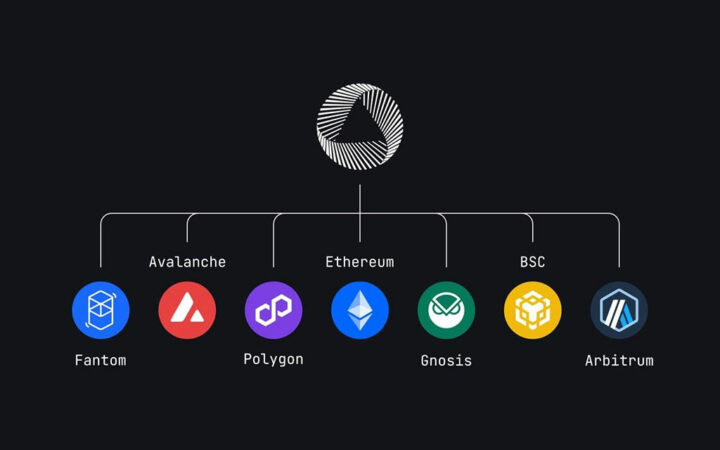

Backed’s RWAs can be accessed on Fantom (FTM), Avalanche (AVAX), Gnosis (GNO), BNB Chain, Arbitrum (ARB), Ethereum (ETH), and Polygon (MATIC).

As investors and consumers battle with the risks of regular cryptocurrencies, stablecoins provide a dependable shelter where value remains generally stable over time.

The XRP market is heavily bolstered by the adoption of Ripple payment products including On-Demand Liquidity (ODL) and RipppeNet.

Following the attack, the Cypher Protocol team highlighted that an internal investigation had been launched to determine the root cause of the exploit.

Worldcoin has lost its documents and machines in Nairobi to Kenyan police and other authorities in a recent raid.

PayPal assures its users that PYUSD is fully backed by USD, reserve with funds supporting the stablecoin, while addressing concerns about issuing unbacked tokens.

Since launching nearly a week ago, Worldcoin has been subject to increased scrutiny and criticism.

Crypto market analyst Adam Cochran also suggests that crypto exchange Binance might be selling a large amount of Tether strategically to counter Huobi.

Philcoin is an exciting project seeking to make real, palpable, and positive changes in the world. Its philanthropic mission is multi-purpose oriented and aims to help as many people in need as possible.

Bloomberg’s ETF analyst believes that ProShares’ multiple Ether-based ETF applications within a short period may indicate a favorable stance from the SEC.

The NCRI has concluded that social media activity was not the only factor contributing to the coins’ popularity, but potentially a strategic ploy to influence market sentiment.